Bitget: Ranked top 4 in global daily trading volume!

BTC market share62.49%

BTC/USDT$77627.37 (-6.76%)Fear and Greed Index34(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$64.9M (1D); -$169.2M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share62.49%

BTC/USDT$77627.37 (-6.76%)Fear and Greed Index34(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$64.9M (1D); -$169.2M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share62.49%

BTC/USDT$77627.37 (-6.76%)Fear and Greed Index34(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$64.9M (1D); -$169.2M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

Major Frog priceMAJOR

Not listed

Quote currency:

USD

Data is sourced from third-party providers. This page and the information provided do not endorse any specific cryptocurrency. Want to trade listed coins? Click here

$0.0006005-15.03%1D

Price chart

Last updated as of 2025-04-06 23:34:45(UTC+0)

Market cap:$507,462.25

Fully diluted market cap:$507,462.25

Volume (24h):$2,743,657.36

24h volume / market cap:540.66%

24h high:$0.0007210

24h low:$0.0006005

All-time high:$0.07032

All-time low:$0.0003341

Circulating supply:845,000,000 MAJOR

Total supply:

987,982,551MAJOR

Circulation rate:85.00%

Max supply:

987,982,551MAJOR

Price in BTC:0.{8}7765 BTC

Price in ETH:0.{6}3863 ETH

Price at BTC market cap:

$1,816.57

Price at ETH market cap:

$221.99

Contracts:

CNyMaR...68uCeJk(Solana)

How do you feel about Major Frog today?

Note: This information is for reference only.

Price of Major Frog today

The live price of Major Frog is $0.0006005 per (MAJOR / USD) today with a current market cap of $507,462.25 USD. The 24-hour trading volume is $2.74M USD. MAJOR to USD price is updated in real time. Major Frog is -15.03% in the last 24 hours. It has a circulating supply of 845,000,000 .

What is the highest price of MAJOR?

MAJOR has an all-time high (ATH) of $0.07032, recorded on 2024-11-18.

What is the lowest price of MAJOR?

MAJOR has an all-time low (ATL) of $0.0003341, recorded on 2025-03-31.

Major Frog price prediction

What will the price of MAJOR be in 2026?

Based on MAJOR's historical price performance prediction model, the price of MAJOR is projected to reach $0.003001 in 2026.

What will the price of MAJOR be in 2031?

In 2031, the MAJOR price is expected to change by +34.00%. By the end of 2031, the MAJOR price is projected to reach $0.006158, with a cumulative ROI of +876.11%.

Major Frog price history (USD)

The price of Major Frog is -99.06% over the last year. The highest price of in USD in the last year was $0.07032 and the lowest price of in USD in the last year was $0.0003341.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h-15.03%$0.0006005$0.0007210

7d-38.85%$0.0003341$0.0009940

30d-86.96%$0.0003341$0.004763

90d-98.80%$0.0003341$0.06250

1y-99.06%$0.0003341$0.07032

All-time-98.45%$0.0003341(2025-03-31, 7 days ago )$0.07032(2024-11-18, 140 days ago )

Major Frog market information

Major Frog's market cap history

Major Frog holdings by concentration

Whales

Investors

Retail

Major Frog addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Major Frog ratings

Average ratings from the community

4.4

This content is for informational purposes only.

MAJOR to local currency

1 MAJOR to MXN$0.011 MAJOR to GTQQ01 MAJOR to CLP$0.581 MAJOR to HNLL0.021 MAJOR to UGXSh2.211 MAJOR to ZARR0.011 MAJOR to TNDد.ت01 MAJOR to IQDع.د0.791 MAJOR to TWDNT$0.021 MAJOR to RSDдин.0.061 MAJOR to DOP$0.041 MAJOR to MYRRM01 MAJOR to GEL₾01 MAJOR to UYU$0.031 MAJOR to MADد.م.0.011 MAJOR to OMRر.ع.01 MAJOR to AZN₼01 MAJOR to SEKkr0.011 MAJOR to KESSh0.081 MAJOR to UAH₴0.02

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-04-06 23:34:45(UTC+0)

Major Frog news

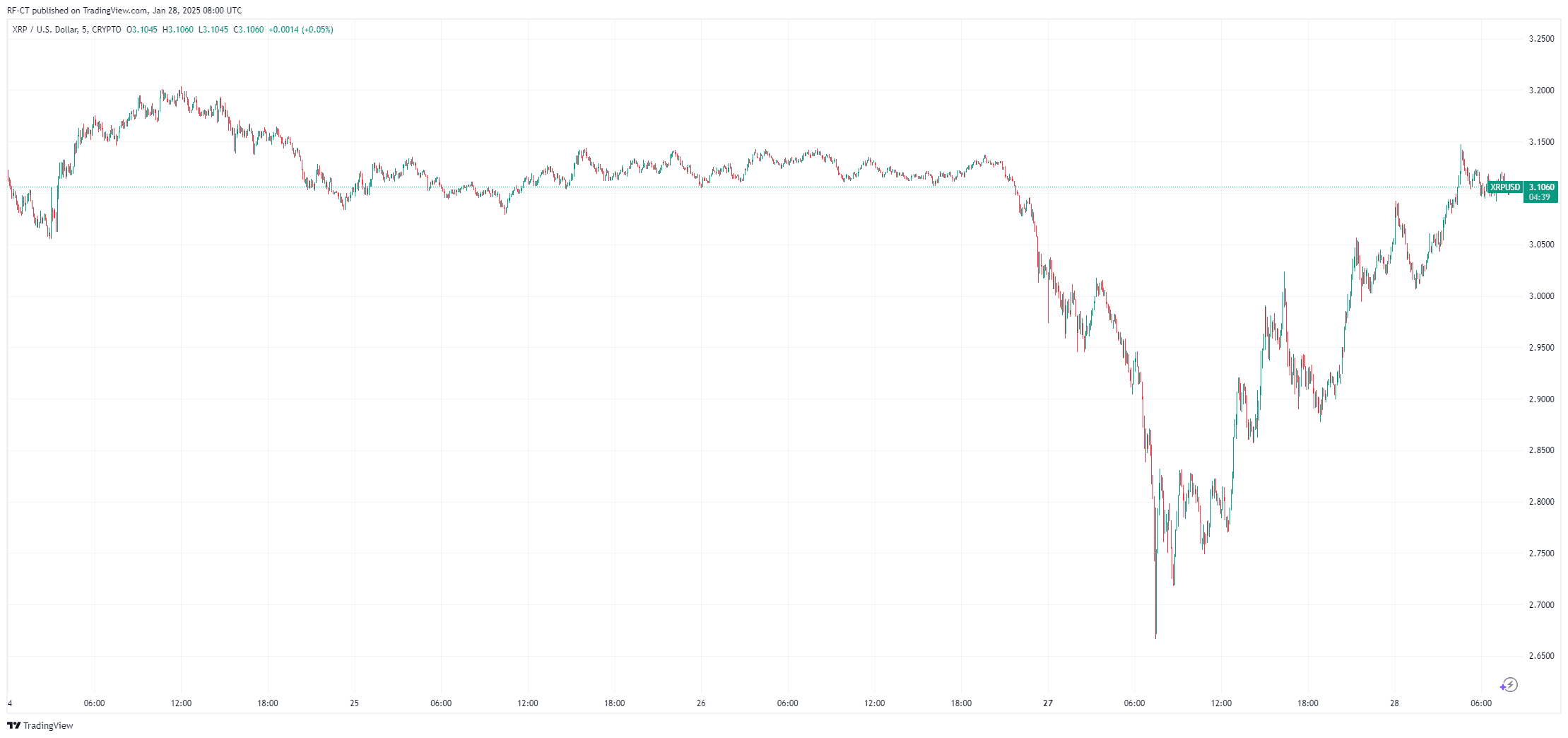

MAJOR XRP News: MTL License, Zero Capital Gains Tax and Ripple SEC Resolution in Sight

Cryptoticker•2025-01-28 19:00

IOTA News: The Biggest Upgrade in IOTA’s History Coming in 2025

CryptoNewsFlash•2025-01-01 22:11

FTX creditors to receive $16B in 2025

Grafa•2024-12-31 06:40

Will FTX Repayments Spark a Crypto Bull Run in 2025? Analysts Weigh in

FTX’s $16B creditor repayments in 2025 could spark a crypto bull run, but doubts remain over payout timelines and liquidity impacts.

BeInCrypto•2024-12-30 07:48

Buy more

FAQ

What is the current price of Major Frog?

The live price of Major Frog is $0 per (MAJOR/USD) with a current market cap of $507,462.25 USD. Major Frog's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Major Frog's current price in real-time and its historical data is available on Bitget.

What is the 24 hour trading volume of Major Frog?

Over the last 24 hours, the trading volume of Major Frog is $2.74M.

What is the all-time high of Major Frog?

The all-time high of Major Frog is $0.07032. This all-time high is highest price for Major Frog since it was launched.

Can I buy Major Frog on Bitget?

Yes, Major Frog is currently available on Bitget’s centralized exchange. For more detailed instructions, check out our helpful How to buy guide.

Can I get a steady income from investing in Major Frog?

Of course, Bitget provides a strategic trading platform, with intelligent trading bots to automate your trades and earn profits.

Where can I buy Major Frog with the lowest fee?

Bitget offers industry-leading trading fees and depth to ensure profitable investments for traders. You can trade on the Bitget exchange.

Where can I buy crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Cryptocurrency investments, including buying Major Frog online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Major Frog, and we try our best to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Major Frog purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and can not be consider as an offer from Bitget.

Bitget Insights

Crypto_Tycoon

4h

🔥 $PUMP Coin – The Rising Star Every Investor Should Watch

In a market full of opportunities, $PUMP Coin is emerging as a rising star catching the attention of smart investors. With its rapidly expanding community, practical use cases, and solid development, $PUMP is making waves in the crypto space. Could this be your next big win?

🌟 Why $PUMP Coin Is Turning Heads

There are several reasons why $PUMP Coin is gaining momentum:

- 🚀 Growing Demand As awareness spreads, more traders are jumping in to ride the wave

- 💼 Utility-Driven Project $PUMP is not just hype — it’s tied to real-world applications in the DeFi and NFT sectors

- 🔐 Trustworthy Network Built with transparency and a secure blockchain foundation

- 📊 Impressive Performance Recent upward trends in volume and price hint at strong future potential

⏳ Don’t Miss the Window

In crypto, timing is everything — and $PUMP Coin might just be at the beginning of a major rally. With increased visibility and stronger fundamentals, this could be the ideal time to take a closer look.

Will you act before the rest of the market catches on?

HYPE-16.03%

MAJOR-11.92%

Nusrat_Mim_CryptoQue

4h

$ETH

ETH/USDT Market Analysis & Prediction — Short-Term Panic or Long-Term Opportunity?

At the time of writing, ETH/USDT is trading around $1,633.79, reflecting a sharp -8.82% drop over the past 24 hours. The recent price action has broken critical support levels, sending shockwaves across the market.

Key Observations (1H Timeframe):

Massive Drop from $1,835 to $1,622: A steep decline within a few hours triggered high sell volume, as shown in the volume histogram.

MACD Signals Strong Bearish Momentum: The MACD line is deeply negative (MACD: -14.69, DIF: -27.26) indicating intense downward pressure.

KDJ in Oversold Zone: K at 16.06 suggests a possible short-term bounce or temporary consolidation.

Parabolic SAR Flipped Bearish: SAR values above current price confirm continued bearish trend.

EMA Cross-Down: Short EMAs (5, 10, 20) are sloping downward, hinting that the correction could persist.

Multi-Timeframe Technical Outlook:

15min Chart:

Shows exhaustion of selling pressure.

Volume spiked, possibly signaling capitulation.

Scalpers may anticipate a short relief bounce toward the $1,660–$1,680 zone.

4H Chart:

A breakdown below $1,700, previously a strong psychological support.

Next major support lies at $1,580, followed by $1,500.

1D Chart:

Still in a broader downtrend unless ETH reclaims $1,750+ with strong buying momentum.

If the correction deepens, we may revisit $1,480–$1,520, key zones from previous cycles.

Future Outlook & Strategy:

Short-Term Prediction: Expect volatile consolidation between $1,620 and $1,680. Watch for volume drop and bullish divergence on lower timeframes.

Mid-Term Prediction: ETH needs to reclaim EMA zones and flip $1,700 into support to regain market confidence.

Long-Term Perspective: Ethereum fundamentals remain strong. Current selloff may present long-term buying opportunities if the macro sentiment stabilizes.

Final Thoughts:

This ETH move may appear aggressive, but these corrections are often precursors to major trend reversals. For long-term holders, these dips can offer entries. For traders, this is a time to remain vigilant, use tight risk management, and monitor volume with MACD/KDJ on different timeframes.

What's your view? Are we near the bottom, or is more downside coming? Let’s discuss below.

MOVE-16.75%

ETH-13.43%

RACECREPTO

4h

$BTC /USDT Market Breakdown

$BTC /USDT Market Breakdown

#Bitcoin has once again taken a sharp hit, dropping to $80,363, down over 3.13% for the day. After holding above the $81,000 support for the last 10 days, BTC has now broken below that key level and is testing the next major zone around $79800 — with today’s low marked at $79636

This breakdown signals growing bearish pressure, and if BTC fails to hold above $80k,

the next critical support could lie around $78,500–$79,000. For traders, this is a high-risk zone — best to wait for clear signs of either a bounce or further breakdown before taking fresh positions. Monitor volume closely; heavy selling below $80k may confirm more downside ahead.

BTC-7.18%

HOLD-4.90%

Crypto-Ticker

4h

Bitcoin Price Crash to $60,000? Here's What the Charts Say Now

Bitcoin (BTC) is currently dancing on a razor’s edge near $82,500, and traders are watching nervously. After a period of sideways consolidation, the crypto giant is showing early signs of weakness—raising the question: Is Bitcoin price preparing for a deep drop to $60,000 , or is this a bear trap before the next rally? Let’s dive into the daily and hourly charts to decode the truth behind BTC’s next major move.

On the daily chart, Bitcoin continues to struggle below major resistance levels. The Heikin Ashi candles are small-bodied and red, signaling a lack of momentum and indecision in the market. Price action is firmly below all major moving averages—with the 20 SMA at $84,477, 50 SMA at $86,921, and 100 SMA at $92,808. This alignment indicates a clear bearish structure where each rally is being sold into.

What’s more concerning is that Bitcoin has failed multiple times to reclaim the 100-day SMA, indicating sustained selling pressure from institutions and swing traders. The presence of the 200 SMA below current price around $86,675 had acted as a temporary support in March, but it has now turned neutral as price hovers well below it.

The ADL (Accumulation/Distribution Line) has sharply dropped, confirming distribution over accumulation. This means that even during slight upward moves, smart money has been offloading, not adding to positions. Without a turn in the ADL, any bounce is suspect.

Zooming into the 1-hour chart, the picture becomes even more clear: Bitcoin is grinding downward in a slow, controlled bleed. After peaking briefly around $87K on April 2nd, BTC experienced sharp rejection and has since been forming lower highs. The recent attempt to climb was stopped cleanly at the 200 SMA near $83,300, confirming it as short-term resistance.

The moving averages on the hourly (20, 50, and 100 SMA) are compressing and curving downward, which typically leads to momentum breakdowns, especially when paired with flat volume and fading bullish candles. The most recent Heikin Ashi candles are small-bodied and leaning bearish, showing that the bulls are losing steam and failing to defend even intraday bounces.

The hourly ADL is declining, further confirming the lack of demand at current price levels. Retail interest appears low, and there’s no sign of whale-driven accumulation on this timeframe either.

Immediate support lies at $82,000, which has been tested several times over the past few sessions. A decisive break below this level could trigger a sharp selloff down to $78,500, with a psychological and structural support zone around $75,000. If that fails, then the long-feared move toward $69,000–$60,000 could come into play quickly.

On the upside, resistance sits heavy around $84,500, followed by $86,900, both marked by the daily 20 and 50 SMA zones. Only a break above $87,500–$88,000, backed by volume, would confirm a bullish reversal and negate the current bearish setup.

Short-Term Outlook (Next 48–72 hours): If $82,000 fails, expect a fast drop to $78,000 or lower. If bulls hold the line and reclaim $84,500 with volume, we might see a short-term bounce to $87K.

Mid-Term Outlook (Next 1–2 weeks): Without a break above the 100-day SMA, Bitcoin price is at risk of cascading down to $75,000. Market sentiment is fragile, and macroeconomic news or ETF flows could tip the balance.

Long-Term Outlook (Rest of April 2025): If $75,000 breaks in April, then a full correction down to $60,000 is on the table. However, if bulls manage to regain $90K territory, it could open the door back to $100K.

The charts are clear—Bitcoin price is at a critical level. The current structure favors bears, with no strong signs of reversal just yet. Accumulation is weak, momentum is fading, and major resistances are pushing BTC price lower. Unless bulls step in with force soon, a deep correction could be just around the corner.

So, is Bitcoin price heading for $60,000 or ready to bounce? For now, the trend says: Proceed with caution.

Bitcoin (BTC) is currently dancing on a razor’s edge near $82,500, and traders are watching nervously. After a period of sideways consolidation, the crypto giant is showing early signs of weakness—raising the question: Is Bitcoin price preparing for a deep drop to $60,000 , or is this a bear trap before the next rally? Let’s dive into the daily and hourly charts to decode the truth behind BTC’s next major move.

On the daily chart, Bitcoin continues to struggle below major resistance levels. The Heikin Ashi candles are small-bodied and red, signaling a lack of momentum and indecision in the market. Price action is firmly below all major moving averages—with the 20 SMA at $84,477, 50 SMA at $86,921, and 100 SMA at $92,808. This alignment indicates a clear bearish structure where each rally is being sold into.

What’s more concerning is that Bitcoin has failed multiple times to reclaim the 100-day SMA, indicating sustained selling pressure from institutions and swing traders. The presence of the 200 SMA below current price around $86,675 had acted as a temporary support in March, but it has now turned neutral as price hovers well below it.

The ADL (Accumulation/Distribution Line) has sharply dropped, confirming distribution over accumulation. This means that even during slight upward moves, smart money has been offloading, not adding to positions. Without a turn in the ADL, any bounce is suspect.

Zooming into the 1-hour chart, the picture becomes even more clear: Bitcoin is grinding downward in a slow, controlled bleed. After peaking briefly around $87K on April 2nd, BTC experienced sharp rejection and has since been forming lower highs. The recent attempt to climb was stopped cleanly at the 200 SMA near $83,300, confirming it as short-term resistance.

The moving averages on the hourly (20, 50, and 100 SMA) are compressing and curving downward, which typically leads to momentum breakdowns, especially when paired with flat volume and fading bullish candles. The most recent Heikin Ashi candles are small-bodied and leaning bearish, showing that the bulls are losing steam and failing to defend even intraday bounces.

The hourly ADL is declining, further confirming the lack of demand at current price levels. Retail interest appears low, and there’s no sign of whale-driven accumulation on this timeframe either.

Immediate support lies at $82,000, which has been tested several times over the past few sessions. A decisive break below this level could trigger a sharp selloff down to $78,500, with a psychological and structural support zone around $75,000. If that fails, then the long-feared move toward $69,000–$60,000 could come into play quickly.

On the upside, resistance sits heavy around $84,500, followed by $86,900, both marked by the daily 20 and 50 SMA zones. Only a break above $87,500–$88,000, backed by volume, would confirm a bullish reversal and negate the current bearish setup.

Short-Term Outlook (Next 48–72 hours): If $82,000 fails, expect a fast drop to $78,000 or lower. If bulls hold the line and reclaim $84,500 with volume, we might see a short-term bounce to $87K.

Mid-Term Outlook (Next 1–2 weeks): Without a break above the 100-day SMA, Bitcoin price is at risk of cascading down to $75,000. Market sentiment is fragile, and macroeconomic news or ETF flows could tip the balance.

Long-Term Outlook (Rest of April 2025): If $75,000 breaks in April, then a full correction down to $60,000 is on the table. However, if bulls manage to regain $90K territory, it could open the door back to $100K.

The charts are clear—Bitcoin price is at a critical level. The current structure favors bears, with no strong signs of reversal just yet. Accumulation is weak, momentum is fading, and major resistances are pushing BTC price lower. Unless bulls step in with force soon, a deep correction could be just around the corner.

So, is Bitcoin price heading for $60,000 or ready to bounce? For now, the trend says: Proceed with caution.

BTC-7.18%

NEAR-12.56%

Crypto-Ticker

4h

Big Win for Crypto: SEC Says Dollar-Backed Stablecoins Are Not Securities

In a huge regulatory development, the U.S. Securities and Exchange Commission ( SEC ) announced on April 4 that "covered" stablecoins — those fully backed by U.S. dollars and easily convertible to fiat — are not considered securities under U.S. law.

That means top-dollar-backed tokens like USDT ( Tether ) and USDC ( Circle ) are finally getting some legal breathing room.

The SEC defines covered stablecoins as digital tokens that are:

In short: they function like digital dollars. And the SEC now says if you're minting or redeeming these types of stablecoins, you don’t need to register with them — because these tokens aren’t securities in their eyes.

There’s a catch.

While dollar-backed stablecoins got the green light, the SEC pointedly did not extend this clarity to algorithmic stablecoins — those backed by code and economic mechanisms rather than dollars. Think: the now-infamous TerraUSD (UST) that collapsed in 2022 and wiped nearly $45 billion from the market.

That silence speaks volumes. It looks like algorithmic stablecoins are still in regulatory limbo, and may face stricter scrutiny moving forward.

This isn’t just a one-off announcement. It aligns perfectly with several bills currently circulating in the U.S. Senate, including the GENIUS Stablecoin Bill and the Stable Act of 2025. Both aim to create a clear legal framework around stablecoins and preserve the U.S. dollar’s role as the global reserve currency.

Under these bills, big-name stablecoin issuers like Tether and Circle would fall under Federal Reserve oversight, ensuring their dollar reserves are held in regulated banks and short-term Treasuries.

With USDT now sitting as the world’s third-largest crypto and dominating the stablecoin market with over $144 billion in market cap, the timing of this SEC clarification is anything but random.

The SEC’s new stance on dollar-backed stablecoins is a major win for the U.S. crypto sector. It signals a shift toward clearer regulations, something the industry has been begging for.

With legal clarity comes more innovation, institutional involvement, and consumer trust. And with the U.S. potentially creating a stablecoin-friendly framework, the country could finally catch up in the global digital asset race.

In a huge regulatory development, the U.S. Securities and Exchange Commission ( SEC ) announced on April 4 that "covered" stablecoins — those fully backed by U.S. dollars and easily convertible to fiat — are not considered securities under U.S. law.

That means top-dollar-backed tokens like USDT ( Tether ) and USDC ( Circle ) are finally getting some legal breathing room.

The SEC defines covered stablecoins as digital tokens that are:

In short: they function like digital dollars. And the SEC now says if you're minting or redeeming these types of stablecoins, you don’t need to register with them — because these tokens aren’t securities in their eyes.

There’s a catch.

While dollar-backed stablecoins got the green light, the SEC pointedly did not extend this clarity to algorithmic stablecoins — those backed by code and economic mechanisms rather than dollars. Think: the now-infamous TerraUSD (UST) that collapsed in 2022 and wiped nearly $45 billion from the market.

That silence speaks volumes. It looks like algorithmic stablecoins are still in regulatory limbo, and may face stricter scrutiny moving forward.

This isn’t just a one-off announcement. It aligns perfectly with several bills currently circulating in the U.S. Senate, including the GENIUS Stablecoin Bill and the Stable Act of 2025. Both aim to create a clear legal framework around stablecoins and preserve the U.S. dollar’s role as the global reserve currency.

Under these bills, big-name stablecoin issuers like Tether and Circle would fall under Federal Reserve oversight, ensuring their dollar reserves are held in regulated banks and short-term Treasuries.

With USDT now sitting as the world’s third-largest crypto and dominating the stablecoin market with over $144 billion in market cap, the timing of this SEC clarification is anything but random.

The SEC’s new stance on dollar-backed stablecoins is a major win for the U.S. crypto sector. It signals a shift toward clearer regulations, something the industry has been begging for.

With legal clarity comes more innovation, institutional involvement, and consumer trust. And with the U.S. potentially creating a stablecoin-friendly framework, the country could finally catch up in the global digital asset race.

UP-7.20%

LOOKS-14.20%

Related assets

Popular cryptocurrencies

A selection of the top 8 cryptocurrencies by market cap.

Recently added

The most recently added cryptocurrencies.

Comparable market cap

Among all Bitget assets, these 8 are the closest to Major Frog in market cap.