Terkait koin

Kalkulator harga

Riwayat harga

Prediksi harga

Analisis teknikal

Panduan pembelian koin

Kategori Kripto

Kalkulator profit

Harga Victoria VRVR

Bagaimana perasaan kamu tentang Victoria VR hari ini?

Harga Victoria VR hari ini

Berapa harga tertinggi VR?

Berapa harga terendah VR?

Prediksi harga Victoria VR

Berapa harga VR di 2026?

Berapa harga VR di 2031?

Riwayat harga Victoria VR (IDR)

Harga terendah

Harga terendah Harga tertinggi

Harga tertinggi

Informasi pasar Victoria VR

Riwayat kapitalisasi pasar Victoria VR

Pasar Victoria VR

Kepemilikan Victoria VR

Matriks distribusi kepemilikan Victoria VR

Kepemilikan Victoria VR berdasarkan konsentrasi

Alamat Victoria VR berdasarkan waktu kepemilikan

Peringkat Victoria VR

Tentang Victoria VR (VR)

Apa itu Victoria VR?

Victoria VR adalah MMORPG berbasis Blockchain pertama dalam Virtual Reality dengan Grafis Realistis yang dibangun di atas Unreal Engine. Proyek ini didirikan oleh Ondřej Dobruský dan Adam Bém pada tahun 2018. Victoria VR adalah dunia virtual mandiri yang tidak hanya bergantung pada kreatornya, tetapi juga tumbuh dan berkembang melalui partisipasi aktif komunitasnya. Proyek ini adalah alam semesta di mana kreativitas tidak mengenal batas, memungkinkan pengguna untuk mewujudkan impian terliar mereka melalui kemungkinan tak terbatas untuk bekerja, berkreasi, menemukan, dan trading.

Pada intinya, Victoria VR adalah proyek ambisius yang berusaha menggabungkan aspek hiburan dari dunia virtual tradisional dengan kepraktisan dan inovasi teknologi blockchain. Proyek ini adalah tentang menciptakan ekosistem yang komprehensif di mana edukasi, produktivitas, ekonomi, dan hiburan bertemu. Metaverse ini didesain untuk menjadi platform universal untuk semua realitas virtual, game, aplikasi terdesentralisasi (dApp), dan banyak lagi, yang didukung oleh token VR asli yang memfasilitasi transaksi, tata kelola, dan sejumlah besar interaksi lain dalam alam semesta digital ini.

Sumber

Dokumen Resmi: https://www.victoriavr.com/whitepaper

Situs Web Resmi: https://www.victoriavr.com/

Bagaimana Cara Kerja Victoria VR?

Victoria VR beroperasi sebagai MMORPG berbasis blockchain di mana pengguna dapat membenamkan diri dalam dunia realitas virtual dengan grafis yang realistis, berkat kekuatan Unreal Engine. Platform ini adalah metaverse komprehensif yang mencakup elemen-elemen finansial terdesentralisasi (DeFi), non-fungible token (NFT), dan ekonomi digital. Pengguna dapat terlibat dalam staking, tata kelola, dan model play-to-earn, yang memberikan hadiah atas partisipasi aktif dan kontribusi terhadap ekosistem. Proyek ini memungkinkan pembelian tanah digital, bangunan, sumber daya, dan beragam item, semuanya direpresentasikan sebagai NFT, yang dapat dimiliki, dibeli, dan dijual, menambahkan layer kepemilikan dan investasi di dunia virtual.

Ekosistem Victoria VR didesain untuk menjadi inklusif dan luas, menawarkan pencarian, penambangan sumber daya, kustomisasi avatar, dan marketplace untuk memperdagangkan NFT dan aset virtual. Ekosistem ini mendukung berbagai aktivitas mulai dari permainan dan eksplorasi hingga pertemuan bisnis, edukasi, dan acara hiburan, menjadikannya platform serbaguna untuk basis pengguna yang beragam. Proyek ini menekankan tata kelola pengguna, yang memungkinkan holder token VR dan pemilik tanah untuk voting pada keputusan penting dan mengusulkan perubahan, menjamin metaverse berkembang ke arah yang bermanfaat bagi komunitas.

Apa Itu Token VR?

VR adalah native token dari ekosistem Victoria VR. Token digunakan untuk membeli dan menjual tanah virtual, barang, sumber daya, dan mengakses berbagai layanan dan pengalaman di dalam platform. Tokenomik VR didesain untuk mendukung ekonomi mandiri, dengan alokasi yang jelas untuk pengembangan, hadiah, dan cadangan strategis. Pengguna bisa mendapatkan token VR melalui partisipasi dalam pencarian, staking, dan berkontribusi pada ekosistem, menyelaraskan insentif antara platform dan penggunanya. VR memiliki total suplai 16.8 miliar token.

Apa yang Menentukan Harga Victoria VR?

Harga token Victoria VR (VR) dipengaruhi oleh interaksi kompleks dari berbagai faktor yang beresonansi dengan dinamika pasar mata uang kripto yang lebih luas, termasuk penawaran dan permintaan, sentimen pasar, kemajuan teknologi dalam ekosistem Victoria VR, dan tren keseluruhan di sektor blockchain dan virtual reality. Karena investor dan penggemar memonitor prediksi harga VR pada tahun 2024, grafik historis token menawarkan wawasan berharga tentang kinerja dan potensinya sebagai investasi. Tingkat adopsi platform Victoria VR, kemitraan, dan kegunaan token VR dalam metaverse-nya semakin mendorong nilainya. Seperti investasi mata uang kripto lainnya, potensi imbal hasil dari VR bergantung pada volatilitas pasar, perkembangan regulasi, dan keberhasilan proyek dalam menciptakan dunia virtual yang berkelanjutan dan menarik, sehingga sangat penting bagi investor untuk melakukan riset secara menyeluruh dan mempertimbangkan prospek jangka panjang Victoria VR dalam lanskap blockchain.

Bagi mereka yang tertarik untuk berinvestasi atau memperdagangkan Victoria VR, mungkin akan bertanya-tanya: Di mana saya bisa membeli VR? Kamu dapat membeli VR di exchange terkemuka, seperti Bitget, yang menawarkan platform yang aman dan ramah pengguna untuk penggemar mata uang kripto.

VR ke mata uang lokal

- 1

- 2

- 3

- 4

- 5

Cara Membeli Victoria VR(VR)

Buat Akun Bitget Gratis Kamu

Verifikasi Akun Kamu

Konversi Victoria VR ke VR

Bergabunglah di copy trading VR dengan mengikuti elite trader.

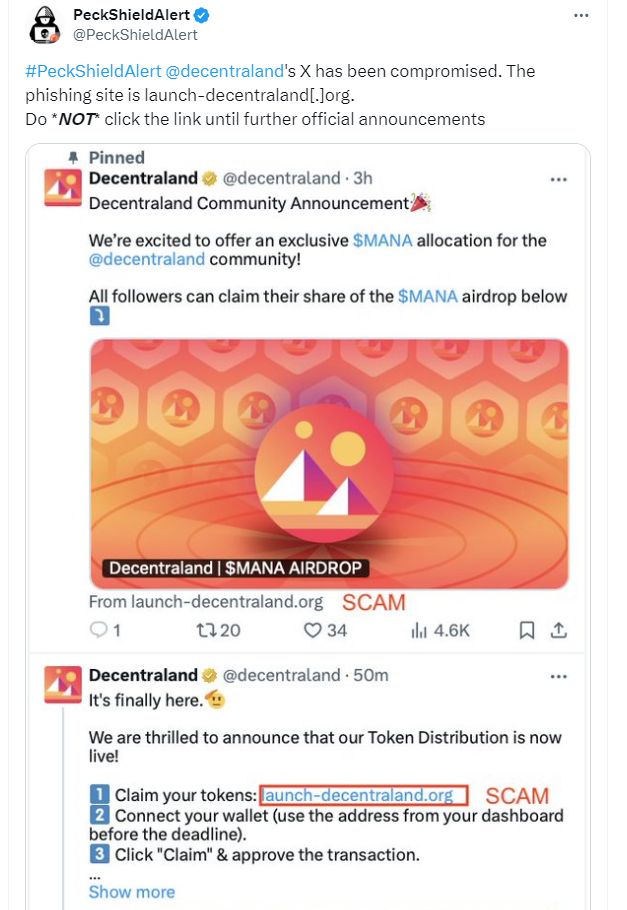

Berita Victoria VR

Mawari Network telah mengumpulkan dana strategis sebesar $10,8 juta dari Borderless Capital, 1kx, dan lainnya. Proyek Solana DePIN sedang membangun jaringan yang bertujuan untuk meningkatkan skala komputasi spasial.

Listing terbaru di Bitget

Beli lebih banyak

FAQ

Berapa harga Victoria VR saat ini?

Berapa volume perdagangan 24 jam dari Victoria VR?

Berapa harga tertinggi sepanjang masa (ATH) dari Victoria VR?

Bisakah saya membeli Victoria VR di Bitget?

Apakah saya bisa mendapatkan penghasilan tetap dari berinvestasi di Victoria VR?

Di mana saya bisa membeli Victoria VR dengan biaya terendah?

Di mana saya dapat membeli Victoria VR (VR)?

Bagian video — verifikasi cepat, trading cepat

Insight Bitget

Aset terkait

Data Sosial Victoria VR

Dalam 24 jam terakhir, skor sentimen media sosial untuk Victoria VR adalah 3, dan sentimen media sosial terhadap tren harga Victoria VR adalah Bullish. Skor media sosial Victoria VR secara keseluruhan adalah 0, yang berada di peringkat 602 di antara semua mata uang kripto.

Menurut LunarCrush, dalam 24 jam terakhir, mata uang kripto disebutkan di media sosial sebanyak 1,058,120 kali, di mana Victoria VR disebutkan dengan rasio frekuensi 0%, berada di peringkat 454 di antara semua mata uang kripto.

Dalam 24 jam terakhir, terdapat total 42 pengguna unik yang membahas Victoria VR, dengan total penyebutan Victoria VR sebanyak 22. Namun, dibandingkan dengan periode 24 jam sebelumnya, jumlah pengguna unik penurunan sebesar 19%, dan jumlah total penyebutan peningkatan sebesar 29%.

Di Twitter, ada total 0 cuitan yang menyebutkan Victoria VR dalam 24 jam terakhir. Di antaranya, 0% bullish terhadap Victoria VR, 0% bearish terhadap Victoria VR, dan 100% netral terhadap Victoria VR.

Di Reddit, terdapat 1 postingan yang menyebutkan Victoria VR dalam 24 jam terakhir. Dibandingkan dengan periode 24 jam sebelumnya, jumlah penyebutan penurunan sebesar 0% .

Semua tinjauan sosial

3