Don’t Fall For It: Saylor Still Buying BTC Despite Fake $100K Quote Prank

A crypto personality on X (formerly Twitter), known for industry updates, posted a surprise quote early Tuesday attributed simply to “Saylor.” Most readers initially assumed this referred to the renowned Strategy founder Michael Saylor. The widely circulated quote claimed Saylor stated Bitcoin (BTC) will never reach $100,000 again.

Considering the timing – April 1st, marking the start of Q2 – the post triggered notable curiosity and some brief panic within the crypto community. This reaction was amplified by recent bearish price pressure on Bitcoin. The original poster offered no immediate context for the supposed prediction, increasing follower speculation.

Related: Saylor’s Relentless Strategy: Buys $1.9B More Bitcoin, Now Holds 2.5% of All BTC

However, community members quickly realized the likely joke. Several remembered the date’s significance (April Fools’ Day) and soon confirmed the post appeared to be a prank. Notably, there was no proof identifying which “Saylor” the poster actually meant, nor any evidence the famous Michael Saylor made such negative public statements about Bitcoin.

In reality, Michael Saylor remains one of the Bitcoin industry’s most vocal and consistent bulls. Reinforcing this, his software firm, Strategy, purchased an additional 22,048 BTC, according to its official March 31 announcement.

According to data from TradingView, Bitcoin traded for $83,446 at the time of writing. The cryptocurrency bounced off an $81,287 low after Strategy’s latest purchase. The current price leaves Bitcoin around 24% below its all-time high price of $109,356, which it achieved on January 20.

Related: Bold Bitcoin Predictions Range from $120K to $13M—Who’s Right?

Many market analysts still expect Bitcoin to recover from recent pullbacks and eventually rally higher. They cite continued belief in the cryptocurrency’s potential to reach new highs in the coming months. Some experts project Bitcoin could surge above $138,000 later in 2025, potentially targeting $150,000 before the year concludes.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Experts: Gold’s Rise Doesn’t Undermine Bitcoin’s Digital Gold Status

On the eve of what U.S. President Donald Trump has called “liberation day,” the price of gold reached a new milestone of $3,117 per ounce. This came just days after the precious metal surpassed the $3,100 mark, fueling optimism among gold proponents.

Gold’s attractiveness amid trade war fears, which have weighed on traditional assets and even bitcoin ( BTC), has prompted Goldman Sachs to revise its year-end price prediction upward. As reported by Reuters, the investment bank raised its forecast range to $3,250-$3,520 from $3,100-$3,300.

Goldman Sachs attributes the change to aggressive gold purchases by Asian central banks, a trend it expects to continue for the next three to six years. It also cites stronger-than-expected gold exchange-traded fund (ETF) inflows as another reason for the upward revision.

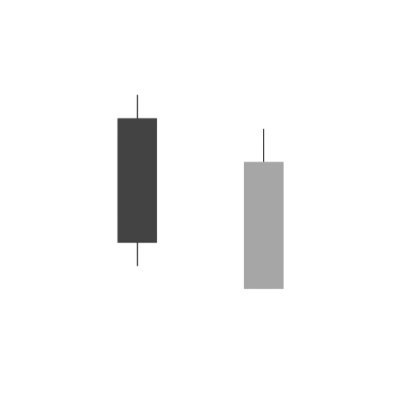

The apparent change in investors’ stance on gold contrasts with their perception of BTC, particularly after Trump’s inauguration on Jan. 20. While gold’s latest milestone brings its year-to-date gain to 22%, BTC’s slide from its Trump inauguration day peak of nearly $109,000 to just under $83,000 on March 31 means it ended the first quarter of 2025 approximately 23% in the red.

This Q1 performance by digital assets, seen by some as a safe-haven asset, has emboldened critics who reject the notion that BTC is digital gold. The fact that BTC has seemingly wavered each time Trump has threatened or imposed tariffs on the U.S.’s main trade partners lends credence to their argument.

However, despite this seeming correlation with traditional assets, bitcoin proponents insist the crypto asset’s first-quarter performance does not undermine its digital gold status. This sentiment is shared by experts interviewed by Bitcoin.com News, including Rena Shah, COO of Trust Machines.

According to Shah, while gold might have retained its safe-haven status, Bitcoin is the “only asset you’ll never sell.” The COO also pointed to how BTC continues to outperform other assets since the launch of bitcoin ETFs.

“Bitcoin is punching above its weight, as a younger asset class compared to legacy ETFs, like gold. Whether you hold bitcoin as a hedge against market uncertainty or are waiting for the right reentry point, Bitcoin is evolving to offer so much more than gold can,” Shah said.

Ben Caselin, CMO at African cryptocurrency exchange VALR, said the prospect of countries and central banks adding BTC to their treasuries signals the start of a country-level game theory. Caselin also cites countries stocking up on gold as indicating better times ahead for BTC.

“We cannot rule out that these movements are due to game theory around Bitcoin, with the rally in gold acting as a precursor for an explosion in bitcoin acquisition,” Caselin said.

Mithil Thakore, CEO of Velar, told Bitcoin.com News that he disagrees with the notion that Bitcoin has lost its digital gold status. Instead, he argued that BTC has become “more important than ever, both in terms of perception and practical adoption.” To support this viewpoint, Thakore pointed to the adoption of BTC by institutions and its proven staying power. Regarding what the rising interest in gold means for BTC, the Velar CEO said:

“Renewed interest in gold actually supports Bitcoin’s value proposition. Both assets are responding to macroeconomic instability, inflation concerns, and growing distrust in fiat systems.”

Luke Xie, co-founder and CEO of Satlayer, suggested that gold’s rally could be temporary, fueled by “short-term safe-haven inflows amid global uncertainty.” This contrasts with BTC, whose value proposition is “anchored in its finite supply, decentralized network, and ever-growing adoption.”

Xie also highlighted how bitcoin’s gold status is boosted by technological advancements, something that cannot be said of gold.

“In essence, rather than losing its ‘digital gold’ status, Bitcoin is evolving—bolstered by technological advancements and strategic initiatives like BTCfi—that underscore its complementary and superior role in modern portfolio construction,” the Satlayer CEO said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

最低價

最低價 最高價

最高價