Has the Crowd's Doom and Gloom Been Overstated? (This week in crypto summary March 14)IntroductionBitcoin Recovers to 84K, Still Down 6.3% WeeklyImpa

Introduction

In the latest market update Brian and Maksim take us through the current state of the crypto market during a turbulent period. With Bitcoin recovering from recent lows and global economic tensions affecting market sentiment, they offer valuable insights backed by on-chain data and social sentiment analysis. This article highlights key moments from their discussion, including potential signals for market recovery, whale behavior patterns, and contrarian market views that could help traders move through these uncertain times.

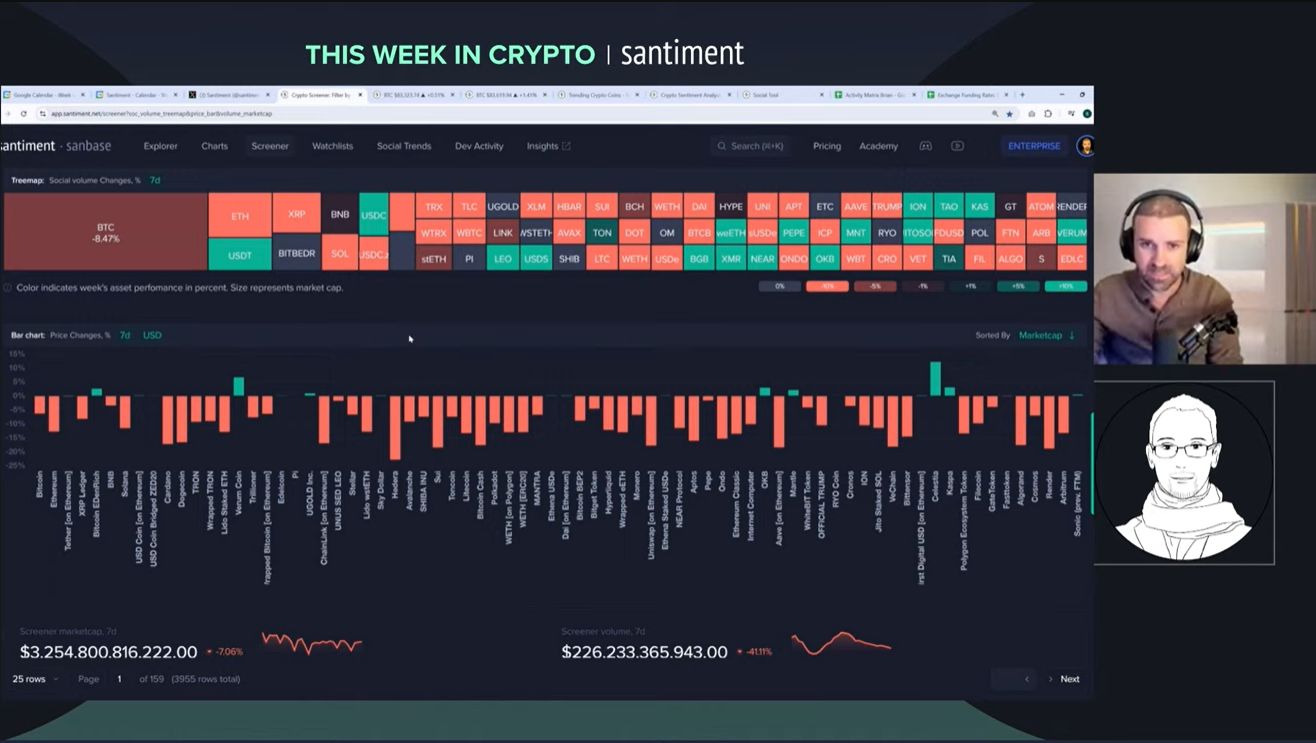

Bitcoin Recovers to 84K, Still Down 6.3% Weekly

Brian kicks off the discussion with an overview of Bitcoin's current price action. After dipping as low as 78K, Bitcoin has bounced back to around 84K but remains down about 6.3% over the past week. The day's trading looks "rather encouraging" with both crypto and equities on the rise. Brian points out that crypto has been following a similar pattern to the S&P 500, suggesting that broader market forces are at play rather than crypto-specific factors. This correlation shows that despite fears about crypto's future, it's simply fluctuating with the same downtrend affecting traditional markets.

Impact of Economic War on Markets

Maksim highlights how current market conditions reflect growing global tensions. "This is typical market behavior during insecurity and war times," he notes. The implementation of tariffs by the US and retaliatory measures from Canada point to rising trade conflicts. Markets typically show growth during peaceful periods of collaboration, but when relations sour and conflicts arise, downward trends follow. The discussion suggests these aren't isolated incidents but part of a broader pattern of separation and conflict that typically precedes bear markets.

Maksim Predicts Potential Long-Term Bear Market

In perhaps the most sobering assessment of the session, Maksim suggests traders should "prepare for long-term bear market" conditions. He bases this on geopolitical factors rather than crypto-specific issues, noting that powers outside of retail control are "going into conflict mode or separating fighting." Both hosts agree there's a "high chance we are in a few years of bear market." This perspective offers a stark contrast to the commonly held view that 2024, being a halving year, should naturally lead to a bull market.

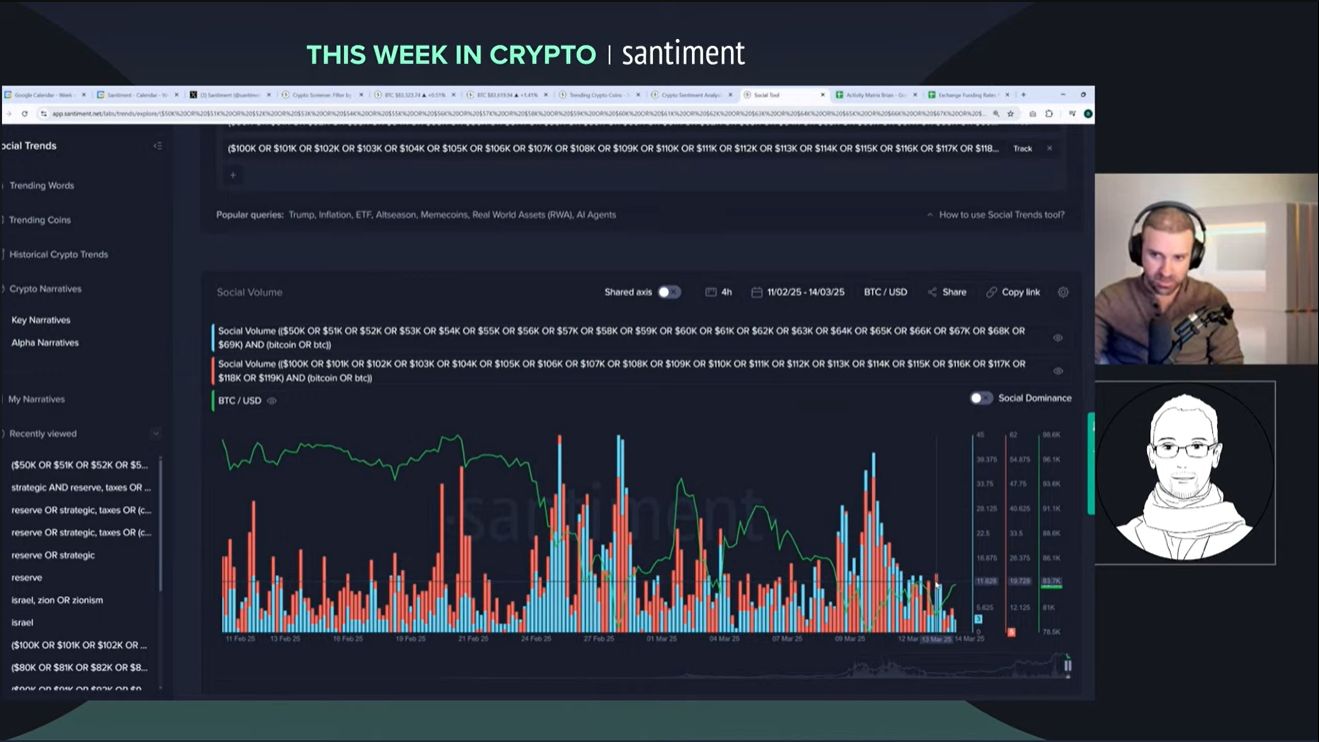

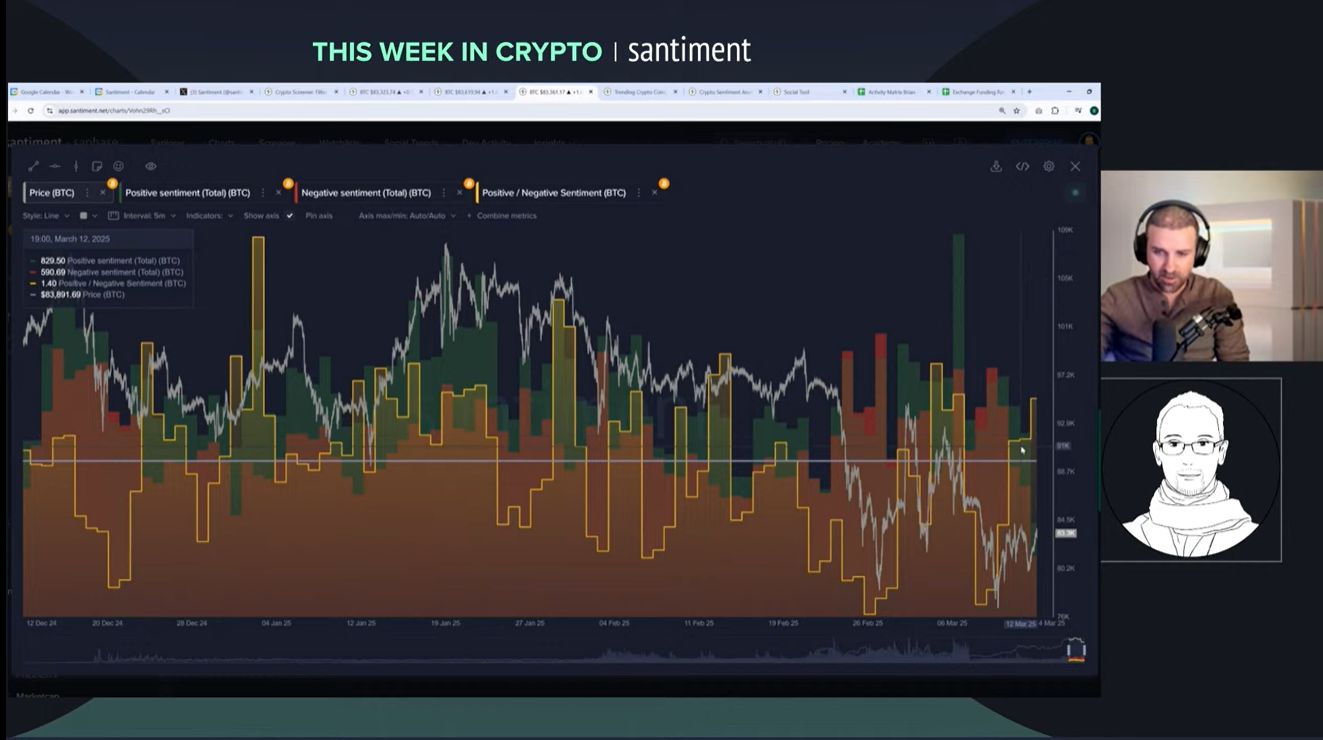

Current Recovery: Genuine or Bull Trap?

While markets show some green in the past 24 hours, the hosts question whether this represents a genuine recovery or a bull trap. Brian examines a chart tracking the frequency of high versus low Bitcoin price predictions, noting that extreme fear readings on March 10th corresponded with a market bounce. The current sentiment shows more confidence than fear on recent dips, which from a contrarian perspective could be concerning. "We need to see if there's some FOMO that might be forming as a result," Brian cautions.

Sentiment Analysis Shows Surprising Optimism

Looking at sentiment data, Brian notes that "for the last three days, we've actually been seeing an above-average level of sentiment." People remain optimistic about a recovery despite recent market tumbles. This optimism actually serves as a contrarian indicator since markets often move against the crowd's expectations. The lack of extreme fear that typically marks market bottoms suggests more downside could be ahead. Maksim adds that the market "always tries to confuse participants" and recommends staying away from trading in such difficult conditions.

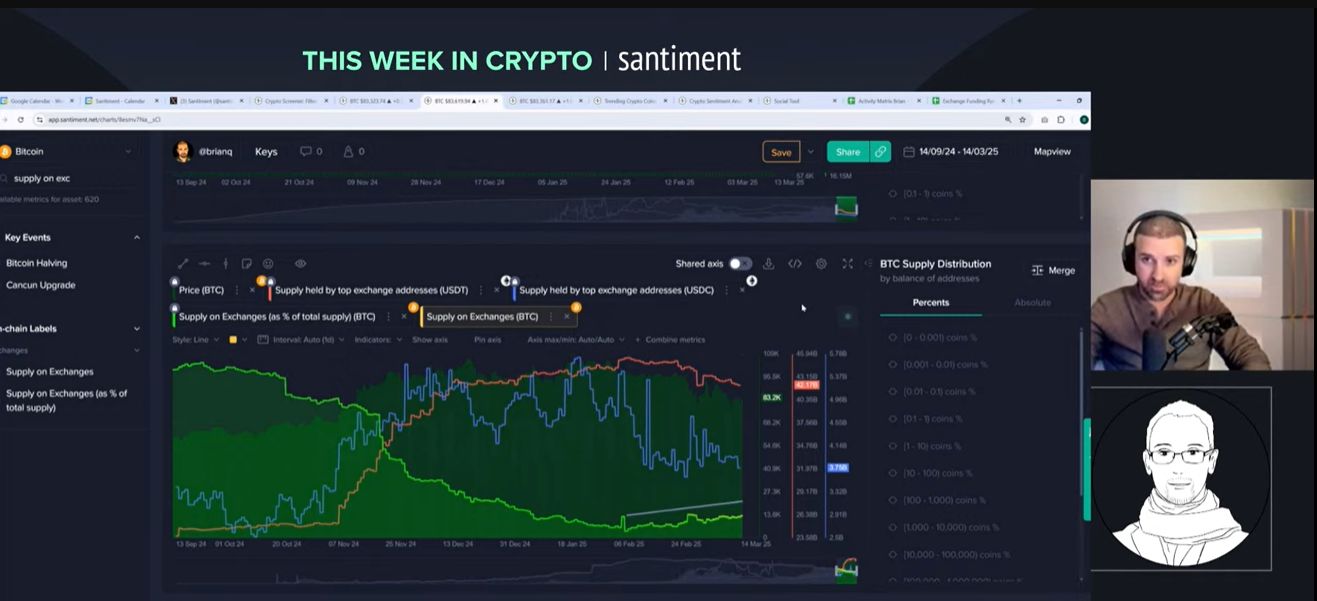

Exchange Supply Increasing (Bearish Signal)

One concerning metric highlighted is the increasing supply of Bitcoin on exchanges. Brian points out that since February 5th, about 35,146 Bitcoin have moved back to exchanges. "That's quite a bit," he notes, explaining that coins moving to exchanges typically signal intent to sell. This trend runs counter to what traders want to see during a healthy accumulation phase and adds to the bearish case. The movement of coins to exchanges over the past five weeks represents 0.17% of the entire Bitcoin supply, a significant amount that warrants attention.

Contrarian View on Market Consensus

Maksim offers a thoughtful contrarian perspective on market expectations. He notes that most articles and commentators mention how previous 20-30% declines were followed by continued growth, but few discuss scenarios where prices recover slightly before crashing further. "So no one writes about it yet, which makes me believe... if this is crowd sentiment and consensus seems to be like, 'okay, we crash, but we will go up again,' we should play safe and say no." This insight suggests that when the crowd universally expects a recovery, the opposite often occurs.

Four-Year Cycle Theory Discussion

Brian and Maksim tackle the popular four-year cycle theory, which suggests 2025 should be bullish following the Bitcoin halving. Brian questions the reliability of this theory, noting it's based on just a few examples: "Crypto has been around for almost 16, 17 years now. But that's not nearly enough to look at five examples of a four-year cycle." He suggests factors like COVID in 2020-2021 may have had more impact on market cycles than the halving itself. This skepticism toward commonly accepted market wisdom reflects the data-driven approach that guides their analysis.

Stablecoin Yields at Historic Lows (Bottom Signal?)

Maksim identifies a potential bottom signal in stablecoin yields, which have reached historically low levels. "The yield on stablecoins are so low... I've never seen it," he notes. This indicates market participants see few opportunities worth pursuing. Historically, such extreme conditions often precede significant upward movements. He explains that stablecoin yields are now "3.5% below Fed rate," meaning crypto investors are accepting less return than they could get from traditional financial instruments despite taking on more risk—typically a sign of extreme market fear.

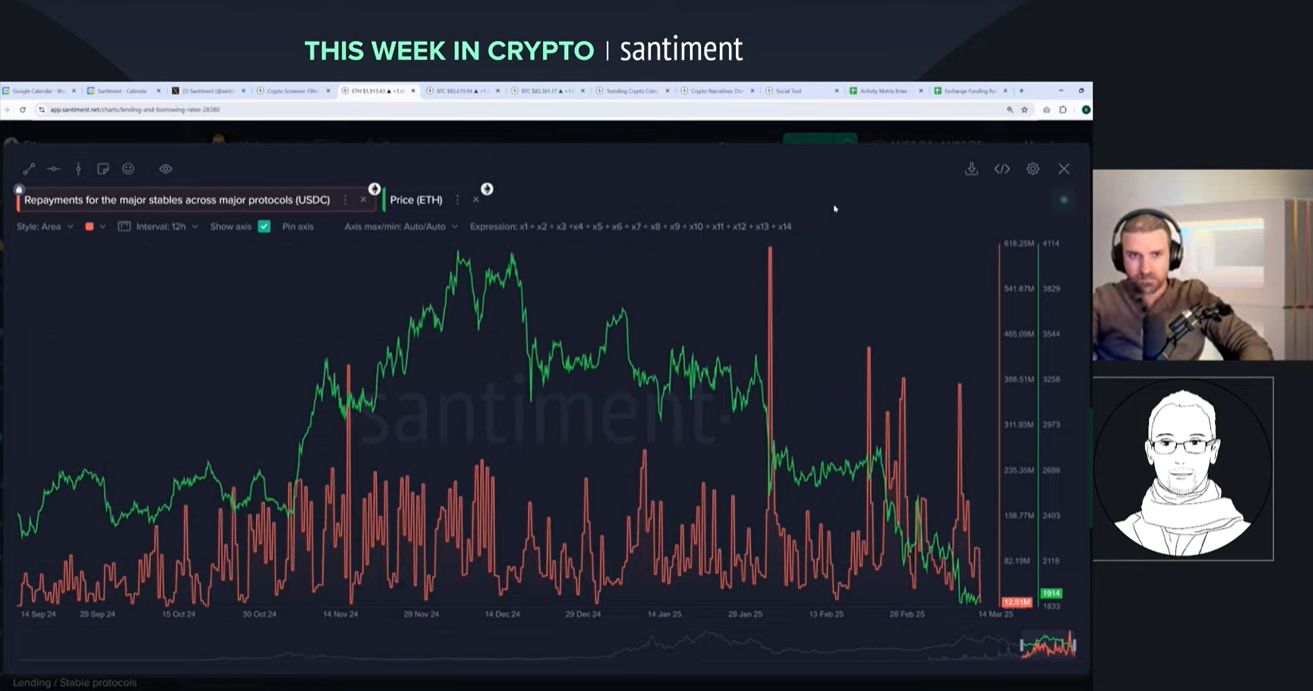

Liquidation Data Suggests Bottom Forming

Looking at liquidation data across protocols, Maksim points to significant liquidations in late February and early March. "This is a bottom sign," he suggests, noting that previous instances of heavy liquidations were followed by market bottoms within two weeks. Combined with repayments in stablecoins and decreased borrowing activity across platforms, these metrics create conditions typically associated with market bottoms. While maintaining his long-term bearish outlook, Maksim acknowledges that near-term relief rallies are possible based on these technical indicators.

Conclusion

Brian and Maksim's analysis reveals a market at a crossroads. While short-term indicators suggest a possible relief rally, longer-term geopolitical and sentiment factors point to challenging conditions ahead. The data shows a surprising amount of optimism despite recent drops—a contrarian warning sign for experienced traders. The decline in borrowing activity and spike in liquidations, however, create the conditions that typically precede at least temporary bottoms.

Their discussion highlights how crucial it is to look beyond price action and examine on-chain metrics, social sentiment, and liquidation patterns to gain a complete picture of market conditions. As Brian notes near the end, "things can always change" — a reminder that while data offers valuable insights, unexpected events can quickly shift market dynamics.

For traders looking to handle these uncertain conditions, the message is clear: proceed with caution, watch for signs of extreme fear or greed, and pay close attention to both on-chain metrics and global economic trends that continue to shape crypto market behavior.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tron Price Outlook: TRX’s Path to $1—Is It Possible?

Navigating Crypto Volatility: How Bitcoin and Altcoins Influence Your Trading Choices

Understanding the Impact of Market Volatility on Crypto Trading: A Look at the Risk and Reward in Bitcoin and Altcoins

Is Bitcoin Fumbling? Possible Further Decline in Store for BTC

Dwindling Sharpe Ratio Sparks Concerns over Bitcoin's Stability Amid Market Volatility

Crypto Whales Bought These Coins in the Second Week of March 2025

Crypto whales have been active in accumulating BTC, PEPE, and ENS this week, signaling potential price movements despite recent market fluctuations.