Market highlights

1.

U.S. President Donald Trump promotes $XRP, $SOL, and $ADA on social media, stating that he has instructed a presidential task force to advance a strategic reserve for cryptocurrencies, including $XRP, $SOL, and $ADA. He later mentions that $BTC and $ETH would also become core assets in this strategic reserve. Following the announcement, $XRP's market capitalization briefly surpasses that of Ethereum, and the overall cryptocurrency market capitalization continues its upward trajectory.

2. Elon Musk publicly stated that memecoins are a "greater fool game" and advised participants not to blindly invest heavily. The daily issuance of memecoins on the Solana blockchain drops sharply to 40,000, marking a three-month low, signaling a noticeable cooling of market speculation.

Meanwhile, a forecast from prediction platform Polymarket suggests an 85% chance that Solana spot ETFs will be approved within this year, indicating a potential "de-bubble" and "institutionalization" of its ecosystem.

3. Whale activity of "setting 10 big goals" in the futures market and the operation of on-chain Hyperliquid futures users have attracted attention. The former holds nearly 2000 $BTC in futures positions, triggering large fluctuations, and ultimately closing at $92,600 with a $15.39 million profit. Meanwhile, the latter leverages the momentum from Trump's endorsement, using 50x leverage to target ETH/BTC long positions.

Social media users label these accounts as "front-running" accounts.

Market overview

1. Due to market catalysts, $BTC surges sharply to $95,000, with various altcoins and AI memecoins, including $ALCH and $AVAAIL, seeing significant increases. $PI continues to dominate in trading volume.

2. On Friday, U.S. stocks rise in the late session; the yield on the 2-year U.S. Treasury bond falls below 4%; gold prices decline for the second consecutive day, marking the first weekly drop of the year.

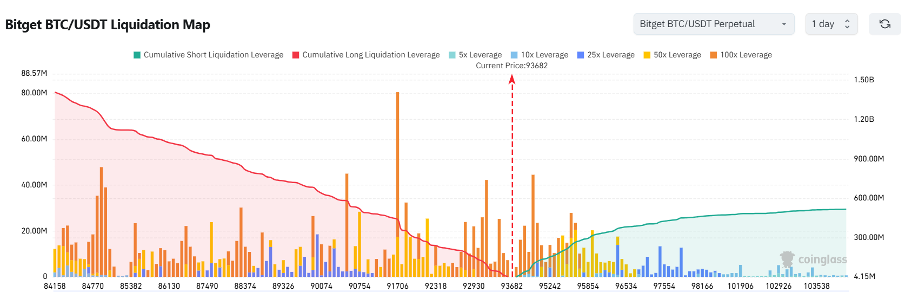

3. Currently standing at 93,791 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 92,791 USDT could trigger

over $188 million in cumulative long-position liquidations. Conversely, a rise to 94,791 USDT could lead to

more than $38 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

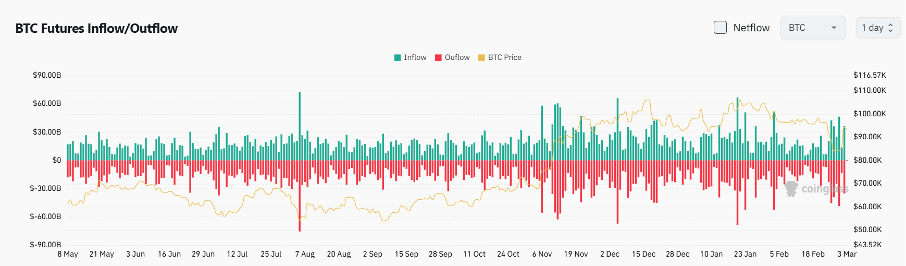

4. Over the past 24 hours, the BTC spot market recorded $36.5 billion in inflows and $35 billion in outflows, resulting in a

net outflow of $1.5 billion.

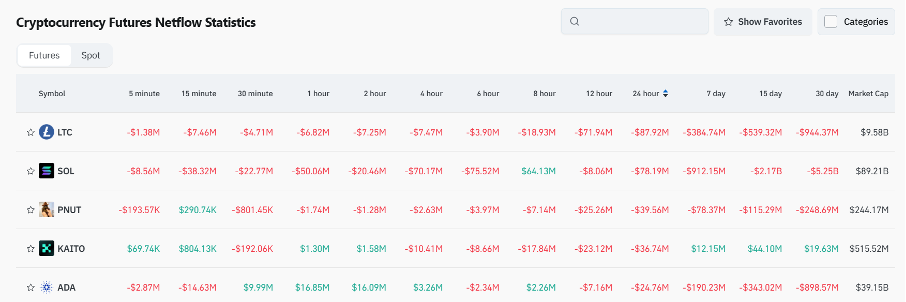

5. Over the last 24 hours, $LTC, $SOL, $PNUT, $KAITO, and $DOGE have led in futures trading

net outflows, signaling potential trading opportunities.

Highlights on X

@CaptainZ: New VC coins and AI agent sector—Opportunities and control strategies from March to May

The core logic for focusing on new VC coins and AI agents from March to May lies in the resonance between "narrative + control". New VC coins (e.g., IP, Kaito, Babylon) are gaining high market expectations and strong token control (reducing airdrops and locking up tokens with institutions). This results in effective market control, creating independent price movements (e.g., recent reversals in IP and Pi). AI agents benefit from mature Web2 technology and the 2025 industry boom expectations, drawing existing projects to pivot. Combined with token concentration after the crash (low-cost accumulation by major players), a positive sentiment shift or key events (e.g., mergers, and technological breakthroughs) could trigger a rebound.

@Alex Xu: Trump's crypto "strategic reserve" list—The political and market manipulation game

Trump's inclusion of SOL, XRP, and ADA in the "strategic reserve" list is essentially political fundraising (e.g., campaign sponsorships or benefits to Mar-a-Lago) in exchange for a symbolic endorsement, aimed at consolidating support within the crypto community and creating short-term market hype. While there is a theoretical possibility of "executive order coin purchases" (e.g., direct sovereign fund purchases), this would need to overcome constitutional limits and fiscal conservatism. Only massive political sponsorships could drive this forward, far exceeding the current lobbying efforts. $ETH is left off the list due to a lack of direct political contributions, while $BTC does not need further backing as both parties already favor it. In the short term, SOL, XRP, and ADA may see price increases due to this news, but they face long-term risks of valuation correction and regulatory backlash after the "political stunt" is debunked.

@CycleStudies: Key support levels for AAVE—Technical bounce and strategy for gradual position building

AAVE has recently touched the key support level from November 2023, where it initially began to rise. The EMA55 line also provides technical support, indicating a potential oversold rebound. However, altcoins are affected by BTC volatility and market liquidity risks, so there's a chance for further declines of 10 – 20%. A gradual buying strategy (starting with small positions and adding more on breakthroughs) and strict stop-loss measures (exit if the price drops below previous lows) are recommended. Investors should wait for a confirmed reversal signal on daily charts before adding more positions.

Phyrex: Trump's policy pushes BTC to $93,000—Key on-chain support zones for short-term defense

Trump's announcement of including BTC, ETH, and SOL in the "U.S. Crypto Strategic Reserve" spurred a BTC price rally to $93,000. Short-term sentiment is supported by expectations for policy details on March 8, but macro risks still center on the Fed's March dot plot (potential risk-off event around March 17). The current price has returned to a key on-chain support zone ($93,000–$98,000), representing the cost base for holdings since November 2023. If no panic selling occurs (indicated by large on-chain transfers and exchange inflows), the price may continue to oscillate within this range. Despite some profit-taking pressure during Asian trading hours, the full impact of the policy hasn't been realized yet, leaving limited downside risk. A light long position could be considered near $93,000 support, with an exit strategy if the price drops below $88,000.

Institutional insights

CryptoQuant CEO: Bitcoin may enter long-term consolidation between $75,000 and $100,000

Greeks.Live: Most traders are watching for $82,000 to hold

as

support on the Bitcoin weekly chart

Glassnode: Bitcoin faces strong resistance between $96,000 and $98,000

News updates

1. Trump instructs the presidential task force to advance the crypto reserve strategy, including $XRP, $SOL, and $ADA.

2. Japan's Finance Minister suggests a possible 110% tax on crypto assets, not limited to crypto alone.

Swiss Central Bank President states Bitcoin is not suitable as a reserve asset.

3. Ukraine plans to set a crypto tax rate between 5% and 10%.

4. Republican members of the U.S. Senate Banking Committee plan to review the stablecoin bill during the week of March 10.

Project updates

1. Pump.fun saw a 38% decrease in revenue month-over-month in February.

2. Metis has launched a new high-performance chain, Hyperion, with a testnet expected by April.

3. Jupiter: Jupiter Mobile will soon receive a major update, and the Trenches migration is scheduled for March.

4. Movement has launched its public mainnet internally.

5. Solana's memecoin issuance fell to a daily volume of 40,000, the lowest level since December 25 of last year.

6. Bio Protocol plans to form a team for BioAgents to accelerate DeSci development using AI.

7. Solana's Co-founder Toly supports the SIMD-0228 proposal.

8. Gitcoin is launching a zkSync community program.

9. Vitalik: Fusaka upgrade implementation is planned for 2025, with testing post-Pectra upgrade.

10. Sci-Hub Founder: Sci-Net will launch soon, offering SCIHUB tokens as incentives for paper uploads.

Recommended reads

Asian crypto stocks surge amid Trump-fueled rally

Cryptocurrency-related stocks in Asia saw significant gains on Monday amid a broader crypto market rally fueled by U.S. President Donald Trump's Sunday social media posts about establishing crypto reserves.

Bitcoin rebounds to over $93,000 with renewed optimism in altcoin markets following Trump’s crypto reserve plan

The crypto market rallied as investors digested news of U.S. President Donald Trump’s plan to establish a crypto reserve. An analyst from Presto Research said market expectations “may remain high” until Friday, given that White House Crypto Czar David Sacks teased “more to come” at the Crypto Summit set to take place on Friday.