Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

LIKE priceLIKE

How do you feel about LIKE today?

Price of LIKE today

What is the highest price of LIKE?

What is the lowest price of LIKE?

LIKE price prediction

What will the price of LIKE be in 2026?

What will the price of LIKE be in 2031?

LIKE price history (USD)

Lowest price

Lowest price Highest price

Highest price

LIKE market information

LIKE holdings by concentration

LIKE addresses by time held

LIKE ratings

About LIKE (LIKE)

The advent of cryptocurrencies has brought about a significant shift in the financial landscape. These digital currencies, with Bitcoin being the most notable example, have gained immense popularity and become a subject of fascination for many individuals. In this article, we will explore the historical significance and key features of cryptocurrencies, shedding light on their profound impact on the world of finance. At its core, a cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks known as blockchain">blockchain technology. This decentralized nature ensures that no single entity or government has total control over the currency, making it resistant to manipulation and censorship. The history of cryptocurrencies dates back to the late 2000s when Bitcoin, the first-ever decentralized cryptocurrency, was introduced. Its whitepaper, published by the pseudonymous figure known as Satoshi Nakamoto, outlined the concept of a peer-to-peer electronic cash system, revolutionizing the way we think about money. Bitcoin's primary goal was to provide a secure, transparent, and efficient alternative to traditional banking systems. One of the key features of cryptocurrencies is their decentralization, which eliminates the need for intermediaries such as banks or payment processors. Transactions are conducted directly between participants on the blockchain network, resulting in faster and cheaper transactions. This peer-to-peer model has the potential to disrupt traditional banking systems by providing financial services to the unbanked population in various parts of the world. Another important aspect of cryptocurrencies is their limited supply. Most cryptocurrencies, including Bitcoin, have a predetermined maximum supply, often resulting in scarcity. This scarcity, along with increasing demand, has led to significan t price appreciation in many cryptocurrencies over the years. However, it is crucial to note that cryptocurrencies are highly volatile and speculative assets, which can lead to substantial price fluctuations. Furthermore, cryptocurrencies offer enhanced privacy and security compared to traditional financial systems. Transactions conducted with cryptocurrencies are usually pseudonymous, meaning that they do not directly reveal the identity of the participants. Cryptography techniques ensure the secure transfer of funds and safeguard against fraudulent activities. Cryptocurrencies have also paved the way for the development of blockchain technology, which has far-reaching implications beyond finance. Blockchain technology has proven to be valuable in a range of industries, including supply chain management, healthcare, real estate, and more. Its transparent and immutable nature makes it an ideal solution for creating trust and reducing fraud in various sectors. In conclusion, cryptocurrencies have marked a significant milestone in the history of finance. They have introduced a decentralized and secure way of conducting financial transactions, challenging the traditional banking system. With their limited supply, enhanced privacy, and potential for wider adoption, cryptocurrencies have the ability to reshape the future of finance and beyond.

LIKE to local currency

- 1

- 2

- 3

- 4

- 5

How to buy LIKE(LIKE)

Create Your Free Bitget Account

Verify Your Account

Convert LIKE to LIKE

Trade LIKE perpetual futures

After having successfully signed up on Bitget and purchased USDT or LIKE tokens, you can start trading derivatives, including LIKE futures and margin trading to increase your income.

The current price of LIKE is $0.01074, with a 24h price change of -6.17%. Traders can profit by either going long or short onLIKE futures.

Join LIKE copy trading by following elite traders.

LIKE news

A recent ECB study reveals that many Europeans stick with cash and conventional bank accounts, exposing a divide between policy plans and real-life payment habits.

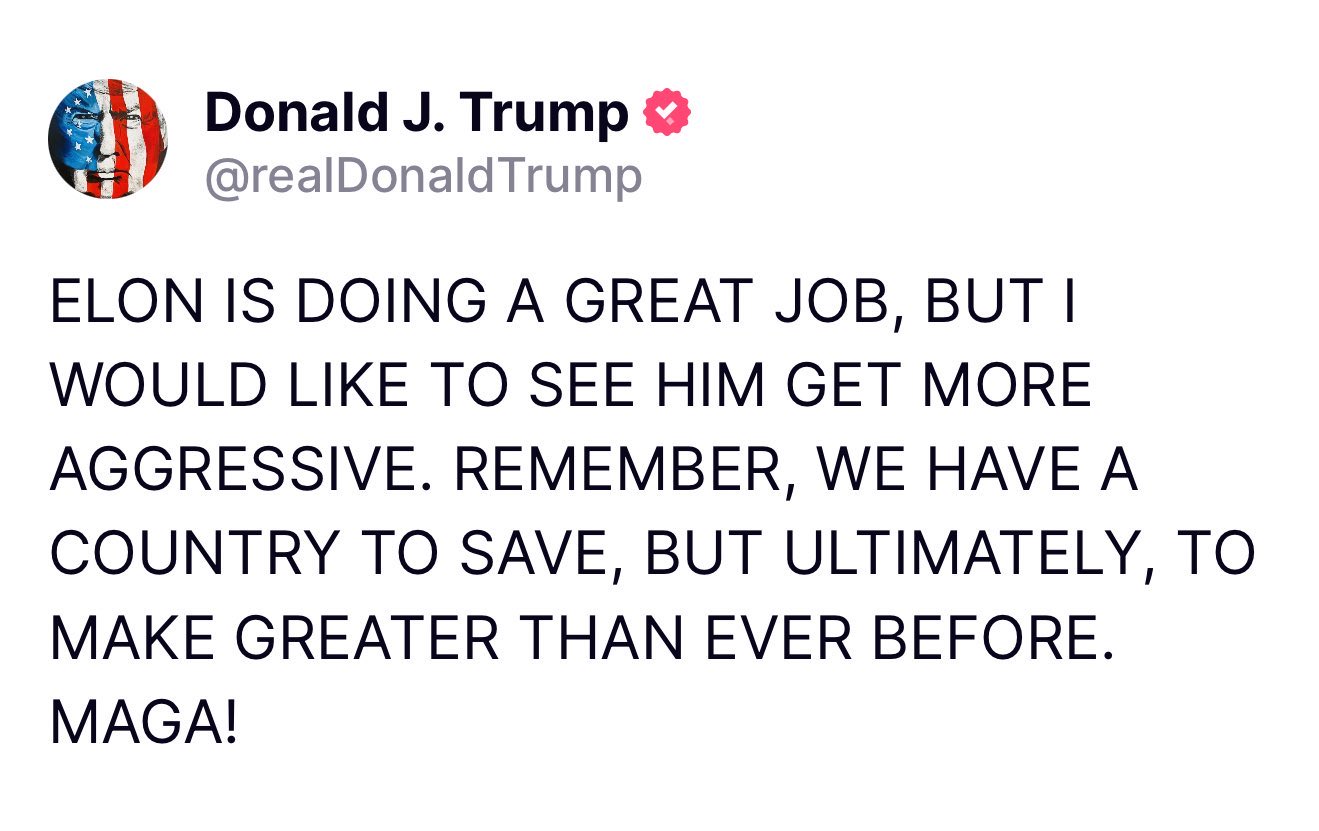

Share link:In this post: Elon Musk told all US federal workers to report what they did last week or lose their jobs. Trump’s administration is already firing tens of thousands of probationary government employees. About 77,000 federal employees quit after Elon demanded full-time office returns.

A convincing break below its 200DMA and 2024 highs could see DOGE slide all the way back to the mid-$0.10s or lower.

New listings on Bitget

Buy more

FAQ

What is the current price of LIKE?

What is the 24 hour trading volume of LIKE?

What is the all-time high of LIKE?

Can I buy LIKE on Bitget?

Can I get a steady income from investing in LIKE?

Where can I buy LIKE with the lowest fee?

Where can I buy LIKE (LIKE)?

Video section — quick verification, quick trading

Bitget Insights

Related assets

LIKE Social Data

In the last 24 hours, the social media sentiment score for LIKE was 0.4, and the social media sentiment towards LIKE price trend was Bearish. The overall LIKE social media score was 158, which ranks 448 among all cryptocurrencies.

According to LunarCrush, in the last 24 hours, cryptocurrencies were mentioned on social media a total of 1,058,120 times, with LIKE being mentioned with a frequency ratio of 0%, ranking 572 among all cryptocurrencies.

In the last 24 hours, there were a total of 0 unique users discussing LIKE, with a total of LIKE mentions of 12. However, compared to the previous 24-hour period, the number of unique users decrease by 0%, and the total number of mentions has increase by 50%.

On Twitter, there were a total of 1 tweets mentioning LIKE in the last 24 hours. Among them, 100% are bullish on LIKE, 0% are bearish on LIKE, and 0% are neutral on LIKE.

On Reddit, there were 0 posts mentioning LIKE in the last 24 hours. Compared to the previous 24-hour period, the number of mentions decrease by 0% .

All social overview

0.4