Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.22%

New listings on Bitget : Pi Network

BTC/USDT$83087.10 (-0.71%)Fear at Greed Index32(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$93.2M (1D); +$445.2M (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.22%

New listings on Bitget : Pi Network

BTC/USDT$83087.10 (-0.71%)Fear at Greed Index32(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$93.2M (1D); +$445.2M (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.22%

New listings on Bitget : Pi Network

BTC/USDT$83087.10 (-0.71%)Fear at Greed Index32(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$93.2M (1D); +$445.2M (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

May kaugnayan sa coin

Price calculator

Kasaysayan ng presyo

Paghula ng presyo

Teknikal na pagsusuri

Gabay sa pagbili ng coin

kategorya ng Crypto

Profit calculator

Achain presyoACT

Hindi naka-list

Quote pera:

PHP

Kinukuha ang data mula sa mga third-party na provider. Ang pahinang ito at ang impormasyong ibinigay ay hindi nag-eendorso ng anumang partikular na cryptocurrency. Gustong i-trade ang mga nakalistang barya? Click here

₱0.08717+0.02%1D

Price chart

Last updated as of 2025-03-30 07:50:17(UTC+0)

Market cap:--

Ganap na diluted market cap:--

Volume (24h):--

24h volume / market cap:0.00%

24h high:₱0.08719

24h low:₱0.08717

All-time high:₱79.75

All-time low:₱0.01331

Umiikot na Supply:-- ACT

Total supply:

1,000,000,000ACT

Rate ng sirkulasyon:0.00%

Max supply:

1,000,000,000ACT

Price in BTC:0.{7}1827 BTC

Price in ETH:0.{6}8259 ETH

Price at BTC market cap:

--

Price at ETH market cap:

--

Mga kontrata:--

Ano ang nararamdaman mo tungkol sa Achain ngayon?

Tandaan: Ang impormasyong ito ay para sa sanggunian lamang.

Presyo ng Achain ngayon

Ang live na presyo ng Achain ay ₱0.08717 bawat (ACT / PHP) ngayon na may kasalukuyang market cap na ₱0.00 PHP. Ang 24 na oras na dami ng trading ay ₱0.00 PHP. Ang presyong ACT hanggang PHP ay ina-update sa real time. Ang Achain ay 0.02% sa nakalipas na 24 na oras. Mayroon itong umiikot na supply ng 0 .

Ano ang pinakamataas na presyo ng ACT?

Ang ACT ay may all-time high (ATH) na ₱79.75, na naitala noong 2018-01-10.

Ano ang pinakamababang presyo ng ACT?

Ang ACT ay may all-time low (ATL) na ₱0.01331, na naitala noong 2024-07-28.

Bitcoin price prediction

Kailan magandang oras para bumili ng ACT? Dapat ba akong bumili o magbenta ng ACT ngayon?

Kapag nagpapasya kung buy o mag sell ng ACT, kailangan mo munang isaalang-alang ang iyong sariling diskarte sa pag-trading. Magiiba din ang aktibidad ng pangangalakal ng mga long-term traders at short-term traders. Ang Bitget ACT teknikal na pagsusuri ay maaaring magbigay sa iyo ng sanggunian para sa trading.

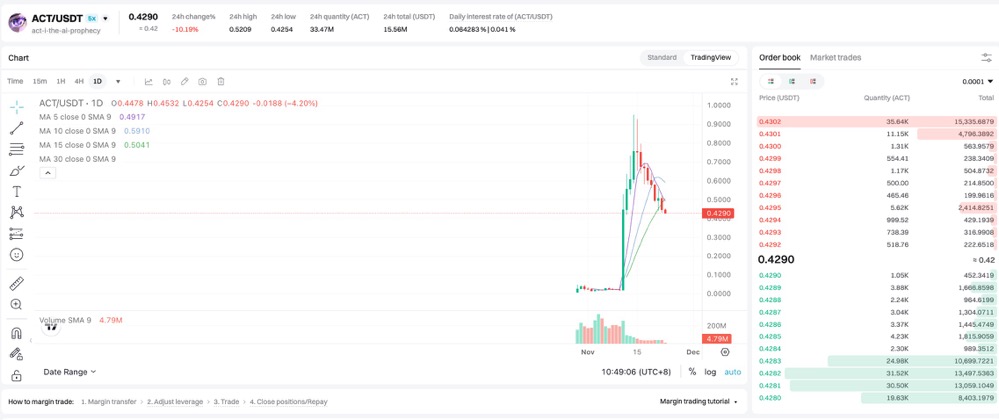

Ayon sa ACT 4 na teknikal na pagsusuri, ang signal ng kalakalan ay Malakas bumili.

Ayon sa ACT 1d teknikal na pagsusuri, ang signal ng kalakalan ay Buy.

Ayon sa ACT 1w teknikal na pagsusuri, ang signal ng kalakalan ay Sell.

Ano ang magiging presyo ng ACT sa 2026?

Batay sa makasaysayang modelo ng hula sa pagganap ng presyo ni ACT, ang presyo ng ACT ay inaasahang aabot sa ₱0.1059 sa 2026.

Ano ang magiging presyo ng ACT sa 2031?

Sa 2031, ang presyo ng ACT ay inaasahang tataas ng +45.00%. Sa pagtatapos ng 2031, ang presyo ng ACT ay inaasahang aabot sa ₱0.2158, na may pinagsama-samang ROI na +147.56%.

Achain price history (PHP)

The price of Achain is -13.09% over the last year. The highest price of in PHP in the last year was ₱0.2719 and the lowest price of in PHP in the last year was ₱0.01331.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h+0.02%₱0.08717₱0.08719

7d+0.55%₱0.06667₱0.08729

30d-5.12%₱0.05909₱0.09903

90d-27.85%₱0.05872₱0.1405

1y-13.09%₱0.01331₱0.2719

All-time-99.36%₱0.01331(2024-07-28, 245 araw ang nakalipas )₱79.75(2018-01-10, 7 taon na ang nakalipas )

Achain impormasyon sa merkado

Achain's market cap history

Achain holdings by concentration

Whales

Investors

Retail

Achain addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Achain na mga rating

Mga average na rating mula sa komunidad

4.6

Ang nilalamang ito ay para sa mga layuning pang-impormasyon lamang.

ACT sa lokal na pera

1 ACT To MXN$0.031 ACT To GTQQ0.011 ACT To CLP$1.431 ACT To HNLL0.041 ACT To UGXSh5.561 ACT To ZARR0.031 ACT To TNDد.ت01 ACT To IQDع.د1.991 ACT To TWDNT$0.051 ACT To RSDдин.0.171 ACT To DOP$0.11 ACT To MYRRM0.011 ACT To GEL₾01 ACT To UYU$0.061 ACT To MADد.م.0.011 ACT To AZN₼01 ACT To OMRر.ع.01 ACT To KESSh0.21 ACT To SEKkr0.021 ACT To UAH₴0.06

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-03-30 07:50:17(UTC+0)

Achain balita

Meta Gorgonite: Bakit ang potensyal ng $ACT ay malayo pa sa katapusan

推特观点精选•2024-11-23 02:50

Sun at Moon Xiao Chu: Bakit patuloy akong nagdadagdag ng posisyon sa pag-pullback ng $PNUT at $ACT?

Twitter Opinion Selection•2024-11-23 02:24

![Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 22]](https://img.bgstatic.com/multiLang/web/8e1199d7822fef00d2ec95133764186d.png)

Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 22]

Renata•2024-11-22 09:22

![Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 18]](https://img.bgstatic.com/multiLang/web/8e1199d7822fef00d2ec95133764186d.png)

Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 18]

Renata•2024-11-18 07:48

Buy more

Ang mga tao ay nagtatanong din tungkol sa presyo ng Achain.

Ano ang kasalukuyang presyo ng Achain?

The live price of Achain is ₱0.09 per (ACT/PHP) with a current market cap of ₱0 PHP. Achain's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Achain's current price in real-time and its historical data is available on Bitget.

Ano ang 24 na oras na dami ng trading ng Achain?

Sa nakalipas na 24 na oras, ang dami ng trading ng Achain ay ₱0.00.

Ano ang all-time high ng Achain?

Ang all-time high ng Achain ay ₱79.75. Ang pinakamataas na presyong ito sa lahat ng oras ay ang pinakamataas na presyo para sa Achain mula noong inilunsad ito.

Maaari ba akong bumili ng Achain sa Bitget?

Oo, ang Achain ay kasalukuyang magagamit sa sentralisadong palitan ng Bitget. Para sa mas detalyadong mga tagubilin, tingnan ang aming kapaki-pakinabang na gabay na Paano bumili ng achain .

Maaari ba akong makakuha ng matatag na kita mula sa investing sa Achain?

Siyempre, nagbibigay ang Bitget ng estratehikong platform ng trading, na may mga matatalinong bot sa pangangalakal upang i-automate ang iyong mga pangangalakal at kumita ng kita.

Saan ako makakabili ng Achain na may pinakamababang bayad?

Ikinalulugod naming ipahayag na ang estratehikong platform ng trading ay magagamit na ngayon sa Bitget exchange. Nag-ooffer ang Bitget ng nangunguna sa industriya ng mga trading fee at depth upang matiyak ang kumikitang pamumuhunan para sa mga trader.

Saan ako makakabili ng crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Ang mga investment sa Cryptocurrency, kabilang ang pagbili ng Achain online sa pamamagitan ng Bitget, ay napapailalim sa market risk. Nagbibigay ang Bitget ng madali at convenient paraan para makabili ka ng Achain, at sinusubukan namin ang aming makakaya upang ganap na ipaalam sa aming mga user ang tungkol sa bawat cryptocurrency na i-eooffer namin sa exchange. Gayunpaman, hindi kami mananagot para sa mga resulta na maaaring lumabas mula sa iyong pagbili ng Achain. Ang page na ito at anumang impormasyong kasama ay hindi isang pag-endorso ng anumang partikular na cryptocurrency.

Bitget Insights

ZhangWeicrypto

58m

💡 Understanding the Basics of Crypto Trading 📚

Crypto trading involves buying

at💡 Understanding the Basics of Crypto Trading 📚

Crypto trading involves buying and selling cryptocurrencies on online exchanges. To succeed in crypto trading, it's essential to understand the basics.

*What is Crypto Trading? 🤔*

- *Definition*: Crypto trading is the act of buying and selling cryptocurrencies on online exchanges.

- *Types*: There are several types of crypto trading, including day trading, swing trading, and long-term investing.

*Key Concepts 📊*

- *Blockchain*: The underlying technology behind cryptocurrencies.

- *Exchanges*: Online platforms where cryptocurrencies are bought and sold.

- *Wallets*: Software programs that store and manage cryptocurrencies.

- *Private Keys*: Unique codes used to access and manage cryptocurrencies.

*Trading Strategies 📈*

- *Day Trading*: Buying and selling cryptocurrencies within a short period.

- *Swing Trading*: Buying and selling cryptocurrencies over a longer period.

- *Long-term Investing*: Holding onto cryptocurrencies for an extended period.

*Risk Management 🚨*

- *Volatility*: Cryptocurrency prices can be highly volatile.

- *Security Risks*: Cryptocurrency exchanges and wallets can be vulnerable to hacking.

- *Regulatory Risks*: Changes in regulations can impact the value of cryptocurrencies.

*Getting Started 📚*

- *Choose an Exchange*: Select a reputable online exchange to buy and sell cryptocurrencies.

- *Set Up a Wallet*: Create a software program to store and manage cryptocurrencies.

- *Educate Yourself*: Learn about blockchain technology, trading strategies, and risk management.$BTC $IOST $MAK $SLF

BTC+0.53%

IOST+1.79%

Cryptonews Official

1h

Hawk Tuah Girl: SEC ends meme coin investigation, ‘work is complete’

Add “Hawk Tuah Girl” to the list of cryptocurrency investigations that the U.S. Securities and Exchange Commission is no longer interested in pursuing.

Haliey Welch, who gained fame as the “Hawk Tuah Girl” in a viral video, has announced that the U.S. regulators concluded their investigation into the controversial meme coin bearing her catchphrase without taking action against her.

“For the past few months, I’ve been cooperating with all the authorities and attorneys, and finally, that work is complete,” Welch told TMZ .

Welch’s attorney, James Sallah, elaborated on the outcome:

The SEC closed the investigation without making any findings against, or seeking any monetary sanctions from, Haliey. Because they did not bring any action against her, there are no restrictions on what she can do in regards to crypto or securities in the future.

The $HAWK token became the subject of regulatory scrutiny after experiencing a crash following its sudden rise. The surge saw the coin reach a market capitalization of nearly $500 million before plunging to around $3 million. The collapse left many investors with substantial losses.

While Welch escaped SEC penalties, the coin’s creators face a separate lawsuit alleging negligence for launching the token without proper regulatory approval.

Sources close to Welch say the influencer has severed ties with the LLC behind the coin and will not support or promote it.

Welch’s viral fame began with a street interview where her description of a certain physical act quickly went viral. She capitalized on her sudden celebrity through various ventures, including the “Talk Tuah” podcast.

Reports also mentioned that a “Hawk Tuah” documentary is being developed.

The Hawk Tuah coin isn’t the only crypto-related entity to see its troubles swept under the rug.

The SEC has recently dismissed various cryptocurrency investigations and lawsuits, including cases against Immutable , Crypto.com , Ripple and Coinbase .

Since Gary Gensler, a Biden administration appointee, resigned as SEC chair, cryptocurrency companies and entrepreneurs enjoy looser regulatory oversight under the current Trump administration.

According to Politico, crypto companies (e.g., Ripple, Coinbase, Kraken, Robinhood, and Circle) have made seven-figure donations to Trump since Nov. 5, 2024.

After the Hawk Tuah meme coin crash, Welch temporarily disappeared from social media, raising questions about her involvement in the project.

Despite the controversy, Welch appears ready to move forward.

“Happy to be starting back up again,” she told TMZ.

UP0.00%

ACT-0.05%

BGUSER-ASLPKDVB

1h

$BANANAS31: Speculative Hype or Long-Term Contender?

The $BANANAS31 meme coin has gained significant attention in the cryptocurrency market, with its unique concept and strong community backing. Here's an analysis of its potential as a long-term contender.

Key Features

- *Meme Concept*: $BANANAS31 is inspired by the "Banana for Scale" meme, which originated from a humorous act of using bananas to measure object sizes.

- *Community Support*: The coin has a strong community backing, with over 110,000 holders and 30,000 holding addresses.

- *Market Performance*: $BANANAS31 has experienced significant market fluctuations, with three early price drops of over 50%.

Long-Term Potential

- *Growth Opportunities*: $BANANAS31 has potential for growth, with its unique concept and strong community backing.

- *Risks*: The coin's market is highly volatile, and its price may fluctuate significantly.

- *Adoption*: The coin's adoption rate is crucial for its long-term success.

Conclusion

$BANANAS31 is a meme coin with a unique concept and strong community backing. While it has potential for growth, its market volatility and risks should be carefully considered. Investors should assess their risk tolerance and investment goals before making a decision.¹

BANANAS31-0.98%

BANANA+0.36%

BGUSER-ASLPKDVB

1h

BANANAS31 Meme Coin Technical Analysis and Trade Signal

The BANANAS31 meme coin has been gaining attention in the cryptocurrency market, with its unique concept and strong community backing. Here's a technical analysis of the coin's performance and potential future trends.

Key Features

- *Meme Concept*: BANANAS31 is inspired by the "Banana for Scale" meme, which originated from a humorous act of using bananas to measure object sizes.

- *Community Support*: The coin has a strong community backing, with over 110,000 holders and 30,000 holding addresses.

- *Market Performance*: BANANAS31 has experienced significant market fluctuations, with three early price drops of over 50%.

Technical Analysis

- *Price Prediction*: The coin's price is predicted to reach $0.018 in 2025, $0.089 in 2026, and $4.42 in 2030.

- *Trend Analysis*: The coin's trend is bullish, with a potential for growth in the long term.

- *Support and Resistance*: The coin's support level is around $0.0075, while its resistance level is around $0.035.

Trade Signal

- *Buy Signal*: A buy signal is generated when the fast moving average (MA) crosses above the slow MA, indicating potential upward momentum.

- *Volume Spike Detection*: The indicator detects high-volume periods using a multiplier, indicating increased buying interest.

- *Bitcoin Trend Alignment*: The trend of Bitcoin is gauged with a 20-day moving average, providing additional bullish confirmation for meme coins.

Conclusion

BANANAS31 is a meme coin with a unique concept and strong community backing. Its technical analysis suggests a bullish trend, with potential for growth in the long term. However, investors should be cautious of the coin's market volatility and potential risks.¹ ²

BANANAS31-0.98%

BITCOIN+1.12%

BGUSER-ASLPKDVB

2h

BANANAS31 Meme Coin Technical Analysis

The BANANAS31 meme coin has gained significant attention in the cryptocurrency market, with its unique concept and strong community backing. Here's a technical analysis of the coin's performance and potential future trends.

Key Features

- *Meme Concept*: BANANAS31 is inspired by the "Banana for Scale" meme, which originated from a humorous act of using bananas to measure object sizes.

- *Community Support*: The coin has a strong community backing, with over 110,000 holders and 30,000 holding addresses.

- *Market Performance*: BANANAS31 has experienced significant market fluctuations, with three early price drops of over 50%.

Technical Analysis

- *Price Prediction*: The coin's price is predicted to reach $0.018 in 2025, $0.089 in 2026, and $4.42 in 2030.

- *Trend Analysis*: The coin's trend is bullish, with a potential for growth in the long term.

- *Support and Resistance*: The coin's support level is around $0.0075, while its resistance level is around $0.035.

Investment Potential

- *Growth Opportunities*: BANANAS31 has potential for growth, with its unique concept and strong community backing.

- *Risks*: The coin's market is highly volatile, and its price may fluctuate significantly.

Conclusion

BANANAS31 is a meme coin with a unique concept and strong community backing. Its technical analysis suggests a bullish trend, with potential for growth in the long term. However, investors should be cautious of the coin's market volatility and potential risks.¹ ²

BANANAS31-0.98%

BANANA+0.36%

Mga kaugnay na asset

Mga sikat na cryptocurrencies

Isang seleksyon ng nangungunang 8 cryptocurrencies ayon sa market cap.

Kamakailang idinagdag

Ang pinakahuling idinagdag na cryptocurrency.

Maihahambing na market cap

Sa lahat ng asset ng Bitget, ang 8 na ito ang pinakamalapit sa Achain sa market cap.

Achain Social Data

Sa nakalipas na 24 na oras, ang marka ng sentimento ng social media para sa Achain ay 3, at ang trend ng presyo ng social media patungo sa Achain ay Bullish. Ang overall na marka ng social media ng Achain ay 0, na nagra-rank ng 846 sa lahat ng cryptocurrencies.

Ayon sa LunarCrush, sa nakalipas na 24 na oras, binanggit ang mga cryptocurrencies sa social media nang 1,058,120 (na) beses, na binanggit ang Achain na may frequency ratio na 0%, na nagra-rank ng 1081 sa lahat ng cryptocurrencies.

Sa nakalipas na 24 na oras, mayroong total 13 na natatanging user na tumatalakay sa Achain, na may kabuuang Achain na pagbanggit ng 1. Gayunpaman, kumpara sa nakaraang 24 na oras, ang bilang ng mga natatanging user bumaba ng 0%, at ang kabuuang bilang ng mga pagbanggit ay bumaba ng 0%.

Sa Twitter, mayroong kabuuang 0 na tweet na nagbabanggit ng Achain sa nakalipas na 24 na oras. Kabilang sa mga ito, ang 0% ay bullish sa Achain, 0% ay bearish sa Achain, at ang 100% ay neutral sa Achain.

Sa Reddit, mayroong 0 na mga post na nagbabanggit ng Achain sa nakalipas na 24 na oras. Kung ikukumpara sa nakaraang 24 na oras, ang bilang ng mga pagbanggit bumaba ng 0% . Bukod pa rito, mayroong 0 na komento na nagbabanggit ng Achain. Kung ikukumpara sa nakaraang 24 na oras, ang bilang ng mga pagbanggit ay bumaba ng 0%.

Lahat ng panlipunang pangkalahatang-ideya

3