Stablecoin market escaping US regulatory oversight: Chainalysis

The United States government may be losing regulatory oversight of the stablecoin market, according to a new report by blockchain research firm Chainalysis.

Stablecoin activity has been increasingly occurring through entities that aren’t licensed in the United States, Chainalysis stated in its latest North America cryptocurrency report released on Oct. 23.

According to Chainalysis’ findings, the majority of stablecoin inflows to the 50 biggest cryptocurrency services have shifted from U.S.-licensed services to non-U.S.-licensed services since spring 2023.

As of June 2023, about 55% of stablecoin inflows to the top 50 services were going to non-U.S.-licensed exchanges, the report stated.

Share of stablecoin inflows to U.S.-licensed vs. non-U.S.-licensed exchanges between July 2022 and June 2023. Source: Chainalysis

Share of stablecoin inflows to U.S.-licensed vs. non-U.S.-licensed exchanges between July 2022 and June 2023. Source: Chainalysis

The study suggested that the U.S. government has been increasingly losing its ability to oversee the stablecoin market, while U.S. consumers have been missing opportunities to engage with regulated stablecoins.

“Though U.S. entities originally helped legitimize and seed the stablecoin market, more crypto users are pursuing stablecoin-related activity with trading platforms and issuers headquartered abroad,” Chainalysis wrote. The firm stated that U.S. lawmakers have yet to pass stablecoin regulations as Congress is still considering related bills like the Clarity for Payment Stablecoins Act and the Responsible Financial Innovation Act .

Despite a drop in licensed stablecoin activity in the United States, North America has emerged as the largest cryptocurrency market, with an estimated $1.2 trillion received between July 2022 and June 2023. The region accounted for 24.4% of global transaction volume during the period, beating the regions of Central, Northern and Western Europe, which received an estimated $1 trillion , according to Chainalysis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

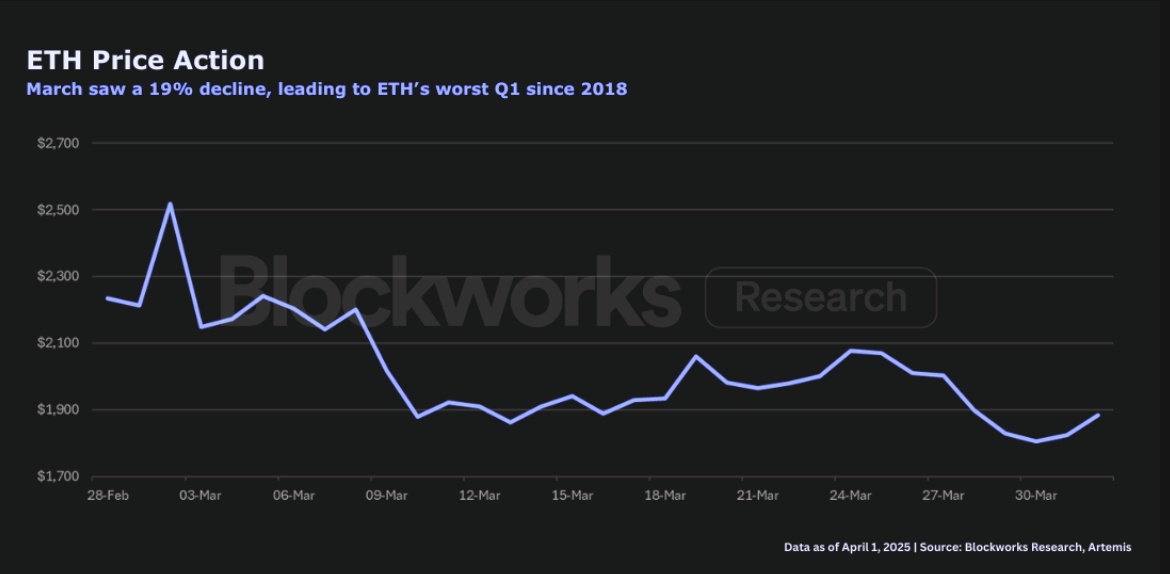

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far

GameStop just announced a $1.5 billion Bitcoin deal