Dogecoin Price Soars, Analysts Predict Potential Rally to $3

The price of Dogecoin is demonstrating powerful upward momentum, which brought it to the $0.172 level after increasing 5.7%. DOGE has pushed through its essential support level and now shows potential for additional price appreciation. Crypto analysts anticipate the price will reach $3 if support levels maintain their current position, which would represent a major recovery for the meme coin.

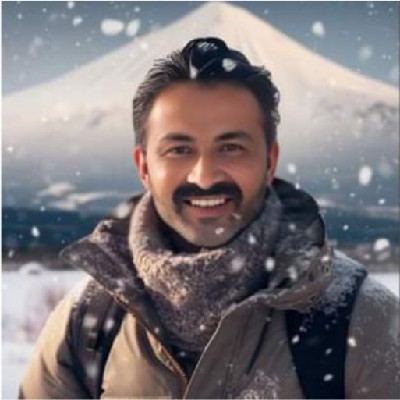

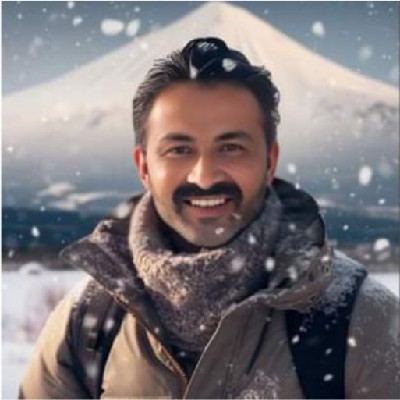

The analyst Ali Martinez found that Dogecoin continues to stay inside an essential price range. A steady price increase for DOGE will become possible if support levels stay stable. The stock RSI triggered two major price uptrends for Dogecoin according to Martinez because of its bullish crossovers which respectively resulted in 88% gains during October 2023 and another 187% increase in February 2024. Another robust price movement seems possible because the stock RSI indicates it will generate a bullish crossover point.

Dogecoin network continues to expand rapidly throughout its operation period. During the last month new DOGE addresses increased by 100% from 16,400 to 34,600. The growing market adoption strengthens Dogecoin’s ecosystem and enhances its potential to grow in the long term.

The open interest for DOGE futures markets has risen by 4.5% to $1.40 billion while the 24-hour total liquidations exceeded $7.24 million. The growing number of market participants demonstrates that investors strongly believe Dogecoin has strong upward potential.

Tardigrade identified a past pattern which indicates Dogecoin could break out according to analyses. The price initially drops down before consolidating its position while RSI readings stay in a region of extreme price weakness. Bullish market sentiment will strengthen as Dogecoin might experience another major uptrend event based on existing patterns.

The investment management firm Bitwise continues its evaluation of launching an ETF that would include Dogecoin as an index component. An approved Dogecoin ETF would establish an opportunity for large institutional capital, amounting to new investments which would hasten its market rise.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Trump Family’s WLFI Token Sale Surges to $550M Amid Market Momentum

World Liberty Financial (WLFI), a project featuring the Trump family, has successfully concluded its token sale, raising an impressive $550 million, Wu Blockchain reports . The initial sale faced slow demand, but momentum shifted following the launch of Trump-themed tokens. This turnaround highlights growing investor interest in politically themed blockchain ventures.

WLFI’s public sale began on October 15 with an initial fundraising target of $300 million. The project offered 20 billion tokens at $0.015 each, restricted to whitelisted investors. However, early sales were sluggish, securing only $11 million from 766 million tokens. Consequently, the team revised its target to $30 million to reflect market conditions.

The landscape changed dramatically after the introduction of the “ Official Trump (TRUMP)” and “ Melania Meme (MELANIA)” tokens. Their rapid popularity ignited renewed interest in WLFI. By January 20, 20% of WLFI’s initial supply had been sold. Seizing the momentum, WLFI issued an additional 5 billion tokens at a higher price of $0.05 each. Demand surged, and by March 13, 99% of these new tokens had been sold.

Tron founder Justin Sun emerged as one of the largest investors. He initially acquired $30 million worth of WLFI tokens in November. He subsequently raised his investment to $75 million in January by an additional $45 million. Pantera Capital, Polychain Capital, Dragonfly Capital Partners, and F-Prime Capital were among the other prominent investors.

WLFI token holders gain governance rights within the WLF Protocol. However, tokens will remain non-transferable for the first 12 months. While the Trump family, including Eric Trump, Donald Trump Jr., and Barron Trump, are prominently featured, the project’s whitepaper clarifies they neither own nor directly manage WLFI. However, they may receive compensation.

Besides token sales, Ethena Labs, which is associated with the project, plans to launch a blockchain targeting traditional financial institutions. Moreover, Ethena recently introduced USDtb, a stablecoin backed by BlackRock’s BUIDL fund. This coin is designed to enhance market stability during stress periods.

Furthermore, following a $1.4 billion hack on the Bybit exchange , Ethena Labs confirmed that its USDe stablecoin remains fully collateralized. Their exposure to Bybit was minimal, safeguarding investors’ assets through off-exchange custody solutions.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

SHIB Team Unveils Revolutionary Solution for Businesses & Governments

The lead of marketing of the Shiba Inu team, Lucie, has recently shared some key details regarding SHIB’s newly launched product, the SHIB OS (Operating System). In a post on the X platform, addressing the crypto community, Lucie described SHIB OS as a foundational innovation poised to secure the future of decentralized governance.

As reported previously, the launch of SHIB OS was initially announced by Shytoshi Kusama, the founder of Shiba Inu, back in January. In her recent tweet, marketing lead Lucie described the SHIB OS as a “turnkey solution” designed for governments and enterprises seeking to transition from outdated centralized systems to transparent, efficient, and secure decentralized governance models.

She further added that the SHIB OS is powered by Shiba Inu’s layer-2 platform Shibarium that guarantees immutability, reliability, and security. This robust foundation enables trustless decision-making and streamlined operations, making it a cutting-edge tool for decentralized governance.

SHIB OS, the latest innovation of the Shiba Inu, would provide governments and enterprises with tools to enhance operations through its censorship-resistant infrastructure. Furthermore, its operating system allows for decentralized identity management and data storage while streamlining processes, reducing bureaucracy, and increasing efficiency.

Additionally, some of the key features of the SHIB OS include treasury management, transparent voting systems, robust data security for sensitive applications, and cross-chain compatibility. Furthermore, governments can also leverage this platform to ensure spending transparency, secure voting processes, and digital identity integration.

On the other hand, enterprises can leverage SHIB OS to enhance supply chain transparency, access decentralized marketplaces, and improve regulatory compliance. Furthermore, non-profits can use SHIB OS to offer transparency in donation allocation, while financial institutions benefit from secure data-sharing mechanisms.

This development marks another step in Shiba Inu’s evolution, moving beyond its “meme coin” image to establish itself as a provider of innovative blockchain solutions in the cryptocurrency ecosystem.

Amid the broader crypto market correction, Shiba Inu has also faced selling pressure, correcting 23% over the past month. Currently, the SHIB price has been flirting around $0.00001250, with some market analysts eyeing a major catalyst ahead, as per our previous analysis .

In related news, the SHIB burn rate, a key metric tied to Shibarium, has seen a moderate uptick, increasing by 123% over the past 24 hours. While the total amount of SHIB destroyed wasn’t massive, it was still notable, with 1,816,326 SHIB permanently removed from circulation. This burn occurred across two transactions, one of which sent 1,000,000 SHIB to a dead wallet.

South Korea Pushes for a Bitcoin Reserve. Could $BTCBULL Presale Benefit?

The South Korean Democrat

South Korea Pushes for a Bitcoin Reserve. Could $BTCBULL Presale Benefit?

The South Korean Democratic Party has called for the formation of a Bitcoin reserve in their country as a response to Trump’s announcement of a US Bitcoin reserve. With nations racing to hoard Bitcoin, the price of $BTC can only rally. If you want to get in on that action, it could be worth checking out a meme coin designed to ride on Bitcoin’s coattails, BTC Bull Token ($BTCBULL). South Korea Takes Cue from the US Just two days back, Trump signed an executive order to set up a Bitcoin reserve in the US, calling it the ‘digital Fort Knox for digital gold.’ He also laid down the country’s plan to build a stable pile of the best altcoins. As expected, this has started a global crypto race, and South Korea is among the first countries to hop on the bandwagon. South Korea’s quick response is .

$BTC has experienced notable price movements recently, reflecting the cryptocurrency market's inherent volatility.

After reaching an all-time high of $109,071 in January, Bitcoin's price has declined by nearly 25%, currently trading around $80,000. This downturn has significantly impacted new investors, especially those who entered the market during the recent crypto surge. Analysts note that recent buyers are incurring substantial losses, with the spent output profit ratio dipping to its lowest level in over a year. Leveraged traders are particularly affected, with daily overall losses exceeding $800 million.

Despite attempts to stabilize the market, such as President Trump's executive order to create a bitcoin strategic reserve, Bitcoin's decline continues, influenced by global stock sell-offs and broader economic concerns. The situation resembles the market turbulence experienced in late 2018, suggesting further volatility ahead before any potential recovery.

Some analysts predict that Bitcoin could face further declines, potentially dropping to $73,000 amid a prolonged pullback. Factors contributing to this outlook include similarities to the end of the 2021 crypto bull market and shifting market narratives from payments to decentralized finance (DeFi), non-fungible tokens (NFTs), and meme coins. Additionally, macroeconomic headwinds, such as US-China tariff escalations and the Federal Reserve's hawkish stance, are influencing Bitcoin's price action.

The cryptocurrency market's volatility underscores the importance of thorough research and caution for investors considering entering this space.

Niedrigster Preis

Niedrigster Preis Höchster Preis

Höchster Preis