News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitcoin Today Attempts to Surpass $85K While PI Network Recovers After 30% Drop2Canary Capital files for first-ever Pengu ETF amid expanded crypto offerings3Bitcoin-focused Metaplanet appoints Eric Trump to advisory board

Ethereum: Crypto Exchange Supply At Its Lowest Since 2015

Cointribune·2025/03/22 17:22

SEC’s PoW Mining Exemption Sparks Confidence—Are Altcoin ETFs Next?

CryptoNewsFlash·2025/03/22 17:00

RWA TVL Hit a New ATH Above $10B, Amidst UAE Tokenization Revolution

CryptoRo·2025/03/22 16:44

Is Bitcoin going to $65K? Traders explain why they're still bearish

Cointime·2025/03/22 16:12

Cardano (ADA) Faces Potential Decline Amid Death Cross Threat and Shrinking Long-Term Holder Profits

Coinotag·2025/03/22 12:33

Crypto Fear & Greed Index: Market Sentiment Inches Away From Extreme Fear – Should You Be Worried?

BitcoinWorld·2025/03/22 11:33

Trump's top crypto advisor open to budget-neutral gold-to-Bitcoin reserve swap

Cryptobriefing·2025/03/22 07:00

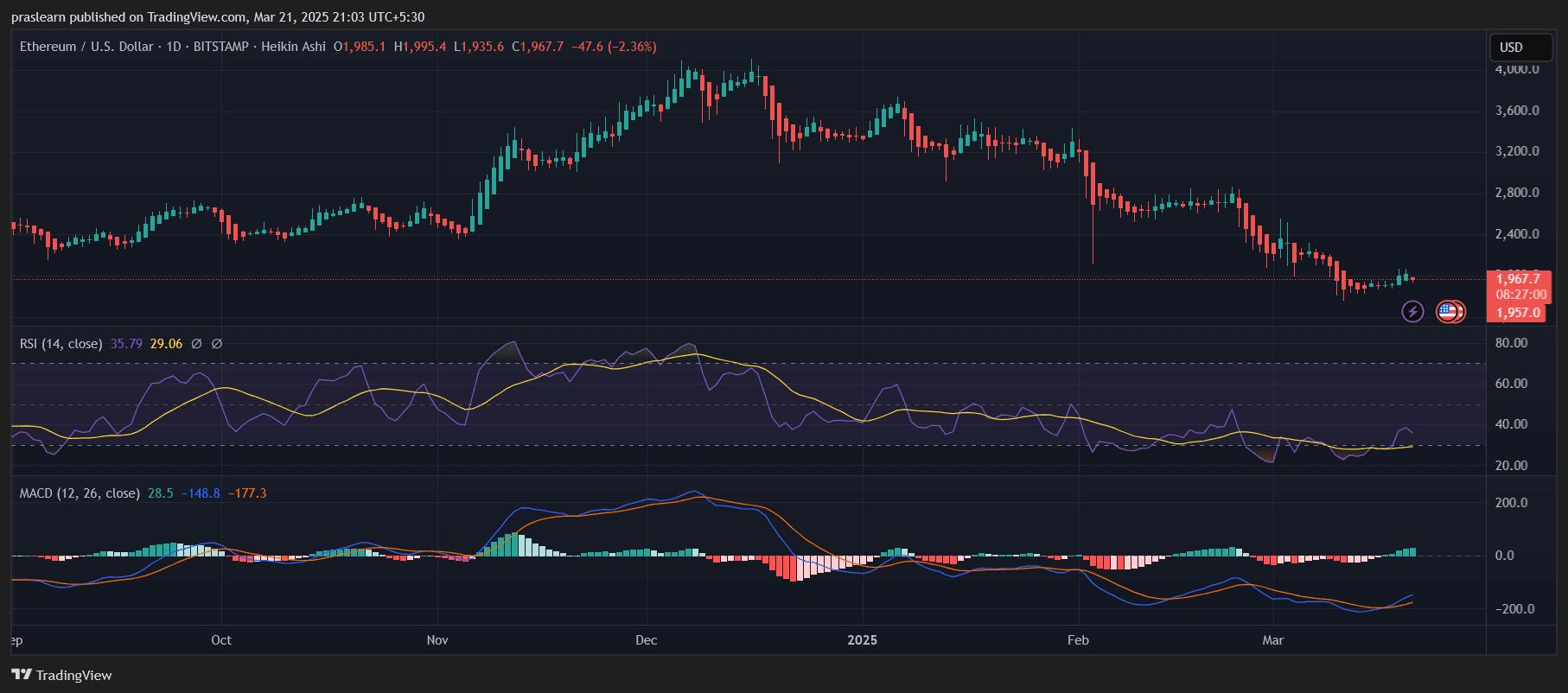

Ethereum Exchange Reserves Drop Below 19M: Key Support and Resistance Levels to Watch

Cryptonewsland·2025/03/22 07:00

Ethereum Price Prediction: Can ETH Reach $7,000?

Cryptoticker·2025/03/22 05:00

APT and FIL Testing Key Support After Major Decline – Will This Pattern Spark a Recovery?

CoinsProbe·2025/03/22 04:22

Flash

- 22:46Data: Hyperliquid's assets have reached 2.281 billion US dollarsOn March 23, according to DefiLlama data, Hyperliquid has currently crossed into assets (the platform supports USDC, USDT) reaching $2.281 billion. In the past 24 hours, the trading volume of this platform's perpetual products reached $3.544 billion.

- 20:59Uniswap's front-end transaction fees have exceeded 176 million US dollarsAccording to data from DefiLlama, as of March 22nd, Uniswap's frontend transaction fees (revenue) reached $176.39 million.

- 20:57The Federal Reserve suffered a loss of $776 billion in operations in 2024, marking the second consecutive year of substantial lossesOn March 21 local time, the audit results of the Federal Reserve's 2024 financial statement showed that the Fed suffered an operating loss of up to $776 billion (approximately RMB 5.6 trillion) in 2024, marking a large deficit for the second consecutive year, with a loss of up to $1145 billion in 2023. Analysts say that the main reason for the Fed's huge losses is its strong support for the economy during the pandemic in 2020 and 2021, as well as its significant interest rate hikes in response to high inflation in 2022 and 2023, raising benchmark interest rates from near zero to between 5.25% and 5.5%. The Fed's income comes from services provided to banks and interest on bonds it holds. According to law, profits must be handed over by Federal Reserve Banks to US Treasury Department. According to research by St Louis Federal Reserve Bank, from years between2011-2021 nearly one trillion dollars was remitted by Federal Reserve Banks towards US Treasury Department . However,Fed officials emphasize that this indicator reflects book losses and will not affect their ability implement monetary policy.