JPMorgan says EU's MiCA regulation could boost euro stablecoins

Quick Take The EU’s MiCA regulation, now in effect, could increase the adoption of euro-pegged stablecoins, according to JPMorgan analysts. MiCA may set the stage for the U.S. to introduce its own crypto regulations, the analysts said.

摩根大通分析师表示,欧盟具有里程碑意义的加密资产市场 (MiCA) 法规将于 2024 年 12 月 30 日生效,这可能会提升与欧元挂钩的稳定币的市场份额。

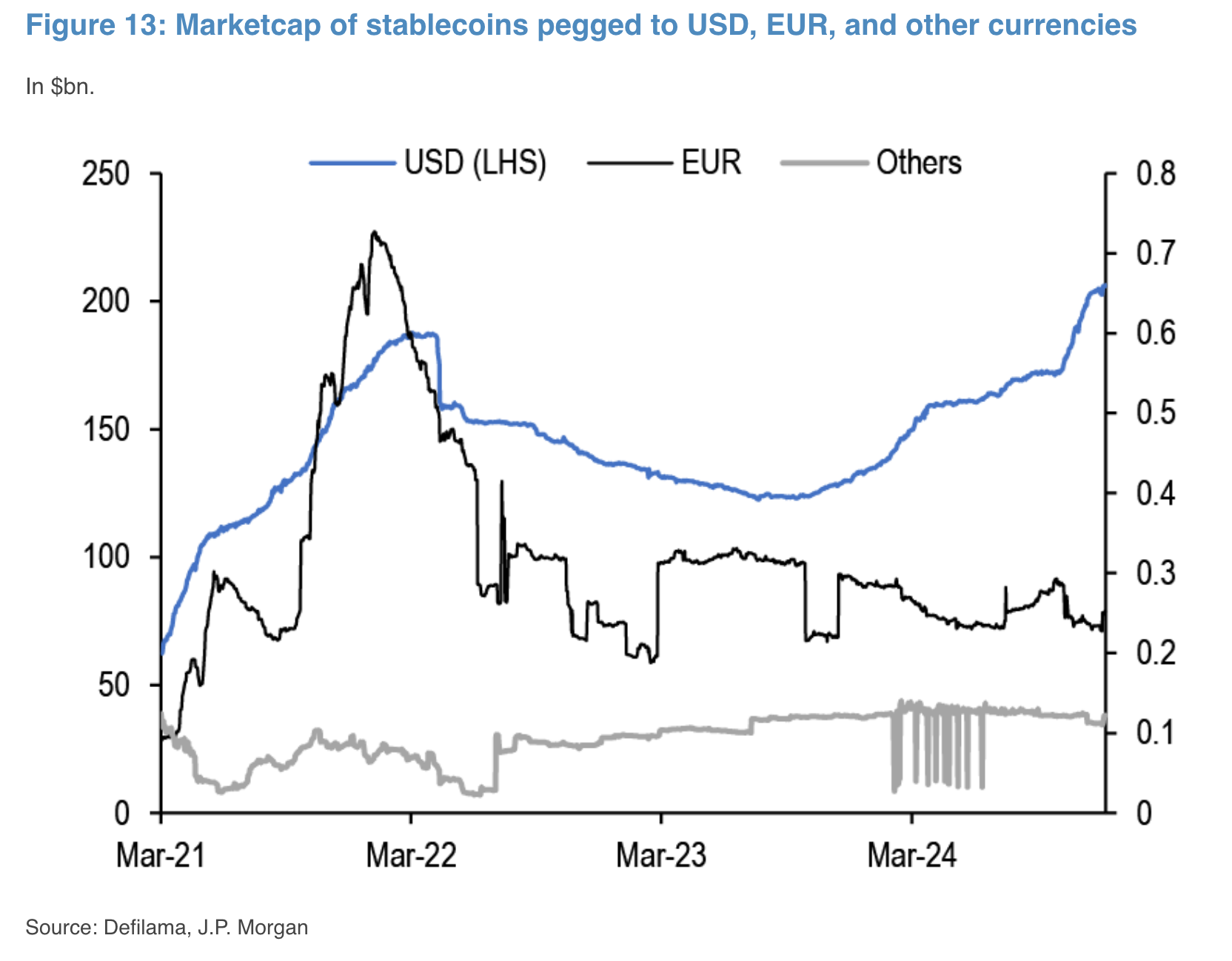

摩根大通分析师(以尼古拉斯·帕尼吉尔佐格鲁为首)在周三的一份报告中表示,目前,与欧元挂钩的稳定币仅占据稳定币市场份额的 0.12%,但 MiCA 可以通过鼓励欧洲银行和金融机构采用欧元稳定币来满足客户需求和基于区块链的金融结算,从而改善这一状况。

分析师表示,值得注意的例子包括法国兴业银行的 EURCV 稳定币和 BBVA 计划与 Visa 合作推出的稳定币。

根据 MiCA,只有合规的稳定币才能在受监管的市场中使用,这迫使 Tether 等发行商要么适应,要么退出。例如,Tether 已停止其 EURT 稳定币,USDT 也从欧盟运营的交易所退市。分析师表示,尽管面临这些挑战,但 Tether 仍在全球占据主导地位,这得益于亚洲等监管限制较少的地区的需求。他们还指出,Tether 对 Quantoz Payments 等符合 MiCA 要求的公司进行了战略投资,表明其打算保持在欧洲的间接存在。

分析师表示,总体而言,尽管 MiCA 引入了更高的合规成本,但其对加密货币市场的长期影响可能是积极的,吸引机构投资者并鼓励采用与欧元挂钩的稳定币。他们补充说,随着欧盟迈出这一监管步伐,美国可能会效仿,在即将上任的唐纳德·特朗普政府领导下制定自己的加密货币立法。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CleanSpark reports $162.3 million in quarterly revenue: 'Why buy bitcoin at current prices when we can mine it for $34,000?'

CleanSpark generated revenue of $162.3 million in the fourth quarter of 2024, up 120% year-over-year.The Bitcoin miner reported net income of $246.8 million and adjusted EBITDA of $321.6 million for Q4 — also up significantly from the same period in 2023.

Bitcoin price seasonality data calls for $120K in Q1, but leverage remains BTC’s ‘biggest risk’

Bitcoin’s historical price data favors new all-time highs in Q1, but liquidity gaps below $80,000 could pull the price lower in the short term.

Utah Advances Digital Asset Reserve Plan as Bill Moves to Senate

Utah’s HB 230 moves forward, paving the way for digital asset investment. While some see it as a step toward a Bitcoin reserve, critics argue it favors stablecoins. The Senate will decide its final direction.

Cardano May Be Set for a Parabolic Rally, Is It Time to Buy?