AI Agent Tokens Bleed Amid Sector-Wide Crimson Torrent of Losses

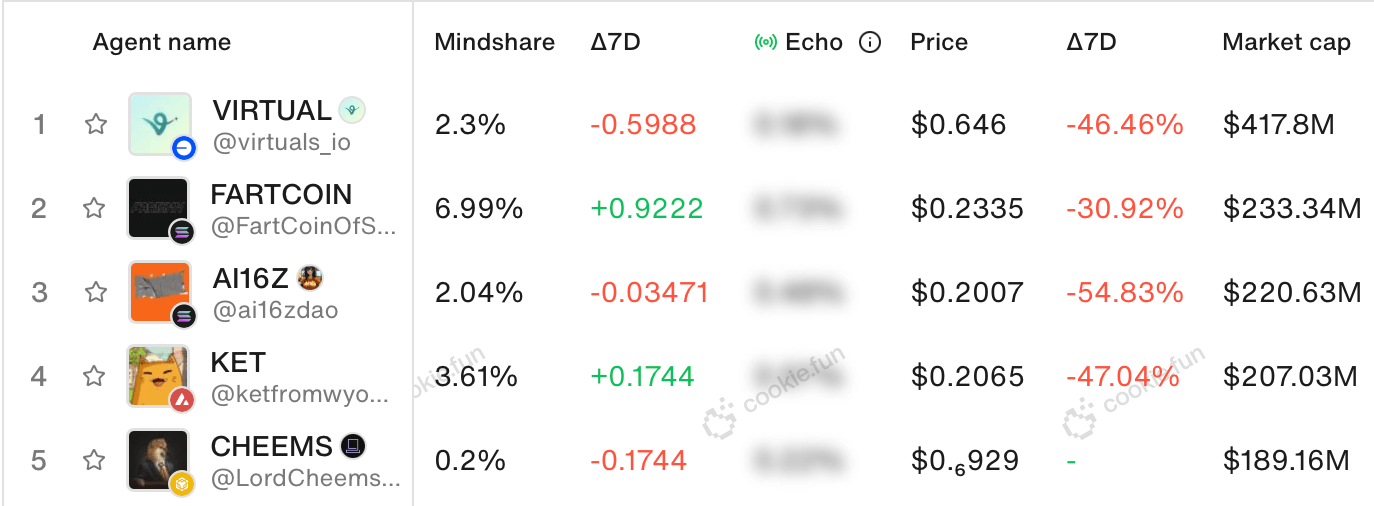

Of the 1,459 agents monitored by cookie.fun, the AI agent token market holds a valuation of $4.19 billion, yet has experienced a 10.4% loss in value within the last 24 hours. The leading virtuals token (VIRTUALS) has plummeted 46.46% over the past week, currently holding a $417.8 million market capitalization.

Top five AI agent tokens by market cap on March 9, 2025.

Trailing closely, fartcoin (FARTCOIN) has deflated by 30.92% during the seven-day span. As of press time at 4:30 p.m. Eastern Time on Sunday, Mar. 9, 2025, FARTCOIN’s total market valuation rests at $233.34 million.

VIRTUALS/USDT 1D chart on March 9, 2025.

Meanwhile, AI16Z—valued at $220.63 million in market capitalization—has experienced a steep 54.83% decline this week. Separately, the AI agent token KET has dropped 47.04% against the U.S. dollar during the same period, concluding Sunday with a $207.03 million market cap. The crypto token CHEEMS defied the downturn, securing a 5.6% uptick amid broader declines.

AI16Z/USDT 1D chart on March 9, 2025.

CHEEMS commands a total market capitalization of $189.16 million. Meanwhile, ACT maintained a $183.26 million valuation this weekend but faced a 12.71% decline over the past week. TOSHI plummeted 30.6% during the same period, concluding with a $150.82 million market cap. TURBO tumbled 43.38%, and the tenth-ranked AI agent token FAI retreated 38.86%.

As of Sunday, TURBO holds a $144.47 million market cap, whereas FAI’s valuation settled at approximately $112.59 million. Within the $4.19 billion sector, $1.78 billion in tokens are allocated to Solana, while Base accounts for $1.41 billion. Cookie.fun data reveals $1.42 billion in tokens circulating on alternative blockchains.

The synchronized decline across AI agent tokens this week reflects heightened volatility in niche and speculative digital asset markets, with sector-wide corrections. While CHEEMS’ resilience highlights selective investor optimism, the pronounced erosion in AI agent token valuations across the board—particularly among Solana- and Base-issued tokens—signals shifting risk appetites.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dow Jones fall as big tech see sell off pressure on Trump’s comments

Share link:In this post: Major stock indices in the US fell on Monday on negative investor sentiment. This followed President Trump’s failure to predict if his tariff policies would lead to a recession. The tech-heavy Nasdaq was weighed by losses in the big techs

Recession risks rise for all 3 North American economies over Trump-US tariff chaos

Share link:In this post: North America’s recession risks rise as Trump’s unpredictable tariff policies create economic uncertainty across the US, Canada, and Mexico. Wall Street tumbles, economists warn of worsening inflation, and the Bank of Canada considers a rate cut amid trade policy chaos. Ontario retaliates with a 25% electricity surcharge on US states, escalating tensions as Trump dismisses economic concerns.

Why XRP Is Poised to Replace the ‘Dying’ SWIFT System

Bitcoin Gold Card in the US? Crypto Insider Floats Proposal