Meme Coin Launch Pad From Lightchain AI—What This Means for the Future of Crypto

This content is provided by a sponsor.

PRESS RELEASE.

The crypto world is buzzing with the latest announcement from Lightchain AI—a cutting-edge meme coin launch pad is on its way, exclusively for Lightchain AI users on the mainnet. Alongside this exciting development, Lightchain AI is also introducing its very own token, LCAI, a project poised to revolutionize how meme coins are created, supported, and launched within the ecosystem.

If you’re a crypto investor, meme coin enthusiast, or part of the Lightchain AI community, this launch pad could open up unprecedented opportunities for innovation and growth within the decentralized economy. Keep reading to discover what this means for you and why it’s the perfect time to join the presale of LCAI tokens.

@@@@@@ Join Final Stage of Lightchain AI Presale @@@@@@@

Why Meme Coins Matter in the Crypto Space

Meme coins are no joke. From the rise of Dogecoin to the explosion of Shiba Inu, meme coins have become a key driver of mass crypto adoption. They represent creativity, community, and a bit of fun in the often-complex crypto landscape. More importantly, they have proven that community-driven projects can thrive, generating millions in trading volumes and reaching expansive market caps.

However, as meme coins gain popularity, they face challenges such as:

This is where Lightchain AI’s meme coin launch pad comes into play.

What Is Lightchain AI’s Meme Coin Launch Pad?

Lightchain AI’s meme coin launch pad is more than just a platform—it’s an ecosystem designed to enable the seamless creation, deployment, and growth of meme coins. Built on Lightchain AI’s high-speed, AI-powered blockchain, it aims to eliminate the barriers standing in the way of meme coin developers and investors.

Here’s what you can expect from the launch pad:

1. Mainnet Integration

The launch pad will be integrated directly into the Lightchain AI mainnet, offering the speed and scalability needed to support meme coin projects effortlessly. Developers can harness the advanced features of Lightchain AI to launch tokens optimized for performance and growth.

2. Accessible to All

Whether you’re an experienced crypto developer or a newcomer with big ideas, the launch pad simplifies the development process. It removes the technical complexities of token creation, allowing anyone to bring their meme coin vision to life.

3. Investor-Centric Features

For investors, the launch pad provides a secure and trustworthy environment to explore new opportunities. All projects launched will undergo rigorous vetting processes, ensuring that scam projects stay out of the ecosystem.

4. AI-Driven Analytics

Developers and investors alike will benefit from AI-powered insights into market trends, audience engagement, and token performance. This real-time data ensures that both teams and investors can make informed decisions as projects grow.

5. Built-in Community Tools

Meme coins thrive on strong communities. Lightchain AI’s launch pad supports this with built-in tools for managing communities, running promotions, and engaging with your audience.

Introducing LCAI: The Token That Powers the Ecosystem

Alongside the meme coin launch pad, Lightchain AI will release its highly anticipated token, LCAI.

LCAI isn’t just another coin—it’s the foundation of the Lightchain AI ecosystem. Designed to fuel all operations on the launch pad, LCAI tokens will be used for everything from transaction fees to funding new projects.

Key Features of LCAI

Why Now Is the Right Time to Join the LCAI Presale

The launch of the Lightchain AI meme coin launch pad represents a monumental moment for the crypto community. But to fully capitalize on this opportunity, being part of the final stage of the LCAI presale is crucial.

@@@@@@ Join Final Stage of Lightchain AI Presale @@@@@@@

Here’s why:

Act now to reserve your spot before the presale ends, and join thousands of forward-thinking crypto enthusiasts already reaping the benefits of Lightchain AI.

Building the Future of Meme Coins—Together

With the introduction of its meme coin launch pad and the release of LCAI, Lightchain AI is setting a new industry standard for innovation, transparency, and accessibility in crypto. This launch pad is more than just a platform; it’s a community-driven initiative to unlock creativity and economic opportunity within the meme coin market.

Crypto investors, meme coin creators, and Lightchain AI community members—this is your moment to be part of something transformational. The future of meme coins is here. Will you be part of it?

_________________________________________________________________________

Bitcoin.com accepts no responsibility or liability, and is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Yield Stablecoins Are the Future, Says JPMorgan

Yield-bearing stablecoins are quickly emerging as the next big thing in the crypto ecosystem. Offering interest returns similar to traditional financial products, these assets have captured attention from investors, institutions, and now major banks. According to JPMorgan , yield-bearing stablecoins could grow from just 6% of the stablecoin market to as much as 50%, provided regulatory developments don’t slow their momentum. With the recent explosion in market cap and use cases, is this the beginning of a stablecoin revolution?

As reported , JPMorgan analysts, led by Nikolaos Panigirtzoglou, highlight several reasons behind the rise. Unlike traditional stablecoins like USDT and USDC , which don’t share reserve yields with users, yield-bearing stablecoins offer passive income—without the risks of lending, trading, or giving up custody.

The top five players in this space — Ethena's USDe, Sky Dollar's USDS, BlackRock's BUIDL, Usual Protocol's USD0, and Ondo Finance's USDY — have seen combined market caps rise from $4 billion to over $13 billion since November 2024. This growth shows no sign of slowing.

Read this article>> Bitcoin or Stablecoins: Which Is the Best to Hold in 2025? <<

A major catalyst has been the adoption of tokenized Treasurys, which behave like digital versions of government bonds. These instruments provide yield and are now accepted as collateral on trading platforms like Deribit and FalconX. This means traders can post them as collateral and still earn yield — a win-win scenario.

In DeFi, declining returns on traditional platforms have pushed users toward tokenized Treasurys. Even projects like Frax Finance are integrating these assets, proving they’re more than just hype — they’re becoming infrastructure.

Regulation remains a double-edged sword. Yield-bearing stablecoins are often classified as securities, meaning they must comply with stricter laws. This adds friction, especially for retail investors. However, the SEC’s recent approval of Figure Markets’ yield-bearing stablecoin, YLDS, as a registered security, suggests a pathway forward.

Traditional stablecoins still have the liquidity edge, with a $220 billion market cap and wide use across exchanges and blockchains. Their speed and low-cost transactions remain a barrier to yield-bearing stablecoins, which are newer and less liquid.

According to JPMorgan, yes—over time. These coins could become the preferred form of collateral in crypto derivatives, DAO treasuries, and venture fund reserves. As they gain traction, the current liquidity disadvantage may fade.

Idle capital currently sitting in traditional stablecoins could flow into yield-bearing alternatives, especially as more institutions seek capital efficiency. While this shift won’t happen overnight, the signs point to a gradual but powerful transformation in how capital moves in crypto.

Read this article>> Bitcoin or Stablecoins: Which Is the Best to Hold in 2025? <<

If the trend continues and regulatory clarity improves, JPMorgan’s projection of 50% market share for yield-bearing stablecoins is not just bold — it’s realistic. With investors demanding both stability and returns, these new stablecoins are well-positioned to disrupt a market long dominated by yieldless tokens.

As crypto evolves toward a more institutional future, yield-bearing stablecoins might just become the default standard.

Build a Lower-Risk Crypto Portfolio: Allocation Strategy Detailed

Building a balanced crypto portfolio is crucial for investors taking a lower-risk approach, especially given ongoing market uncertainty. This uncertainty stems from macroeconomic factors like past quantitative easing (QE) and persistent questions around Federal Reserve interest rate decisions.

While crypto market cycles suggest significant upside potential still exists, the lack of clarity on Fed timing makes risk management essential. This suggested strategy aims to buffer potential downside while retaining exposure to growth opportunities.

Bitcoin (BTC) and Ethereum (ETH) anchor this suggested portfolio framework, allocated at 40% and 15% respectively. Bitcoin is increasingly viewed as an institutional-grade asset, with large players and even companies like GameStop reportedly accumulating or aiming to increase their BTC holdings.

At press time, BTC traded near $87,378 (possible data discrepancy in source), holding a market cap around $1.73 trillion. Such a significant Bitcoin allocation aims primarily to reduce overall portfolio volatility compared to smaller altcoins.

Ethereum provides further stability, trading near $2,024 and showing resilience around the $2,000 support level recently. Its foundational role supporting much of the decentralized finance (DeFi) and smart contract ecosystem makes it essential. Additionally, ETH has considerable room to grow before potentially revisiting its previous all-time high (ATH).

Solana (SOL) receives a 15% allocation in this model. This provides exposure to a high-speed blockchain noted for its rapidly growing developer ecosystem and strong performance relative to past cycles. SOL currently trades near $138.87 .

Another 10% of the portfolio adds diversification through other established large-cap tokens. Examples cited align with key emerging crypto narratives: Chainlink (LINK) for oracle infrastructure, Sui (SUI) for Layer 1 innovation, Hedera (HBAR) for enterprise use cases, and Ondo (ONDO) focused on real-world asset (RWA) tokenization. Recent performance highlights include SUI gaining over 15% and LINK nearly 7% in the past week.

For higher growth potential, 10% is designated for selected mid-cap assets. The examples span various sectors: Bittensor (TAO) focusing on AI, Aptos (APT) on Layer 1 technology, Render (RENDER) in GPU/AI rendering, and Telcoin (TEL) targeting remittances. Render (near $3.96) recently surged almost 19% over seven days. These assets offer exposure to newer trends.

A final 10% targets carefully chosen small-cap projects within high-growth verticals like Artificial Intelligence (AI), RWA, Decentralized Physical Infrastructure Networks (DePIN), innovative DeFi protocols, and blockchain gaming.

While individual small caps carry higher inherent risk, they also hold potential for significant returns during market upswings. Limiting the total allocation aims to capture this upside potential while managing the overall portfolio’s risk exposure.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

最低價

最低價 最高價

最高價

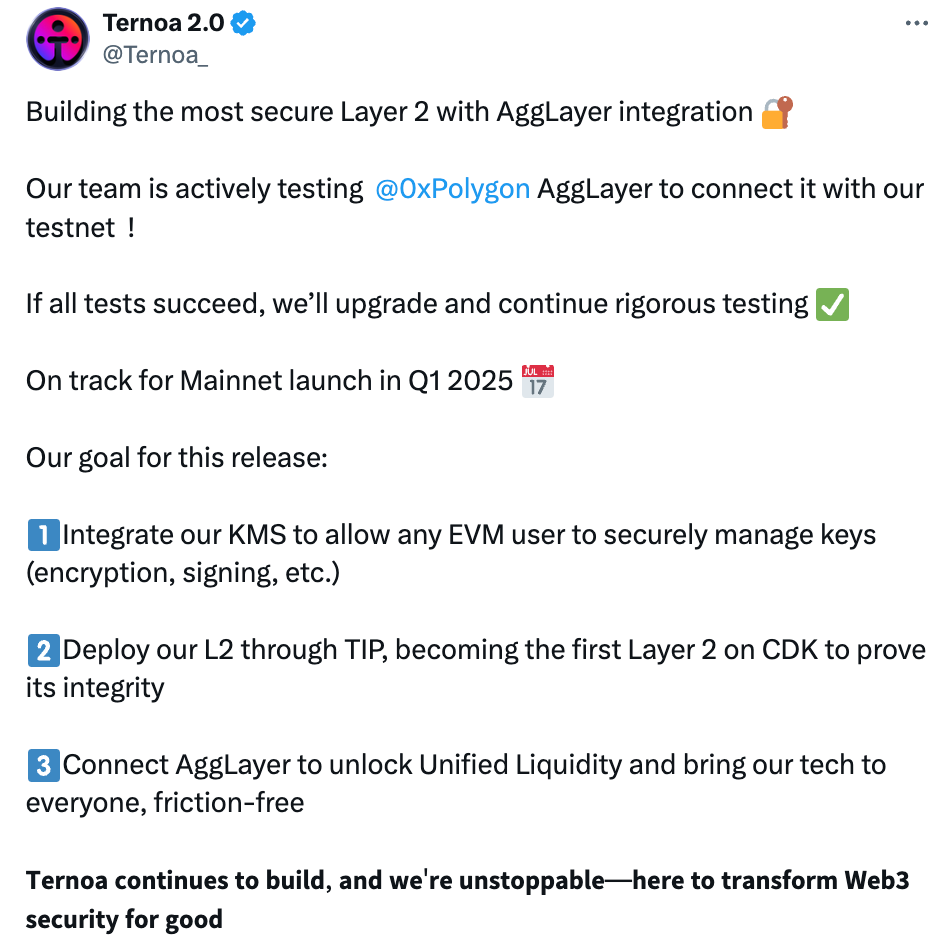

Ternoa 社群媒體數據

過去 24 小時,Ternoa 社群媒體情緒分數是 4,社群媒體上對 Ternoa 價格走勢偏向 看漲。Ternoa 社群媒體得分是 18,在所有加密貨幣中排名第 297。

根據 LunarCrush 統計,過去 24 小時,社群媒體共提及加密貨幣 1,058,120 次,其中 Ternoa 被提及次數佔比 0%,在所有加密貨幣中排名第 397。

過去 24 小時,共有 158 個獨立用戶談論了 Ternoa,總共提及 Ternoa 31 次,然而,與前一天相比,獨立用戶數 增加 了 5%,總提及次數減少。

Twitter 上,過去 24 小時共有 1 篇推文提及 Ternoa,其中 100% 看漲 Ternoa,0% 篇推文看跌 Ternoa,而 0% 則對 Ternoa 保持中立。

在 Reddit 上,最近 24 小時共有 7 篇貼文提到了 Ternoa,相比之前 24 小時總提及次數 增加 了 17%。

社群媒體資訊概況

4