Bitget: ¡En el Top 4 por volumen de trading diario global!

Cuota de mercado de BTC61.59%

Nuevos listados en Bitget : Pi Network

BTC/USDT$84934.17 (+2.04%)Índice de miedo y codicia34(Miedo)

Índice de la temporada de altcoins:0(Temporada de Bitcoin)

Monedas listadas en el pre-mercadoPAWS,WCTFlujo neto total de ETF en spot de Bitcoin -$60.6M (1d); +$218.9M (7d). Paquete de obsequios de bienvenida para nuevos usuarios por valor de 6.200 USDT.Reclamar ahora

Tradea en cualquier momento y lugar con la app de Bitget. Descargar ahora

Bitget: ¡En el Top 4 por volumen de trading diario global!

Cuota de mercado de BTC61.59%

Nuevos listados en Bitget : Pi Network

BTC/USDT$84934.17 (+2.04%)Índice de miedo y codicia34(Miedo)

Índice de la temporada de altcoins:0(Temporada de Bitcoin)

Monedas listadas en el pre-mercadoPAWS,WCTFlujo neto total de ETF en spot de Bitcoin -$60.6M (1d); +$218.9M (7d). Paquete de obsequios de bienvenida para nuevos usuarios por valor de 6.200 USDT.Reclamar ahora

Tradea en cualquier momento y lugar con la app de Bitget. Descargar ahora

Bitget: ¡En el Top 4 por volumen de trading diario global!

Cuota de mercado de BTC61.59%

Nuevos listados en Bitget : Pi Network

BTC/USDT$84934.17 (+2.04%)Índice de miedo y codicia34(Miedo)

Índice de la temporada de altcoins:0(Temporada de Bitcoin)

Monedas listadas en el pre-mercadoPAWS,WCTFlujo neto total de ETF en spot de Bitcoin -$60.6M (1d); +$218.9M (7d). Paquete de obsequios de bienvenida para nuevos usuarios por valor de 6.200 USDT.Reclamar ahora

Tradea en cualquier momento y lugar con la app de Bitget. Descargar ahora

Relacionado con la moneda

Calculadora de precios

Historial de precios

Predicción de precios

Análisis técnico

Guía de compra de la moneda

Categoría cripto

Calculadora de ganancias

Relacionado con el trading

Comprar/vender

Depositar/retirar

Spot

Margen

Futuros USDT-M

Futuros Coin-M

Bots de trading

Copy trading

Earn

Pre-mercado

Actualizaciones de la moneda

Noticias de SHIB ON SOLANA

Alerta de SHIB ON SOLANA

Calendario de eventos

ICO

Airdrop

Precio de SHIB ON SOLANASHIB

No listado

Moneda de cotización:

EUR

Los datos proceden de proveedores externos. Esta página y la información proporcionada no respaldan ninguna criptomoneda específica. ¿Quieres tradear monedas listadas? Haz clic aquí

€0.{4}1180+3.34%1D

Gráfico de precios

Última actualización el 2025-04-01 18:27:18(UTC+0)

Capitalización de mercado:--

Capitalización de mercado totalmente diluida:--

Volumen (24h):€638,994.76

Volumen en 24h/Capitalización de mercado:0.00%

Máximo 24h:€0.{4}1217

Mínimo 24h:€0.{4}1142

Máximo histórico:€0.002436

Mínimo histórico:€0.{4}1014

Suministro circulante:-- SHIB

Suministro total:

999,985,088SHIB

Tasa de circulación:0.00%

Suministro máx.:

--SHIB

Precio en BTC:0.{9}1502 BTC

Precio en ETH:0.{8}6692 ETH

Precio en la capitalización de mercado de BTC:

--

Precio en la capitalización de mercado de ETH:

--

Contratos:

7wz31s...vXuZhso(Solana)

¿Qué opinas hoy de SHIB ON SOLANA?

Nota: Esta información es solo de referencia.

Precio actual de SHIB ON SOLANA

El precio de SHIB ON SOLANA en tiempo real es de €0.{4}1180 por (SHIB / EUR) hoy con una capitalización de mercado actual de €0.00 EUR. El volumen de trading de 24 horas es de €638,994.76 EUR. SHIB a EUR el precio se actualiza en tiempo real. SHIB ON SOLANA es del 3.34% en las últimas 24 horas. Tiene un suministro circulante de 0 .

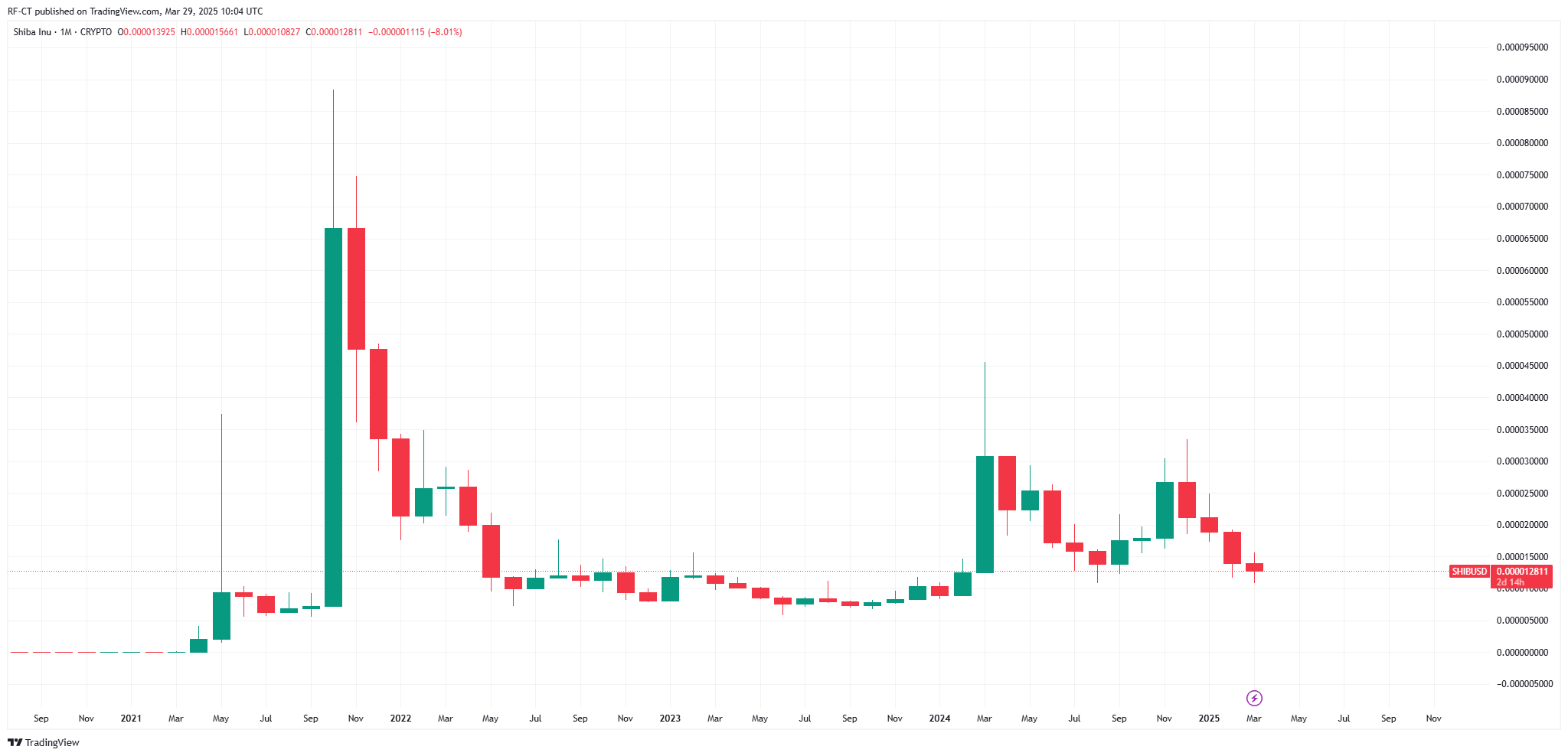

¿Cuál es el precio más alto de SHIB?

SHIB tiene un máximo histórico (ATH) de €0.002436, registrado el 2024-05-30.

¿Cuál es el precio más bajo de SHIB?

SHIB tiene un mínimo histórico (ATL) de €0.{4}1014, registrado el 2025-03-11.

Predicción de precios de SHIB ON SOLANA

¿Cuál será el precio de SHIB en 2026?

Según el modelo de predicción del rendimiento histórico del precio de SHIB, se prevé que el precio de SHIB alcance los €0.{4}1384 en 2026.

¿Cuál será el precio de SHIB en 2031?

En 2031, se espera que el precio de SHIB aumente en un +14.00%. Al final de 2031, se prevé que el precio de SHIB alcance los €0.{4}3505, con un ROI acumulado de +196.21%.

Historial del precio de SHIB ON SOLANA (EUR)

El precio de SHIB ON SOLANA fluctuó un -99.25% en el último año. El precio más alto de en EUR en el último año fue de €0.002436 y el precio más bajo de en EUR en el último año fue de €0.{4}1014.

FechaCambio en el precio (%) Precio más bajo

Precio más bajo Precio más alto

Precio más alto

Precio más bajo

Precio más bajo Precio más alto

Precio más alto

24h+3.34%€0.{4}1142€0.{4}1217

7d+0.60%€0.{4}1110€0.{4}1444

30d-14.15%€0.{4}1014€0.{4}1444

90d-39.49%€0.{4}1014€0.{4}2309

1y-99.25%€0.{4}1014€0.002436

Histórico-99.25%€0.{4}1014(2025-03-11, 22 día(s) atrás )€0.002436(2024-05-30, 307 día(s) atrás )

Información del mercado de SHIB ON SOLANA

Capitalización de mercado de SHIB ON SOLANA

Capitalización de mercado

--

Capitalización de mercado totalmente diluida

€11,801.34

Clasificación de mercado

Holdings de SHIB ON SOLANA

Matriz de distribución de holdings de SHIB ON SOLANA

Holdings por concentración de SHIB ON SOLANA

Ballenas

Inversores

Minoristas

SHIB ON SOLANA direcciones por tiempo en holding

Holders

Cruisers

Traders

Gráfico de precios de coinInfo.name (12) en tiempo real

Clasificación de SHIB ON SOLANA

Clasificaciones promedio de la comunidad

4.4

Este contenido solo tiene fines informativos.

SHIB a la moneda local

1 SHIB a MXN$01 SHIB a GTQQ01 SHIB a CLP$0.011 SHIB a HNLL01 SHIB a UGXSh0.051 SHIB a ZARR01 SHIB a TNDد.ت01 SHIB a IQDع.د0.021 SHIB a TWDNT$01 SHIB a RSDдин.01 SHIB a DOP$01 SHIB a MYRRM01 SHIB a GEL₾01 SHIB a UYU$01 SHIB a MADد.م.01 SHIB a AZN₼01 SHIB a OMRر.ع.01 SHIB a KESSh01 SHIB a SEKkr01 SHIB a UAH₴0

- 1

- 2

- 3

- 4

- 5

Última actualización el 2025-04-01 18:27:18(UTC+0)

Noticias de SHIB ON SOLANA

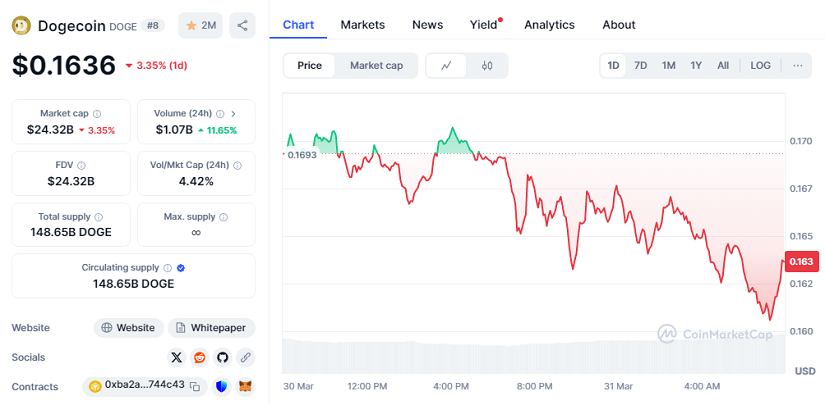

Musk Dice que el Gobierno de EE.UU. No Usará Dogecoin: ¡DOGE se Desploma!

CryptoEconomy•2025-03-31 13:56

Cripto: Shiba Inu va a alcanzar un hito histórico en 48 horas

CryptoNewsNet•2025-03-31 11:33

Predicción del precio de Shiba Inu: ¿Puede SHIB caer a $0 en este mercado bajista?

Shiba Inu (SHIB) está bajo presión ya que un sentimiento bajista domina el mercado de criptomonedas. ¿Podría SHIB caer a $0.000001, o todavía es posible un cambio de tendencia? Esto es lo que se puede esperar a medida que aumenta la volatilidad.

Cryptoticker•2025-03-30 02:11

Shiba Inu podría estar preparando una trampa de precios: entérate de los detalles

Criptofacil•2025-03-27 21:33

Comprar más

Preguntas frecuentes

¿Cuál es el precio actual de SHIB ON SOLANA?

El precio en tiempo real de SHIB ON SOLANA es €0 por (SHIB/EUR) con una capitalización de mercado actual de €0 EUR. El valor de SHIB ON SOLANA sufre fluctuaciones frecuentes debido a la actividad continua 24/7 en el mercado cripto. El precio actual de SHIB ON SOLANA en tiempo real y sus datos históricos están disponibles en Bitget.

¿Cuál es el volumen de trading de 24 horas de SHIB ON SOLANA?

En las últimas 24 horas, el volumen de trading de SHIB ON SOLANA es de €638,994.76.

¿Cuál es el máximo histórico de SHIB ON SOLANA?

El máximo histórico de SHIB ON SOLANA es €0.002436. Este máximo histórico es el precio más alto de SHIB ON SOLANA desde su lanzamiento.

¿Puedo comprar SHIB ON SOLANA en Bitget?

Sí, SHIB ON SOLANA está disponible actualmente en el exchange centralizado de Bitget. Para obtener instrucciones más detalladas, consulta nuestra útil guía Cómo comprar .

¿Puedo obtener un ingreso estable invirtiendo en SHIB ON SOLANA?

Desde luego, Bitget ofrece un plataforma de trading estratégico, con bots de trading inteligentes para automatizar tus trades y obtener ganancias.

¿Dónde puedo comprar SHIB ON SOLANA con la comisión más baja?

Nos complace anunciar que plataforma de trading estratégico ahora está disponible en el exchange de Bitget. Bitget ofrece comisiones de trading y profundidad líderes en la industria para garantizar inversiones rentables para los traders.

¿Dónde puedo comprar cripto?

Sección de video: verificación rápida, trading rápido

Cómo completar la verificación de identidad en Bitget y protegerte del fraude

1. Inicia sesión en tu cuenta de Bitget.

2. Si eres nuevo en Bitget, mira nuestro tutorial sobre cómo crear una cuenta.

3. Pasa el cursor por encima del ícono de tu perfil, haz clic en "No verificado" y haz clic en "Verificar".

4. Elige tu país o región emisora y el tipo de ID, y sigue las instrucciones.

5. Selecciona "Verificación por teléfono" o "PC" según tus preferencias.

6. Ingresa tus datos, envía una copia de tu ID y tómate una selfie.

7. Envía tu solicitud, ¡y listo! Habrás completado la verificación de identidad.

Las inversiones en criptomoneda, lo que incluye la compra de SHIB ON SOLANA en línea a través de Bitget, están sujetas al riesgo de mercado. Bitget te ofrece formas fáciles y convenientes de comprar SHIB ON SOLANA, y hacemos todo lo posible por informar exhaustivamente a nuestros usuarios sobre cada criptomoneda que ofrecemos en el exchange. No obstante, no somos responsables de los resultados que puedan surgir de tu compra de SHIB ON SOLANA. Ni esta página ni ninguna parte de la información que incluye deben considerarse respaldos de ninguna criptomoneda en particular.

Bitget Insights

Berserker_09

6h

Can Or Will Memecoins Rise Again ?

Why Memecoins Have Faded

Memecoins like Dogecoin ( $DOGE ) and Shiba Inu ( $SHIB ) and PEPE ( $PEPE ) hit their peak when social media hype and celebrity endorsements sent prices soaring. In 2021, a single Elon Musk tweet could double Dogecoin’s value overnight. Traders jumped in, hoping for quick profits, but as the overall crypto market cooled, so did memecoins. Without strong use cases, they struggled to keep investor interest.

The reality is, memecoins live and die by speculation. When the hype dies down, so do their prices. But if history is any indication, they’re never truly out of the game. Unlike traditional cryptocurrencies that rely on blockchain development and institutional adoption, memecoins thrive on sheer excitement. Once that excitement returns, a revival could happen faster than most expect.

Could Memecoins Become More Than Just Hype ?

One of the biggest questions surrounding memecoins is whether they can evolve beyond speculation. Some projects are trying to create real utility by integrating staking, governance, or even partnerships with gaming and metaverse platforms. If memecoins can carve out a sustainable niche, their long-term prospects could change dramatically.

That said, even if memecoins remain purely speculative, they still hold a unique place in the crypto world. Unlike Bitcoin, which positions itself as digital gold, or Ethereum, which powers decentralized applications, memecoins represent a different side of crypto—one driven by culture, entertainment, and community-driven value. This alone makes them a fascinating phenomenon.

Will Memecoins Rise Again ?

Betting against memecoins has never been a safe move. They’ve staged massive comebacks before, and the next crypto bull run could easily bring them back. The key is knowing when the wave is coming and riding it at the right time. While they remain speculative, their ability to defy expectations means they should never be written off completely. If another wave of hype-driven investing takes off, memecoins will almost certainly be at the center of it once again.

MOVE+0.69%

DOGE+2.93%

Crypto_inside

9h

Day trading ❌ Swing trading. 🧐😵💫

Day trading and swing trading are two popular trading strategies used in financial markets. While both strategies aim to profit from market fluctuations, they differ in their approach, time frame, and risk management.

Day Trading:

1. Intra-day trading: Day traders buy and sell securities within a single trading day.

2. Closing positions before market close: Day traders close all positions before the market closes to avoid overnight risks.

3. Frequent trading: Day traders make multiple trades throughout the day.

4. Technical analysis: Day traders rely heavily on technical analysis, using charts and indicators to identify trading opportunities.

5. Risk management: Day traders use stop-loss orders and position sizing to manage risk.

Swing Trading:

1. Short-term trading: Swing traders hold positions for a shorter period than investors, typically from a few days to a few weeks.

2. Holding positions overnight: Swing traders may hold positions overnight, exposing themselves to overnight risks.

3. Less frequent trading: Swing traders make fewer trades than day traders, as they hold positions for longer periods.

4. Combination of technical and fundamental analysis: Swing traders use a combination of technical and fundamental analysis to identify trading opportunities.

5. Risk management: Swing traders use stop-loss orders, position sizing, and risk-reward ratios to manage risk.

Key Differences:

1. Time frame: Day traders hold positions for minutes or hours, while swing traders hold positions for days or weeks.

2. Trading frequency: Day traders make multiple trades throughout the day, while swing traders make fewer trades.

3. Risk management: Day traders focus on managing risk through quick trade execution and tight stop-loss orders, while swing traders use a combination of risk management strategies.

4. Analysis: Day traders rely heavily on technical analysis, while swing traders use a combination of technical and fundamental analysis.

Choosing Between Day Trading and Swing Trading:

1. Trading style: Day trading suits traders who can dedicate several hours a day to monitoring markets and making trades. Swing trading suits traders who prefer to hold positions for longer periods.

2. Risk tolerance: Day trading involves higher risk due to the fast-paced nature of the markets. Swing trading involves lower risk, as positions are held for longer periods.

3. Market analysis: Day traders rely on technical analysis, while swing traders use a combination of technical and fundamental analysis.

4. Time commitment: Day trading requires a significant time commitment, while swing trading requires less time.

Thank you...🙂

$BTC $ETH $SOL $PI $AI $XRP $DOGE $SHIB $BONK $COQ $CATS $BGB $BNB $U2U $WUF $WHY $SUNDOG $PARTI $CEC $BLUR

SUNDOG+1.87%

BTC+2.82%

Crypto_inside

9h

What is 'Position trading'..🤔🤔??

Position trading is a long-term trading strategy that involves holding a position in a security for an extended period, typically weeks, months, or even years. This approach focuses on capturing significant price movements and trends, rather than trying to time the market or make quick profits.

Key Characteristics:

1. Long-term focus: Position traders hold positions for an extended period, riding out market fluctuations.

2. Trend following: Position traders aim to identify and follow long-term trends in the market.

3. Fundamental analysis: Position traders often rely on fundamental analysis, examining a company's financials, management, and industry trends.

4. Risk management: Position traders must manage risk carefully, as large price movements can result in significant losses.

Position Trading Strategies:

1. Trend identification: Position traders use technical indicators and chart patterns to identify long-term trends.

2. Breakout trading: Position traders buy or sell when a security breaks out of a established trading range.

3. Mean reversion: Position traders bet on prices reverting to their historical means.

Advantages:

1. Reduced transaction costs: Position traders incur lower transaction costs due to fewer trades.

2. Less emotional stress: Position traders are less affected by short-term market volatility.

3. *Potential for significant gains*: Position traders can capture significant price movements and trends.

Disadvantages:

1. Market risk: Position traders are exposed to market risk, as large price movements can result in significant losses.

2. Opportunity cost: Position traders may miss out on other investment opportunities while holding a long-term position.

3. Requires patience and discipline: Position traders must be patient and disciplined, as it can take time for a trade to develop.

Position Trading vs. Day Trading:

1. Trade duration: Position traders hold positions for weeks, months, or years, while day traders close their positions within a single trading day.

2. Trade frequency: Position traders make fewer trades, while day traders make multiple trades throughout the day.

3. Risk management: Position traders focus on managing risk through position sizing and stop-loss orders, while day traders focus on managing risk through quick trade execution and tight stop-loss orders.

Position trading requires a unique combination of fundamental analysis, technical analysis, and risk management. While it can be a profitable strategy, it's essential to carefully consider the risks and challenges involved.

Thank you...🙂

$BTC $ETH $SOL $PI $AI $XRP $BGB $BNB $DOGE $SHIB $BONK $FLOKI $U2U $WUF $ORDER $SUNDOG $TRX $WHY

SUNDOG+1.87%

BTC+2.82%

TokenTalk

9h

💎 2016: $ETH was the gem

💎 2017: $ADA shone bright

💎 2018: $BNB shone bold

💎 2019: $LINK connected the dots

💎 2020: $DOT took the lead

💎 2021: $SHIB made waves

💎 2022: $LUNA rode high

💎 2023: $BONK barked loud

💎 2024: $VIRTUAL Drove high

🚨 What would be the next big thing in 2025?

#Ethereum #SHIB

LINK+4.74%

DOT+3.55%

Crypto_inside

9h

What is Scalping...🤔🤔??

Scalping is a trading strategy that involves making multiple small trades in a short period, typically seconds or minutes, to take advantage of small price movements. The goal of scalping is to accumulate small profits from each trade, which can add up to significant gains over time.

Key Characteristics:

1. Short-term focus: Scalping involves holding trades for a very short period.

2. High-frequency trading: Scalpers make multiple trades in rapid succession.

3. Small profit targets: Scalpers aim to make small profits from each trade.

4. Risk management: Scalpers must manage risk carefully to avoid significant losses.

Scalping Strategies:

1. Trend following: Scalpers follow the trend, making trades in the direction of the market momentum.

2. Range trading: Scalpers buy and sell within a specific price range, taking advantage of oscillations.

3. Mean reversion: Scalpers bet on prices reverting to their historical means.

Tools and Techniques:

1. Technical analysis: Scalpers use technical indicators, such as moving averages and RSI, to identify trading opportunities.

2. Chart patterns: Scalpers recognize chart patterns, such as triangles and wedges, to anticipate price movements.

3. Order flow analysis: Scalpers analyze order flow to gauge market sentiment and identify potential trading opportunities.

Risks and Challenges:

1. Market volatility: Scalping involves trading in volatile markets, which can result in significant losses.

2. Commissions and fees: Scalpers incur high transaction costs due to frequent trading.

3. Emotional stress: Scalping can be emotionally demanding, requiring intense focus and quick decision-making.

Scalping vs. Day Trading:

1. Trade duration: Scalping involves holding trades for seconds or minutes, while day trading involves holding trades for hours or until the market closes.

2. Trade frequency: Scalpers make multiple trades in rapid succession, while day traders typically make fewer trades.

Scalping requires a unique combination of technical analysis, risk management, and mental discipline. While it can be a profitable strategy, it's essential to carefully consider the risks and challenges involved.

Thank you...🙂

$BTC $ETH $SOL $PI $AI $XRP $DOGE $SHIB $BONK $COQ $U2U $WUF $ADA $WHY $SUNDOG $PARTI $CATS

SUNDOG+1.87%

BTC+2.82%

Activos relacionados

Criptomonedas populares

Una selección de las 8 criptomonedas principales por capitalización de mercado.

Agregada recientemente

Las criptomonedas agregadas más recientemente.

Capitalización de mercado comparable

Entre todos los activos de Bitget, estos 8 son los más cercanos a SHIB ON SOLANA en capitalización de mercado.