Ripple Execs Blast SEC Over Refusal To Postpone Appeal: ‘Waste of Time and Taxpayer Dollars’

- The Ripple Vs. SEC case remains ongoing despite rulings establishing that XRP retail sales did not constitute a security offering.

- The SEC’s new Chairman may drop enforcement actions initiated against crypto under Gary Gensler.

- Spot XRP ETF applications are pending responses from the SEC, with initial decisions expected by the end of January 2025.

The U.S. Securities and Exchange Commission (SEC) continues to play hardball under Gary Gensler as the regulator refuses to postpone the filing of its appeal against Ripple’s ( XRP ) landmark courtroom victory.

Ripple heavy hitters, CEO Brad Garlinghouse and Chief Legal Officer (CLO) Stuart Alderoty have called out the agency’s decision.

-

Crypto Ripple CEO Basks in Trump’s 2025 Crypto Boom, Plans US Expansion

-

Crypto SOL, XRP, LTC ETF Approvals Loom Under Donald Trump Presidency? Potential Timelines Explained

-

Crypto Gary Gensler’s Top 5 Crypto Crackdowns as SEC Chair: A Legacy of Legal Battles

Ripple Vs. SEC

As per an X post from Alderoty, the SEC has declined to postpone its appeal filing against a recent judgment in favor of Ripple.

Ripple’s legal team had previously requested the SEC postpone its principal brief filing, which has a deadline of Jan. 15.

The civil case against Ripple, initially filed in December 2020, accused the firm of violating securities laws by selling XRP tokens.

In 2023, a judge ruled that XRP sales to retail investors did not constitute a securities offering but found institutional sales did.

This appears to be a final shot from outgoing SEC Chairman Gary Gensler, who has spent four years battling Ripple over whether or not the XRP token qualifies as a security.

Now, a pro-crypto government is set to take over Washington, including the SEC, which bodes well for the pending spot XRP exchange-traded fund (ETF) applications piling up on the SEC’s desk.

Furthermore, it’s unclear if the SEC will continue its case against Ripple or the dozen other enforcement cases against crypto when it comes under new management, though several u-turns are anticipated.

Gensler on Bitcoin

Speaking with CNBC’s “Squawk Box” on Jan. 14 , Gensler reiterated his stance that crypto is “a highly speculative field” that has struggled to comply with numerous laws and regulations:

“[…] whether it’s any money laundering laws, sanctions laws, or in our case, securities laws. Now, Bitcoin’s not a security, but these 10,000 or 15,000 other tokens, the investing public has been hurt over the many years.”

He once again explained that he believes crypto markets operate mostly on sentiment, not fundamentals.

Fascinatingly on the subject of Bitcoin’s future as a store of value, he noted that “we at the SEC have never said it’s a security,” and then he espoused perhaps his most bullish comments on Bitcoin, stating:

“I think that Bitcoin is a highly speculative, volatile asset. But with 7 billion people around the globe, 7 billion people want to trade it just like we do have gold for 10,000 years. We have Bitcoin. It might be something else in the future as well.”

But when pressed on whether he owns or loves BTC, he is adamant he doesn’t and has “never owned it.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

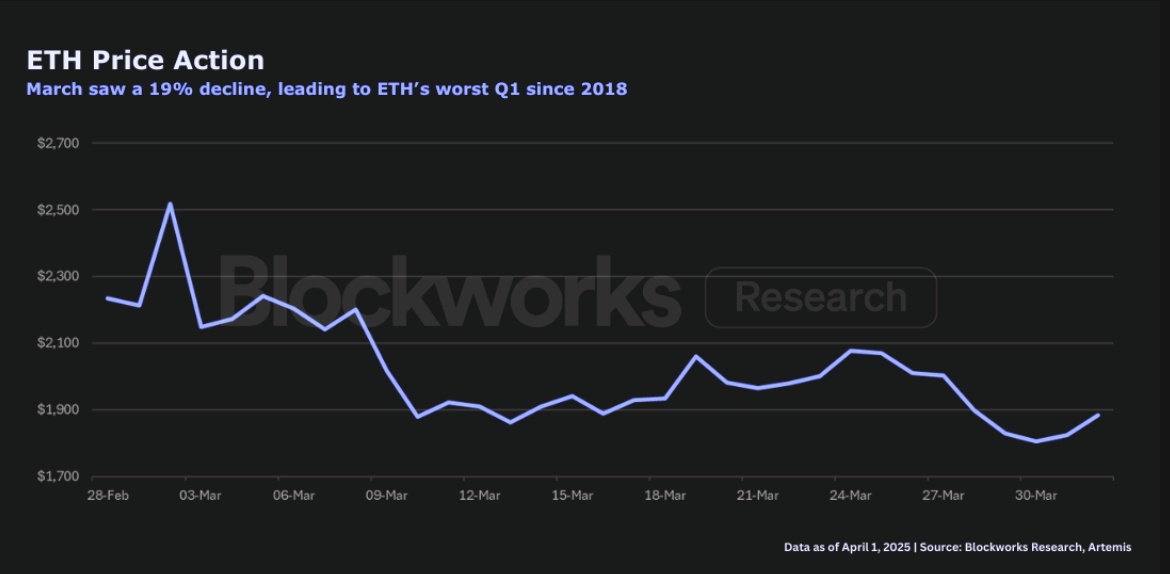

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far