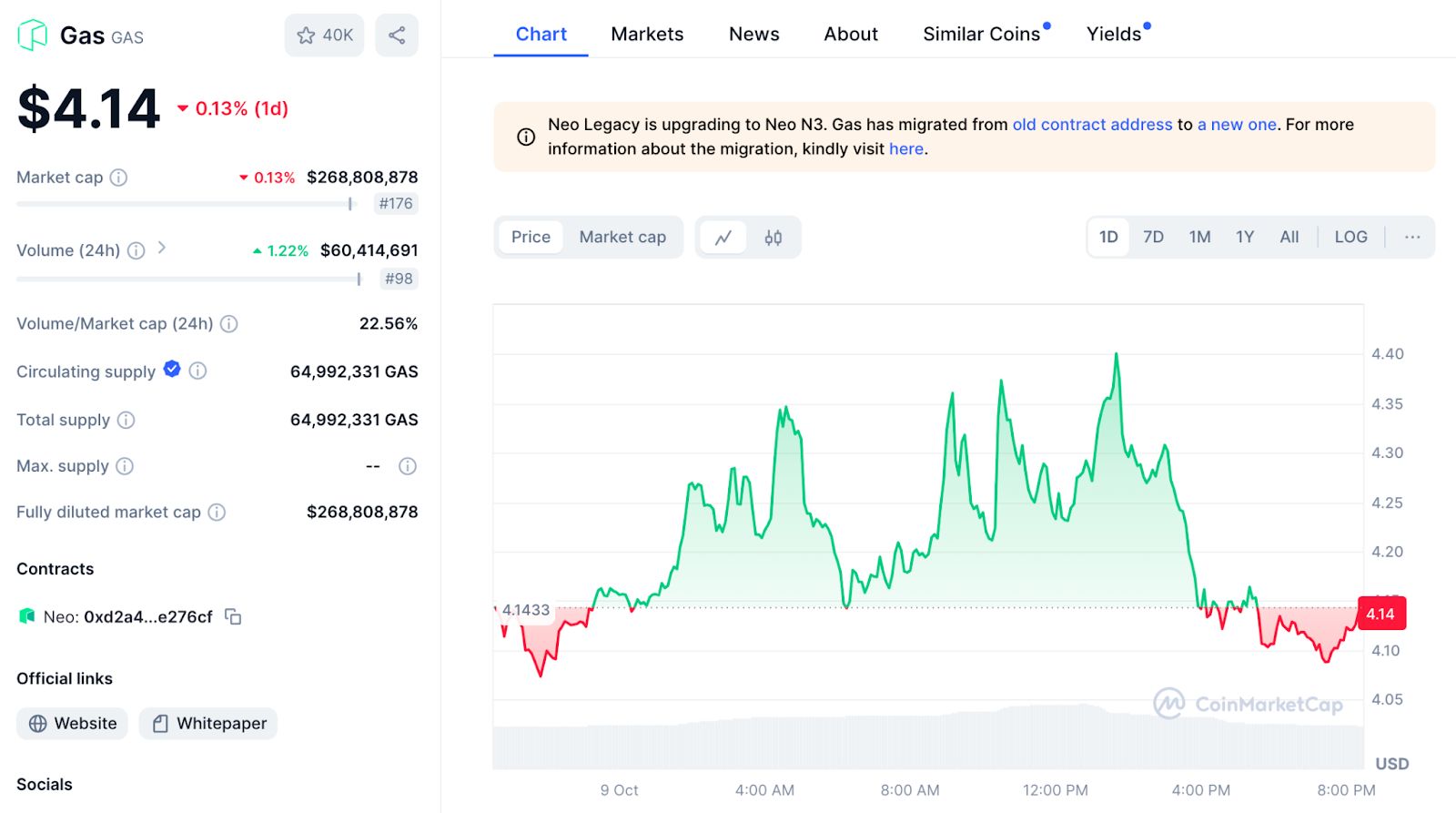

Gasの価格GAS

Gasに投票しましょう!

今日のGasの価格

GASの最高価格はいくらですか?

GASの最安価格はいくらですか?

Gasの価格予測

GASの買い時はいつですか? 今は買うべきですか?それとも売るべきですか?

2026年のGASの価格はどうなる?

2031年のGASの価格はどうなる?

Gasの価格履歴(JPY)

最低価格

最低価格 最高価格

最高価格

Gasの市場情報

Gas市場

Gasの集中度別保有量

Gasの保有時間別アドレス

Gasの評価

Gas (GAS)について

加密货币的燃料 - 了解加密货币Gas

在加密货币世界中,Gas是一个重要的概念,它在许多区块链平台上起着关键的作用。Gas是以太坊网络上的一种加密货币单位,用于支付交易费用和执行智能合约。

Gas的作用是确保网络的正常运行和交易的顺利执行。在以太坊平台上,每个交易和智能合约的执行都需要一定数量的Gas。这些Gas费用是以太币(ETH)支付的,因此用户需要有一定数量的以太币来支付交易费用。

Gas的数量取决于交易的复杂性和计算资源的消耗量。如果一个交易或智能合约需要大量的计算资源和时间来执行,那么所需的Gas就会更多。这意味着复杂的交易和智能合约需要更高的Gas费用。

Gas的使用还有助于防止恶意行为和网络拥堵。通过向交易和智能合约执行者收取一定数量的Gas费用,平台可以减少恶意活动和滥用行为。此外,由于每个交易都需要一定数量的Gas,这也可以抑制网络拥堵,使整个系统更加高效。

通过支付Gas费用,用户可以优先处理他们的交易。高额的Gas费用意味着该交易将被优先处理,确保快速完成,而低额的Gas费用则可能导致较慢的确认速度。

总结一下,Gas在加密货币世界中扮演着重要角色,它用于支付交易费用和执行智能合约,并确保网络的安全性和顺畅运行。通过设定Gas价格,用户可以优化交易的处理时间和速度。了解加密货币Gas的概念和作用,对于参与加密货币交易以及使用基于区块链技术的应用程序是至关重要的。

GASから現地通貨

- 1

- 2

- 3

- 4

- 5

Gas(GAS)の購入方法

無料でBitgetアカウントを作成します

アカウントを認証する

GasをGASに交換

GAS無期限先物を取引する

Bitgetに登録し、USDTまたはGASトークンを購入した後、GAS先物やマージン取引を含むデリバティブ取引を開始することができ、収入を増やすことができます。

GASの現在価格は¥273.67で、24時間の価格変動は-10.77%です。トレーダーはGAS先物をロングまたはショートすることで利益を獲得できます。

エリートトレーダーをフォローして、GASのコピートレードを始めましょう。

Gasのニュース

もっと購入する

よくあるご質問

Gasの現在の価格はいくらですか?

Gasの24時間取引量は?

Gasの過去最高値はいくらですか?

BitgetでGasを購入できますか?

Gasに投資して安定した収入を得ることはできますか?

Gasを最も安く購入できるのはどこですか?

Gas(GAS)はどこで買えますか?

動画セクション - 素早く認証を終えて、素早く取引へ

Bitgetインサイト

関連資産

Gasのソーシャルデータ

直近24時間では、Gasのソーシャルメディアセンチメントスコアは3で、Gasの価格トレンドに対するソーシャルメディアセンチメントは強気でした。全体的なGasのソーシャルメディアスコアは0で、全暗号資産の中で753にランクされました。

LunarCrushによると、過去24時間で、暗号資産は合計1,058,120回ソーシャルメディア上で言及され、Gasは0.01%の頻度比率で言及され、全暗号資産の中で366にランクされました。

過去24時間で、合計656人のユニークユーザーがGasについて議論し、Gasの言及は合計67件です。しかし、前の24時間と比較すると、ユニークユーザー数は増加で53%、言及総数は減少で18%増加しています。

X(Twitter)では、過去24時間に合計1件のGasに言及したポストがありました。その中で、0%はGasに強気、100%はGasに弱気、0%はGasに中立です。

Redditでは、過去24時間にGasに言及した2件の投稿がありました。直近の24時間と比較して、Gasの言及数が0%減少しました。

すべてのソーシャル概要

3