Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.00%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$84807.00 (+3.85%)Fear at Greed Index27(Fear)

Total spot Bitcoin ETF netflow -$135.2M (1D); -$1.29B (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.00%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$84807.00 (+3.85%)Fear at Greed Index27(Fear)

Total spot Bitcoin ETF netflow -$135.2M (1D); -$1.29B (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.00%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$84807.00 (+3.85%)Fear at Greed Index27(Fear)

Total spot Bitcoin ETF netflow -$135.2M (1D); -$1.29B (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

May kaugnayan sa coin

Price calculator

Kasaysayan ng presyo

Paghula ng presyo

Teknikal na pagsusuri

Gabay sa pagbili ng coin

kategorya ng Crypto

Profit calculator

ARB Protocol presyoARB

Hindi naka-list

Quote pera:

USD

Kinukuha ang data mula sa mga third-party na provider. Ang pahinang ito at ang impormasyong ibinigay ay hindi nag-eendorso ng anumang partikular na cryptocurrency. Gustong i-trade ang mga nakalistang barya? Click here

$0.{4}3736-0.24%1D

Price chart

Last updated as of 2025-03-14 15:28:54(UTC+0)

Market cap:--

Ganap na diluted market cap:--

Volume (24h):$37.4

24h volume / market cap:0.00%

24h high:$0.{4}3737

24h low:$0.{4}3549

All-time high:$0.02608

All-time low:$0.{4}1853

Umiikot na Supply:-- ARB

Total supply:

555,000,000ARB

Rate ng sirkulasyon:0.00%

Max supply:

--ARB

Price in BTC:0.{9}4410 BTC

Price in ETH:0.008851 ETH

Price at BTC market cap:

--

Price at ETH market cap:

--

Mga kontrata:

9tzZzE...p9YTEoh(Solana)

Ano ang nararamdaman mo tungkol sa ARB Protocol ngayon?

Tandaan: Ang impormasyong ito ay para sa sanggunian lamang.

Presyo ng ARB Protocol ngayon

Ang live na presyo ng ARB Protocol ay $0.{4}3736 bawat (ARB / USD) ngayon na may kasalukuyang market cap na $0.00 USD. Ang 24 na oras na dami ng trading ay $37.4 USD. Ang presyong ARB hanggang USD ay ina-update sa real time. Ang ARB Protocol ay -0.24% sa nakalipas na 24 na oras. Mayroon itong umiikot na supply ng 0 .

Ano ang pinakamataas na presyo ng ARB?

Ang ARB ay may all-time high (ATH) na $0.02608, na naitala noong 2022-07-27.

Ano ang pinakamababang presyo ng ARB?

Ang ARB ay may all-time low (ATL) na $0.{4}1853, na naitala noong 2025-01-07.

Bitcoin price prediction

Ano ang magiging presyo ng ARB sa 2026?

Batay sa makasaysayang modelo ng hula sa pagganap ng presyo ni ARB, ang presyo ng ARB ay inaasahang aabot sa $0.{4}4174 sa 2026.

Ano ang magiging presyo ng ARB sa 2031?

Sa 2031, ang presyo ng ARB ay inaasahang tataas ng +8.00%. Sa pagtatapos ng 2031, ang presyo ng ARB ay inaasahang aabot sa $0.{4}8370, na may pinagsama-samang ROI na +130.68%.

ARB Protocol price history (USD)

The price of ARB Protocol is -97.82% over the last year. The highest price of in USD in the last year was $0.003052 and the lowest price of in USD in the last year was $0.{4}1853.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h-0.24%$0.{4}3549$0.{4}3737

7d-5.88%$0.{4}3335$0.{4}4061

30d-42.79%$0.{4}3335$0.{4}8683

90d-73.54%$0.{4}1853$0.0001858

1y-97.82%$0.{4}1853$0.003052

All-time-99.74%$0.{4}1853(2025-01-07, 66 araw ang nakalipas )$0.02608(2022-07-27, 2 taon na ang nakalipas )

ARB Protocol impormasyon sa merkado

ARB Protocol's market cap history

ARB Protocol holdings by concentration

Whales

Investors

Retail

ARB Protocol addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

ARB Protocol na mga rating

Mga average na rating mula sa komunidad

4.4

Ang nilalamang ito ay para sa mga layuning pang-impormasyon lamang.

ARB sa lokal na pera

1 ARB To MXN$01 ARB To GTQQ01 ARB To CLP$0.031 ARB To HNLL01 ARB To UGXSh0.141 ARB To ZARR01 ARB To TNDد.ت01 ARB To IQDع.د0.051 ARB To TWDNT$01 ARB To RSDдин.01 ARB To DOP$01 ARB To MYRRM01 ARB To GEL₾01 ARB To UYU$01 ARB To MADد.م.01 ARB To OMRر.ع.01 ARB To AZN₼01 ARB To SEKkr01 ARB To KESSh01 ARB To UAH₴0

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-03-14 15:28:54(UTC+0)

ARB Protocol balita

Inilabas ang ApeChain: Ang Blockchain na Nagpapalaki sa Legacy ng BAYC na may 132% Token Surge sa Unang Araw

Ano ang ApeChain at ApeCoin? Ang ApeChain ay isang bagong inilunsad na blockchain platform na binuo sa Arbitrum technology stack. Dinisenyo ito bilang isang dedikadong layer ng imprastraktura upang paganahin ang ApeCoin ecosystem, na nakatuon sa pagbibigay ng pinakamahusay na karanasan ng user at d

Bitget Academy•2024-10-30 08:44

Anunsyo sa Pagpapatuloy ng UXLINK-Arbitrum One Mga Serbisyo sa Pag-withdraw ng Network

Bitget Announcement•2024-09-30 10:48

Paunawa ng Pagsuspinde para sa Arbitrum Pagdeposito at Pag-withdraw

Upang makapagbigay ng mas magandang karanasan sa pangangalakal, sinuspinde ng Bitget ang mga function ng pagdeposito at pag-withdraw ng Arbitrum mula Setyembre 4 (UTC) hanggang sa susunod na petsa. Pakitandaan na ang trading ay hindi maaapektuhan sa panahon ng downtime. Kapag nagdeposito at nag-wit

Bitget Announcement•2024-09-04 01:07

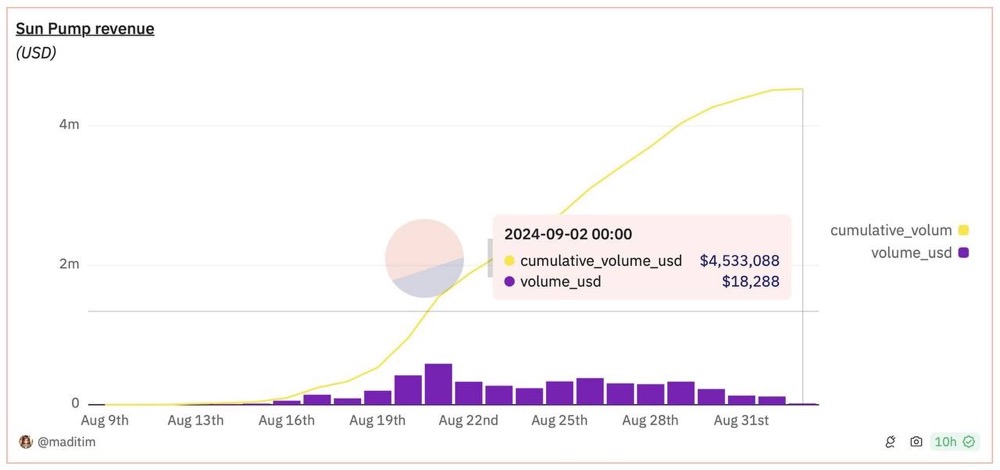

Sa Web3, Casino > Teknolohiya?

白泽研究院•2024-09-03 03:48

Paano tingnan ang kasalukuyang naratibo ng chain at ang hinaharap na pag-unlad nito

cryptoHowe.eth•2024-08-30 03:07

Buy more

Ang mga tao ay nagtatanong din tungkol sa presyo ng ARB Protocol.

Ano ang kasalukuyang presyo ng ARB Protocol?

The live price of ARB Protocol is $0 per (ARB/USD) with a current market cap of $0 USD. ARB Protocol's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. ARB Protocol's current price in real-time and its historical data is available on Bitget.

Ano ang 24 na oras na dami ng trading ng ARB Protocol?

Sa nakalipas na 24 na oras, ang dami ng trading ng ARB Protocol ay $37.4.

Ano ang all-time high ng ARB Protocol?

Ang all-time high ng ARB Protocol ay $0.02608. Ang pinakamataas na presyong ito sa lahat ng oras ay ang pinakamataas na presyo para sa ARB Protocol mula noong inilunsad ito.

Maaari ba akong bumili ng ARB Protocol sa Bitget?

Oo, ang ARB Protocol ay kasalukuyang magagamit sa sentralisadong palitan ng Bitget. Para sa mas detalyadong mga tagubilin, tingnan ang aming kapaki-pakinabang na gabay na Paano bumili ng .

Maaari ba akong makakuha ng matatag na kita mula sa investing sa ARB Protocol?

Siyempre, nagbibigay ang Bitget ng estratehikong platform ng trading, na may mga matatalinong bot sa pangangalakal upang i-automate ang iyong mga pangangalakal at kumita ng kita.

Saan ako makakabili ng ARB Protocol na may pinakamababang bayad?

Ikinalulugod naming ipahayag na ang estratehikong platform ng trading ay magagamit na ngayon sa Bitget exchange. Nag-ooffer ang Bitget ng nangunguna sa industriya ng mga trading fee at depth upang matiyak ang kumikitang pamumuhunan para sa mga trader.

Saan ako makakabili ng crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Ang mga investment sa Cryptocurrency, kabilang ang pagbili ng ARB Protocol online sa pamamagitan ng Bitget, ay napapailalim sa market risk. Nagbibigay ang Bitget ng madali at convenient paraan para makabili ka ng ARB Protocol, at sinusubukan namin ang aming makakaya upang ganap na ipaalam sa aming mga user ang tungkol sa bawat cryptocurrency na i-eooffer namin sa exchange. Gayunpaman, hindi kami mananagot para sa mga resulta na maaaring lumabas mula sa iyong pagbili ng ARB Protocol. Ang page na ito at anumang impormasyong kasama ay hindi isang pag-endorso ng anumang partikular na cryptocurrency.

Bitget Insights

BGUSER-BNELE6M5

19h

The Ethereum Layer-2 space has been gaining significant attention in recent times, with several pro

The Ethereum Layer-2 space has been gaining significant attention in recent times, with several projects emerging to provide scaling solutions for the Ethereum network. $MINT is one such project that has been making waves in the Layer-2 space. In this article, we'll compare $MINT's tokenomics to similar projects in the Ethereum Layer-2 space and provide valuable tips for investors and traders.

Tokenomics Overview

Tokenomics refers to the study of the economics and design of a token. It involves analyzing the token's supply, distribution, and use cases to understand its potential value and adoption. In the context of the Ethereum Layer-2 space, tokenomics plays a crucial role in determining the success of a project.

$MINT Tokenomics

$MINT has a unique tokenomics design that sets it apart from other projects in the Layer-2 space:

- *Token Supply*: $MINT has a total token supply of 1 billion, with 30% allocated for community development and 20% allocated for the team.

- *Token Distribution*: $MINT tokens are distributed through a combination of airdrops, community events, and token sales.

- *Use Cases*: $MINT tokens have several use cases, including payment for transaction fees, staking, and governance.

Comparison to Similar Projects

Here's a comparison of $MINT's tokenomics to similar projects in the Ethereum Layer-2 space:

- *Optimism (OP)*: Optimism has a total token supply of 4.2 billion, with 20% allocated for the team and 15% allocated for advisors.

- *Polygon (MATIC)*: Polygon has a total token supply of 10 billion, with 16% allocated for the team and 4% allocated for advisors.

- *Arbitrum (ARB)*: Arbitrum has a total token supply of 1.2 billion, with 30% allocated for the team and 20% allocated for advisors.

Tips for Investors and Traders

Here are some valuable tips for investors and traders considering $MINT and other projects in the Ethereum Layer-2 space:

- *Conduct Thorough Research*: Conduct thorough research on the project's tokenomics, including its supply, distribution, and use cases.

- *Evaluate the Team*: Evaluate the team's experience, expertise, and track record to determine their ability to execute the project's vision.

- *Assess the Competition*: Assess the competition in the Layer-2 space and determine how the project differentiates itself from others.

- *Monitor Market Trends*: Monitor market trends and adjust your investment strategy accordingly.

Common Mistakes to Avoid

Here are some common mistakes to avoid when investing in $MINT and other projects in the Ethereum Layer-2 space:

- *Failing to Conduct Thorough Research*: Failing to conduct thorough research on the project's tokenomics and team can lead to poor investment decisions.

- *Not Evaluating the Competition*: Not evaluating the competition in the Layer-2 space can lead to a lack of understanding of the project's potential.

- *Not Monitoring Market Trends*: Not monitoring market trends can lead to missed opportunities or unexpected losses.

- *Not Diversifying Your Portfolio*: Not diversifying your portfolio can lead to increased risk exposure and potential losses.

Conclusion

$MINT's tokenomics design sets it apart from other projects in the Ethereum Layer-2 space. By conducting thorough research, evaluating the team, assessing the competition, and monitoring market trends, you can make informed investment decisions and maximize your returns.

The Future of $MINT

As the Ethereum Layer-2 space continues to evolve, $MINT is likely to remain a popular choice among investors:

- *Increased Adoption*: Increased adoption of $MINT and other Layer-2 solutions could lead to increased liquidity and demand.

- *Improved Scalability*: Improved scalability solutions could lead to increased adoption and use cases for $MINT.

- *Enhanced Security Measures*: Enhanced security measures, such as upgraded smart contracts and increased transparency, could reduce the risk of technical issues.

ARB+5.53%

WAVES+3.03%

BGUSER-HULGH49X

1d

News Alert For PI Network?

Now don't miss out on MIRA Network!

Download MIRA Network now and mine Lumira coins. maximum supply of just 250M.

Use The invitation code: comcomabbi

ARB+5.53%

PI-7.42%

Walkers-Family

1d

LONG TERMS HOLDING LIKE ONLY ECCO SYSTEM CHAIN'S TOKEN

*$ASTR SONEIUM ECCO CHAIN

*$ARB ARBITRUM ECCO CHAIN TOKEN

*$SOL

SOLANA ECCO CHAIN TOKEN

ASTR+3.94%

ARB+5.53%

InEx360

1d

Sell:

XPR

RED

SATS

BAT

COMP

BADGER

TRB

QNT

ZOO

ROSE

MINA

MAK

PENGU

HEI

INJ

OP

HIPPO

XLM

MELANIA

ATOM

DBR

BERA

TRUMP

SHIB

PEAQ

TAO

BNB

GRASS

AVAX

ORCA

XMR

IP

ONDO

ARB

SUI

VIRTUAL

HBAR

BTC

ETH

X

ADA

PEPE

DOGE

PI

XRP

SOL

BUY:

BGB(BUY it like a - Hippo)

BCH(BUY it like a - Hippo)

LTC(BUY it like a - Hippo)

CRO

MEXC

HIPPO(BUY it like a - Hippo)

ENA trade posted a few minutes ago.

BTC+4.50%

ARB+5.53%

AdamuIbrahim

1d

Big Players Are Buying BTC.

So Why Is It Dropping?

Why Is Bitcoin Still Dropping Despite Massive Institutional Buys?

Over the past few months, major institutional players have been making significant moves into Bitcoin (BTC):

BlackRock bought $50 billion in BTC.

MicroStrategy increased its holdings to a staggering $24 billion in BTC.

El Salvador added another $500 million in BTC to its national reserves.

With this level of institutional accumulation, you’d expect Bitcoin’s price to skyrocket. Yet, BTC continues to face downward pressure. After spending over 48 hours analyzing the market dynamics, I’ve uncovered the underlying reasons why Bitcoin’s price is still underperforming — and what you can do about it.

1. Profit-Taking and Market Cycles

Institutional buying often triggers short-term profit-taking from early investors and retail traders. After a significant price surge driven by positive news, many traders opt to lock in profits, leading to sell pressure that offsets the buying momentum.

2. Futures Market Manipulation

The Bitcoin futures market plays a massive role in influencing spot prices. Large players can open short positions, creating artificial downward pressure. This strategy allows them to accumulate more BTC at lower prices while shaking out weaker hands.

3. Liquidity Drains and Macro Uncertainty

Global economic uncertainty — including rising interest rates, inflation fears, and geopolitical tensions — has pushed many investors into risk-off mode. When liquidity dries up, even large buy orders struggle to lift the market.

4. On-Chain Distribution by Whales

Despite institutional buying, on-chain data reveals that some long-term holders and whales have been distributing BTC. This creates additional sell pressure, which slows down any potential recovery.

5. ETF Rebalancing and Arbitrage

The introduction of Bitcoin ETFs has created a complex dynamic where market makers and institutional players engage in arbitrage and portfolio rebalancing. This often leads to temporary price volatility and downward pressure as funds adjust their holdings.

6. Regulatory Uncertainty

Ongoing regulatory battles, especially in the U.S., have kept some potential large-scale investors on the sidelines. Fear of future crackdowns continues to weigh on overall market sentiment.

So, What’s Next?

Despite the short-term volatility, the long-term outlook for BTC remains strong. Institutional accumulation signals long-term confidence, and once the selling pressure subsides, the market could resume its upward trajectory.

6 Must-Buy Altcoins Right Now

While Bitcoin consolidates, there’s massive opportunity in carefully selected altcoins. Here are six must-buy alts that could outperform in the next cycle:

1. Ethereum (ETH) – Layer 1 dominance and upcoming network upgrades make ETH a solid long-term play.

2. Solana (SOL) – High-speed transactions and growing ecosystem adoption position Solana as a leading competitor.

3. Chainlink (LINK) – Critical for DeFi infrastructure, LINK’s oracle network remains essential to the crypto space.

4. Avalanche (AVAX) – Fast finality and interoperability give AVAX an edge in the Layer 1 race.

5. Polkadot (DOT) – Cross-chain communication and parachain auctions make DOT a long-term bet.

6. Arbitrum (ARB) – As a leading Layer 2 solution for Ethereum, ARB benefits from scaling demand.

Final Thoughts

Bitcoin’s short-term weakness is driven by market structure and external factors — not lack of confidence. Smart money is accumulating during this dip, and strategic positioning in BTC and key altcoins could pay off as the next bull run emerges.

Stay focused, accumulate strategically, and prepare for the next market shift.

LINK+11.34%

BTC+4.50%

Mga kaugnay na asset

Mga sikat na cryptocurrencies

Isang seleksyon ng nangungunang 8 cryptocurrencies ayon sa market cap.

Kamakailang idinagdag

Ang pinakahuling idinagdag na cryptocurrency.