ALIENX launches 25% token destruction plan: comprehensive analysis of project highlights and future price expectations

远山洞见2024/10/28 09:41

By:远山洞见

I. Project introduction

ALIENX is a high-performance staking public chain driven by AI nodes, aiming to promote the widespread adoption of NFTs and games. Launched by a strategic partnership between AlienSwap, Offchain Labs, and Caldera, ALIENX is built on Arbitrum Orbit technology and supports various assets such as BTC, ETH, ARB, SOL, and NFTs. As an EVM-compatible blockchain platform, ALIENX utilizes its 50,000 AI nodes worldwide to provide intelligent support for cyber security, data processing, and reward distribution.

By combining AI technology with the decentralized nature of blockchain, ALIENX provides users with multiple staking and profit opportunities, including native staking rewards that support multiple assets and automatic distribution of network rewards. The platform developer has previously received investments from top institutions such as OKX Ventures, C ² Ventures, and Next Leader Capital, with a total financing of $17 million and a latest valuation of $200 million. ALIENX is committed to building an active ecosystem and incentivizing customer engagement through airdrops, gas fee revenue sharing, and other means.

On October 25th, ALIENX announced a large-scale token destruction plan, AIX BURN MOON, which will destroy up to 250 million AIX tokens in the next 30 days, accounting for 25% of the total supply. According to ALIENX's announcement, the destruction plan includes two main parts: 200 million AIX tokens will be destroyed from the team share, accounting for 100% of the team share, equivalent to 20% of the total supply. 50 million AIX tokens will be destroyed from the community ecosystem, accounting for 5% of the total supply. The AIX BURN MOON mechanism will be launched on October 25th, 2024, lasting for 30 days until November 24th.

II. Project highlights

1. High-performance public chain driven by AI nodes

ALIENX is supported by 50,000 AI nodes worldwide, which not only ensure the security of the network, but also automate network observation and reward allocation through AI Technology Implementation. Each node is a super node run by AI agents, providing intelligent support for the entire ecosystem and is the core of high-performance operation of ALIENX.

2. Multi-asset pledge and reward

ALIENX allows users to stake various assets such as BTC, ETH, ARB, SOL, and NFT to obtain rewards, meeting diverse user requests. The platform provides native staking rewards for stakers, allowing users to achieve profits while supporting the ecosystem.

3. Large-scale user airdrop incentives

In order to promote Network Effect and establish long-term user vitality, ALIENX has reserved no less than 60% of airdrop rewards specifically for motivating network users and ecosystem builders. This large-scale Incentive Mechanism aims to quickly expand the client base and stimulate active user participation in the platform.

4. Gas fee revenue sharing

Unlike traditional Layer 2 projects, ALIENX will activate the Gas fee revenue sharing function 180 days after the mainnet goes live, distributing revenue to AI node operators, dapp developers, and ecosystem users to ensure that every ecosystem participant can share the platform's growth dividends.

5. Top investment institutions and partner support

ALIENX is supported by well-known institutions such as OKX Ventures, C ² Ventures, and Next Leader Capital, and has strong market influence and financial support in cooperation with strategic partners such as AlienSwap, Offchain Labs, and Caldera.

II. Market value expectations

ALIENX ($AIX) is a staking public chain that combines AI node technology with high-performance blockchain. With its innovative multi-asset staking and yield Incentive Mechanism, it has attracted many users and investors. Based on the current initial circulation of $AIX tokens 125 million and a unit price of $0.0265 dollars, the circulating market value of ALIENX is $3,321,148.

To estimate the market value of the $AIX token, which is consistent with similar decentralized AI and computing network projects, the unit price of the token can be calculated as follows:

Benchmark project type and market value expectations :

AgentLayer ($AGENT) - Decentralized AI Proxy Public Chain

Token unit price : 0.01946 dollars

Market capitalization : $3,173,137.363

If the circulating market cap of $AIX is the same as $AGENT, the token unit price is : about 0.0254 dollars

AgentLayer is a decentralized AI proxy network that performs complex tasks through agents to drive intelligent applications.

io.net

($IO) - Decentralized Computing Network

Token unit price : 1.76 dollars

Market capitalization : $211,378,773.234

If the circulating market cap of $AIX is the same as $IO, the token unit price is : about 1.69 dollars

io.net It is a decentralized computing resource network designed to provide efficient and distributed computing power for decentralized applications.

IV. Token Economics

Total published: 1,000,000,000

Initial circulation: 125,000,000 (12.5%)

Round A (10%): TGE 0.00%, Cliff 3, 36-month linear release

Strategy Round (2.50%): TGE 0.00%, Cliff 3, 36-month linear release

Community (0.50%): TGE 15.00%, Cliff 3, 36-month linear release

X-Nodes (40.00%): TGE 10.00%, Cliff 6, 36-month linear release

Ecology (7.00%): TGE 91.78%, Cliff 6, 36-month linear release

Stake (20.00%): TGE 10%, Cliff 6, 36-month linear release

Team (20.00%): TGE 0.00%, Cliff 3, 36-month linear release

V. Team and financing

Team members

ALIENX is led by founder

Ying Mu . The core members of the team have rich experience in blockchain and internet product development, and are committed to applying AI node-driven high-performance public chains to the NFT and gaming fields, promoting their large-scale adoption.

Investors

ALIENX has received support from top investment institutions including

OKX Ventures ,

C ² Ventures and

NEXT Leader Capital . The funds and resources invested by these well-known institutions provide a solid foundation for the continuous development of the project.

Developers

AlienSwap , as the main developer of ALIENX, is committed to Technology Implementation and ecosystem construction, helping projects build a powerful EVM-compatible chain on Arbitrum Orbit, and introducing innovative staking and Incentive Mechanisms.

VI. Risk Warning

1. According to the token distribution model, the unlocking cycle of ALIENX tokens is relatively long, especially the unlocking of X-Nodes, teams, and staking will be gradually released in the next three years. This long-term linear release model can relieve the pressure of one-time selling, but as the unlocking ratio gradually increases, it may still have a negative impact on the market, causing fluctuations in the price of ALIENX tokens.

2. ALIENX incentivizes customer engagement through airdrops and gas fee revenue sharing, but the sustainability of this incentive model depends on the long-term healthy development of the platform. If users mainly participate for short-term incentives without actual usage needs and ecological contributions, there may be a large number of User Churns after the incentive ends. At the same time, excessive reliance on incentive measures may lead to low user loyalty to the platform, making it difficult for the ecosystem to form a stable user base, which in turn poses a threat to the long-term growth of the platform.

3. ALIENX promises to open the Gas fee revenue sharing function 180 days after the mainnet goes live, and the revenue will be distributed to AI node operators, dApp developers, and ecosystem users. However, this revenue distribution mechanism depends on the stable growth of platform transaction volume. If the actual usage is lower than expected, the Gas fee revenue may not cover the operating costs and user incentives, and the actual effect of revenue sharing will be greatly discounted, which may even cause participants to question the economic return of the project, thus affecting the attractiveness of the platform.

VII. Official links

Website :

https://alienxchain.io/home

Twitter:

https://x.com/ALIENXchain

Telegram :

https://t.me/alienswap_official

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Coinotag•2025/04/04 09:55

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

Coinotag•2025/04/04 09:55

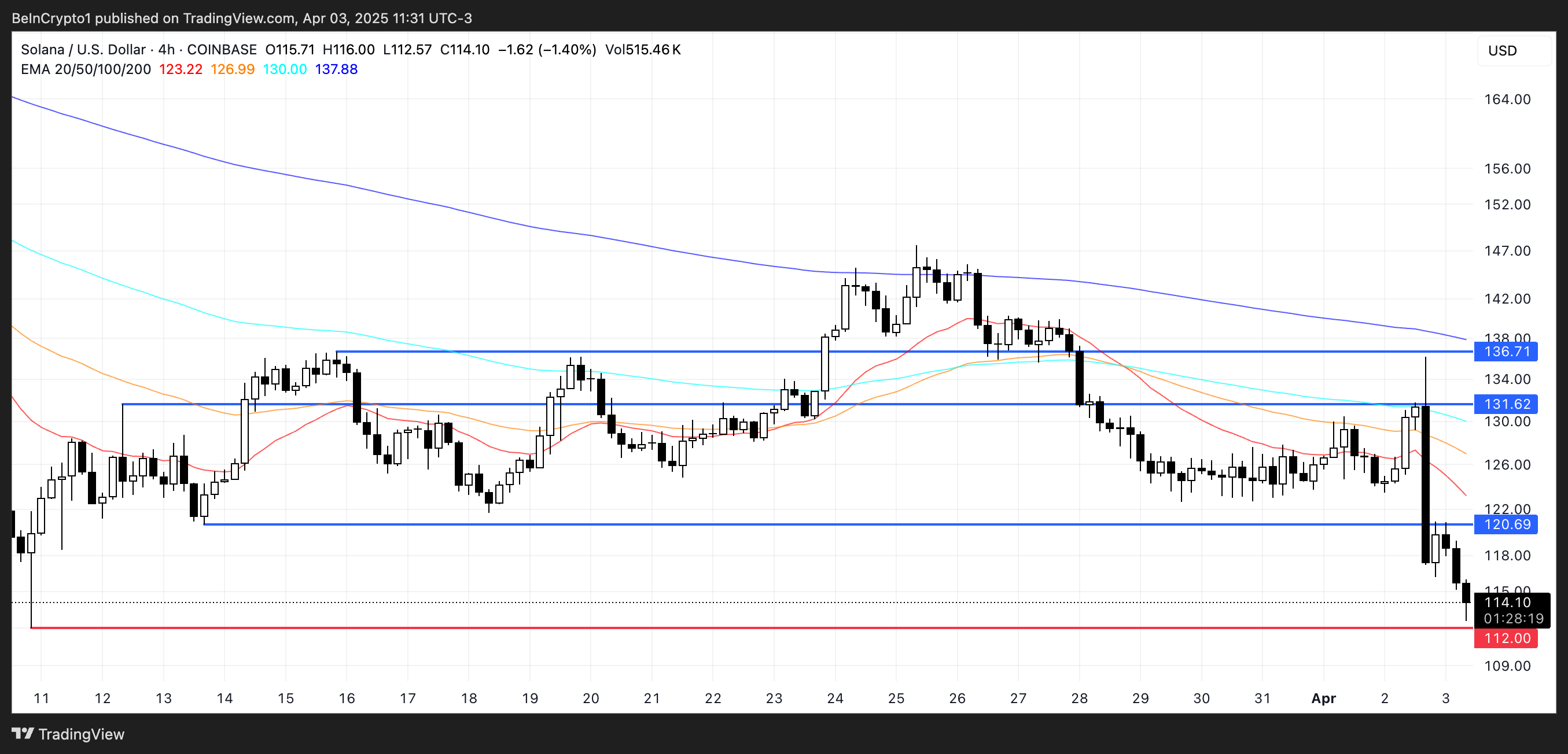

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

Coinotag•2025/04/04 09:55

XRP’s Retail Interest Surges Amidst Caution Over Potential Volatility Compared to Bitcoin

Coinotag•2025/04/04 09:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$82,913.7

+1.25%

Ethereum

ETH

$1,793.9

+0.92%

Tether USDt

USDT

$0.9995

-0.02%

XRP

XRP

$2.13

+6.57%

BNB

BNB

$592.87

+1.22%

Solana

SOL

$118.5

+3.74%

USDC

USDC

$1.0000

-0.00%

Dogecoin

DOGE

$0.1681

+6.21%

Cardano

ADA

$0.6583

+4.87%

TRON

TRX

$0.2397

+2.58%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now