Bitget: Ranked top 4 in global daily trading volume!

BTC market share62.64%

New listings on Bitget: Pi Network

BTC/USDT$80023.29 (+3.50%)Fear and Greed Index24(Extreme fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketBABY,PAWS,WCTTotal spot Bitcoin ETF netflow -$97.7M (1D); -$355.9M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share62.64%

New listings on Bitget: Pi Network

BTC/USDT$80023.29 (+3.50%)Fear and Greed Index24(Extreme fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketBABY,PAWS,WCTTotal spot Bitcoin ETF netflow -$97.7M (1D); -$355.9M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share62.64%

New listings on Bitget: Pi Network

BTC/USDT$80023.29 (+3.50%)Fear and Greed Index24(Extreme fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketBABY,PAWS,WCTTotal spot Bitcoin ETF netflow -$97.7M (1D); -$355.9M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

Ben (v2) priceBEN

Not listed

Quote currency:

USD

Data is sourced from third-party providers. This page and the information provided do not endorse any specific cryptocurrency. Want to trade listed coins? Click here

$0.{6}3579+0.00%1D

Price chart

Last updated as of 2025-04-08 04:18:05(UTC+0)

Market cap:--

Fully diluted market cap:--

Volume (24h):$417,620.55

24h volume / market cap:0.00%

24h high:$0.{6}3579

24h low:$0.{6}3579

All-time high:$0.{4}1947

All-time low:$0.{7}1999

Circulating supply:-- BEN

Total supply:

888,000,000,000BEN

Circulation rate:0.00%

Max supply:

--BEN

Price in BTC:0.{11}4481 BTC

Price in ETH:0.{9}2259 ETH

Price at BTC market cap:

--

Price at ETH market cap:

--

Contracts:

0xdcc9...350e4b1(Ethereum)

How do you feel about Ben (v2) today?

Note: This information is for reference only.

Price of Ben (v2) today

The live price of Ben (v2) is $0.{6}3579 per (BEN / USD) today with a current market cap of $0.00 USD. The 24-hour trading volume is $417,620.55 USD. BEN to USD price is updated in real time. Ben (v2) is 0.00% in the last 24 hours. It has a circulating supply of 0 .

What is the highest price of BEN?

BEN has an all-time high (ATH) of $0.{4}1947, recorded on 2023-11-02.

What is the lowest price of BEN?

BEN has an all-time low (ATL) of $0.{7}1999, recorded on 2025-02-13.

Ben (v2) price prediction

What will the price of BEN be in 2026?

Based on BEN's historical price performance prediction model, the price of BEN is projected to reach $0.{6}3083 in 2026.

What will the price of BEN be in 2031?

In 2031, the BEN price is expected to change by +1.00%. By the end of 2031, the BEN price is projected to reach $0.{6}6080, with a cumulative ROI of +69.87%.

Ben (v2) price history (USD)

The price of Ben (v2) is -92.98% over the last year. The highest price of in USD in the last year was $0.{5}6288 and the lowest price of in USD in the last year was $0.{7}1999.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h+0.00%$0.{6}3579$0.{6}3579

7d+0.00%$0.{6}3579$0.{6}3579

30d+0.00%$0.{6}3579$0.{6}3579

90d+138.25%$0.{7}1999$0.{5}4805

1y-92.98%$0.{7}1999$0.{5}6288

All-time-97.22%$0.{7}1999(2025-02-13, 54 days ago )$0.{4}1947(2023-11-02, 1 years ago )

Ben (v2) market information

Ben (v2) holdings by concentration

Whales

Investors

Retail

Ben (v2) addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Ben (v2) ratings

Average ratings from the community

4.6

This content is for informational purposes only.

BEN to local currency

1 BEN to MXN$01 BEN to GTQQ01 BEN to CLP$01 BEN to UGXSh01 BEN to HNLL01 BEN to ZARR01 BEN to TNDد.ت01 BEN to IQDع.د01 BEN to TWDNT$01 BEN to RSDдин.01 BEN to DOP$01 BEN to MYRRM01 BEN to GEL₾01 BEN to UYU$01 BEN to MADد.م.01 BEN to OMRر.ع.01 BEN to AZN₼01 BEN to KESSh01 BEN to SEKkr01 BEN to UAH₴0

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-04-08 04:18:05(UTC+0)

Ben (v2) news

Bitcoin Fails If Used as a Store of Value? Jack Dorsey Thinks So

Newscrypto•2025-04-06 16:00

Malta Regulator Issues $1.2M Fine to OKX Crypto Exchange, Addressing Past Anti-Money Laundering Compliance Failures

Malta’s Financial Intelligence Analysis Unit (FIAU) has fined OKX €1.1 million ($1.2 million) for anti-money laundering (AML) compliance failures, marking one of the most significant penalties in the cryptocurrency sector.

DeFi Planet•2025-04-05 04:11

Pi Network price nears all-time lows as supply pressure mounts

Cointelegraph•2025-04-03 01:34

Bitfarms secures $300m loan to fuel AI and data center growth

Crypto.News•2025-04-01 16:00

Experts: Gold’s Rise Doesn’t Undermine Bitcoin’s Digital Gold Status

Bitcoin.com•2025-04-01 14:33

New listings on Bitget

New listings

Buy more

FAQ

What is the current price of Ben (v2)?

The live price of Ben (v2) is $0 per (BEN/USD) with a current market cap of $0 USD. Ben (v2)'s value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Ben (v2)'s current price in real-time and its historical data is available on Bitget.

What is the 24 hour trading volume of Ben (v2)?

Over the last 24 hours, the trading volume of Ben (v2) is $417,620.55.

What is the all-time high of Ben (v2)?

The all-time high of Ben (v2) is $0.{4}1947. This all-time high is highest price for Ben (v2) since it was launched.

Can I buy Ben (v2) on Bitget?

Yes, Ben (v2) is currently available on Bitget’s centralized exchange. For more detailed instructions, check out our helpful How to buy guide.

Can I get a steady income from investing in Ben (v2)?

Of course, Bitget provides a strategic trading platform, with intelligent trading bots to automate your trades and earn profits.

Where can I buy Ben (v2) with the lowest fee?

Bitget offers industry-leading trading fees and depth to ensure profitable investments for traders. You can trade on the Bitget exchange.

Where can I buy crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Cryptocurrency investments, including buying Ben (v2) online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Ben (v2), and we try our best to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Ben (v2) purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and can not be consider as an offer from Bitget.

Bitget Insights

Cryptonews Official

2025/04/02 15:35

Bitfarms secures $300m loan to fuel AI and data center growth

Canadian Bitcoin mining company Bitfarms secured up to $300 million in private debt from Australian multinational investment firm Macquarie to fund its data center development.

Bitfarms has reached an initial agreement for a private debt facility of up to $300 million from Macquarie Equipment Capital to support its Panther Creek data center project in Pennsylvania.

In an April 2 press release , the Canadian crypto mining company said that the first tranche of the loan is $50 million, with the rest available if the company “achieves specific development milestones.”

Bitfarms CEO Ben Gagnon says the partnership with Macquarie is the beginning of its investment in the “near-term development” of Panther Creek data center, adding that amid the surging AI revolution and the growing demand for power and infrastructure, the financing “arrives at a pivotal time.”

“The maturity of each facility is two years from the date of closing. Each facility will bear interest at a rate of 8% per annum, with interest on the initial draw of $50 million paid in kind for the first three months.”

Bitfarms

Joshua Stevens, an associate director at Macquarie, pointed out that the location is “within 100 miles of New York City and Philadelphia,” which could make it appealing to high-performance computing tenants. Following the announcement, Bitfarms’ shares rose by 2.54% on Nasdaq.

The loan agreement comes just weeks after Bitfarms completed its all-stock acquisition of Stronghold Digital Mining through a stock-for-stock merger, with Stronghold shareholders receiving 2.52 Bitfarms shares for every Stronghold share they held.

As crypto.news reported, nearly 60 million Bitfarms shares and over 10.5 million warrants were issued as part of the deal, and Stronghold’s stock was delisted from Nasdaq and ceased trading.

UP+3.61%

NEAR+0.28%

Aicoin-EN-Bitcoincom

2025/04/01 14:35

Experts: Gold’s Rise Doesn’t Undermine Bitcoin’s Digital Gold Status

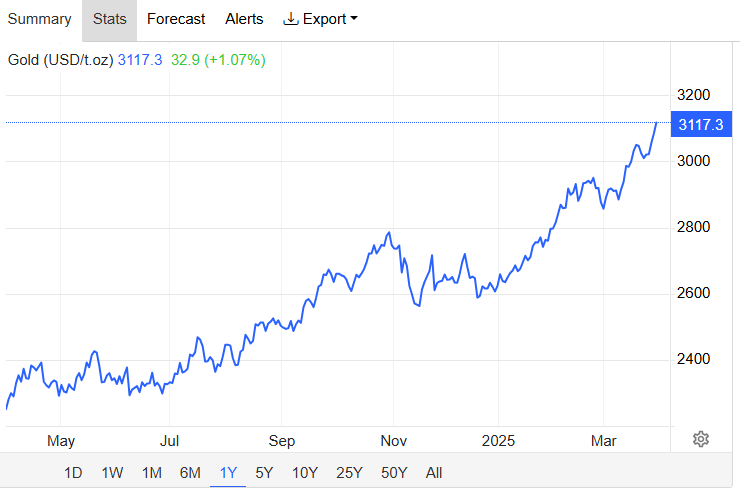

On the eve of what U.S. President Donald Trump has called “liberation day,” the price of gold reached a new milestone of $3,117 per ounce. This came just days after the precious metal surpassed the $3,100 mark, fueling optimism among gold proponents.

Gold’s attractiveness amid trade war fears, which have weighed on traditional assets and even bitcoin ( BTC), has prompted Goldman Sachs to revise its year-end price prediction upward. As reported by Reuters, the investment bank raised its forecast range to $3,250-$3,520 from $3,100-$3,300.

Goldman Sachs attributes the change to aggressive gold purchases by Asian central banks, a trend it expects to continue for the next three to six years. It also cites stronger-than-expected gold exchange-traded fund (ETF) inflows as another reason for the upward revision.

The apparent change in investors’ stance on gold contrasts with their perception of BTC, particularly after Trump’s inauguration on Jan. 20. While gold’s latest milestone brings its year-to-date gain to 22%, BTC’s slide from its Trump inauguration day peak of nearly $109,000 to just under $83,000 on March 31 means it ended the first quarter of 2025 approximately 23% in the red.

This Q1 performance by digital assets, seen by some as a safe-haven asset, has emboldened critics who reject the notion that BTC is digital gold. The fact that BTC has seemingly wavered each time Trump has threatened or imposed tariffs on the U.S.’s main trade partners lends credence to their argument.

However, despite this seeming correlation with traditional assets, bitcoin proponents insist the crypto asset’s first-quarter performance does not undermine its digital gold status. This sentiment is shared by experts interviewed by Bitcoin.com News, including Rena Shah, COO of Trust Machines.

According to Shah, while gold might have retained its safe-haven status, Bitcoin is the “only asset you’ll never sell.” The COO also pointed to how BTC continues to outperform other assets since the launch of bitcoin ETFs.

“Bitcoin is punching above its weight, as a younger asset class compared to legacy ETFs, like gold. Whether you hold bitcoin as a hedge against market uncertainty or are waiting for the right reentry point, Bitcoin is evolving to offer so much more than gold can,” Shah said.

Ben Caselin, CMO at African cryptocurrency exchange VALR, said the prospect of countries and central banks adding BTC to their treasuries signals the start of a country-level game theory. Caselin also cites countries stocking up on gold as indicating better times ahead for BTC.

“We cannot rule out that these movements are due to game theory around Bitcoin, with the rally in gold acting as a precursor for an explosion in bitcoin acquisition,” Caselin said.

Mithil Thakore, CEO of Velar, told Bitcoin.com News that he disagrees with the notion that Bitcoin has lost its digital gold status. Instead, he argued that BTC has become “more important than ever, both in terms of perception and practical adoption.” To support this viewpoint, Thakore pointed to the adoption of BTC by institutions and its proven staying power. Regarding what the rising interest in gold means for BTC, the Velar CEO said:

“Renewed interest in gold actually supports Bitcoin’s value proposition. Both assets are responding to macroeconomic instability, inflation concerns, and growing distrust in fiat systems.”

Luke Xie, co-founder and CEO of Satlayer, suggested that gold’s rally could be temporary, fueled by “short-term safe-haven inflows amid global uncertainty.” This contrasts with BTC, whose value proposition is “anchored in its finite supply, decentralized network, and ever-growing adoption.”

Xie also highlighted how bitcoin’s gold status is boosted by technological advancements, something that cannot be said of gold.

“In essence, rather than losing its ‘digital gold’ status, Bitcoin is evolving—bolstered by technological advancements and strategic initiatives like BTCfi—that underscore its complementary and superior role in modern portfolio construction,” the Satlayer CEO said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

BTC+1.06%

UP+3.61%

Crypto News Flash

2025/04/01 05:25

BitMEX Co-Founders Receive Trump Pardon—Crypto Industry Reacts

U.S. President Donald Trump has granted pardons to three co-founders and executives of the cryptocurrency exchange BitMEX. This groundbreaking development comes years after the trio pleaded guilty to financial crimes related to the Bank Secrecy Act (BSA).

According to a CNBC report , Arthur Hayes, Benjamin Delo, and Samuel Reed, who co-founded digital asset firm BitMEX, were granted a presidential pardon on Friday, March 28th, 2025

As noted in our previous post, Arthur Hayes and Ben Delo pleaded guilty to violating the Bank Secrecy Act while at BitMEX’s helm. Each agreed to pay $10 million in penalties.

Similarly, BitMEX was found guilty of operating without the necessary compliance measures with the right authorities. The trading firm was charged for illegal financial transactions on its platform.

In addition, federal prosecutors stated that despite publicly claiming to restrict U.S. users, the exchange continued to serve them during the period it was charged for.

A US District Judge pronounced a $100 million fine on the company earlier this year, concluding the case. Likewise, the founders and executives received different sentences, including probation alongside financial penalties.

As we covered in our latest report, BitMEX co-founder Arthur Hayes was sentenced to six months of home confinement in May 2022, along with a two-year probation. Delo and Reed also received probation as part of their penance.

With President Trump’s pardon, these BitMEX founders are now free from any legal consequences tied to their convictions.

Following the presidential pardons, reactions in the digital asset community remain contentious. For example, supporters of the BitMEX executives argue that they were unfairly targeted and that enforcing financial regulations in the cryptocurrency industry has been inconsistent.

Other community members believe the charges were necessary to uphold legal standards in digital finance.

The US Department of Justice (DoJ) had maintained that BitMEX knowingly failed to comply with financial laws. Officials highlighted that the company’s lack of oversight created opportunities for illegal activities, which could have been prevented with proper policies.

The case had been closely watched within the cryptocurrency industry, as it set a precedent for how regulators handle compliance failures in digital asset exchanges.

In related news, Hawk Tuah girl Hailey Welch, popular for her connection with the controversial $HAWK token, has been cleared of wrongdoing after a lengthy investigation by the United States Securities and Exchange Commission (SEC).

Meanwhile, Under President Donald Trump, regulatory trends around crypto have improved. As we mentioned in our previous news brief, the US SEC has dismissed its case with Ripple Labs, with the firm also closing its counter-appeal. Like Ripple, Coinbase, Uniswap, and Robinhood, among other firms, have also seen their respective legal cases closed.

SIX+2.85%

ACT+0.89%

CoCo_

2025/03/26 06:50

Ya ben was a shot caller for alot of years, made tons off him in my early days, sad to see, im a big bitboy fan

Coinedition

2025/03/20 17:25

Bybit’s $1.23B ETH Heist: Tracking the Ghost Chain, Seeking Crypto Sleuths

The digital trail of the massive Bybit hack is getting clearer, revealing the hacker’s elaborate efforts to launder the stolen 500,000 ETH (worth a staggering $1.23 billion).

The pilfered ETH was converted into 12,836 BTC and then scattered across a jaw-dropping 9,117 wallets, averaging just 1.41 BTC per wallet. To further muddy the waters and ensure anonymity, the attacker employed crypto mixers like Wasabi, CryptoMixer, Railgun, and TornadoCash.

Related: FBI: North Korea’s “TraderTraitor” Gang Behind $1.5B Bybit Hack

Despite these intricate maneuvers designed to obscure the funds, investigators have managed to trace a significant 88.87% of the stolen cryptocurrency, offering a glimmer of hope for recovery.

However, a frustrating 7.59% of the funds have vanished without a trace, adding a layer of complexity to the ongoing investigations. In response, Bybit has swiftly frozen 3.54% of the stolen funds, amounting to 17,700 ETH worth nearly $35 million, preventing any further movement. This rapid action was made possible through quick collaboration with other exchanges and blockchain analysis firms.

Bybit CEO, Ben Zhou, has issued a direct appeal to the crypto community, urging anyone with insights to assist in deciphering the complex layers of mixer transactions. Bybit’s security team has flagged the increasing use of Bitcoin mixers as a major obstacle in their recovery efforts. Decoding these transactions has now become the platform’s top priority. Just as Zhou emphasized in his post,

“After mixer the funds went to various p2p vendors. We believe this trend will grow as more funds will go through mixers. Decoding mixer transactions is the number one challenge we face now. If you can help, please reach out.”

Related: Bybit CEO: $1.4 Billion Crypto Hack Tracked, Majority Potentially Recoverable

To expedite the process of tracking down the remaining funds, Bybit has put out bounties for individuals who can provide actionable intelligence. Over the past 30 days, the exchange has received a total of 5,012 bounty reports, with 63 of them deemed valid and providing useful leads.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

BTC+1.06%

ETH+2.31%

Related assets

Popular cryptocurrencies

A selection of the top 8 cryptocurrencies by market cap.

Recently added

The most recently added cryptocurrencies.

Comparable market cap

Among all Bitget assets, these 8 are the closest to Ben (v2) in market cap.