Samson Mow Reiterates Bullish Bitcoin Stance Amid Market Volatility and ETF Outflows

- Samson Mow maintains $2M BTC price target despite volatility ($77.9K-$85.9K) and ETF outflows ($275.9M over eight days).

- JAN3’s 12 BTC purchase yielded 15% return ($150K) in one month, reinforcing Mow’s institutional adoption thesis.

Bitcoin (BTC) price volatility persists, with daily swings between $77,900 and $85,900, sparking investor caution. Samson Mow, CEO of Bitcoin-focused firm JAN3, reaffirmed his bullish outlook publicly, stating, “I’m still bullish,” despite recent market turbulence contradicting bullish forecasts.

I’m still bullish.

— Samson Mow (@Excellion) February 28, 2025

Mow attributes Bitcoin’s potential to its scarcity, resistance to inflation, and growing institutional adoption as a reserve asset. He initially projected BTC reaching $1 million per coin but revised this to $2 million, citing accelerated institutional demand. JAN3 recently added 12 BTC to its balance sheet, generating a 15% return ($150,000) within one month.

Bitcoin ETFs reported $275.9 million in net outflows over eight days, signaling reduced institutional participation. This contrasts with Mow’s emphasis on Bitcoin’s long-term viability as a macroeconomic hedge.

While current crypto market challenge short-term sentiment, Mow maintains that Bitcoin’s structural advantages , including fixed supply and decentralized architecture, position it to redefine global finance.

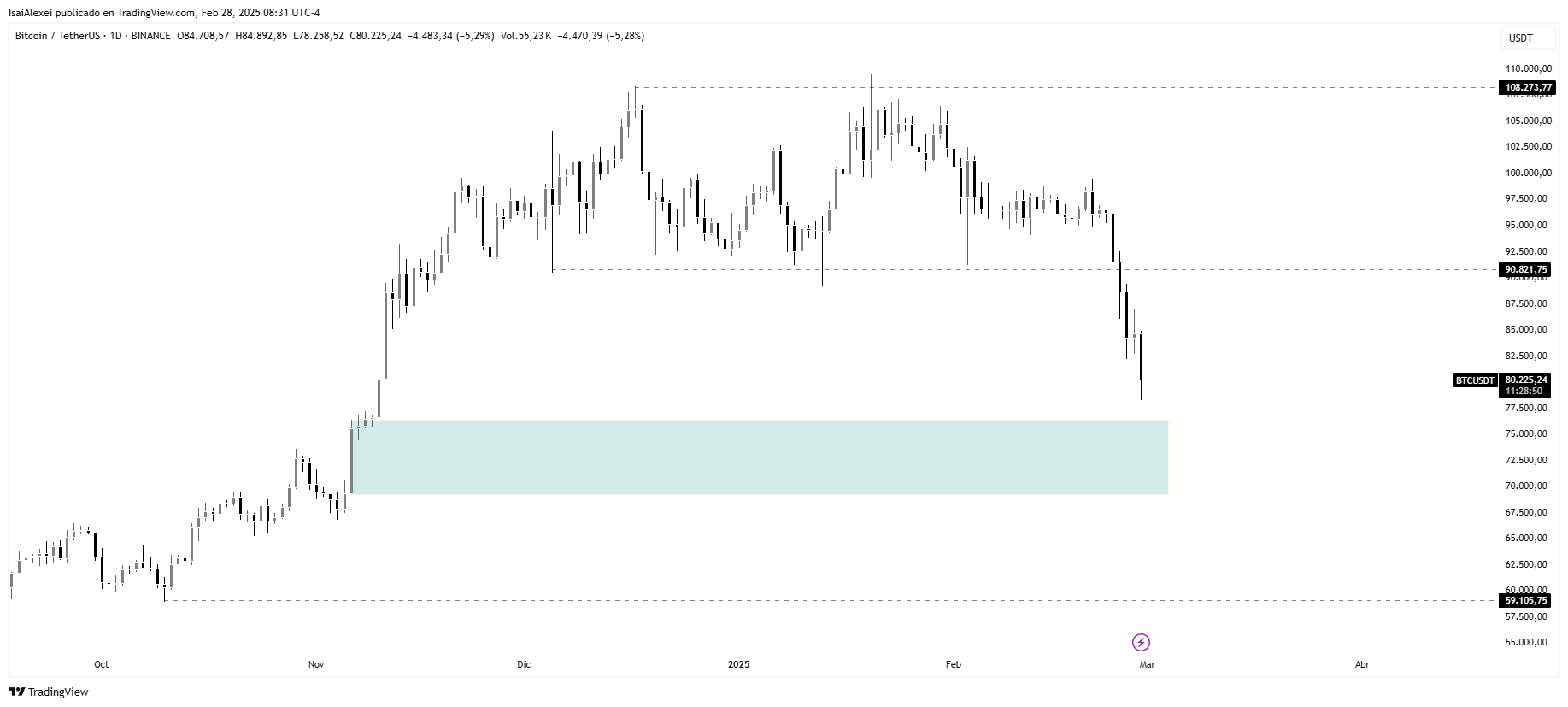

Source: Tradingview

Source: Tradingview

Bitcoin is currently trading at $80,316 USD, reflecting a 0.77% decrease in the last 24 hours. Over the past week, Bitcoin has fallen by 13.64%, and in the last month, it has dropped 18.23%. Despite this recent decline, Bitcoin has increased by 28.48% over the past year.

The price reached a high of $109,356 USD in January 2025, but it has since retraced. The current trading volume in the last 24 hours is $59.31 billion, indicating continued active participation despite the downturn. Bitcoin is facing resistance around $85,000 – $90,000, and it could see further consolidation or potential pullbacks if these levels hold strong.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fantom’s Solid Pattern of Higher Lows: What’s Next for FTM Price?

LINK’s Nearly 5% Daily Jump Sparks Optimism- Will LINK Reach $20 Soon?

Sonic Soars Over 6%—Can a Successful Breakout Send It Toward $1?

Solana’s Path to $3,800—Will It Hold Above $130 This Weekend?