Celo vs. Tron: Who’s Winning the Battle for Stablecoin Supremacy?

- Celo’s stablecoin supply has grown significantly in 2024, challenging Tron’s dominance in USDT transactions according to DeFiLlama.

- Celo prepares for further expansion with upcoming Alfajores testnet launch and mainnet expected early November 2024.

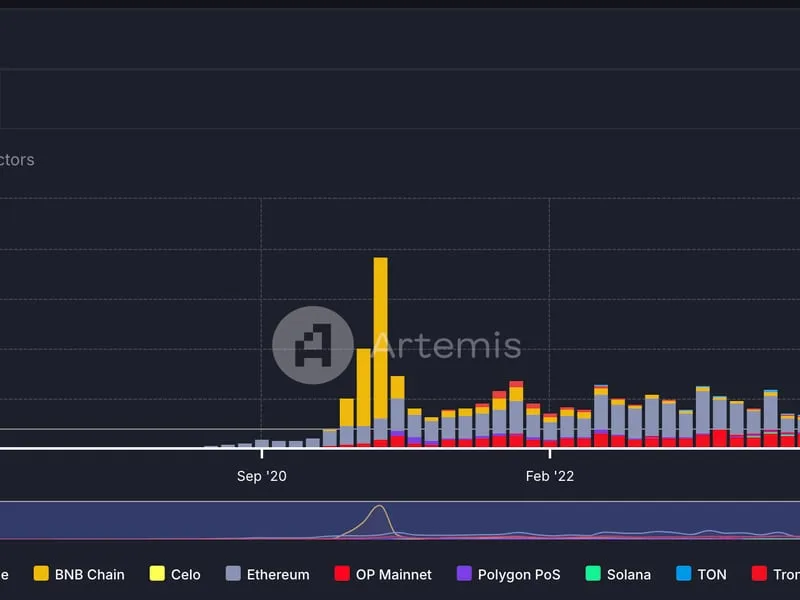

Celo, which launched in 2020 as a first-layer (L1) network, is transitioning into a second-layer (L2) for Ethereum (ETH) and has experienced a notable increase in stablecoin activity. According to a recent report from the on-chain analytics platform Artemis, Celo has exceeded Tron (TRX) in daily active addresses related to stablecoin usage.

The report by Artemis emphasizes that Celo’s activity has not only surpassed Tron but has also overtaken other networks such as Solana (SOL), The Open Network (TON), and BNB Chain in this metric.

The analysis indicates that the size of stablecoin transactions on Celo varies, suggesting authentic use of the network beyond mere transaction inflation.

Source: Artemis

Source: Artemis

Artemis’s data show a growth in transaction volume over time, with daily transactions peaking at over 1.3 million around the 32nd week of 2024. This data could suggest an increasing adoption of stablecoins in various transaction sizes, from micro to larger volume operations.

The supply of stablecoins on the Celo network has significantly grown in 2024. However, it is important to note that Artemis’s statistics alone may not conclusively prove Celo’s dominance over Tron, as Tron still holds a 98% share in USDT transactions, the most used stablecoin, according to DeFiLlama.

Celo is currently running a testnet (L2) on Ethereum named Dango, using the Ethereum Virtual Machine (EVM), and plans to introduce another testnet, Alfajores, by September 26, 2024. The mainnet is anticipated to be available in early November 2024, though a specific date within that month has not been confirmed.

The increase in stablecoin usage on Celo can be linked to its capability to process approximately 200 transactions per second (TPS) and its very low fees, averaging 0.0005 CELO per transaction, equivalent to about $0.00034. The network’s EVM compatibility also facilitates the migration of decentralized applications (dApps) from Ethereum.

The introduction of popular stablecoins like USDC and USDT to Celo in early 2024 has further fueled the network’s usage. Additionally, Artemis highlighted that Celo’s growth was propelled by the expanding adoption of dApps and robust demand for digital assets in regions such as Africa.

Vitalik Buterin , acknowledged Celo’s development, noting that Celo’s utilization for everyday payments aligns with Ethereum’s fundamental objectives.

“Improving worldwide access to basic payments/finance has always been a key way that ethereum can be good for the world, and it’s great to see @Celo getting traction,” Buterin said on X.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Indiana Moves to Allow Bitcoin in Pension Funds as States Eye Crypto Reserves

Grayscale Expands Crypto Offerings with Bitcoin Miners ETF

Bitcoin Holds Strong Above $100K While Altcoins Struggle – What’s Next?

Bitcoin’s Price Moves Like Small Tech Stocks, Says JPMorgan