Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

X priceX

How do you feel about X today?

Price of X today

What is the highest price of X?

What is the lowest price of X?

X price prediction

When is a good time to buy X? Should I buy or sell X now?

What will the price of X be in 2026?

What will the price of X be in 2031?

X price history (USD)

Lowest price

Lowest price Highest price

Highest price

X market information

X holdings by concentration

X addresses by time held

X ratings

About X (X)

Cryptocurrencies continue to penetrate the global financial system, promising a new era of transactions defined by decentralization, security, and anonymity. From the launch of Bitcoin, the grandparent of digital currencies, in 2009, to the recent introduction of various altcoins, including utility tokens such as BGB, the impact and relevance of this innovative monetary concept have significantly grown over time. It's important to explore the historical significance and major features of cryptocurrencies to fully grasp their unique value proposition.

The Emergence and Historical Significance of Cryptocurrencies

Cryptocurrencies sprouted from the seeds of an idea to create a decentralized form of money, free from governmental control. Their inception traces back to the 2008 financial crisis, which left many disillusioned with the central banking system. As a result, an anonymous person or group under the pseudonym Satoshi Nakamoto conceptualized Bitcoin as a "Peer-to-Peer Electronic Cash System" through a whitepaper, and not long after, the first blockchain-based Bitcoin was mined. Since then, thousands of digital currencies have proliferated in the financial landscape, acknowledging the historical advent of cryptocurrency.

The historical underpinning of cryptocurrencies signified a significant shift: the democratization of the financial system. Cryptocurrencies paved the way for an open financial system, where transactions were no longer exclusive to banks and could occur directly between parties. This new form of money also offered a unique investment opportunity that enables individuals to participate in a dynamic global market, fostering a sense of financial inclusion.

Key Features of Cryptocurrencies

One of the primary features of cryptocurrencies is their decentralization. Unlike traditional money controlled by centralized banks, cryptocurrencies operate on decentralized platforms. Transactions are recorded on a public ledger known as a blockchain, and this transparency renders third-party intermediaries redundant, resulting in low-cost transactions.

Another fundamental attribute of cryptocurrencies is their security. The cryptographic technology underpinning their operations ensures that transactions and identities remain secure, providing users with the peace of mind that their assets are safe from hacks and fraud.

Most cryptocurrencies come with a cap, defining their scarcity. For instance, only 21 million Bitcoins can ever exist. This feature, distinct from traditional money, which governments can print ad nausea, counters inflation and contributes significantly to the value of cryptocurrencies.

Anonymity and privacy are also key features of cryptocurrencies. While transactions are recorded on a public ledger, individuals' identities are not publicly disclosed, making transactions anonymous on the blockchain.

Conclusion

Cryptocurrencies, unequivocally, have transformed the fabric of the financial system and offered an alternative pathway for transactions. Their historical significance lies in their decentralization, giving control back to individuals, and their features of security, scarcity, and anonymity further position them as an unprecedented concept in global economics. As cryptocurrencies, like BGB and others, continue to innovate and evolve, it's vital for users to understand these key features and their inherent value in the crypto landscape.

X to local currency

- 1

- 2

- 3

- 4

- 5

X news

Share link:In this post: Strategy decided not to reinvest in Bitcoin last week when the price dropped below $87,000. SEC filings revealed that Strategy did not sell any class A common stock shares during the March 31–April 6 period. Michael Saylor has proved to be a loyal supporter of Bitcoin despite its increased volatility.

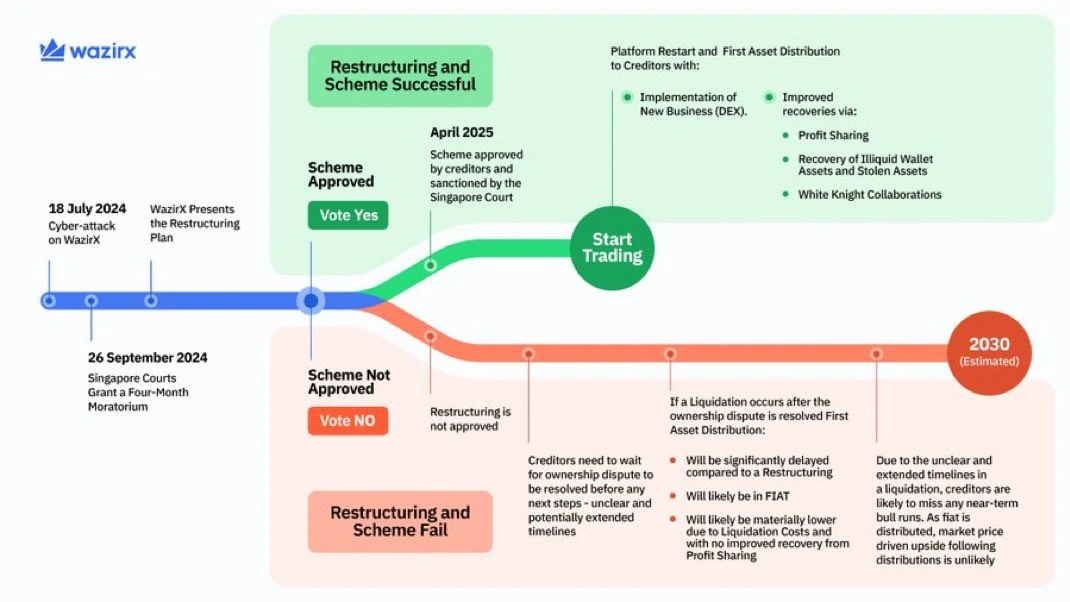

Share link:In this post: Over 90% of WazirX’s voting creditors supported the restructuring scheme, with 93.1% voting in favor, representing 94.6% of the total value of claims. Pending court approval in Singapore, distributions to creditors are expected to begin within 10 business days of the scheme’s legal effectiveness. The restructuring plan follows a significant hack last summer that resulted in a loss of over $230 million, attributed to North Korean hackers.

New listings on Bitget

Buy more

FAQ

What is the current price of X?

What is the 24 hour trading volume of X?

What is the all-time high of X?

Can I buy X on Bitget?

Can I get a steady income from investing in X?

Where can I buy X with the lowest fee?

Where can I buy crypto?

Video section — quick verification, quick trading

Bitget Insights

Related assets