Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.82%

New listings on Bitget : Pi Network

BTC/USDT$83326.00 (-1.50%)Fear at Greed Index25(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow +$334M (1D); +$227.8M (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.82%

New listings on Bitget : Pi Network

BTC/USDT$83326.00 (-1.50%)Fear at Greed Index25(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow +$334M (1D); +$227.8M (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.82%

New listings on Bitget : Pi Network

BTC/USDT$83326.00 (-1.50%)Fear at Greed Index25(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow +$334M (1D); +$227.8M (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

May kaugnayan sa coin

Price calculator

Kasaysayan ng presyo

Paghula ng presyo

Teknikal na pagsusuri

Gabay sa pagbili ng coin

kategorya ng Crypto

Profit calculator

Kaugnay ng trade

Bili/benta

Magdeposito/Mag-withdraw

Spot

Margin

USDT-M futures

Coin-M futures

Mga bot sa trading

Kopyahin ang trading

Kumita

Pre-market

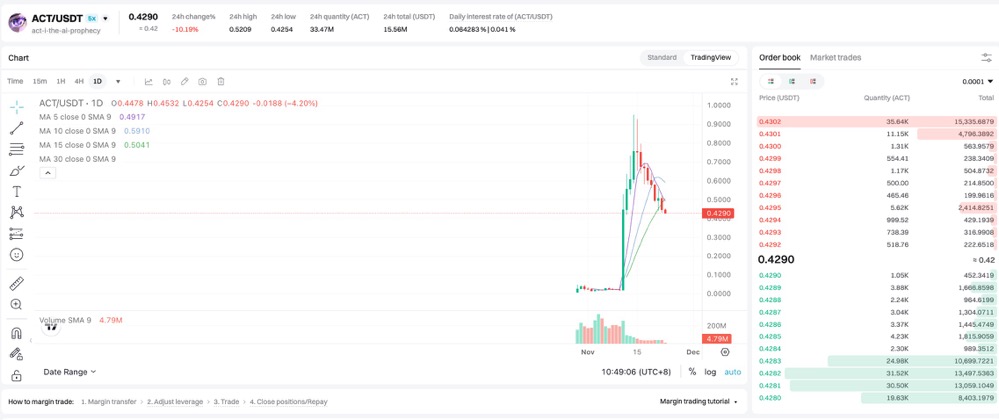

Act I : The AI Prophecy presyoACT

Listed

Quote pera:

PHP

₱3.11-23.37%1D

Price chart

TradingView

Last updated as of 2025-04-03 04:30:12(UTC+0)

Market cap:₱2,952,381,644.83

Ganap na diluted market cap:₱2,952,381,644.83

Volume (24h):₱23,228,408,965.87

24h volume / market cap:786.76%

24h high:₱4.18

24h low:₱2.93

All-time high:₱53.85

All-time low:₱0.008277

Umiikot na Supply:948,245,400 ACT

Total supply:

948,245,404.16ACT

Rate ng sirkulasyon:99.00%

Max supply:

--ACT

Price in BTC:0.{6}6535 BTC

Price in ETH:0.{4}2984 ETH

Price at BTC market cap:

₱99,713.15

Price at ETH market cap:

₱13,278.57

Mga kontrata:

GJAFwW...gUnpump(Solana)

Higit pa

Ano ang nararamdaman mo tungkol sa Act I : The AI Prophecy ngayon?

Tandaan: Ang impormasyong ito ay para sa sanggunian lamang.

Presyo ng Act I : The AI Prophecy ngayon

Ang live na presyo ng Act I : The AI Prophecy ay ₱3.11 bawat (ACT / PHP) ngayon na may kasalukuyang market cap na ₱2.95B PHP. Ang 24 na oras na dami ng trading ay ₱23.23B PHP. Ang presyong ACT hanggang PHP ay ina-update sa real time. Ang Act I : The AI Prophecy ay -23.37% sa nakalipas na 24 na oras. Mayroon itong umiikot na supply ng 948,245,400 .

Ano ang pinakamataas na presyo ng ACT?

Ang ACT ay may all-time high (ATH) na ₱53.85, na naitala noong 2024-11-14.

Ano ang pinakamababang presyo ng ACT?

Ang ACT ay may all-time low (ATL) na ₱0.008277, na naitala noong 2024-10-19.

Bitcoin price prediction

Ano ang magiging presyo ng ACT sa 2026?

Batay sa makasaysayang modelo ng hula sa pagganap ng presyo ni ACT, ang presyo ng ACT ay inaasahang aabot sa ₱11.28 sa 2026.

Ano ang magiging presyo ng ACT sa 2031?

Sa 2031, ang presyo ng ACT ay inaasahang tataas ng +22.00%. Sa pagtatapos ng 2031, ang presyo ng ACT ay inaasahang aabot sa ₱11.15, na may pinagsama-samang ROI na +210.74%.

Act I : The AI Prophecy price history (PHP)

The price of Act I : The AI Prophecy is +103.81% over the last year. The highest price of ACT in PHP in the last year was ₱53.85 and the lowest price of ACT in PHP in the last year was ₱0.008277.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h-23.37%₱2.93₱4.18

7d-71.79%₱2.93₱11.07

30d-71.72%₱2.93₱11.87

90d-82.08%₱2.93₱25.13

1y+103.81%₱0.008277₱53.85

All-time+82.55%₱0.008277(2024-10-19, 166 araw ang nakalipas )₱53.85(2024-11-14, 140 araw ang nakalipas )

Act I : The AI Prophecy impormasyon sa merkado

Act I : The AI Prophecy's market cap history

Act I : The AI Prophecy market

Act I : The AI Prophecy holdings by concentration

Whales

Investors

Retail

Act I : The AI Prophecy addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Act I : The AI Prophecy na mga rating

Mga average na rating mula sa komunidad

4.3

Ang nilalamang ito ay para sa mga layuning pang-impormasyon lamang.

ACT sa lokal na pera

1 ACT To MXN$1.11 ACT To GTQQ0.421 ACT To CLP$52.061 ACT To HNLL1.41 ACT To UGXSh198.581 ACT To ZARR1.031 ACT To TNDد.ت0.171 ACT To IQDع.د71.331 ACT To TWDNT$1.811 ACT To RSDдин.5.861 ACT To DOP$3.441 ACT To MYRRM0.241 ACT To GEL₾0.151 ACT To UYU$2.291 ACT To MADد.م.0.521 ACT To OMRر.ع.0.021 ACT To AZN₼0.091 ACT To KESSh7.041 ACT To SEKkr0.541 ACT To UAH₴2.25

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-04-03 04:30:12(UTC+0)

Paano Bumili ng Act I : The AI Prophecy(ACT)

Lumikha ng Iyong Libreng Bitget Account

Mag-sign up sa Bitget gamit ang iyong email address/mobile phone number at gumawa ng malakas na password para ma-secure ang iyong account.

Beripikahin ang iyong account

I-verify ang iyong pagkakakilanlan sa pamamagitan ng paglalagay ng iyong personal na impormasyon at pag-upload ng wastong photo ID.

Convert Act I : The AI Prophecy to ACT

Gumamit ng iba't ibang mga pagpipilian sa pagbabayad upang bumili ng Act I : The AI Prophecy sa Bitget. Ipapakita namin sa iyo kung paano.

I-trade ang ACT panghabang-buhay na hinaharap

Pagkatapos ng matagumpay na pag-sign up sa Bitget at bumili ng USDT o ACT na mga token, maaari kang magsimulang mag-trading ng mga derivatives, kabilang ang ACT futures at margin trading upang madagdagan ang iyong inccome.

Ang kasalukuyang presyo ng ACT ay ₱3.11, na may 24h na pagbabago sa presyo ng -23.37%. Maaaring kumita ang mga trader sa pamamagitan ng alinman sa pagtagal o pagkukulang saACT futures.

Sumali sa ACT copy trading sa pamamagitan ng pagsunod sa mga elite na traders.

Pagkatapos mag-sign up sa Bitget at matagumpay na bumili ng mga token ng USDT o ACT, maaari ka ring magsimula ng copy trading sa pamamagitan ng pagsunod sa mga elite na traders.

Act I : The AI Prophecy balita

Meta Gorgonite: Bakit ang potensyal ng $ACT ay malayo pa sa katapusan

推特观点精选•2024-11-23 02:50

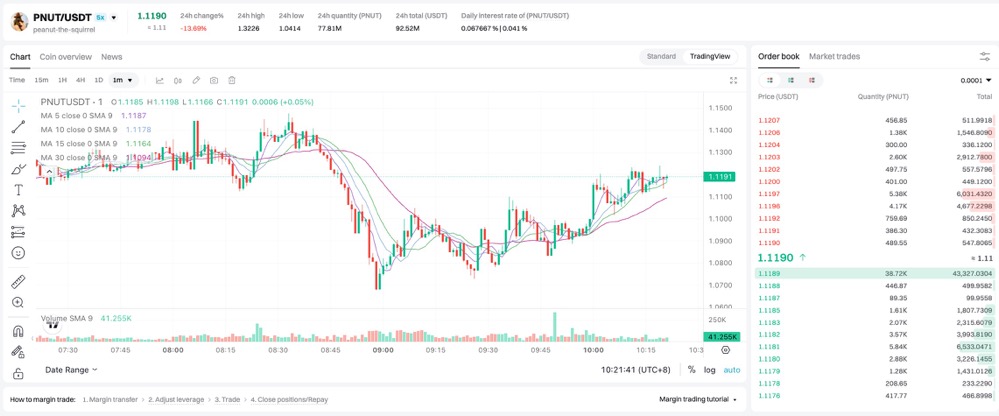

Sun at Moon Xiao Chu: Bakit patuloy akong nagdadagdag ng posisyon sa pag-pullback ng $PNUT at $ACT?

Twitter Opinion Selection•2024-11-23 02:24

![Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 22]](https://img.bgstatic.com/multiLang/web/8e1199d7822fef00d2ec95133764186d.png)

Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 22]

Renata•2024-11-22 09:22

![Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 18]](https://img.bgstatic.com/multiLang/web/8e1199d7822fef00d2ec95133764186d.png)

Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 18]

Renata•2024-11-18 07:48

Buy more

Ang mga tao ay nagtatanong din tungkol sa presyo ng Act I : The AI Prophecy.

Ano ang kasalukuyang presyo ng Act I : The AI Prophecy?

The live price of Act I : The AI Prophecy is ₱3.11 per (ACT/PHP) with a current market cap of ₱2,952,381,644.83 PHP. Act I : The AI Prophecy's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Act I : The AI Prophecy's current price in real-time and its historical data is available on Bitget.

Ano ang 24 na oras na dami ng trading ng Act I : The AI Prophecy?

Sa nakalipas na 24 na oras, ang dami ng trading ng Act I : The AI Prophecy ay ₱23.23B.

Ano ang all-time high ng Act I : The AI Prophecy?

Ang all-time high ng Act I : The AI Prophecy ay ₱53.85. Ang pinakamataas na presyong ito sa lahat ng oras ay ang pinakamataas na presyo para sa Act I : The AI Prophecy mula noong inilunsad ito.

Maaari ba akong bumili ng Act I : The AI Prophecy sa Bitget?

Oo, ang Act I : The AI Prophecy ay kasalukuyang magagamit sa sentralisadong palitan ng Bitget. Para sa mas detalyadong mga tagubilin, tingnan ang aming kapaki-pakinabang na gabay na Paano bumili ng .

Maaari ba akong makakuha ng matatag na kita mula sa investing sa Act I : The AI Prophecy?

Siyempre, nagbibigay ang Bitget ng estratehikong platform ng trading, na may mga matatalinong bot sa pangangalakal upang i-automate ang iyong mga pangangalakal at kumita ng kita.

Saan ako makakabili ng Act I : The AI Prophecy na may pinakamababang bayad?

Ikinalulugod naming ipahayag na ang estratehikong platform ng trading ay magagamit na ngayon sa Bitget exchange. Nag-ooffer ang Bitget ng nangunguna sa industriya ng mga trading fee at depth upang matiyak ang kumikitang pamumuhunan para sa mga trader.

Saan ako makakabili ng Act I : The AI Prophecy (ACT)?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Ang mga investment sa Cryptocurrency, kabilang ang pagbili ng Act I : The AI Prophecy online sa pamamagitan ng Bitget, ay napapailalim sa market risk. Nagbibigay ang Bitget ng madali at convenient paraan para makabili ka ng Act I : The AI Prophecy, at sinusubukan namin ang aming makakaya upang ganap na ipaalam sa aming mga user ang tungkol sa bawat cryptocurrency na i-eooffer namin sa exchange. Gayunpaman, hindi kami mananagot para sa mga resulta na maaaring lumabas mula sa iyong pagbili ng Act I : The AI Prophecy. Ang page na ito at anumang impormasyong kasama ay hindi isang pag-endorso ng anumang partikular na cryptocurrency.

Bitget Insights

Honeyxgpt

3h

Binance criticized on sudden drop of various coins including $ACT -75% in 2 days.

This post reached to 200K people

Keep Sharing and commenting

Let them know

Community is disappointed over these manipulations

@binance @cz_binance

PEOPLE+3.53%

ACT+4.22%

Aicoin-EN-Bitcoincom

5h

Bitcoin Tops $86K on ‘Liberation Day’

President Donald Trump is set to announce new U.S. tariffs on the country’s global trading partners on Wednesday afternoon and bitcoin is trending upward on the news.

The digital asset saw a modest 1.93% gain over the past 24 hours, bringing its price to $86,478.86 at the time of reporting, according to Coinmarketcap. Despite this short-term uptick, BTC remains slightly down 0.31% over the past seven days.

( BTC price / Tradingview)

Bitcoin’s 24-hour price range fluctuated between $83,939.88 and $86,521.54, showing resilience after recent market fluctuations. Trading volume increased by 8.53%, reaching $28.77 billion, indicating renewed market activity ahead of Trump’s trade announcement. Meanwhile, BTC’s market capitalization rose by 1.98% to $1.71 trillion.

Despite ongoing uncertainty, BTC dominance continued its upward trajectory, climbing 0.64% to 62.92%, highlighting its strength against altcoins. Additionally, BTC futures open interest surged 4.31% to $56.53 billion, reflecting heightened investor engagement.

( BTC dominance / Trading View)

Short sellers found themselves on the losing end once again, as $12.93 million in liquidations occurred over the past 24 hours, $12.91 million of which were short positions. This indicates that many traders incorrectly bet on a BTC decline, forcing them to exit their positions.

Trump has dubbed April 2nd “Liberation Day” in the U.S. and is set to kick off a trade war with the country’s global trading partners when he officially announces new sweeping tariffs on Wednesday afternoon at 4 p.m. eastern standard time.

The move could bolster bitcoin’s price as tariffs may weaken the U.S. dollar, driving investors to safe-haven assets such as gold and BTC.

While bitcoin remains somewhat volatile, today’s tariff decision could act as a catalyst for BTC’s next move. If markets perceive Trump’s trade policies as disruptive to traditional financial stability, bitcoin could break higher toward the $90,000 mark in the near term. But if the announcement fails to shake global markets, BTC may continue consolidating within its current range.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

BTC+0.97%

NEAR+2.53%

BGUSER-L93Z90DE

5h

BTC

NEXT POSSIBLE MOVE

Possible Next Move:

1. Support Level: Around $82,638, which is also the 24-hour low. If this level fails to hold, further decline is possible.

2. Resistance Level: Around $85,341 - $88,500. If Bitcoin moves upward, these levels may act as resistance.

3. RSI Indicator: Currently at 45.7 and 36.4, indicating a shift towards a bearish zone. If it drops near 30, it could signal an oversold condition, leading to a potential price reversal.

4. Large Red Candle After a Bullish Move: The price surged to $88,500 before experiencing a sharp decline, possibly due to correction or short selling pressure.

Conclusion:

If the $82,600 support level holds, a short-term bounce is possible.

If it breaks, the price could drop further towards the $81,500 - $80,000 zone.

If Bitcoin reclaims $85,300, it may attempt to reach $88,000 again.

Trading Strategy:

Short-term traders may consider long positions near $82,600, but a stop-loss is essential in case of further decline.

If Bitcoin faces resistance near $85,300, short positions could be an option.

RED+4.29%

HOLD+2.84%

CryptoBriefing

5h

Trump enacts 10% tariff on all imports, ramps up pressure on 60 countries

President Donald Trump announced today a sweeping new tariff policy that will impose a minimum 10% levy on nearly all goods entering the United States, effective April 5.

The policy excludes Canada and Mexico, with both countries exempt from the 10% baseline tariff and reciprocal levies for now.

However, non-compliant goods from those nations will continue to face a 25% tariff, originally imposed on the grounds that they were failing to curb the flow of drugs and crime into the United States. The 10% tariff would only apply if the current 25% duties on Canadian and Mexican imports are lifted or suspended.

In addition to the general import levies, the plan also imposes a separate 25% tariff on all foreign-made automobiles, which takes effect at midnight ET.

Building on that, the administration is also implementing “reciprocal” tariffs on approximately 60 nations, calculated at half their current total trade barriers on US exports.

Among the major US trade partners impacted, China will face a 34% tariff, the EU 20%, Vietnam 46%, Japan 24%, India 26%, Taiwan 32%, Indonesia 32%, and Brazil 10%. These country-specific rates take effect April 9.

“This is not full reciprocal. This is kind reciprocal,” Trump said.

Trump declared a national emergency linked to the US trade deficit, which exceeded $918 billion in 2024, invoking the International Emergency Economic Powers Act to authorize the measures.

“For years, hard-working American citizens were forced to sit on the sidelines as other nations got rich and powerful, much of it at our expense. But now it’s our turn to prosper,” Trump said from the White House Rose Garden. “I blame former presidents and past leaders who weren’t doing their job. They let it happen — to an extent that nobody can even believe,” he added.

The administration projects that the tariffs will generate hundreds of billions in new revenue and boost domestic industry.

Trump said the plan aims to open foreign markets, dismantle trade barriers, and increase production at home, which he believes will lead to stronger competition and lower prices for consumers.

Markets reacted swiftly to the announcement: Bitcoin briefly surged to $88,000 before settling at $84,500, the 10-year US Treasury yield declined, and futures tied to major US indexes fell sharply.

S&P 500 futures dropped 1.9%, while Nasdaq 100 futures slid 2.7% as investors absorbed the full scope of Trump’s sweeping trade action.

Story in development

ACT+4.22%

MAJOR-0.61%

CryptoBriefing

5h

Bhutan government moves $32M Bitcoin on Trump's 'Liberation Day'

Bhutan’s government transferred $32 million worth of Bitcoin to a new wallet today, its second crypto movement in two weeks, according to data from Arkham Intelligence.

The transfer follows last week’s movement of $63 million in Bitcoin to three separate wallets. Druk Holdings, the government’s investment arm, maintains holdings of approximately 8,594 Bitcoin, valued at $729 million at current prices.

Druk Holdings’ portfolio extends beyond Bitcoin to include Ether, LinqAI, Phil, and Apu Apustaja tokens.

While crypto is not legal tender in Bhutan, the country has been mining Bitcoin using hydroelectric resources since 2019, building crypto wealth equivalent to 30.7% of its GDP.

In January, Bhutan’s newly established Gelephu Mindfulness City Special Administration Region announced plans to include Bitcoin, Ether, and BNB in its strategic reserves. The initiative, announced under the Application of Laws Act 2024, aims to enhance the region’s digital asset ecosystem within a regulated framework.

The Bitcoin transfer comes as markets prepare for potential volatility ahead of President Donald Trump’s “Liberation Day” tariff announcement. The White House confirmed the tariffs will take effect immediately upon announcement.

Agne Linge, Head of Growth at WeFi, cautioned that the growing link between digital and traditional markets amplifies crypto’s vulnerability to macroeconomic changes, especially when investors become risk-averse.

“The recent downturn in the S&P 500, hitting a new low, serves as a strong signal that global markets are facing heightened uncertainty, which in turn is putting pressure on risk assets, including cryptocurrencies,” Linge noted in a statement.

According to Linge, economic volatility indicators have surged past historical benchmarks, surpassing peaks from both the 2008 financial crisis and the early 2020 pandemic.

“This surge in uncertainty highlights the growing concern about the stability of the global economy, particularly as inflationary pressures remain persistent,” Linge added.

Trump’s tariffs are expected to fuel inflation, which could lead to higher interest rates. This environment might initially be unfavorable for Bitcoin, as investors seek safe assets.

Bitcoin was trading above $84,000 at press time, per CoinGecko.

ACT+4.22%

LINK+1.85%

Mga kaugnay na asset

Mga sikat na cryptocurrencies

Isang seleksyon ng nangungunang 8 cryptocurrencies ayon sa market cap.

Kamakailang idinagdag

Ang pinakahuling idinagdag na cryptocurrency.

Maihahambing na market cap

Sa lahat ng asset ng Bitget, ang 8 na ito ang pinakamalapit sa Act I : The AI Prophecy sa market cap.