Bitget: входит в топ-4 по глобальному ежедневному объему торговли!

Доля рынка BTC62.51%

BTC/USDT$76908.60 (-7.82%)Индекс страха и жадности23(Чрезвычайный страх)

Индекс сезона альткоинов:0(Сезон биткоина)

Монеты, запущенные на премаркетеBABY,PAWS,WCTОбщий чистый приток средств в спотовые биткоин-ETF -$64.9M (1 д.); -$169.2M (7 д.).Приветственные подарки для новых пользователей стоимостью 6200 USDT.Получить

Торгуйте в любое время и в любом месте с помощью приложения Bitget. Скачать сейчас

Bitget: входит в топ-4 по глобальному ежедневному объему торговли!

Доля рынка BTC62.51%

BTC/USDT$76908.60 (-7.82%)Индекс страха и жадности23(Чрезвычайный страх)

Индекс сезона альткоинов:0(Сезон биткоина)

Монеты, запущенные на премаркетеBABY,PAWS,WCTОбщий чистый приток средств в спотовые биткоин-ETF -$64.9M (1 д.); -$169.2M (7 д.).Приветственные подарки для новых пользователей стоимостью 6200 USDT.Получить

Торгуйте в любое время и в любом месте с помощью приложения Bitget. Скачать сейчас

Bitget: входит в топ-4 по глобальному ежедневному объему торговли!

Доля рынка BTC62.51%

BTC/USDT$76908.60 (-7.82%)Индекс страха и жадности23(Чрезвычайный страх)

Индекс сезона альткоинов:0(Сезон биткоина)

Монеты, запущенные на премаркетеBABY,PAWS,WCTОбщий чистый приток средств в спотовые биткоин-ETF -$64.9M (1 д.); -$169.2M (7 д.).Приветственные подарки для новых пользователей стоимостью 6200 USDT.Получить

Торгуйте в любое время и в любом месте с помощью приложения Bitget. Скачать сейчас

Связанно с монетами

Калькулятор цены

История цены

Прогноз цены

Технический анализ

Руководство по покупке монет

Категория криптовалют

Калькулятор прибыли

Курс MovementMOVE

В листинге

Валюта котировки:

RUB

₽26.35-16.56%1D

График цен

TradingView

Последнее обновление: 2025-04-07 04:45:30(UTC+0)

Рыночная капитализация:₽64,565,257,911.94

Полностью разводненная рыночная капитализация:₽64,565,257,911.94

24 ч. объем:₽4,642,100,353.8

Объем за 24 часа / рыночная капитализация:7.18%

Макс. за 24 ч.:₽31.7

Мин. за 24 ч.:₽25.97

Исторический максимум:₽122.72

Исторический минимум:₽25.97

Объем в обращении:2,450,000,000 MOVE

Общее предложение:

10,000,000,000MOVE

Скорость обращения:24.00%

Макс. предложение:

--MOVE

Цена в BTC:0.{5}4049 BTC

Цена в ETH:0.0002015 ETH

Цена при рыночной капитализации BTC:

Цена при рыночной капитализации ETH:

Контракты:

0x3073...51a3073(Ethereum)

Еще

Что вы думаете о Movement сегодня?

Примечание: данная информация носит исключительно справочный характер.

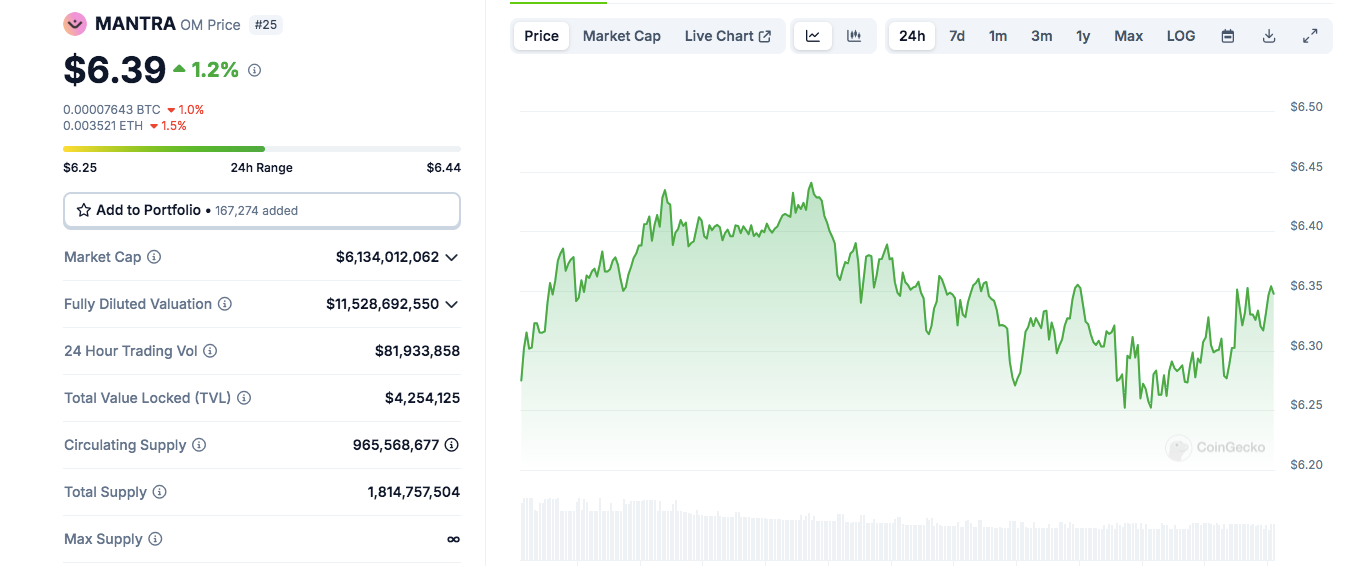

Цена Movement на сегодня

Актуальная цена Movement на сегодня составляет ₽26.35 за (MOVE / RUB) с текущей капитализацией ₽64.57B RUB. Торговый объем за 24 ч. составляет ₽4.64B RUB. Цена MOVE в RUB обновляется в режиме реального времени. Изменение цены Movement: -16.56% за последние 24 ч. Объем в обращении составляет 2,450,000,000 .

Какова наибольшая цена MOVE?

MOVE имеет исторический максимум (ATH) ₽122.72, зафиксированный 2024-12-10.

Какова наименьшая цена MOVE?

Исторический минимум MOVE (ATL): ₽25.97, зафиксированный 2025-04-07.

Прогноз цен на Movement

Когда наступает благоприятное время для покупки MOVE? Стоит сейчас покупать или продавать MOVE?

Принимая решение о покупке или продаже MOVE, необходимо в первую очередь учитывать собственную торговую стратегию. Торговая активность долгосрочных и краткосрочных трейдеров также будет отличаться. Технический анализ Bitget MOVE может служить ориентиром для торговли.

В соответствии с Технический анализ MOVE на 4 ч. торговый сигнал — Активно продавать.

В соответствии с Технический анализ MOVE на 1 д. торговый сигнал — Активно продавать.

В соответствии с Технический анализ MOVE на 1 нед. торговый сигнал — Активно продавать.

Какой будет цена MOVE в 2026?

Основываясь на модели прогнозирования исторических показателей MOVE, цена MOVE может достигнуть ₽33.58 в 2026 г.

Какой будет цена MOVE в 2031?

Ожидается, что в 2031 году цена MOVE изменится на +6.00%. По прогнозам, к концу 2031 года цена MOVE достигнет ₽47.71, а совокупный ROI составит +73.31%.

История цен Movement (RUB)

Цена Movement изменилась на -50.44% за последний год. Самая высокая цена MOVE в RUB за последний год составила ₽122.72, а самая низкая цена MOVE в RUB за последний год составила ₽25.97.

ВремяИзменение цены (%) Самая низкая цена

Самая низкая цена Самая высокая цена

Самая высокая цена

Самая низкая цена

Самая низкая цена Самая высокая цена

Самая высокая цена

24h-16.56%₽25.97₽31.7

7d-25.00%₽25.97₽36.09

30d-36.50%₽25.97₽50.69

90d-71.66%₽26.19₽84.29

1y-50.44%₽25.97₽122.72

Все время-40.45%₽25.97(2025-04-07, Сегодня )₽122.72(2024-12-10, 118 дней назад )

Информация о рынке криптовалют

История рыночной капитализации Movement

Рыночная капитализация

₽64,565,257,911.94

Полностью разводненная рыночная капитализация

₽263,531,664,946.36

Рыночные рейтинги

Рыночный Movement

Удержание Movement по концентрации

Киты

Инвесторы

Ритейл

Адреса Movement по времени удержания

Держатели

Крейсеры

Трейдеры

График цен coinInfo.name (12) в реальном времени

Рейтинг Movement

Средний рейтинг от сообщества

4.5

Содержимое страницы представлено только в ознакомительных целях.

MOVE в местную валюту

1 MOVE в MXN$6.431 MOVE в GTQQ2.41 MOVE в CLP$299.881 MOVE в UGXSh1,144.461 MOVE в HNLL8.011 MOVE в ZARR5.991 MOVE в TNDد.ت0.961 MOVE в IQDع.د407.591 MOVE в TWDNT$10.341 MOVE в RSDдин.33.261 MOVE в DOP$19.551 MOVE в MYRRM1.391 MOVE в GEL₾0.861 MOVE в UYU$13.241 MOVE в MADد.م.2.961 MOVE в OMRر.ع.0.121 MOVE в AZN₼0.531 MOVE в SEKkr3.141 MOVE в KESSh40.471 MOVE в UAH₴12.85

- 1

- 2

- 3

- 4

- 5

Последнее обновление: 2025-04-07 04:45:30(UTC+0)

Как купить Movement(MOVE)

Создайте бесплатный аккаунт на Bitget

Зарегистрируйтесь на Bitget, указав свой адрес электронной почты/номер мобильного телефона, и придумайте надежный пароль для защиты учетной записи.

Верификация учетной записи

Подтвердите свою личность, введя персональные данные и загрузив действительное удостоверение личности с фотографией.

Конвертировать Movement в MOVE

Чтобы купить Movement на Bitget, используйте различные способы оплаты. Мы покажем вам, как это сделать.

ПодробнееТорговля MOVE бессрочными фьючерсами

После успешной регистрации на Bitget и приобретения USDT или MOVE вы можете торговать производными инструментами, включая фьючерсы MOVE и маржинальную торговлю, чтобы увеличить свой доход.

Текущая цена MOVE составляет ₽26.35, а изменение цены за 24 часа равно -16.56%. Трейдеры могут получать прибыль как при длинных, так и при коротких фьючерсахMOVE.

Присоединяйтесь к копированию сделок с MOVE, подписываясь на элитных трейдеров.

После регистрации на Bitget и покупки USDT или MOVE вы также можете начать копировать сделки, подписавшись на элитных трейдеров.

Новости о Movement

Данные по разблокировке на этой неделе: MOVE, APT и AXS будут иметь большую разблокировку

Cointime•2025-04-07 02:12

OM, MOVE, WAL: Топ-3 самых популярных монет на этой неделе – Анализ цен

CryptoNews•2025-04-05 22:00

OM, MOVE, WAL: Топ-3 самых популярных монет на этой неделе – Анализ цен

Coinedition•2025-04-05 15:44

Новые листинги на Bitget

Новые листинги

Купить больше

ЧАСТО ЗАДАВАЕМЫЕ ВОПРОСЫ

Какова текущая цена Movement?

Актуальная цена Movement составляет ₽26.35 за (MOVE/RUB) с текущей рыночной капитализацией ₽64,565,257,911.94 RUB. Стоимость Movement подвержена частым колебаниям из-за постоянной круглосуточной активности на криптовалютном рынке. Текущая цена Movement в реальном времени и ее исторические данные доступны на Bitget.

Каков торговый объем Movement за 24 часа?

За последние 24 часа торговый объем Movement составил ₽4.64B.

Какая рекордная цена Movement?

Рекордная цена Movement составляет ₽122.72. Это самая высокая цена Movement с момента запуска.

Могу ли я купить Movement на Bitget?

Можете. Movement представлен на централизованной бирже Bitget. Более подробную инструкцию можно найти в полезном гайде Как купить movement .

Могу ли я получать стабильный доход от инвестиций в Movement?

Конечно, Bitget предоставляет платформа для стратегического трейдинга с интеллектуальными торговыми ботами для автоматизации ваших сделок и получения прибыли.

Где я могу купить Movement по самой низкой цене?

Мы рады сообщить, что платформа для стратегического трейдинга теперь доступен на бирже Bitget. Bitget предлагает лучшие в отрасли торговые сборы и глубину для обеспечения прибыльных инвестиций для трейдеров.

Где можно купить Movement (MOVE)?

Раздел с видео – быстрая верификация, быстрая торговля

Как пройти верификацию личности на Bitget и защитить себя от мошенничества

1. Войдите в ваш аккаунт Bitget.

2. Если вы новичок на Bitget, ознакомьтесь с нашим руководством по созданию аккаунта.

3. Наведите курсор на значок профиля, нажмите на «Не верифицирован» и нажмите «Верифицировать».

4. Выберите страну или регион выдачи и тип документа, а затем следуйте инструкциям.

5. Выберите «Верификация по мобильному» или «ПК» в зависимости от ваших предпочтений.

6. Введите свои данные, предоставьте копию вашего удостоверения личности и сделайте селфи.

7. Отправьте вашу заявку, и вуаля, вы прошли верификацию личности!

Инвестирование в криптовалюты, включая покупку Movement онлайн на Bitget, подразумевает риски. Bitget предлагает легкие и удобные способы покупки Movement и делает все возможное, чтобы предоставить полную информацию о криптовалюте, представленной на бирже. Однако платформа не несет ответственность за последствия вашей покупки Movement. Вся представленная информация не является рекомендацией покупки.

Bitget Идеи

GracyChen

1ч.

💥 Will Bitcoin $BTC Make a Comeback? 💥

Bitcoin saw a huge dip earlier, but could it be preparing for the next bull run? As we move into 2025, all eyes are on $BTC and its next major move. 📈

📊 Key Factors:

Global economic conditions 🌍

Institutional adoption 🏦

Market sentiment 😎

💬 What do you think? Will Bitcoin soar past $50k again, or are we in for more dips? Drop your predictions in the comments!

#BitcoinForecast #BTC #CryptoMarket #BitcoinPrice #Blockchain

BTC-2.04%

MOVE-2.27%

khadijA098765k5433

1ч.

$BRETT

As of now, **Brett Coin (BRETT)** is a relatively lesser-known cryptocurrency, and its price movements can be volatile. Since it's not as widely traded as major coins like Bitcoin or Ethereum, predicting its short-term price can be difficult. However, a deeper dive into potential factors that could influence the price in the next 3 days can provide a clearer picture. Here's a more detailed outlook:

### **Factors Influencing Brett Coin (BRETT) in the Short Term:**

1. **Market Sentiment:**

- **General Cryptocurrency Market Trends:** As with many altcoins, Brett Coin is influenced by the overall sentiment in the cryptocurrency market. If Bitcoin and other major cryptocurrencies experience a bullish trend, altcoins like Brett could see a corresponding rise. Conversely, a downturn in the broader market could pull down Brett Coin’s value.

- **Community Activity:** If the community behind Brett Coin becomes more active, whether through social media campaigns, influencer involvement, or increased discussion in forums, this could positively affect its price. Many smaller altcoins experience price surges due to social media buzz or the backing of notable figures.

2. **Technological Developments and Partnerships:**

- **Project Updates or Announcements:** Any announcements related to the coin’s technology, such as major upgrades, partnerships, or real-world use case integrations, could drive its price higher.

- **Community Support or Developer Engagement:** If there are any important updates from the development team or community-driven events, they could play a role in increasing investor confidence.

3. **Liquidity and Exchange Listings:**

- Brett Coin’s liquidity—how easily it can be bought and sold on exchanges—plays a significant role in its price volatility. Coins listed on more popular exchanges tend to see higher volume and less slippage, which can lead to more stable or upward price movements.

- **Exchange Listings:** If Brett Coin is listed on major exchanges like Binance, Kraken, or Coinbase, it could see a significant price increase due to wider exposure.

4. **Market Capitalization and Volume:**

- Smaller-cap coins like Brett can have significant price swings even with relatively small changes in volume. A sudden increase in trading volume—whether due to speculative trading or news announcements—could push the price up. However, low-volume periods could see the price stagnate or dip.

### **Technical Analysis (Short-Term Predictions for 3 Days):**

1. **Support and Resistance Levels:**

- **Support Level:** As of the current price, the support for Brett Coin is around **$0.024-$0.025**. If the price falls near this level, it might find buyers and stabilize or bounce back.

- **Resistance Level:** The nearest resistance level is at **$0.029-$0.03**. If the price can break through this level, we could see a rise toward the next resistance area around **$0.035-$0.037**.

2. **Moving Averages:**

- The **50-day moving average (MA)** and **200-day moving average** are key indicators to watch. If Brett Coin’s price stays above the 200-day MA, it is generally seen as bullish. A failure to stay above this average could signal a bearish trend.

- **Short-term (4-12 hours) charts** will be useful to spot any intraday fluctuations. If the price is staying above short-term moving averages, there may be potential for a positive short-term price movement.

3. **Relative Strength Index (RSI):**

- The **RSI** is used to determine whether the asset is overbought or oversold. An RSI above 70 could suggest that the coin is overbought and might pull back in the short term, whereas an RSI below 30 suggests the coin could be oversold and might experience a price recovery.

4. **MACD (Moving Average Convergence Divergence):**

- The MACD is another useful indicator for short-term trends. A positive MACD crossover (when the MACD line crosses above the signal line) would indicate potential bullish momentum. A negative crossover could signal further downward pressure.

### **Potential Price Predictions for the Next 3 Days:**

1. **Bullish Scenario (Price Target $0.03 - $0.035):**

- If there’s a surge in social media activity or a broader market rally, Brett Coin could rise towards **$0.03-$0.035**. Positive news or a strong breakout above the resistance level of $0.03 would likely lead to this scenario.

2. **Neutral Scenario (Price Stagnation Around $0.025):**

- If there are no major news developments or external market drivers, it’s likely that Brett Coin will trade sideways, hovering around the **$0.025** range. During such periods, it might experience small price fluctuations but remain within a narrow range.

3. **Bearish Scenario (Price Target $0.02 - $0.022):**

- If the broader market faces a downturn or there’s a lack of positive catalysts for Brett Coin, it could see a pullback to its **support level** of around **$0.02-$0.022**. A failure to hold above this support could lead to further declines.

### **Other Considerations:**

- **Volume Analysis:**

- A sudden spike in trading volume could signal that either a significant buy or sell pressure is forming. Watching the volume closely can help anticipate potential price swings. If the volume is low, expect slower, less volatile price movements.

- **Market Sentiment for MEME Coins:**

- As Brett Coin is likely considered a meme or lesser-known altcoin, its price could be more sensitive to "hype" and social media influence. Positive trends from influencers or viral posts could drive a temporary price surge, but without solid fundamentals, such moves are often short-lived.

### **Conclusion:**

- **Bullish Move**: If market sentiment is strong and there's increased attention on Brett Coin, it could rise to $0.03-$0.035.

- **Neutral Move**: The price may hover around $0.025 if the market remains flat, with no major catalysts in the next few days.

- **Bearish Move**: In the case of a broader market downturn or no news, Brett Coin might slide back to $0.02-$0.022.

As with all cryptocurrencies, especially smaller or newer coins like Brett, it's crucial to monitor developments closely, as sudden changes in market conditions, news, or social media trends can significantly affect prices.

MOVE-2.27%

HYPE-1.85%

khadijA098765k5433

1ч.

$DOGE

Dogecoin (DOGE) is known for its high volatility, so short-term predictions can be difficult to make with absolute certainty. However, there are a few factors that can influence the price of Dogecoin in the next 3 days:

### **Key Influencing Factors:**

1. **Market Sentiment:**

- **Social Media Influence:** Dogecoin, like many other cryptocurrencies, is heavily impacted by social media trends and news. Memes, tweets from high-profile figures like Elon Musk, and general online buzz can lead to sudden price spikes or declines.

- **Market-wide Sentiment:** The overall mood in the cryptocurrency market, including Bitcoin (BTC) and Ethereum (ETH), can also affect Dogecoin. If the market is trending upward, DOGE may follow, but if there is a bearish trend, it could see more downward pressure.

2. **Technological Developments and Updates:**

- Dogecoin has long been seen as a "meme coin," but there are ongoing efforts to improve its functionality. Any technological upgrades or partnerships can provide positive momentum.

- The community behind Dogecoin, including developers and influential figures, may announce updates that could boost investor confidence.

3. **Bitcoin’s Influence:**

- As Bitcoin remains the dominant cryptocurrency, its price movements often set the trend for altcoins, including Dogecoin. If Bitcoin surges in value or has a strong performance, DOGE could follow suit. Conversely, a downturn in Bitcoin could drag DOGE’s price down.

4. **Macroeconomic Factors:**

- Broader economic conditions, such as inflation concerns, regulatory developments, and market crashes, can also affect Dogecoin. For example, if inflation rises or central banks signal tightening of monetary policies, it could impact crypto markets broadly.

### **Technical Analysis:**

Some analysts use **technical analysis** to predict Dogecoin's price movements. Here's what the technical indicators are suggesting:

- **Support and Resistance Levels:**

- Support is at around $0.14 to $0.145, which is the price at which buyers may enter to prevent further declines.

- Resistance is often cited around $0.17 to $0.18, where selling pressure could rise and potentially slow or reverse upward momentum.

- **Moving Averages:**

- The 50-day and 200-day moving averages are common indicators of potential trends. If DOGE is above the 200-day moving average, this is often seen as a bullish signal, while if it’s below, it indicates bearish conditions.

- Short-term indicators, like the 4-hour or 12-hour charts, may suggest price action trends over the next 2-3 days.

- **Volume Trends:**

- Trading volume is crucial. If there’s a surge in trading volume, it could signal increased investor interest, which could lead to price volatility. Conversely, low volume could indicate that the price will continue to hover within a narrow range.

### **Potential Predictions (3-Day Outlook):**

1. **Bullish Scenario (Price Target $0.18-$0.20):**

- If Dogecoin experiences a surge in social media activity or a favorable news event, we could see a rise in momentum, pushing DOGE toward the $0.18 to $0.20 range.

- In this case, the market sentiment would need to be bullish, with Bitcoin showing strength and Dogecoin benefiting from this larger trend.

2. **Bearish Scenario (Price Target $0.14-$0.12):**

- On the flip side, if there's negative sentiment in the crypto market or broader financial markets (such as a stock market correction), Dogecoin could fall back towards its support levels around $0.14 or even dip to $0.12.

- A lack of new developments or a decline in market volume could further slow down any price recovery.

### **Short-Term Technical Indicators (Next 3 Days):**

1. **RSI (Relative Strength Index):**

- If the RSI is above 70, Dogecoin might be overbought, indicating potential for a pullback. If it's below 30, DOGE might be oversold, which could lead to a short-term price rebound.

2. **MACD (Moving Average Convergence Divergence):**

- A MACD crossover (when the shorter-term moving average crosses above the longer-term moving average) could signal a bullish trend, while a negative crossover could indicate a bearish move.

### **Conclusion:**

While short-term predictions for Dogecoin are often speculative due to the unpredictability of crypto markets, it’s essential to watch social media trends, technical indicators, and broader market conditions.

In the next 3 days, DOGE could either:

- **Rise** towards resistance levels near $0.18 or $0.20 if favorable news or market conditions boost sentiment.

- **Fall** toward support at $0.14 or even lower if broader market sentiment weakens, or if there’s a lack of positive catalysts for DOGE.

It’s important to monitor the crypto market closely and consider setting stop-loss orders or taking profits if you’re trading on short-term movements.

BTC-2.04%

MOVE-2.27%

INVESTERCLUB

1ч.

Bitcoin Price Dips Below $80K as Traders Eye Post-Tariff Rebound Despite ‘Black Monday

$BTC Bitcoin (BTC) fell below the key $80,000 level heading into the April 6 weekly close, shedding 3% since the week’s start amid intensifying fears of a global market crash reminiscent of 1987’s Black Monday. However, crypto traders remain cautiously optimistic, as BTC continues to decouple from traditional markets in the face of macroeconomic headwinds.

Stocks Dive, Bitcoin Holds Relative Strength

U.S. stock indices plunged nearly 6% on April 4, with over $8.2 trillion in market capitalization wiped out following President Trump’s sweeping trade tariff announcement.

Commentators likened the week’s bloodbath to the 2008 financial crisis and even the October 1987 crash, with CNBC’s Jim Cramer warning that a repeat of the “Black Monday” collapse is “not off the table yet.”

Meanwhile, Bitcoin dipped below $80,000, but analysts noted the move as relatively minor compared to the chaos in equities. At press time, BTC was trading near $79,700, down just 3% for the week, showcasing its increasing resilience to traditional market turmoil.

“The VIX (Volatility Index) just closed at its highest level since the COVID crash in 2020, while BTC volatility is compressing — a rare divergence,” noted crypto analyst mianikramullah. “This sets the stage for a major breakout in crypto next week.”

Analysts Eye $150K–$220K Bitcoin Run as Safe Haven Appeal Grows

Despite short-term downside, bullish sentiment remains high among Bitcoin supporters. Some predict a massive upside move could follow this week’s volatility:

Max Keiser boldly forecast a Bitcoin price surge to $220,000 by month-end, calling it the “ultimate safe haven” amid trillions fleeing collapsing equity markets.

Crypto Caesar and Gulshanewafa both shared charts suggesting that BTC could soon begin its “last push” of the cycle — possibly targeting $150,000+.

BTC Price Setup: Fakeout or Trend Reversal?

Technical analysts are watching Bitcoin’s weekly structure closely. The recent dip to $76,000 is being compared to past "fake breakdowns", similar to the post-ETF dump in January and August 2024's correction.

“This looks no different than the post-ETF and August crashes,” trader Cas Abbe said. “A weekly close above $92K would confirm the uptrend.”

Still, some warn that Bitcoin remains vulnerable to global macro shocks, particularly if U.S. bond market volatility escalates, echoing the 2020 COVID-era ‘dash for cash.’

Bottom Line

As global markets teeter under record-breaking sell-offs, Bitcoin’s modest drop below $80K appears relatively controlled — a signal of its growing maturity and safe-haven narrative. With compressed volatility and strong divergence from equities, many crypto analysts believe a decisive move is imminent.

Next week’s trading sessions — particularly for stocks and U.S. Treasury yields — will be critical in determining whether Bitcoin breaks higher or joins the broader risk-asset retreat.

BTC Support to Watch: $76K

Bullish Reclaim Target: $92K

Market Volatility Indicator: VIX at COVID-crash levels

Macro Trigger Ahead: Early-week market open + response to tariff sell-off$BTC

BTC-2.04%

SOON+0.50%

Elijah-de-Great

4ч.

Potential factors impacting the price of $PUMP/USD

$PUMP When considering potential factors impacting the price of $PUMP/USD, focus on pump efficiency, power consumption, maintenance, reliability, and availability, as these all affect the total cost of ownership.

Here's a more detailed breakdown of factors to consider:

Pump Performance and Efficiency:

Flow Rate: The volume of fluid the pump can handle, measured in gallons per minute (GPM) or liters per second (L/s).

Head: The pressure the pump can generate to move the fluid, measured in feet or meters.

Pump Efficiency: The ratio of output power to input power, indicating how effectively the pump converts energy into useful work.

Energy Efficiency: The pump's ability to minimize energy consumption while maintaining high efficiency levels.

Power Consumption: The amount of energy the pump requires to operate.

Cavitation: The formation of vapor bubbles in a liquid that can damage pump components.

Vibration and Noise: Unusual vibration or noise can indicate potential problems with the pump.

MOVE-2.27%

PUMP+14.91%

Похожие активы

Популярные криптовалюты

Подборка топ-8 криптовалют по рыночной капитализации.

Недавно добавленный

Последние добавленные криптовалюты.