News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (March 20) | Fed to slow pace of balance sheet reduction in April, Trump to attend Digital Asset Summit in New York2Mubarak (MUBARAK) Price Prediction 2025-2030: Will It Hold Its Bullish Momentum?3Canary Capital files for first-ever Pengu ETF amid expanded crypto offerings

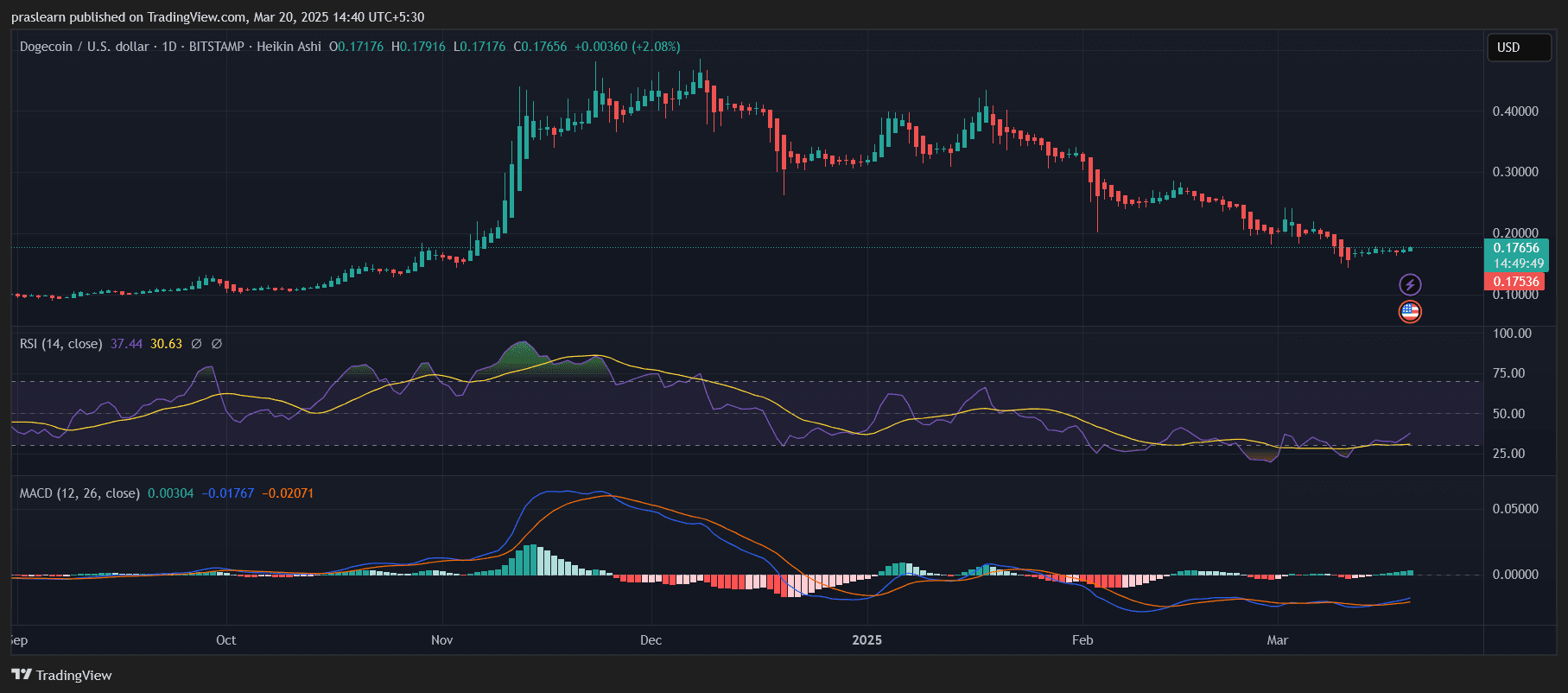

Dogecoin Breaks $0.1689 Amid Market Volatility – Can It Surge Past $0.1789?

Cryptonewsland·2025/03/20 22:22

Kryll (KRL) Creates Stealthy Bullish Divergence: What Traders Should Know

Cryptonewsland·2025/03/20 22:22

Bullish Divergence in Bitcoin: $90K Breakout or Fakeout?

Cryptonewsland·2025/03/20 22:22

SHIB vs DOGE: Can One of Them Make You a Millionaire?

Cryptoticker·2025/03/20 20:33

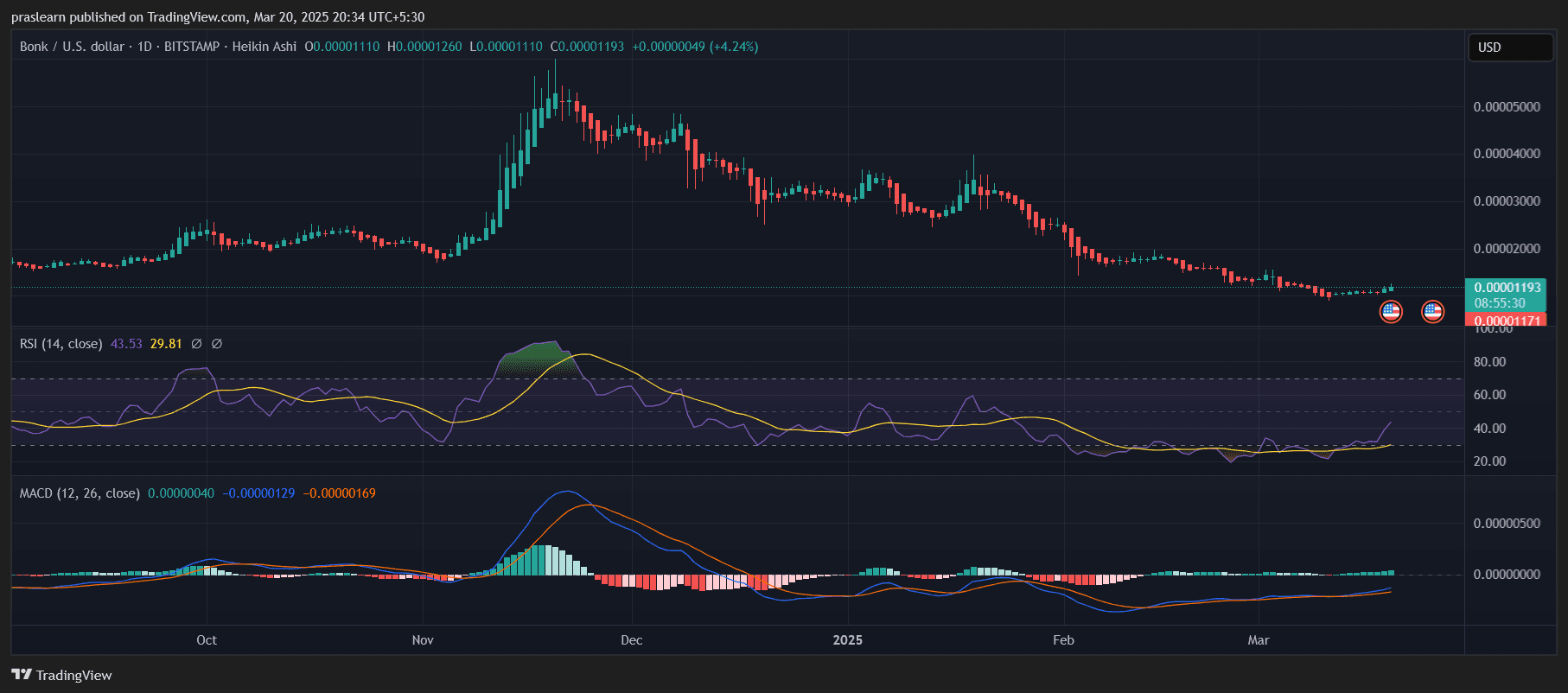

Will BONK Price Reach $1 in the Next 30 Days?

Cryptoticker·2025/03/20 20:33

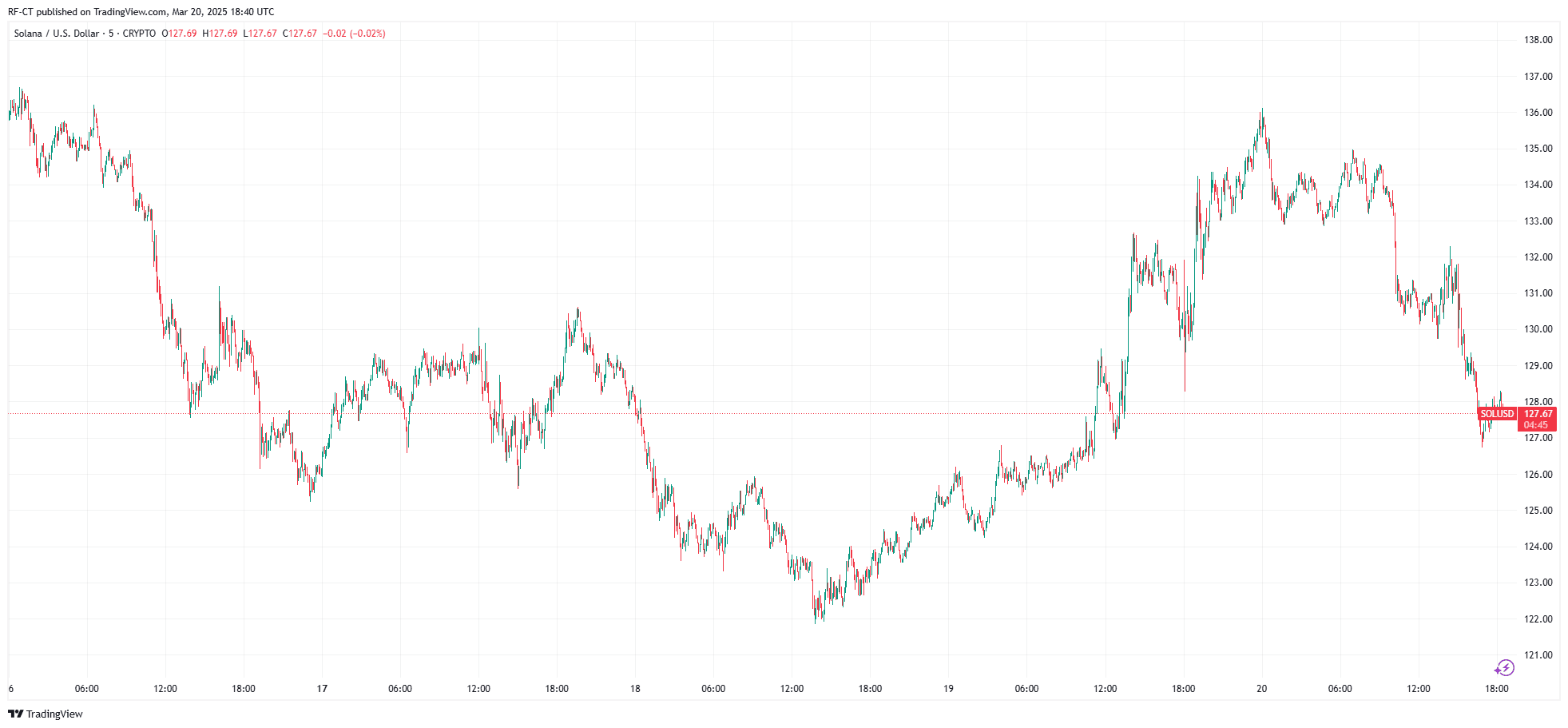

With US Solana Futures ETF Debut, Can SOL Price Reach $500?

Cryptoticker·2025/03/20 20:33

Is Litecoin (LTC) Preparing for a Bullish Rally Like XRP? Fractal Pattern Says Yes

CoinsProbe·2025/03/20 19:44

Is Ethena (ENA) Gearing Up for Reversal? Cup and Handle Pattern Signals an Upside Move

CoinsProbe·2025/03/20 19:44

Bittensor (TAO) Holds Key Support – Can the Double Bottom Pattern Spark a Recovery?

CoinsProbe·2025/03/20 19:44

Crypto: XRP Soars After Victory Against The SEC

Cointribune·2025/03/20 16:22

Flash

- 04:2710x Research: If the price of Bitcoin remains below the range of 90,000-92,000 US dollars, the overall market may still be in a consolidation phase10x Research has stated that despite the dovish stance of the Federal Reserve, the Bitcoin market may still face upward resistance in the short term. The research institution pointed out that as long as Bitcoin prices remain below the resistance range of $90,000-$92,000, the overall market may continue to be in a consolidation phase. The Fed lowered growth expectations and slightly slowed down its balance sheet reduction (QT) pace; Fed Chairman Powell emphasized that recent inflation increases might be temporary. Although this provides short-term support for risk assets, 10x Research believes investors may remain cautious ahead of Trump's tariff announcement on April 2nd and US corporate earnings season starting on April 11th. The report also noted that weakened consumer confidence and a deteriorating real estate market could lead to poor performance during earnings season; market structure indicators are still sluggish, indicating it is difficult for this rebound to gain significant momentum or push Bitcoin back into a broader bull market sentiment.

- 04:25Trump once again calls for the Federal Reserve to cut interest ratesTrump posted, "The price of eggs has dropped significantly more than the prices Biden has caused to rise. The prices of 'groceries' and gasoline have also fallen. Now, if the Federal Reserve can do the right thing and lower interest rates, that would be great."

- 04:17ZKsync: The backward compatibility issue with the Mailbox contract may take 1.5-2 weeks to resolveThe Ethereum Layer 2 network, ZKsync, has issued a notice on platform X that during the protocol upgrade v26, backward compatibility of the Mailbox contract temporarily encountered issues which may affect L1→L2 transactions. This is because these transactions were initially handled by the Mailbox contract. However, due to different transition stages between bridging and L2 during the v26 upgrade period, backward compatibility temporarily does not work. It might take about 1.5-2 weeks to resolve this issue. Therefore it's recommended for users to use "requestL2TransactionDirect requestL2TransactionTwoBridges" on BridgeHub instead of Mailbox and also suggested migrating to BridgeHub in order to avoid future deprecation of the Mailbox contract.