Is the Bitcoin Bull Cycle Over? On-Chain Analytical Indicators Say Yes

Prominent Cryptocurrency founder and analyst Ki Young Ju believes the Bitcoin bull cycle has ended. Referencing on-chain market metrics, Ju explains his reasoning, citing key occurrences in previous weeks.

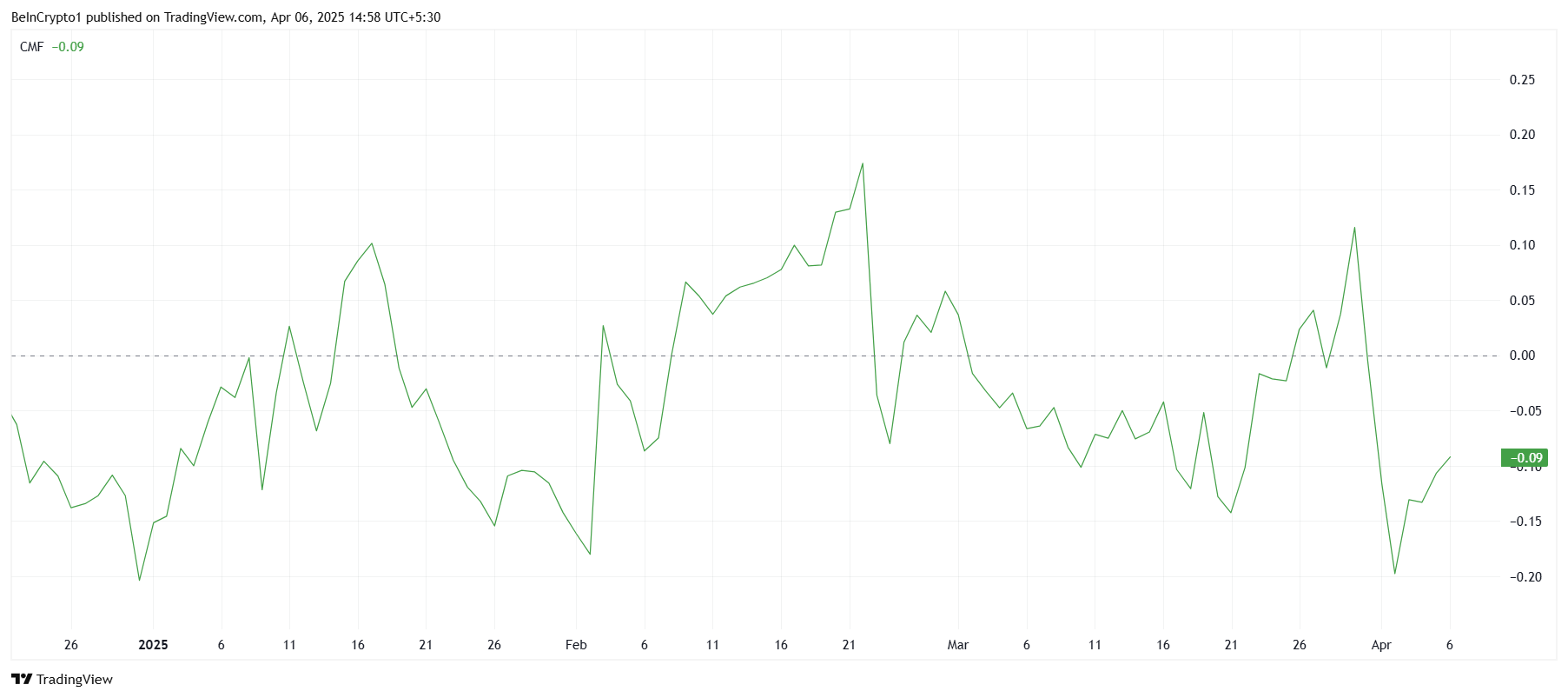

Ju asserts that if an increase in the realized cap, a metric that tracks the flow of funds into Bitcoin through wallet movements, does not trigger a price surge for Bitcoin, the bears might have taken over. “A classic bearish signal,” he writes.

On the flipside, a bullish signal can be observed when stagnation in Realized Cap does not interfere with the upsurge in market capitalization. “It suggests that even a small amount of new capital is driving prices higher.” Ju asstered. “Right now, we’re seeing the former—capital is entering the market, but prices aren’t responding. That’s typical of a bear market.” he noted

According to the analyst, a decrease in selling pressure could allow for small Bitcoin purchases to trigger a price pump, and by extension, an even higher pump in market cap value

The analyst points to MicroStrategy to validate the aforementioned observation, noting that the firm’s move to purchase Bitcoin from the proceeds obtained from the issuing of convertible bonds resulted in a spike in the value of the firm’s fiat holding, which was particularly higher than the capital deployed

His assertion suggests that small capitals are price drivers only in a bull market, while large capitals failing to trigger a price spike signals a bear market in play. Notably, the current on-chain data points to the latter.

While selling pressure could be contained at any time, a short-term rally seems unlikely, as historical data shows that reversals typically commence after a six-month period.

During this report, Bitcoin, having failed to sustain momentum above the $80,000 price level, is trading at $78,365 after losing more than 5% of its gains.

Decoding Demand: Understanding the $PUMP Market Dynamics in 2025

The market demand for pumps ($PUMP) in 2025 is a multifaceted landscape influenced by a confluence of global trends, technological advancements, and sector-specific needs. Understanding these dynamics is crucial for manufacturers, suppliers, and end-users alike. This article delves into the key factors shaping the demand for $PUMP across various industries.

Foundational Drivers of $PUMP Demand

Several overarching factors consistently fuel the need for efficient and reliable pumping solutions:

* Population Growth and Urbanization: The ever-increasing global population, coupled with rapid urbanization, necessitates robust infrastructure for water management, wastewater treatment, and building services. This directly translates to a sustained high demand for various types of $PUMP. For instance, growing cities require more powerful pumps for water distribution networks and efficient drainage systems.

* Industrial Expansion: Industrial activities across sectors like manufacturing, chemical processing, oil and gas, pharmaceuticals, and food and beverage heavily rely on $PUMP for fluid transfer, processing, and various operational needs. As industrial output expands globally, so does the demand for specialized $PUMP solutions. A new chemical plant, for example, will require a range of pumps designed for specific chemical compatibilities and flow rates.

* Agricultural Needs: The agricultural sector is a significant consumer of $PUMP, primarily for irrigation purposes crucial for food security. The demand here is influenced by factors like climate patterns, the adoption of modern irrigation techniques, and the expansion of agricultural land. Regions facing water scarcity are particularly reliant on efficient irrigation pumps.

* Infrastructure Development: Investments in infrastructure projects, including water and wastewater treatment plants, power generation facilities, and transportation networks (like pipelines), are key drivers for $PUMP demand. Governments and private entities undertaking such projects require a wide array of pumps for construction and long-term operation.

Key Trends Shaping $PUMP Market Demand in 2025

Beyond the foundational drivers, several contemporary trends are significantly influencing the type and volume of $PUMP demanded:

* Focus on Energy Efficiency: With increasing energy costs and a global push towards sustainability, there's a growing demand for energy-efficient $PUMP systems. This includes pumps with advanced hydraulic designs, variable speed drives (VSDs), and smart controls that optimize energy consumption based on actual demand. Industries are increasingly seeking $PUMP that reduce their operational costs and environmental footprint.

* Integration of Smart Technologies and IoT: The incorporation of sensors, data analytics, and IoT (Internet of Things) capabilities into $PUMP is gaining traction. Smart $PUMP allows for real-time monitoring of performance parameters, predictive maintenance, and remote control, leading to increased efficiency and reduced downtime. For instance, a smart pump in a water treatment plant can automatically adjust its operation based on flow rate and pressure data, and alert maintenance teams to potential issues before they cause a breakdown.

* Growing Demand for Specialized and Custom $PUMP: Industries often have unique fluid handling requirements, leading to a demand for specialized $PUMP designed for specific applications, materials, pressures, and temperatures. This trend encourages manufacturers to offer customized solutions tailored to individual client needs. For example, the oil and gas industry requires robust $PUMP capable of handling corrosive and high-viscosity fluids under extreme pressure.

* Increasing Emphasis on Sustainable Water Management: With growing concerns about water scarcity and environmental regulations, the demand for $PUMP in water and wastewater treatment applications is rising. This includes pumps used for water purification, desalination, and the efficient transfer of wastewater. Municipalities and industries are investing in advanced pumping technologies to ensure sustainable water usage.

* Expansion in Emerging Economies: Rapid industrialization and infrastructure development in emerging economies are creating significant growth opportunities for the $PUMP market. These regions often require substantial investments in water infrastructure, manufacturing facilities, and agricultural advancements, all of which drive $PUMP demand. Countries in Asia-Pacific and Africa, for instance, are witnessing increased demand for pumps across various sectors.

Sector-Specific Demand Dynamics

The demand for $PUMP varies significantly across different end-user sectors:

* Water and Wastewater: This sector remains a major consumer of $PUMP for water extraction, distribution, treatment, and wastewater management. The demand is driven by population growth, urbanization, and stricter environmental regulations.

* Industrial: The demand from manufacturing, chemical, pharmaceutical, and other industrial sectors is influenced by production levels, technological upgrades, and the need for efficient and reliable fluid handling.

* Oil and Gas: This sector requires high-pressure $PUMP for extraction, transportation, and refining processes. Demand is linked to energy prices and global energy consumption patterns.

* Agriculture: The demand for irrigation pumps is influenced by climate conditions, agricultural practices, and government initiatives promoting efficient water use.

* Construction: $PUMP are used for dewatering construction sites, concrete pumping, and water supply for construction activities. Demand is tied to the level of construction activity and infrastructure development.

* Power Generation: Thermal and nuclear power plants utilize large $PUMP for cooling water circulation and other critical processes. Demand is influenced by investments in new power plants and the maintenance of existing ones.

Conclusion

The market demand for $PUMP in 2025 is robust and driven by fundamental global needs and evolving technological trends. The increasing focus on energy efficiency, smart technologies, sustainability, and the growth in emerging economies are shaping the types of $PUMP demanded and creating new opportunities for innovation. Understanding these multifaceted dynamics is crucial for stakeholders to effectively navigate and capitalize on the evolving $PUMP market landscape. Manufacturers who can offer energy-efficient, smart, and customized pumping solutions are well-positioned to meet the diverse and growing demands of various industries in 2025 and beyond.

Lowest price

Lowest price Highest price

Highest price

![BitTorrent [New]](https://img.bgstatic.com/multiLang/coinPriceLogo/c87b5c29752b2123cca40f4dd2c6b6501710522527061.png)

Flow Social Data

In the last 24 hours, the social media sentiment score for Flow was 2.1, and the social media sentiment towards Flow price trend was Bearish. The overall Flow social media score was 83,559, which ranks 325 among all cryptocurrencies.

According to LunarCrush, in the last 24 hours, cryptocurrencies were mentioned on social media a total of 1,058,120 times, with Flow being mentioned with a frequency ratio of 0.01%, ranking 311 among all cryptocurrencies.

In the last 24 hours, there were a total of 384 unique users discussing Flow, with a total of Flow mentions of 107. However, compared to the previous 24-hour period, the number of unique users increase by 6%, and the total number of mentions has increase by 22%.

On Twitter, there were a total of 9 tweets mentioning Flow in the last 24 hours. Among them, 0% are bullish on Flow, 67% are bearish on Flow, and 33% are neutral on Flow.

On Reddit, there were 1 posts mentioning Flow in the last 24 hours. Compared to the previous 24-hour period, the number of mentions decrease by 0% .

All social overview

2.1