Lunar New Year Drives Bitcoin and Crypto Trading Surge

- Analysts have predicted a positive surge for Bitcoin as the asset has had impressive gains in 11 of the last 12 Lunar New Years.

- The Eastern trading hours are reported to have accounted for almost 50% of the Bitcoin trading volume from the 44% recorded on January 14.

Analysts have tipped Bitcoin (BTC) to stage a massive rebound during the Lunar New Year. According to the current market data, Bitcoin is trading at $102.6k after declining by 0.17% in the last 24 hours. Meanwhile, an analyst believes that this drop is temporal, as we discussed earlier.

The Impact of the Lunar New Year on Bitcoin Price

According to IntoTheBlock’s data, the trading volume of Bitcoin was skewed towards the Western trading hours in the week of January 14. At that time, the Western trading hours accounted for 56% of the 24-hour trading volume, while the Eastern trading hours accounted for almost 44%.

In the week leading to the Lunar New Year, the Western trading hours accounted for 53%, against the almost 47% recorded by the Eastern side. On the final day of the period, the Eastern trading hours had its volume increased to 49.55% while the Western hours trading volume declined to 50.45%. As highlighted in our previous article, Bitcoin surged to surpass $103k on January 28, pending the Lunar New Year. Fascinatingly, this significant trend was confirmed in a report by digital assets service firm Matrixport.

According to that report, January has mostly contributed to the worst gains for Bitcoin in the past decade. Specifically, its average return of negative 1% over the period is only worse than the September returns of negative 3%. Meanwhile, February has contributed an average gains of 14% for Bitcoin, only behind October, which has an average gain of 23%.

More About the Lunar New Year’s Impact on BTC

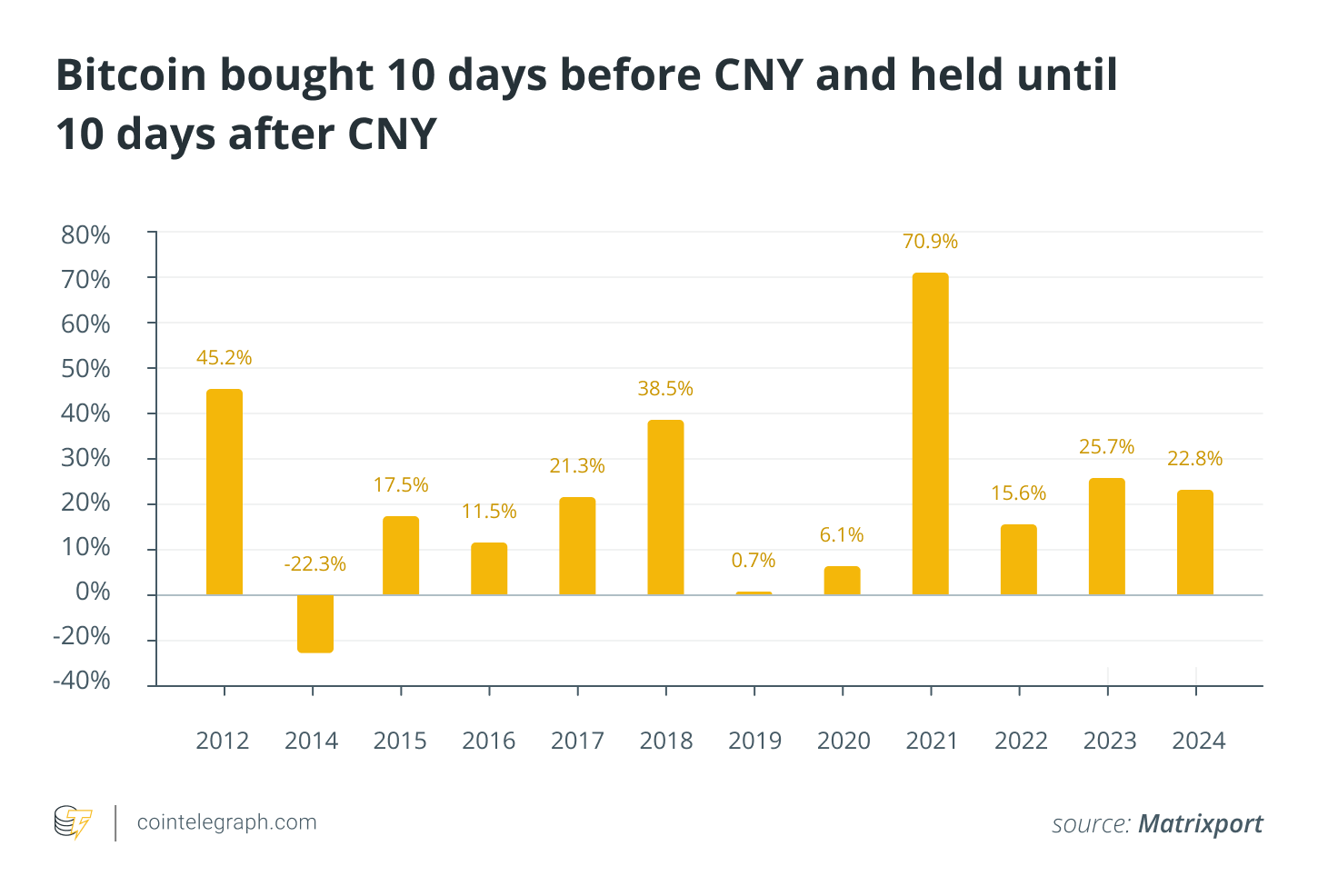

Critically examining the price performance, Matrixport highlighted that the New Year dates vary yearly. However, it mostly falls within late January and early February. Meanwhile, the asset’s performance in the current festive period has been one of the highest, as it made an average of 21% gains in the 10 days leading to the New Year.

Positive returns have been generated in the last 11 of the 12 Lunar New Years. Interestingly, this aligns with experts’ prediction that Bitcoin could hit $122k in February, as detailed in our last news piece.

Bitcoin has delivered positive returns during the Chinese New Year in 11 of the past 12 years, resulting in a statistically impressive 83% success rate for generating gains during this period.

This year has been reported to be a good season for the meme coins led by the TRUMP and MELANIA tokens. However, the Lunar New Year has generated its own version of speculative mania linked to the year of the snake. Solana meme coins called “The Year of Snake,” for instance, reached a market cap of $1.7 million before taking a nosedive. An Ethereum-based asset called “Chinese New Year” has also recorded an impressive surge of 119,194% to hit $7 million in market cap.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MIND of Pepe’s $4.5M Presale – Will It Spark a Price Rebound for AI Agents Tokens?

Indiana Moves to Allow Bitcoin in Pension Funds as States Eye Crypto Reserves

Grayscale Expands Crypto Offerings with Bitcoin Miners ETF

Bitcoin Holds Strong Above $100K While Altcoins Struggle – What’s Next?