Bitget:全球日交易量排名前 4!

BTC 市占率61.28%

Bitget 新幣上架 : Pi Network

BTC/USDT$83843.91 (-1.69%)恐懼與貪婪指數26(恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種PAWS,WCT比特幣現貨 ETF 總淨流量:-$93.2M(1 天);+$445.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率61.28%

Bitget 新幣上架 : Pi Network

BTC/USDT$83843.91 (-1.69%)恐懼與貪婪指數26(恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種PAWS,WCT比特幣現貨 ETF 總淨流量:-$93.2M(1 天);+$445.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率61.28%

Bitget 新幣上架 : Pi Network

BTC/USDT$83843.91 (-1.69%)恐懼與貪婪指數26(恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種PAWS,WCT比特幣現貨 ETF 總淨流量:-$93.2M(1 天);+$445.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

OneFinity 價格ONE

未上架

報價幣種:

TWD

數據來源於第三方提供商。本頁面和提供的資訊不為任何特定的加密貨幣提供背書。想要交易已上架幣種? 點擊此處

NT$1.81-9.97%1D

價格走勢圖

最近更新時間 2025-03-29 08:18:31(UTC+0)

市值:NT$7,896,887.71

完全稀釋市值:NT$7,896,887.71

24 小時交易額:NT$9,763.24

24 小時交易額/市值:0.12%

24 小時最高價:NT$2.01

24 小時最低價:NT$1.78

歷史最高價:NT$28.55

歷史最低價:NT$1.24

流通量:4,371,636 ONE

總發行量:

25,543,088ONE

流通率:17.00%

最大發行量:

25,546,534ONE

以 BTC 計價:0.{6}6503 BTC

以 ETH 計價:0.{4}2895 ETH

以 BTC 市值計價:

NT$12,609,232.6

以 ETH 市值計價:

NT$1,722,159.36

合約:

ONE-f9...-f9954f(Elrond)

您今天對 OneFinity 感覺如何?

注意:此資訊僅供參考。

OneFinity 今日價格

OneFinity 的即時價格是今天每 (ONE / TWD) NT$1.81,目前市值為 NT$7.90M TWD。24 小時交易量為 NT$9,763.24 TWD。ONE 至 TWD 的價格為即時更新。OneFinity 在過去 24 小時內的變化為 -9.97%。其流通供應量為 4,371,636 。

ONE 的最高價格是多少?

ONE 的歷史最高價(ATH)為 NT$28.55,於 2024-03-14 錄得。

ONE 的最低價格是多少?

ONE 的歷史最低價(ATL)為 NT$1.24,於 2023-12-28 錄得。

OneFinity 價格預測

什麼時候是購買 ONE 的好時機? 我現在應該買入還是賣出 ONE?

在決定買入還是賣出 ONE 時,您必須先考慮自己的交易策略。長期交易者和短期交易者的交易活動也會有所不同。Bitget ONE 技術分析 可以提供您交易參考。

根據 ONE 4 小時技術分析,交易訊號為 賣出。

根據 ONE 1 日技術分析,交易訊號為 強力賣出。

根據 ONE 1 週技術分析,交易訊號為 強力賣出。

ONE 在 2026 的價格是多少?

根據 ONE 的歷史價格表現預測模型,預計 ONE 的價格將在 2026 達到 NT$2.13。

ONE 在 2031 的價格是多少?

2031,ONE 的價格預計將上漲 +8.00%。 到 2031 底,預計 ONE 的價格將達到 NT$4.93,累計投資報酬率為 +170.92%。

OneFinity 價格歷史(TWD)

過去一年,OneFinity 價格上漲了 -88.59%。在此期間, 兌 TWD 的最高價格為 NT$17.95, 兌 TWD 的最低價格為 NT$1.63。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h-9.97%NT$1.78NT$2.01

7d-15.01%NT$1.78NT$2.7

30d-9.10%NT$1.63NT$2.7

90d-63.37%NT$1.63NT$5.13

1y-88.59%NT$1.63NT$17.95

全部時間-37.46%NT$1.24(2023-12-28, 1 年前 )NT$28.55(2024-03-14, 1 年前 )

OneFinity 市場資訊

OneFinity 持幣分布集中度

巨鯨

投資者

散戶

OneFinity 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

OneFinity 評級

社群的平均評分

4.6

此內容僅供參考。

ONE 兌換當地法幣匯率表

1 ONE 兌換 MXN$1.111 ONE 兌換 GTQQ0.421 ONE 兌換 CLP$51.241 ONE 兌換 UGXSh199.291 ONE 兌換 HNLL1.391 ONE 兌換 ZARR11 ONE 兌換 TNDد.ت0.171 ONE 兌換 IQDع.د71.31 ONE 兌換 TWDNT$1.811 ONE 兌換 RSDдин.5.911 ONE 兌換 DOP$3.441 ONE 兌換 MYRRM0.241 ONE 兌換 GEL₾0.151 ONE 兌換 UYU$2.31 ONE 兌換 MADد.م.0.531 ONE 兌換 OMRر.ع.0.021 ONE 兌換 AZN₼0.091 ONE 兌換 KESSh7.041 ONE 兌換 SEKkr0.551 ONE 兌換 UAH₴2.26

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-03-29 08:18:31(UTC+0)

OneFinity 動態

KOL修練指南:如何在社群網路上擴大受眾?

Panews•2025-02-28 22:30

以太坊做空倉位一週激增40%,空頭回補還是回天乏術?

Abmedia•2025-02-10 01:15

Velar 向聯合 Stacks 社區推出“.BTC 名稱授予計劃”

簡單來說 Velar 推出了“.BTC 名稱授予計劃”,以促進 Stacks 上數位身分的標準化,並推動“.btc”數位身分標準在比特幣生態系統中更廣泛的採用。

Mpost•2025-01-31 11:33

有雷慎入!《魷魚遊戲》第二季這個玩家竟是知名炒幣 Youtuber?導演想表達什麼社會現象?

Abmedia•2024-12-26 23:15

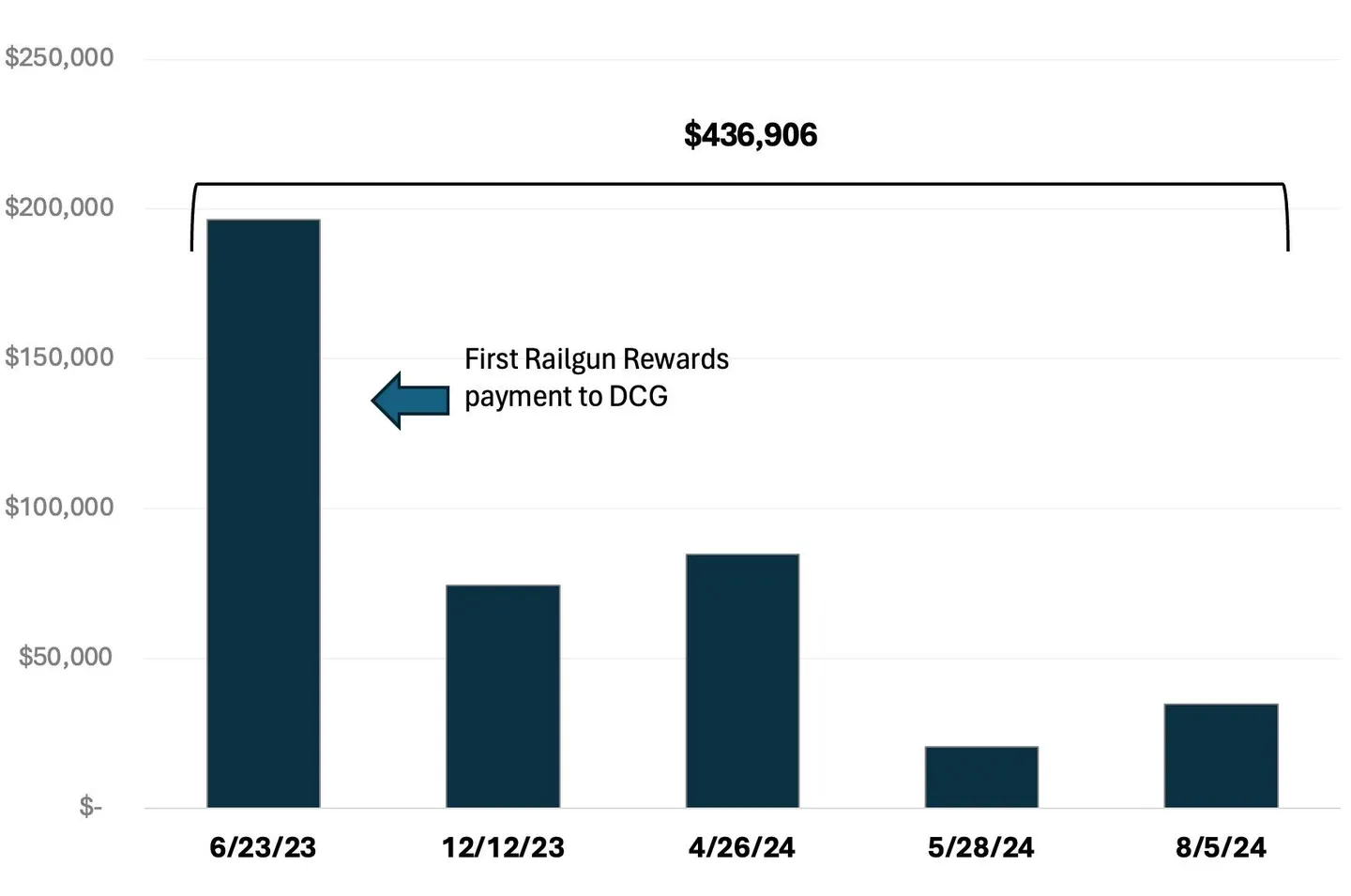

福布斯:DCG 是否從朝鮮黑客洗錢活動中獲利?

DCG 去年 6 月至今從混幣器 Railgun 獲得了約 43 萬美元資金。有調查顯示,Railgun 可能涉嫌朝鮮黑客集團 Lazarus Group 的非法洗錢活動。

Chaincatcher•2024-11-02 00:33

購買其他幣種

用戶還在查詢 OneFinity 的價格。

OneFinity 的目前價格是多少?

OneFinity 的即時價格為 NT$1.81(ONE/TWD),目前市值為 NT$7,896,887.71 TWD。由於加密貨幣市場全天候不間斷交易,OneFinity 的價格經常波動。您可以在 Bitget 上查看 OneFinity 的市場價格及其歷史數據。

OneFinity 的 24 小時交易量是多少?

在最近 24 小時內,OneFinity 的交易量為 NT$9,763.24。

OneFinity 的歷史最高價是多少?

OneFinity 的歷史最高價是 NT$28.55。這個歷史最高價是 OneFinity 自推出以來的最高價。

我可以在 Bitget 上購買 OneFinity 嗎?

可以,OneFinity 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 指南。

我可以透過投資 OneFinity 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 OneFinity?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

在哪裡可以購買加密貨幣?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 OneFinity)具有市場風險。Bitget 為您提供購買 OneFinity 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 OneFinity 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

AtiTRADER

30分鐘前

What is the daily trading volume of Banana For Scale (BANANAS31)?

What is the daily trading volume of Banana For Scale (BANANAS31)?

The trading volume of Banana For Scale (BANANAS31) is $61,098,570 in the last 24 hours, representing a -11.30% decrease from one day ago and signalling a recent fall in market activity. .

What is the highest and lowest price for Banana For Scale (BANANAS31)?

Banana For Scale (BANANAS31) reached an all-time high of $0.008236 and an all-time low of $0.0007234. It’s now trading 36.57% below that peak and 622.14% above its lowest price.

What is the market cap of Banana For Scale (BANANAS31)?

Market capitalization of Banana For Scale (BANANAS31) is $51,875,330 and is ranked #634 on CoinGecko today. Market cap is measured by multiplying token price with the circulating supply of BANANAS31 tokens (10 Billion tokens are tradable on the market today).

What is the fully diluted valuation of Banana For Scale (BANANAS31)?

The fully diluted valuation (FDV) of Banana For Scale (BANANAS31) is $51,875,330. This is a statistical representation of the maximum market cap, assuming the maximum number of 10 Billion BANANAS31 tokens are in circulation today. Depending on how the emission schedule of BANANAS31 tokens are designed, it might take multiple years before FDV is realized.

BANANAS31 to USD Chart

Banana For Scale (BANANAS31) is worth $0.005193 today, which is a 2.8% increase from an hour ago and a 5.5% decline since yesterday. The value of BANANAS31 today is 5.8% lower compared to its value 7 days ago. In the last 24 hours, the total volume of Banana For Scale traded was $61,241,594.

7-day price history of Banana For Scale (BANANAS31) to USD

The daily exchange rate of Banana For Scale (BANANAS31) to USD fluctuated between a high of $0.00667560 on Thursday and a low of $0.00508888 on Saturday in the last 7 days. Within the week, the price of BANANAS31 in USD had the largest 24-hour price movement on Thursday (2 days ago) by $0.00081029 (13.8%).

Compare the daily prices of Banana For Scale (BANANAS31) in USD and their 24-hour price movements for the week.

$BANANAS31

BANANAS31+0.09%

BANANA-1.52%

BGUSER-M9J9P6GJ

31分鐘前

*Unlocking the Potential of $BANANAS31: A Comprehensive Analysis*

The cryptocurrency market is known for its volatility and unpredictability, with new projects emerging and existing ones evolving continuously. $BANANAS31 is one such project that has gained significant attention in recent times. In this article, we'll delve into the potential of $BANANAS31, exploring its strengths, weaknesses, and growth prospects.

Understanding $BANANAS31

Before unlocking the potential of $BANANAS31, it's essential to understand the project's underlying fundamentals:

1. *Decentralized Ecosystem*: $BANANAS31 operates on a decentralized ecosystem, ensuring transparency, security, and community-driven decision-making.

2. *Unique Consensus Algorithm*: $BANANAS31 utilizes a novel consensus algorithm, combining the benefits of proof-of-work (PoW) and proof-of-stake (PoS) to ensure energy efficiency, security, and scalability.

3. *Growing Adoption*: $BANANAS31 has been gaining traction, with increasing adoption rates, growing community engagement, and expanding use cases.

Strengths and Weaknesses

To unlock the potential of $BANANAS31, it's crucial to identify its strengths and weaknesses:

1. *Strengths*: Decentralized ecosystem, unique consensus algorithm, growing adoption, and a strong community.

2. *Weaknesses*: Regulatory uncertainty, market volatility, and the need for further infrastructure development.

Growth Prospects

Despite the challenges, $BANANAS31 has significant growth prospects:

1. *Increasing Adoption*: Growing adoption rates and expanding use cases could drive up demand and prices.

2. *Partnerships and Collaborations*: Strategic partnerships and collaborations could enhance $BANANAS31's ecosystem and drive growth.

3. *Technological Advancements*: Continued innovation and development could improve $BANANAS31's scalability, security, and usability.

Technical Analysis

A technical analysis of $BANANAS31's price action reveals several key indicators:

1. *Trend Analysis*: $BANANAS31's price trend is currently bullish, with a potential breakout above the resistance level.

2. *Moving Averages*: The short-term moving averages are above the long-term moving averages, indicating a strong bullish trend.

3. *Relative Strength Index (RSI)*: The RSI is currently in the overbought region, suggesting a potential correction or consolidation.

Conclusion

Unlocking the potential of $BANANAS31 requires a comprehensive understanding of its strengths, weaknesses, and growth prospects. While challenges persist, $BANANAS31's decentralized ecosystem, unique consensus algorithm, and growing adoption position it for significant growth. By monitoring technical indicators and staying informed about market developments, investors can capitalize on $BANANAS31's potential and navigate the volatile cryptocurrency market.

FAQs

Q: What are the key strengths and weaknesses of $BANANAS31?

A: Strengths include its decentralized ecosystem, unique consensus algorithm, and growing adoption, while weaknesses include regulatory uncertainty and market volatility.

Q: What are the growth prospects for $BANANAS31?

A: Increasing adoption, partnerships, and technological advancements could drive up demand and prices.

Q: What is the current technical analysis of $BANANAS31's price action?

A: The trend is currently bullish, with a potential breakout above the resistance level, and the RSI is in the overbought region.

BANANAS31+0.09%

UP+2.65%

BGUSER-M9J9P6GJ

33分鐘前

*$IMT Coin: A Strategic Vision for Long-Term Sustainability and Growth*

As the cryptocurrency market continues to evolve, it's essential for projects to prioritize long-term sustainability and growth. $IMT Coin is one such project that has been gaining attention for its strategic vision and commitment to achieving lasting success. In this article, we'll delve into the key aspects of $IMT Coin's strategy, exploring how it's poised for long-term sustainability and growth.

Community-Driven Approach

$IMT Coin's community-driven approach is a crucial aspect of its strategic vision:

1. *Decentralized Governance*: $IMT Coin operates on a decentralized governance model, ensuring that decision-making is community-driven and transparent.

2. *Community Engagement*: The project prioritizes community engagement, fostering a strong and active community that contributes to the project's growth and development.

3. *Incentivization*: $IMT Coin's incentivization mechanisms encourage community participation, rewarding contributors and promoting a sense of ownership.

Technological Advancements

$IMT Coin's commitment to technological advancements is another key aspect of its strategic vision:

1. *Blockchain Optimization*: The project focuses on optimizing its blockchain technology, ensuring scalability, security, and efficiency.

2. *Innovation*: $IMT Coin encourages innovation, exploring new technologies and solutions that can enhance the project's ecosystem and user experience.

3. *Partnerships*: Strategic partnerships with other projects and industry leaders enable $IMT Coin to stay at the forefront of technological advancements.

Ecosystem Development

$IMT Coin's ecosystem development is a critical component of its strategic vision:

1. *Use Cases*: The project focuses on developing practical use cases, ensuring that $IMT Coin has real-world applications and value.

2. *Infrastructure*: $IMT Coin invests in building a robust infrastructure, providing a solid foundation for its ecosystem and users.

3. *User Experience*: The project prioritizes user experience, ensuring that its ecosystem is intuitive, user-friendly, and accessible.

Financial Sustainability

$IMT Coin's financial sustainability is a key aspect of its strategic vision:

1. *Treasury Management*: The project implements effective treasury management, ensuring that its finances are stable and secure.

2. *Revenue Streams*: $IMT Coin develops diverse revenue streams, reducing its dependence on any single source of income.

3. *Cost Management*: The project prioritizes cost management, optimizing its expenses and ensuring that its finances are allocated efficiently.

Conclusion

$IMT Coin's strategic vision for long-term sustainability and growth is comprehensive and well-rounded. By prioritizing community engagement, technological advancements, ecosystem development, and financial sustainability, $IMT Coin is poised for lasting success. As the cryptocurrency market continues to evolve, $IMT Coin's commitment to its strategic vision will enable it to navigate challenges and capitalize on opportunities.

FAQs

Q: What is $IMT Coin's strategic vision for long-term sustainability and growth?

A: $IMT Coin prioritizes community engagement, technological advancements, ecosystem development, and financial sustainability.

Q: How does $IMT Coin's community-driven approach contribute to its strategic vision?

A: $IMT Coin's community-driven approach ensures that decision-making is transparent and community-driven, fostering a strong and active community.

Q: What role do technological advancements play in $IMT Coin's strategic vision?

A: Technological advancements enable $IMT Coin to optimize its blockchain technology, explore new solutions, and stay at the forefront of innovation.

S-5.66%

ONE-4.09%

Coinedition

33分鐘前

Gemini, Binance Breach Claims Surface: Is Your Crypto Account Data at Risk?

Hackers claim they breached crypto exchanges Gemini and Binance, exposing personal information from over 100,000 users of each platform. The data – allegedly including names, emails, and phone numbers – is reportedly up for sale on the dark web, according to cybersecurity researchers at The Dark Web Informer .

These unconfirmed claims heighten concerns about cybercrime risks and potential scams targeting cryptocurrency users.

The Dark Web Informer’s report details claims from a hacker using the alias “AKM69.” This individual allegedly stole and is selling a database containing records for around 100,000 Gemini users. The affected users are reportedly primarily in the United States, though some records are linked to Singapore and the UK.

Sensitive information allegedly includes full names, email addresses, phone numbers, and location details. The source of this potential breach remains unconfirmed. Gemini has not commented publicly on the matter, and it’s unclear whether the issue, if confirmed, stems from an internal network compromise or external factors like widespread phishing or malware on user devices.

Following the Gemini report, a separate hacker identified as “kiki88888” reportedly offered over 132,000 records for sale, claiming they contain Binance user data including emails and passwords.

The authenticity and origin of this claimed Binance data are also unconfirmed. The Dark Web Informer suggests compromised user devices are one possible vector if the data proves legitimate.

Binance has faced similar, unverified claims before; last September, the exchange investigated and denied a hacker’s claim of accessing 12 million user records.

Related: Pump.fun Eyes Own AMM, Thwarts Bybit Hacker’s Laundering Attempt

The data allegedly stolen from users of both exchanges is reportedly being marketed on dark web forums for various malicious purposes. Common uses include targeted scams, financial fraud, identity theft, and sophisticated phishing attacks designed to steal more credentials or funds.

The Dark Web Informer recently noted a broader trend of device compromises globally, with cybercriminals actively exploiting stolen personal and corporate data to execute scams, such as phishing emails or messages carefully spoofing legitimate crypto platforms.

These alleged Gemini and Binance incidents align with a wider pattern of cyber threats facing the crypto industry and its users. Australian authorities, for example, issued a warning on March 21 about scam messages specifically targeting users of various crypto exchanges.

These scams often use spoofed sender IDs from exchanges like Binance to trick recipients into revealing login credentials or transferring funds to fraudulent wallets. Similar phishing campaigns had also targeted Coinbase and Gemini users in mid-March, reportedly deceiving some individuals into sending cryptocurrency to attacker-controlled addresses, resulting in the permanent loss of their funds.

Users should remain vigilant against unsolicited messages asking for sensitive information or requesting fund transfers.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

UP+2.65%

S-5.66%

Coinedition

33分鐘前

Saylor’s Strategy Now Owns 84% of Top 10 Public Companies’ Bitcoin Holdings

Bitcoin adoption among public companies reached new levels in early 2025, with a growing number choosing the cryptocurrency as a core treasury reserve asset. And still, Saylor’s Strategy (formerly known as MicroStrategy) holds a commanding lead in this trend, according to data compiled by Coingecko and shared on March 27. The business intelligence firm holds a staggering 506,137 BTC, worth over $44.2 billion at current prices (near $87k/BTC.)

Strategy Inc.’s Bitcoin position is substantial by multiple measures. Its holdings represent roughly 2.5% of Bitcoin’s entire current circulating supply. These holdings also account for nearly 84% of the combined Bitcoin reserves held just by the top 10 publicly traded corporate holders .

The company, heavily influenced by Executive Chairman Michael Saylor’s Bitcoin advocacy, aggressively built this position through calculated debt offerings and equity sales starting in 2020. Only one modest sale of 704 BTC, reported in December 2022, was conducted, primarily for tax optimization purposes. This sheer scale places Strategy Inc. in a league of its own among corporate Bitcoin accumulators.

Beyond Strategy Inc., Bitcoin mining firms represent another major category of corporate BTC holders. Companies like Marathon Digital (currently holding ~26,842 BTC) and Galaxy Digital (~15,449 BTC) benefit directly from holding the asset they produce. They mine Bitcoin at operational costs significantly below its market value.

This model allows them to build substantial asset reserves without the typical capital expenditure required for direct market purchases. As mining hardware and energy efficiency improve over time, this approach can become even more profitable, strengthening their balance sheets. Hut 8 Mining is also frequently cited among significant miner holders.

Related: Build a Lower-Risk Crypto Portfolio: Allocation Strategy Detailed

Several non-mining public companies have also emerged as key Bitcoin holders, demonstrating diverse motivations. Block Inc. (formerly Square) holds around 8,038 BTC (worth ~$702M), reflecting its early entry and continued conviction in the asset.

Tesla, despite selling a portion of its initial purchase in 2022, still maintains 11,509 BTC on its balance sheet. Coinbase, as a leading crypto-native exchange, naturally holds about 9,183 BTC for operational and reserve needs.

Additionally, newer entrants signal potentially broadening corporate adoption. Tokyo-based investment firm Metaplanet, for instance, has aggressively accumulated 2,888 BTC , drawing some comparisons to Strategy Inc.’s approach.

Related: Metaplanet, ‘Asia’s MicroStrategy,’ Boosts Bitcoin Holdings to 400 BTC

Video platform Rumble Inc. also made headlines by purchasing 188 BTC as part of its stated digital transformation strategy. This growing wave of diverse corporate interest suggests Bitcoin is becoming increasingly embedded within modern corporate finance considerations.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

BTC-0.68%

CORE-0.58%

相關資產

相近市值

在所有 Bitget 資產中,這8種資產的市值最接近 OneFinity。