How does Cowswap drive token value growth with diversified liquidity integration and MEV protection?

远山洞见2024/11/07 07:05

By:远山洞见

I. Project introduction

Cowswap is a decentralized trading platform that uses a unique "batch auction" mechanism for price discovery and combines "demand overlap" to achieve direct peer-to-peer matching transactions. This is different from traditional automatic market makers. Cowswap does not execute transactions in real time, but aggregates orders off-chain and determines a unified settlement price through batch processing, providing users with a better trading experience.

The platform pays special attention to the issue of unfair transactions caused by miners being able to extract value. Cowswap is based on the second version of the Gnosis protocol, developed by the Gnosis team. It aims to fundamentally avoid preemptive and sandwich attacks caused by MEV through off-chain aggregation and unified on-chain settlement, providing users with a fairer trading environment.

In addition, Cowswap not only achieves higher liquidity utilization efficiency through the CoW liquidity sharing mechanism, but also integrates liquidity sources from mainstream decentralized exchanges such as Uniswap. In the future, it will further expand to more DEXs. Users only need to sign off-chain once to complete the transaction, and only need to pay fees when the transaction is successful, making the transaction more convenient.

II. Project highlights

1. Batch processing and cost reduction: Cowswap uses a batch auction model to aggregate and process multiple orders to complete transactions at a unified settlement price. This not only reduces the gas fee for each transaction, but also improves the overall processing efficiency, allowing users to enjoy a lower-cost trading experience.

2. Protecting against MEV attacks: The mechanism of Cowswap effectively prevents preemptive and sandwich attacks caused by miner extractable value (MEV). Through off-chain aggregation and unified on-chain settlement, all orders are executed at the same price, making transactions fairer and protecting user interests.

3. Intelligent and flexible matching: Users can easily submit transaction intentions, and Cowswap's "searcher" automatically finds the best transaction path and matches it, without the need for users to manually select. Orders that cannot be directly matched will be executed through external liquidity to ensure that each transaction is completed at the best price.

4. Diversified liquidity support: Cowswap integrates the liquidity of mainstream DEXs such as Uniswap, and will expand to more platforms in the future. This diversified liquidity source ensures smooth transactions and better pricing experience. Users only need to sign off-chain once, and unsuccessful orders are not charged, making transactions more convenient and stress-free.

III. Market value expectations

Cowswap ($COW) is a decentralized trading protocol that focuses on preventing MEV attacks through a unique batch auction mechanism. Based on the current circulation of 264 million $COW tokens and a unit price of 0.5587 dollars, the circulation market value of $COW is $150,486,524.

To estimate the unit price of the $COW token when it is consistent with the market value of similar trading protocol projects, the token can be calculated as follows

Benchmark project type and market value expectations

Jito ($JTO) - Solana's MEV infrastructure

Token price: 2.27 dollars

Market capitalization: $292,415,717.477

If the circulating market value of $COW is the same as $JTO, the token unit price is about 1.11 dollars

Increase: + 98.6% of current price

Raydium ($RAY) - On-Chain Order Book AMM

Token price: 4.63 dollars

Market capitalization: $1,222,334,266.384

If the circulating market value of $COW is the same as $RAY, the token unit price is about 4.63 dollars

Increase: + 728.9% of current price

Uniswap ($UNI) - Decentralized Trading Protocol

Unit price: 8.94 dollars

Market capitalization: $5,358,521,603.103

If the circulating market value of $COW is the same as $UNI, the token unit price is about 20.28 dollars

Increase: + 3531.6% of current price

IV. Token Economics

The native token of CoW Protocol is COW, and its token economics design aims to promote the governance, incentives, and value capture of the protocol.

Total supply: 1 billion COW tokens.

Allocation ratio

Communities and ecosystems: 40%

Teams and consultants: 25%

Investors: 20%

Reserve: 15%

Token usage

Governance: COW token holders can participate in the governance of CoW DAO, vote on key parameters and development direction of the protocol, and ensure the common interests of the community.

Incentive Mechanism: COW tokens are used to reward solvers who provide the best trading path in the protocol, encouraging them to continuously optimize trading execution and improve User Experience.

CoW Protocol plans to introduce a protocol fee mechanism. Part of the revenue will be used to repurchase and destroy COW tokens, reducing market supply and potentially increasing token value.

V. Team and financing

Team: Cowswap is led by Anna George (co-founder and CEO) and Olga Fetisova (data leader). The team has a deep technical background and industry experience, dedicated to building a secure and fair decentralized trading platform.

Financing: Cowswap completed a $23 million private placement financing on March 30, 2022, with investors including 0x, 1kx, Blockchain Capital, Ethereal Ventures, Robot Ventures, SevenX Ventures, Delphi Digital and other well-known institutions. In addition, it also attracted several Subject-Matter Experts and senior investors to participate.

VI. Risk Warning

1. Market volatility. The cryptocurrency market price fluctuates greatly, and the token value of Cowswap is no exception. When the market is good, the increase may be very attractive, but the loss when it falls may also be very fast. Before investing, you should evaluate your risk tolerance and not have the mentality of "only rising and not falling"

2. Liquidity issues. Although Cowswap integrates multiple sources of liquidity, when market conditions are poor, liquidity may also be insufficient, which will affect the smooth progress of transactions and price stability. During peak trading hours, there may be slow transactions or increased slippage.

3. Competitive pressure. Cowswap faces fierce competition from other decentralized trading platforms, such as Uniswap, Sushiswap, and other projects that are constantly launching new features. This competition may affect Cowswap's user growth and market share, and may even affect the long-term value of the token.

VII. Official link

Website :https://cow.fi/

Twitter:https://x.com/CoWSwap

Discord:https://discord.com/invite/cowprotocol

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Coinotag•2025/04/04 09:55

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

Coinotag•2025/04/04 09:55

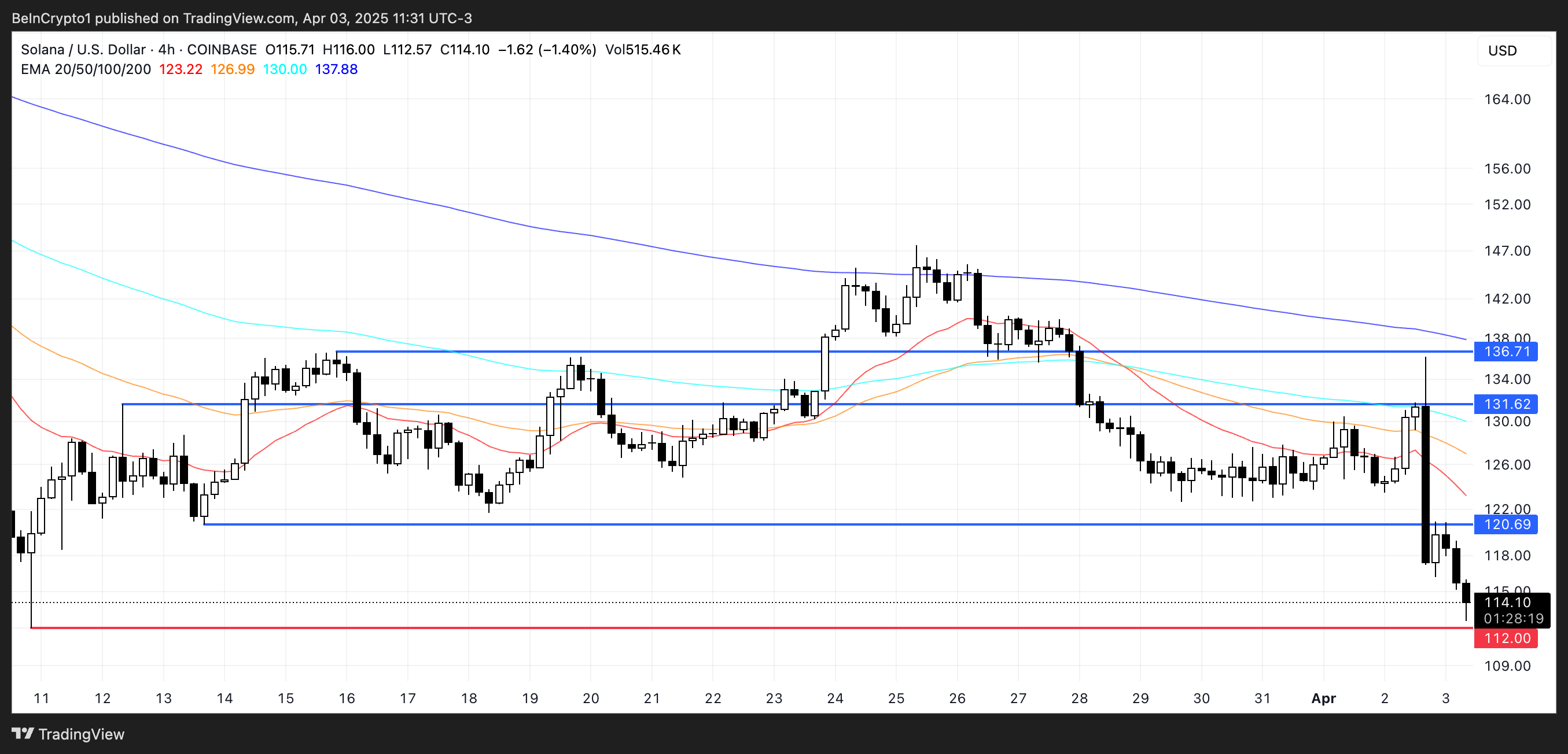

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

Coinotag•2025/04/04 09:55

XRP’s Retail Interest Surges Amidst Caution Over Potential Volatility Compared to Bitcoin

Coinotag•2025/04/04 09:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$83,102.81

+1.51%

Ethereum

ETH

$1,788.42

+0.70%

Tether USDt

USDT

$0.9996

-0.02%

XRP

XRP

$2.11

+5.34%

BNB

BNB

$592.81

+0.91%

Solana

SOL

$119.14

+4.46%

USDC

USDC

$1

-0.01%

Dogecoin

DOGE

$0.1679

+6.11%

Cardano

ADA

$0.6518

+3.66%

TRON

TRX

$0.2399

+2.40%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now