Detailed explanation of Pectra upgrade: How it affects Ethereum value and stakeholders

Original article from Galaxy Research

Compiled by Odaily Planet Daily Golem ( @web3_golem )

Editor’s Note: Ethereum’s Pectra upgrade is expected to be activated on the mainnet in early 2025. In a report released yesterday, Galaxy Research detailed the content and development progress of the Pectra upgrade, as well as the expected impact on Ethereum prices and its stakeholders. It also introduced the Fusaka upgrade related to the Pectra upgrade and other protocol developments that are expected to have an impact on Ethereum’s value, such as historical expiration, proposer-builder separation (ePBS), and verkle tree migration.

Because the original text is too long and contains too many expanded points, Odaily Planet Daily has condensed the report, focusing on the 10 EIPs included in the Pectra upgrade, explaining the role of the Pectra upgrade in fixing network defects, improving UX, and increasing DA capacity, while analyzing the impact of these upgrades on ETH prices and stakeholders.

Pectra Upgrade Overview

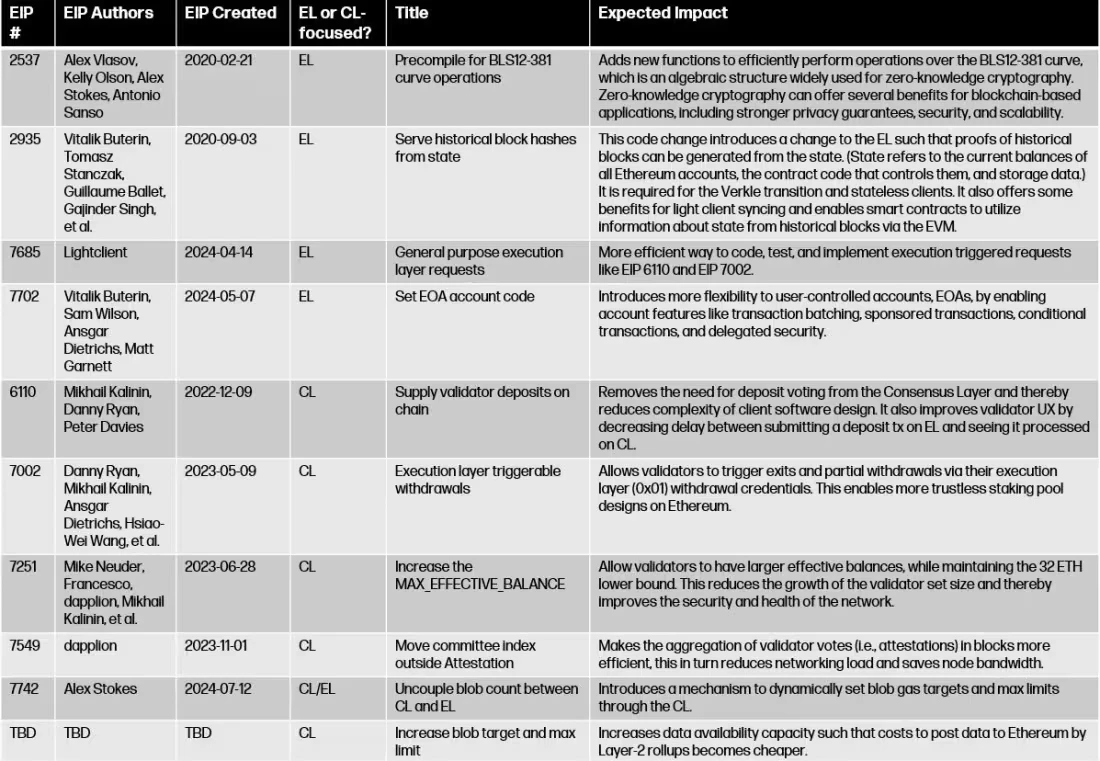

As of October 2024 , developers have agreed to expand the scope of the Pectra upgrade to include one additional code change, EIP 7742. Including this code change in Pectra makes it possible for developers to include blob capacity increases in Pectra in addition to the current 9 EIPs. The Pectra upgrade is tentatively scheduled for mainnet activation in early 2025 and may include the following 10 code changes:

Overall, Pectra consists of a series of updates to Ethereum that are expected to achieve three results:

Fixing the protocol’s key flaws as a proof-of-stake blockchain;

Improving the user experience (UX) of interacting with smart contract applications on Ethereum;

Improving Ethereum’s Data Availability (DA) capacity.

On the surface, UX improvements and improvements to Ethereum as a DA layer are in opposition to each other, as improvements to Ethereum as a DA layer are designed to encourage end users to no longer interact with smart contracts on Ethereum, but to interact with smart contracts on rollups in a cheaper way. However, improvements to Ethereum UX are likely to have a trickle-down effect, meaning that because they are implemented on the mainnet, they are likely to be adopted by rollups, thereby benefiting end users of rollups and Ethereum.

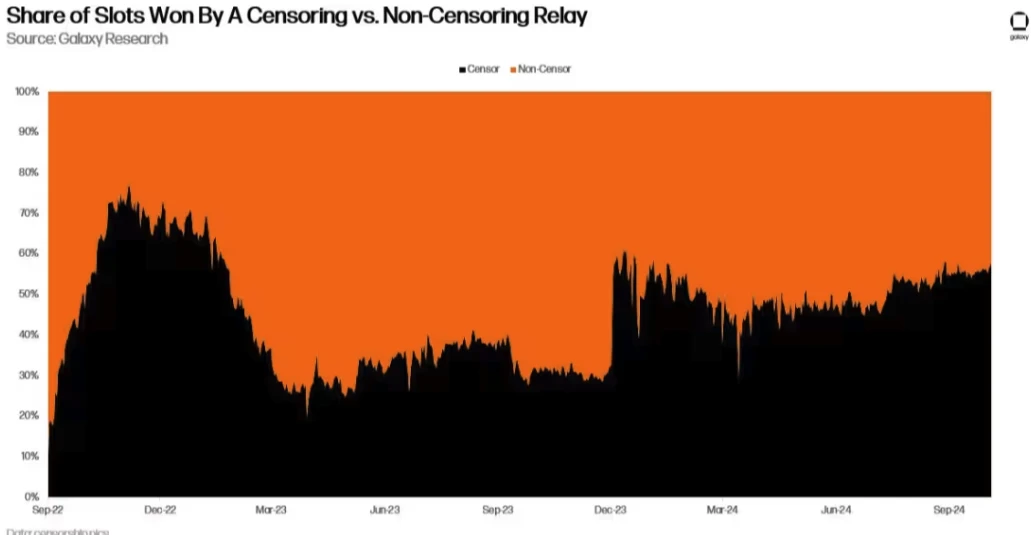

Notably, there are no code changes in Pectra that are targeted at reinforcing the narrative of ETH as “sound money” or a store of value. Additionally, no EIPs directly improve Ethereum’s quality as a censorship-resistant blockchain, an issue that has become a higher priority for developers to address since the Merge upgrade as the number of known regulated entities participating in the block building process has increased.

More than 50% of blocks on Ethereum are generated by OFAC-compliant relayers, meaning that the entities responsible for creating these blocks intentionally exclude transactions interacting with Ethereum addresses listed on the US OFAC sanctions list .

Developers are working to include code changes in future upgrades to reduce ETH issuance and improve censorship resistance . However, these are not the focus of the Pectra upgrade. Next, we will specifically classify the above 10 EIPs and explain their expected impact on ETH and stakeholders.

EIP 7251: A critical fix for the Ethereum network

All critical and non-critical fixes will be implemented in the first part of the Pectra upgrade in the first quarter of 2025.

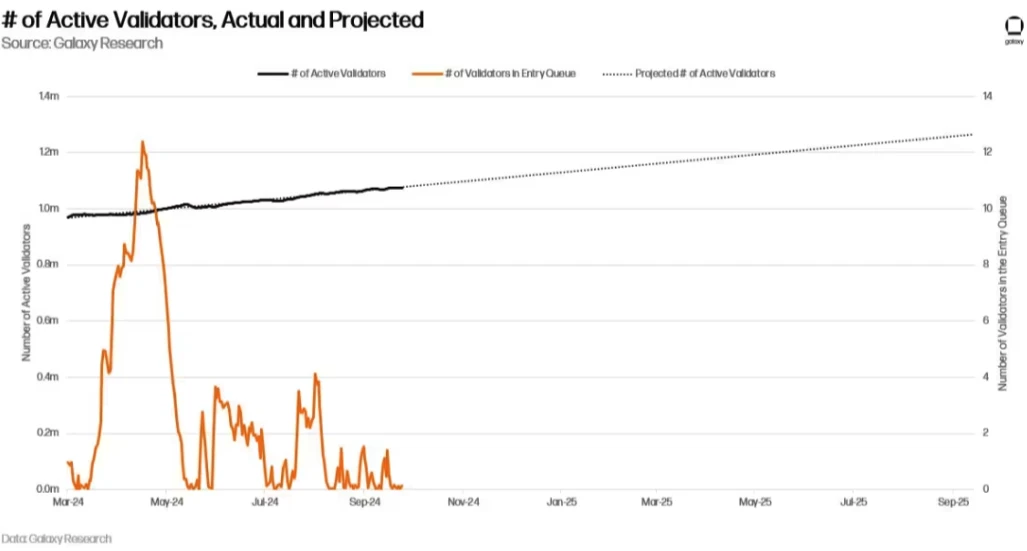

There is an EIP in Pectra that is critical to Ethereum’s operation as a proof-of-stake blockchain. EIP 7251 increases the maximum valid balance of a validator from 32 ETH to 2048 ETH and allows existing validators with a maximum valid balance of 32 ETH to consolidate their stakes. This is expected to reduce the number of validators on Ethereum, which is over 1 million as of September 2024.

A simulation conducted by engineers at the Ethereum Foundation (EF) showed that Ethereum encountered serious network problems when it reached 1.4 million validators. EIP 7251 is expected to ease network pressure by encouraging merged staking of ETH.

The reason for setting the validator stake limit at 32 ETH

The beacon chain was initially designed for validators with a maximum effective balance of 32 ETH, as protocol developers wanted to encourage a large number of participants to participate in the proof-of-stake consensus protocol . Developers conservatively estimated that with 32 ETH, the beacon chain would attract approximately 312,500 validators, who would generate enough aggregate cryptographic signatures to secure the nascent chain.

When the beacon chain was launched in December 2020, the price of ETH was about $600, which meant that users with less than $20,000 in funds could also operate their own validators and earn staking rewards independently. At the time, staking rewards did not include transaction fees or MEV rewards, and since users could not withdraw funds, staking was quite risky.

In addition to encouraging participation, the effective balance of 32 ETH was chosen because the original design of scaling the beacon chain through sharding requires each validator to maintain the same effective balance. If all users maintain a staked balance above 32 ETH, developers are concerned that there will not be enough validators to protect the chain. If all users maintain a staked balance below 32 ETH, there is a concern that there will be too many unnecessary validators burdening Ethereums network layer.

In addition to the maximum effective balance of 32 ETH, developers set a series of other constants and parameters in the protocol that are based on rough estimates of Ethereums future staking demand. Even if the developers estimates are highly inaccurate, they believe that they can adjust the chains economics and staking parameters through subsequent hard forks. Today, the rapid adoption of liquid staking solutions such as Lido and Coinbase has prompted developers to adjust Ethereums issuance curve lower.

Finally, there may be false assumptions about the true capacity of Ethereum’s network layer. Ethereum founder Vitalik Buterin wrote in a 2021 blog that the design specification of the beacon chain can support 4.1 million validators, or stake the entire ETH supply, when the maximum effective balance is 32 ETH. In reality, due to various upgrades and changes in client implementations, Ethereum’s network layer is unlikely to be able to support 1.4 million validators, let alone more than 4 million.

Implementation details of EIP 7251

EIP 7251 is a complex code change. It fundamentally changes the way the protocol calculates validator rewards, penalties, and withdrawals. Instead of making these calculations based on the number of active validators, the protocol will make them based on the total effective balance of the validators, which can range from a minimum of 32 ETH to 2048 ETH per validator.

In particular, during the process of changing the relevant penalty mechanism, developers discovered an extreme case where validators with smaller effective balances were punished more severely than validators with larger effective balances. However, this extreme case has been resolved during the subsequent Pectra testing process. As of October 2024, developers are still working to resolve errors in the EIP 7251 specification.

In addition to updating the calculation, this EIP also introduces new operations for validators to merge existing validators, and reduces the initial slashing penalties for validators with larger effective balances to encourage merging.

Once the upgrade is activated, it is unclear how quickly large staking entities will be able to merge their validators and relieve pressure on the network. There is concern that any surge in the number of validators between now and when validator mergers take effect could negatively impact network health and network participants running validators on lower-grade hardware or in locations with limited internet bandwidth.

The chart below shows the growth in the number of active validators since the Dencun upgrade. The Dencun upgrade reduced the maximum number of validator entries per epoch on Ethereum from 15 to a constant value of 8. The chart below provides a forecast of the growth of the Ethereum validator set based on the activity of new validator entries since the validator entry churn rate dropped to 8. It is important to note that the following forecasts are conservative and do not take into account potential catalysts for future growth in staking demand, such as the maturation of re-staking protocols such as Eigenlayer on Ethereum.

Other EIPs for non-network critical fixes

In addition to EIP 7251, there are a few other EIPs in the 10 EIPs for the Pectra upgrade that also fix the network, albeit non-critically. They include:

EIP 7549, moving committee index out of attestation : In order to make the CL client software more efficient, this code change introduces a refactoring of validator attestation messages. It is expected to reduce the network load on validator nodes, although to a lesser extent than EIP 7251;

EIP 6110, Providing Validator Deposits on-chain : This code change moves the responsibility for validating new staked ETH deposits from CL to EL. By doing so, developers can increase the security of deposits, reduce protocol complexity in CL clients, and improve the staking user experience by reducing the delay between depositing 32 ETH on EL and newly activating a validator on CL;

EIP 2935, Providing Historical Block Hashes from State : Makes changes to EL so that proofs of historical blocks can be generated from state. It may provide some additional functionality to smart contract developers, as they will be able to access information about the Ethereum state from previous blocks. Mainly, this is a necessary code change to prepare for the Verkle upgrade transition;

EIP 7685, Generic Execution Layer Requests : Creates a generic framework for storing CL requests triggered by smart contracts. As smart contract-based stake pools grow in popularity, there is a need to enable smart contracts to directly trigger validator withdrawals (EIP 7002) and merges (EIP 7251) on CLs. This code change introduces a protocol framework for storing these types of requests so that CLs can easily handle them.

Expected impact

Affected stakeholders: Validator node operators

Expected impact on ETH: Neutral

The critical and non-critical fixes activated in the Pectra upgrade will primarily affect validator node operators, who will have to update their operations to take advantage of higher effective balances from EIP 7251, efficiency gains from EIP 7549, and minor user experience improvements from EIP 6110. The other two EIPs, EIP 2935 and EIP 7685, offer little direct benefit to node operators.

End users and ETH holders are not expected to benefit directly from these five code changes. These packages of code changes primarily benefit the health and resilience of Ethereum as a proof-of-stake blockchain. They are positive for the value of the protocol in the long run, as they ensure that it can continue to operate securely and smoothly. However, they do not introduce new features that materially improve the user experience for end users, smart contract developers, or aggregates. Therefore, they are not expected to have an outsized impact on the value of ETH.

As with any network-wide upgrade on Ethereum, ETH volatility may be heightened during Pectra, and the price could move negatively if there are any unexpected bugs or glitches during the upgrade. To be clear, the likelihood of a failed Pectra upgrade is low, given the extensive battle-testing of these code changes before activation on mainnet, and the extensive experience of Ethereum protocol developers in executing these types of backwards-incompatible code changes without disrupting the network.

Therefore, barring temporary volatility in ETH before and shortly after the upgrade, the code changes in the Pectra upgrade related to fixing various parts of the protocol are not expected to have a long-term positive or negative impact on the value of ETH.

User Experience (UX) Improvement Related EIPs

There are 3 EIPs in the Pectra upgrade that will bring user experience improvements to Ethereum end users and smart contract developers. While Ethereum pursues a rollup-centric roadmap, developers are also working together to improve Ethereums value proposition as a leading general-purpose blockchain.

EIP 2537, Precompiles for BLS 12-381 curve operations : Adds new functionality to efficiently perform operations on the BLS 12-381 curve, an algebraic structure widely used for zero-knowledge cryptography. Zero-knowledge cryptography can provide multiple benefits to blockchain-based applications, including stronger privacy guarantees, security, and scalability. The ability to perform operations on BLS curves will benefit applications and rollups built on top of Ethereum that already use zero-knowledge proof systems or are looking to integrate such systems into their operations;

EIP 7002, the execution layer can trigger withdrawals : EIP 7002 creates a stateful precompile for validator withdrawals, which is a mechanism to modify the EVM state. Currently, validators on the beacon chain can only exit through the intervention of the validator withdrawal key owner, who is usually the operator of the validator. EIP 7002 introduces a mechanism for smart contracts to own validator withdrawal credentials and use them to trigger validator exits without manual intervention by the validator operator. It will provide more trustless designs for staking applications and enable existing staking applications to eliminate trust assumptions about the honest behavior of their validator node operators, which will also have a trickle-down effect on users of staking applications that leverage EIP 7002, enhancing the security of these applications;

EIP 7702, Set EOA Account Code : Creates a new transaction type for end users to add short-term functionality to Ethereum accounts controlled by their users, such as: transaction batching (authorizing the execution of multiple on-chain actions from signing a single transaction), sponsorship (paying for a transaction on behalf of another account), and permission downgrades (authorizing specific spending conditions on an account balance).

Given that most users perform transactions on Ethereum through wallet providers, wallet developers will take advantage of new transaction types and add these features to their designs in a way that is easily accessible to users.

Expected impact

Affected stakeholders: End users, smart contract developers

Expected impact on ETH: Positive

Unlike critical and non-critical network fixes, these code changes will directly support the development of more fully functional applications on Ethereum. EIPs 7002, 2537, and 7702 will support more trustless stake pool designs, privacy-enhanced decentralized financial protocols, and secure user-controlled accounts, respectively.

Data Availability (DA) Improvement Related EIPs

As mentioned earlier in this report, another code change may be included in Pectra. Developers are considering a slight increase in the blob gas target to improve the scalability of Ethereum as a data availability (DA) layer. There is a larger, more complex series of code changes related to increasing DA capacity through the EIP 7594 (PeerDAS) upgrade. However, since EIP 7549 will no longer be activated in Pectra, a simpler change has been proposed to reduce DA costs.

Currently, Ethereum can handle up to 6 blobs per block and dynamically adjusts the cost of these blobs so that on average each block contains 3 blobs. The proposal from Francis Li, developer of L2 rollup Base, is to increase the target number of blobs per block to 5 and the maximum number of blobs per block to 8.

In Lis proposal, he noted that even a conservative increase in the target blob number from 3 to 4 would help teams building rollups on Ethereum. Developers are largely in favor of increasing the blob target in Pectra. However, confirmation of this view and formal inclusion of DA improvements in Pectra remains to be decided in a future ACD call. For now, developers have agreed to include EIP 7742 in Pectra, which will pave the way for changing Ethereums blob capacity by adjusting CL.

EIP 7742, decoupling blob counting between CL and EL : Maximum and target blob limits have always been hard-coded on the EL and CL. EIP 7742 enables the CL to dynamically adjust the maximum and target blob limits so that future changes in DA capacity do not require hard forks on both layers, but can be adjusted specifically through the CL.

In addition to EIP 7742 and the blob capacity increase, developers are considering two other code changes related to optimizing Ethereum’s DA functionality in either the Pectra upgrade or the Fusaka upgrade:

EIP 7762, increase MIN_BASE_FEE_PER_BLOB_GAS : When demand for blobs exceeds the target fee rate (currently 3 blobs per block), the protocol automatically adjusts the mandatory base cost of blobs upwards. This pricing mechanism is similar to the pricing mechanism for regular Ethereum transactions under EIP 1559. EIP 7762 adjusts the minimum base cost of blobs higher so that the blob fee market can be more sensitive to fluctuations in blob demand and achieve faster price discovery for blobs.

EIP 7623, increasing the cost of call data : In addition to blobs, rollups can also use the call data field of transactions to publish arbitrary data to Ethereum. However, in general, using the call data field of transactions is more expensive for rollups. EIP 7623 aims to further increase the cost of call data in order to reduce the size of Ethereum blocks. As Ethereum developers increase the size of blocks by increasing blob capacity, they are seeking to prevent extreme cases where validators propagate abnormally large blocks that contain a large amount of call data and the maximum number of blobs.

Increasing blob throughput in Pectra is a controversial topic among developers, as it could negatively impact Ethereum’s decentralization by reducing the number of independent stakers running on the network. Independent stakers are users who stake their own ETH and run their own staking operations from home or through a cloud provider, rather than relying on staking pools or other intermediary services for staking. Independent stakers are users who run validators on the most resource-constrained devices compared to other types of stakers .

Increased blob throughput could increase the computational requirements of operating a validator, causing some independent stakers to shut down their machines. At ACDE #197 , developers shared some evidence that some independent stakers were already struggling to operate validators after Dencun. Developers have agreed to conduct a data study on the health of independent staking operations before deciding to increase blob capacity in the Pectra upgrade.

Expected impact

Affected stakeholders: L2 rollups, L2 end users, ETH holders

Expected impact on ETH: Negative

In the short term, Ethereum’s DA improvements are expected to reduce protocol revenue from L2, increase margins for L2 sorters, and reduce transaction fees for L2 end users. These effects are expected to be similar to the effects of activating EIP 4844 in the Dencun upgrade.

in conclusion

While there is still uncertainty about the scope and timeline of the Pectra upgrade, Ethereum remains a frontrunner in ushering in the Web3 era, in which human coordination is primarily conducted through decentralized blockchain technology rather than centralized Internet protocols. To achieve this, Ethereum must continue to scale as a decentralized technology while fighting centralized forces such as Maximum Extractable Value (MEV) and transaction censorship.

Ethereum continues to have the highest network effect of all general-purpose blockchains. It remains the most battle-tested blockchain for smart contract developers and the most studied blockchain by researchers and developers in solving challenges related to scaling, MEV, censorship, user experience, etc. However, as Ethereum developers pursue a rollup-centric roadmap, the role of Ethereum as a technology and the importance of Ethereum upgrades should gradually diminish, as solutions to the biggest problems facing Web3 will be inherited by rollups.

Pectra will introduce UX-focused code changes that are expected to attract new users and smart contract developers to the Web3 space . However, it will likely be one of the last upgrades that will directly impact users and ETH holders. As users migrate to rollups and protocol revenues are increasingly driven by rollup activity, the most important code changes for Ethereum stakeholders will be those involving rollups. To this end, it is important to analyze the maturity of rollups as a technology and their ability to meaningfully inherit Ethereum security and scale for millions of new users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anticipating Outcomes as Trump’s Stamp on DeFi Broker Rule Repeal Looms

Analyzing the Implications of a Congressional Vote Awaiting Presidential Seal to Revoke DeFi Regulations in the U.S.

DOJ Seizes $200K in Crypto Tied to Hamas—17 Wallets Busted

Wirex Travel Launches With Crypto Payments and Booking Rewards

Ghibli (GHIBLI): The Meme Coin That Combines Ghiblification, AI, and Crypto