Bitcoin cycle review: 1.6 years of oscillation vs 6 months of rise, March may become the next sprint window

CryptoCon2025/02/12 07:01

By:CryptoCon

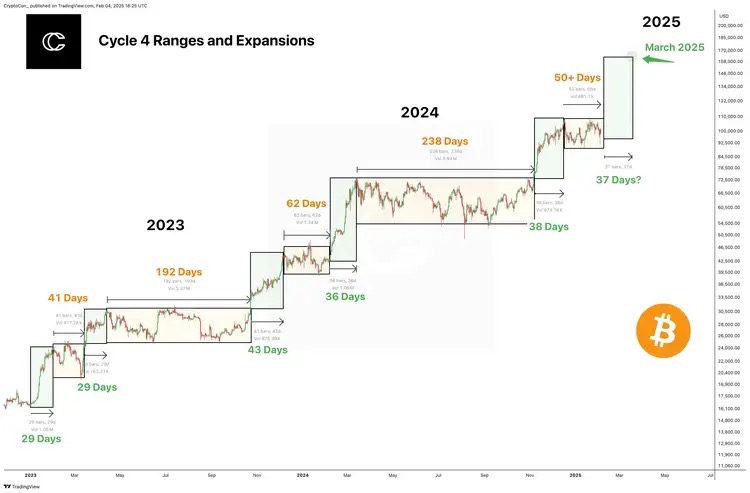

Bitcoin has accumulated 583 days in the current cycle and is in a consolidation phase, accounting for about 19.5 months (1.6 years), while the time that really drives the price up is only 175 days (less than 6 months). From a historical pattern, the market has mostly been in a sideways range, and significant price increases often occur in short-term concentrated outbreak periods.

Reviewing the past few rounds of rising cycles, it can be found that the price of Bitcoin often experiences a rapid rise of 30-60 days after a long period of oscillation. The structure from 2023 to 2024 also verifies this pattern. After each price break through the range oscillation, it will usher in a rapid rise window of 29-62 days.

The key focus of the current market is that March 2025 may become the next important breakthrough window. If historical patterns continue to play a role, the market may enter a new round of price discovery.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Easing inflation could ignite another BTC rally: 10x Research

10x Research’s Markus Thielen sees a “real possibility” of a lower CPI print in the US on Feb. 12, which could defy consensus expectations and trigger a Bitcoin rally.

Cointelegraph•2025/02/12 08:37

TON integrates with interoperability protocol LayerZero

Coinjournal•2025/02/12 07:33

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$96,066.21

-2.00%

Ethereum

ETH

$2,622.41

-2.89%

Tether USDt

USDT

$0.9999

-0.01%

XRP

XRP

$2.41

-2.95%

Solana

SOL

$196.24

-2.94%

BNB

BNB

$651.57

+1.87%

USDC

USDC

$0.9999

-0.00%

Dogecoin

DOGE

$0.2544

-3.84%

Cardano

ADA

$0.7912

-0.32%

TRON

TRX

$0.2426

-1.43%

Bitget pre-market

Buy or sell coins before they are listed, including PLUME, J, and more.

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now