Market Dynamics on May 6: Meme and AI sectors take the lead in launching

I. Market Fundamentals

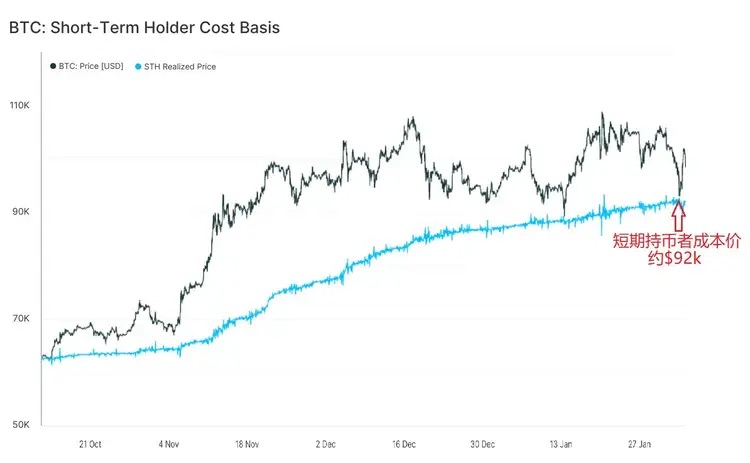

1. BTC rebounds, and altcoins surge significantly. Historical data shows that whenever Bitcoin bull market first experiences a significant correction, the altcoin season will follow.

2. U.S stocks soar while the dollar index plummets. Non-farm employment data supports expectations of interest rate cuts moving forward from November to September.

II. Market Focus

1. AI concepts such as AR, ARKM, WLD, RNDR, AKT and ALEPH have all seen significant increases. The current market trend is still led by Meme and AI sectors which are recovering to pre-drop levels first. Chatgpt5 plans to launch in June.

2. Social class FRINED and XPET also show strong performance.Friend as a social application on Base chain has some deficiencies in economic model design; influencers who call for purchases all have airdrop income.

3.TRB and FRONT manipulated by market makers also recorded substantial growth.As the market stabilizes,funds begin to take an interest in these speculative stocks.

4.L2 project STRK will unlock nearly $100 million funds next week.Due to large selling pressure from VC,the market value may increase but coin price might not necessarily rise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CleanSpark reports $162.3 million in quarterly revenue: 'Why buy bitcoin at current prices when we can mine it for $34,000?'

CleanSpark generated revenue of $162.3 million in the fourth quarter of 2024, up 120% year-over-year.The Bitcoin miner reported net income of $246.8 million and adjusted EBITDA of $321.6 million for Q4 — also up significantly from the same period in 2023.

Bitcoin price seasonality data calls for $120K in Q1, but leverage remains BTC’s ‘biggest risk’

Bitcoin’s historical price data favors new all-time highs in Q1, but liquidity gaps below $80,000 could pull the price lower in the short term.