SHIB Grows 360% in Whale Activity: Sign of Sustainable Rally?

- Shiba Inu coin erupted by 37% last week, claiming a new 3-month peak.

- After Monday’s correction, SHIB is pushed back below key resistance.

- Analysts assert that SHIB’s rally continuation relies on Elliott Wave 3.

Shiba Inu (SHIB) pounced on the crypto market relief rally last week, climbing to a fresh monthly peak of $0.00002136 on September 28, 2024. This has convinced many large investors to return to Shiba and adjust their positions.

According to Santiment’s research, the broader crypto markets have enjoyed a resurgence in whale activity. PEPE led the meme coin niche with $1.1 billion in large transactions, qualifying as $100K or more. Dogecoin took second place with $938.5M, while SHIB snatched the bronze with a $573.54M volume in 7-day whale activity.

SHIB Picks Up Pace on Huge Whale Support

This served as a 360% boost for Shiba Inu’s whale activity compared to last week. Large holders picking up the coin’s volume usually give a bullish signal if the returning SHIB whales are accumulating rather than distributing. To determine this, DailyCoin looked at the Chaikin Money Flow (CMF) indicator, which is pivotal in establishing the whales’ sentiment.

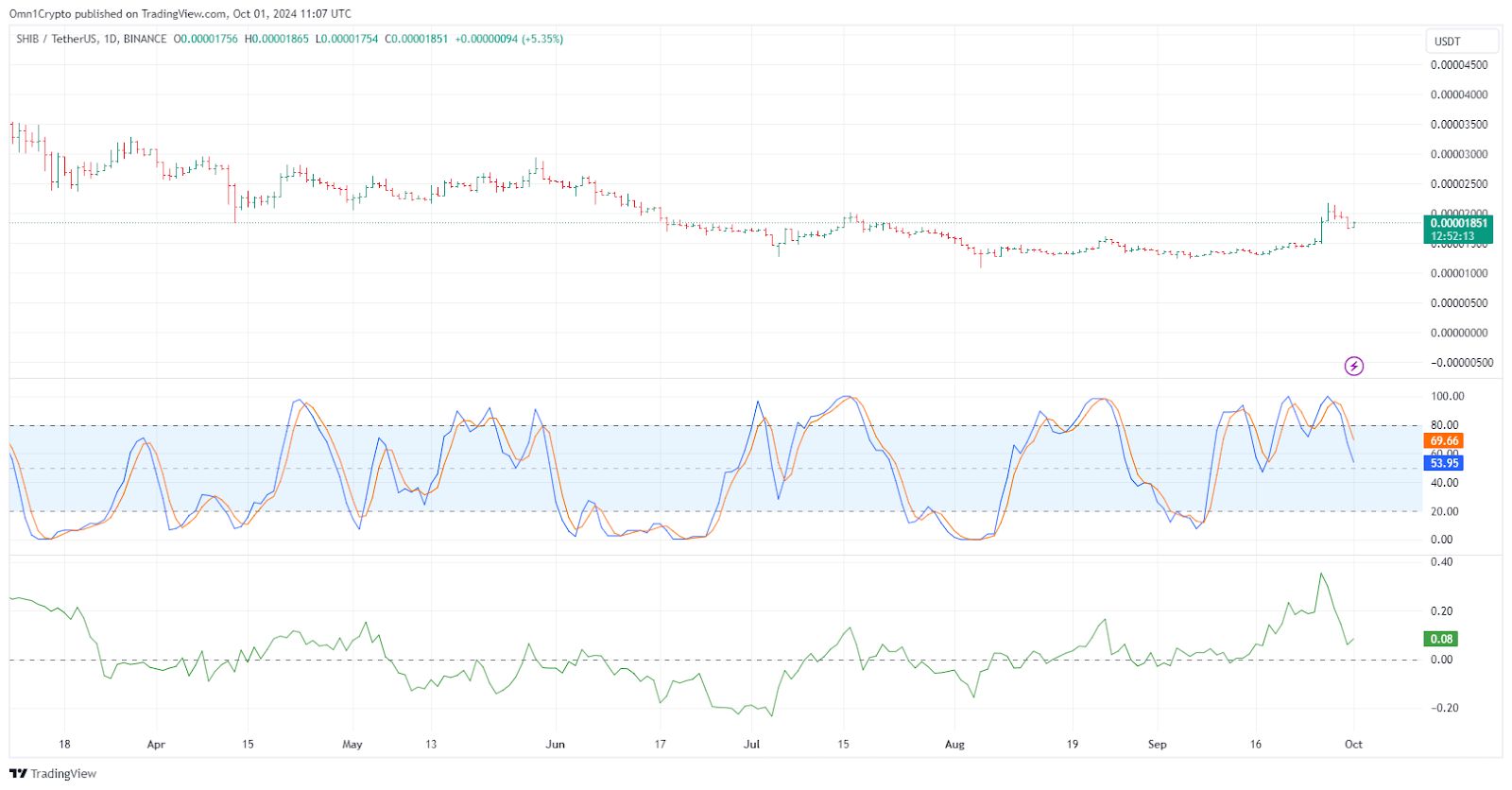

Compellingly, both one-day and one-hour technical Shiba charts show a positive pattern. The one-day charts point to a 0.09 CMF at publication, implying that large investors are increasing their stake holdings. The CMF is counted by a combination formula of recent volume and price movements, deeming the market oversold or overbought.

Is Shiba Crypto on Track to Reclaim $0.00002?

As the $10.9 billion market cap SHIB is changing hands at $0.00001851 after Monday’s crypto market correction, traders are weighing the chances of a next leg in SHIB’s recent symmetrical triangle breakout.

However, only a daily close above the critical resistance of $0.00002 would validate the bullish thesis. According to on-chain data from IntoTheBlock, the next price range bubble starts at $0.000019, meeting SHIB with 99.21T tokens split between 102.36K wallets.

Furthermore, this strong resistance level between $0.000019 and $0.000024 could play out as a support level, given that SHIB’s market value returns to early June 2024 levels. Last Spring, SHIB and the main competing dog-themed tokens soared to yearly heights, with SHIB claiming $0.000044 for a brief moment on March 6, 2024.

The bull run for SHIB in March was the second-largest spike in the canine token’s history, only overshadowed by the greatest SHIB bull run to the current peak of $0.00008616 in October 2021. For Shiba to break this price range and produce a new all-time high, crypto traders rely on the Elliott Wave 3, which looks technically stronger than the previous two.

Besides the whale trading volume and other critical on-chain metrics, Shiba Inu’s northward trajectory is closely linked to the upgrades in Shibarium’s ecosystem and speculative traders’ interest in Derivatives markets. Since September 19, 2024, Shiba Inu’s perpetual contracts have faced a substantial surge in Open Interest-weighted funding rates, but the volumes have significantly tumbled after last week’s 37% run .

On the Flipside

- The Stochastic Relative Strength Index (stochRSI) still alludes to an overbought phase in Shiba crypto’s price movements, between 69.66 and 53.95, as depicted in the above graphic.

Why This Matters

The cryptocurrencies most demanded by major investors tend to have a deeper market, which can be helpful in severe market conditions and drastic sentiment shifts.

Check out DailyCoin’s popular crypto news:

Ether ETFs Break Negative 5-Week Streak with $87M Inflows

Panicked Solana Meme Coin Trader Misses Out on $6.3M Gains

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AVLUSDT now launched for futures trading and trading bots

ECB board member Simkus: Supports the expectation of three more rate cuts in 2025

A whale spent 9794 SOL to buy PAIN, with an average price of $18.81

Memeland CEO: Bitcoin is the largest meme coin on earth