Cardano (ADA) May Be Approaching a Key Price Turning Point Amid Weakening Downtrend

-

Cardano (ADA) has faced notable declines recently, dropping over 23% in a week, yet indicators suggest a potential shift in market dynamics.

-

The trend of whale addresses has decreased significantly, echoing a phase of distribution that may prolong the current bearish sentiment.

-

Analysts indicate that should ADA break through the resistance at $0.75, it could redefine targets up to $1.02, while a fall below $0.64 might lead to further drops.

Cardano (ADA) faces a week of volatility with a drop over 23%. Key indicators reveal potential shifts, making it a critical moment for investors navigating ADA’s next moves.

Cardano’s Current Downtrend Is Fading

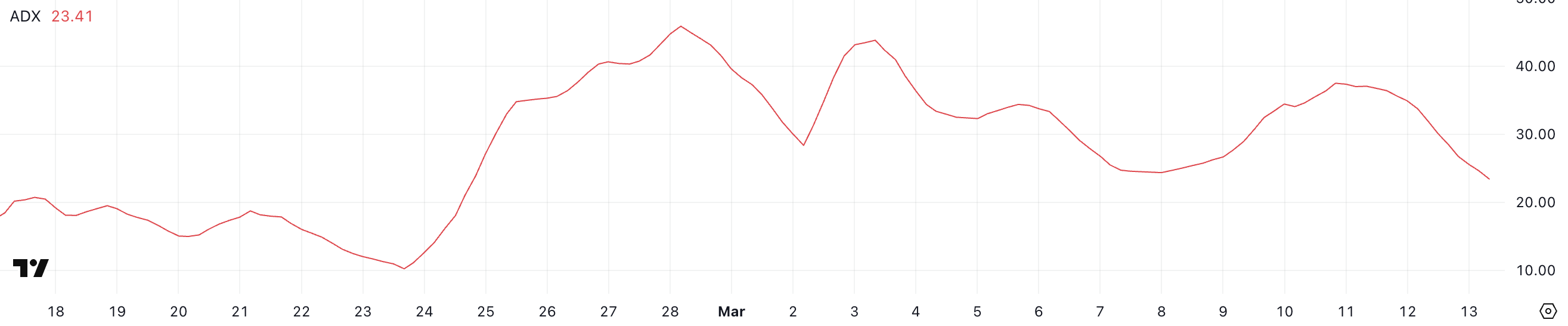

Currently, ADA’s Average Directional Index (ADX) stands at a reduced 23.4, down from previous highs, indicating a weakening trend. Typically, ADX values above 25 signify a strong movement, while values below 20 often suggest stagnation or consolidation within the market.

The recent decline in ADA’s ADX suggests that while the bearish phase persists, its intensity may be diminishing. This change could signal an impending shift in market sentiment towards a more bullish outlook.

Despite the downtrend, ADA’s declining ADX indicates that momentum may be subsiding. A continued decline below 20 would further confirm this trend, leading to an environment ripe for consolidation or potential reversals. However, for a comprehensive trend reversal, an increase in buying volume alongside a rising ADX will be critical.

ADA Whales Are Steadily Dropping In The Last Few Days

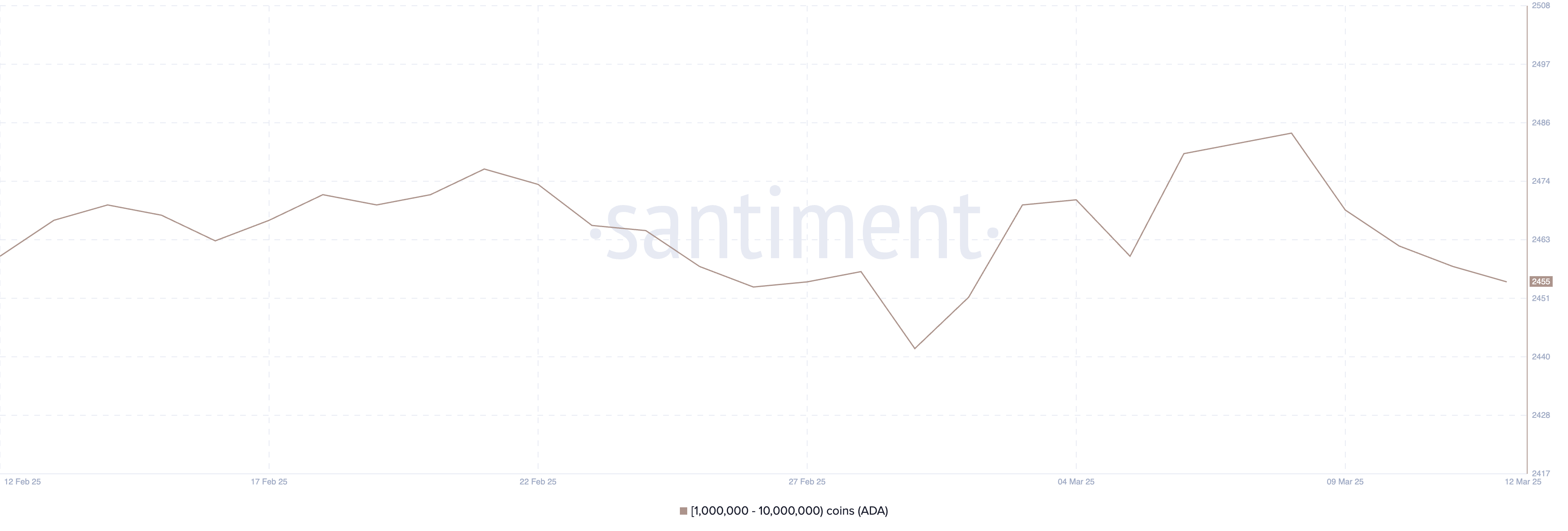

Data indicates that the population of Cardano whale addresses has contracted significantly. Currently, there are 2,455 active addresses holding between 1 million and 10 million ADA, signifying a drop from 2,484 just a week ago.

This trend of declining whale addresses reflects a broader distribution phase, as large investors tend to drive substantial market movements. An uptick in whale selling could exacerbate prevailing bearish conditions.

With a notable decrease in whale activity, market confidence among large holders appears to be waning. This could foreshadow an increase in volatility as smaller investors react to the ongoing selling pressure.

Although this pattern might prolong ADA’s downtrend, should there be a rebound in whale addresses, it may yield renewed bullish sentiments and a rise in ADA’s price movement.

Will Cardano Rise Back To $1 Soon?

Currently, the Exponential Moving Averages (EMAs) portray a period of consolidation, indicative of ADA’s struggle to maintain momentum in the short term. The short-term EMAs remain beneath the long-term counterparts, a configuration typically associated with bearish trends.

ADA will need to breach the critical resistance level at $0.75 to seek higher targets around $0.81 or more robust levels if buying interest grows. Stronger bullish pressure could potentially catalyze a move towards $1.02, and perhaps even $1.17.

Conversely, should ADA face an increase in selling momentum, a test of the $0.64 support could occur. A breach of this level would signify a deeper potential retracement to approximately $0.58.

The proximity of the EMA lines suggests that the market is at a critical juncture, where either a significant breakout or a substantial breakdown is plausible.

Conclusion

In summary, Cardano (ADA) is navigating a complex landscape defined by declining whale activity and weakening bearish momentum. While current indicators like the ADX provide insights into potential market reversals, critical resistance levels loom ahead. Investors will need to closely monitor ADA’s ability to maintain these supports while seeking opportunities for upside movement.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating Crypto Volatility: How Bitcoin and Altcoins Influence Your Trading Choices

Understanding the Impact of Market Volatility on Crypto Trading: A Look at the Risk and Reward in Bitcoin and Altcoins

Crypto Whales Bought These Coins in the Second Week of March 2025

Crypto whales have been active in accumulating BTC, PEPE, and ENS this week, signaling potential price movements despite recent market fluctuations.

James Howells Loses Appeal to Dig Up Landfill for $675 Million Bitcoin Hard Drive

James Howells has faced years of legal setbacks in his attempt to recover 8,000 lost Bitcoins from a Newport landfill. Despite offering millions, he now plans to approach the European Court of Human Rights.