News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1FARTCOIN’s Recovery Kicks Off With a Classic Pattern – Will GOAT Follow the Same Path?2Bitget Daily Digest (March 24) | Trump pumps $TRUMP on social media; U.S. tariff policy shifts again3Merlin Chain Expands Bitcoin Yield Opportunities in Partnership with Hemi Network

Bitcoin proxy Strategy acquires 6,911 BTC, now holds 506,000 BTC

Cryptobriefing·2025/03/25 00:11

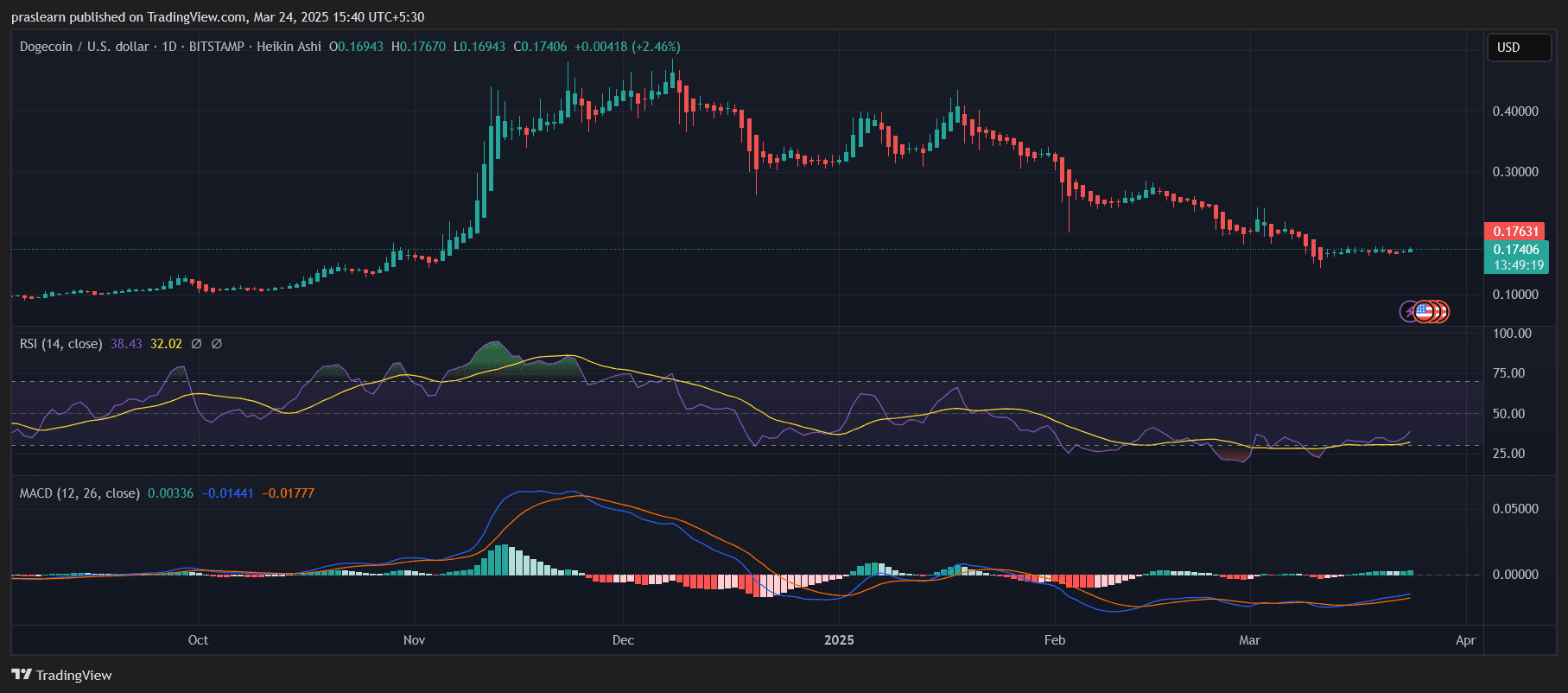

Dogecoin Prediction for April 2025: Will DOGE Price Skyrocket to $5?

Cryptoticker·2025/03/24 22:22

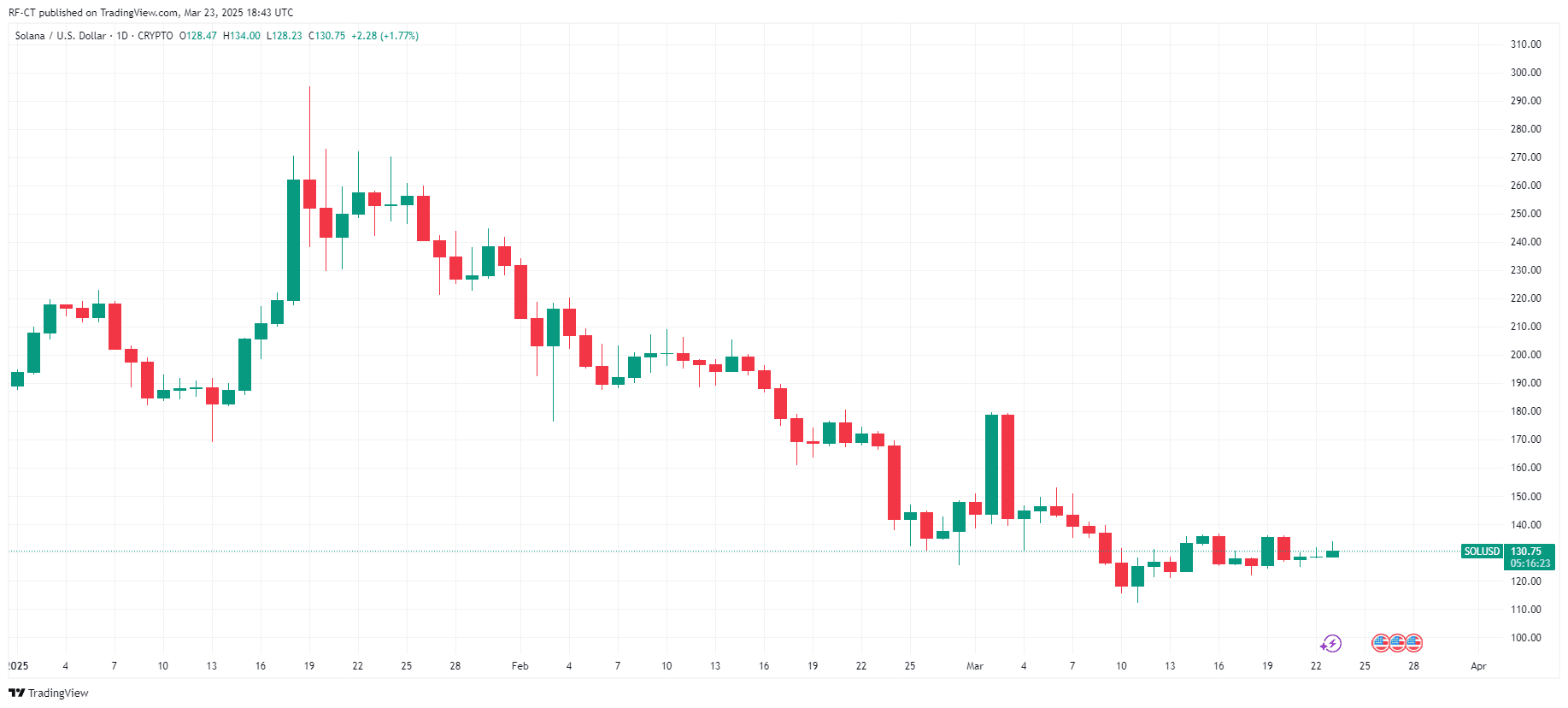

SOLANA May Be a Top Crypto Investment for April 2025, Here's WHY?

Cryptoticker·2025/03/24 22:22

AVAX Gains Momentum Following Key Breakout – Is VET Gearing Up For A Similar Move?

CoinsProbe·2025/03/24 21:44

AIXBT and GRIFFAIN See Double-Digit Gains – Could This Pattern Lead to a Recovery?

CoinsProbe·2025/03/24 21:44

DOGE Gains Momentum Following Key Breakout – Is PEPE Gearing Up For A Similar Move?

CoinsProbe·2025/03/24 21:44

Ethereum Supply Dries Up on Exchanges as Leverage Spikes—Bullish Signs for ETH?

CryptoNewsNet·2025/03/24 20:44

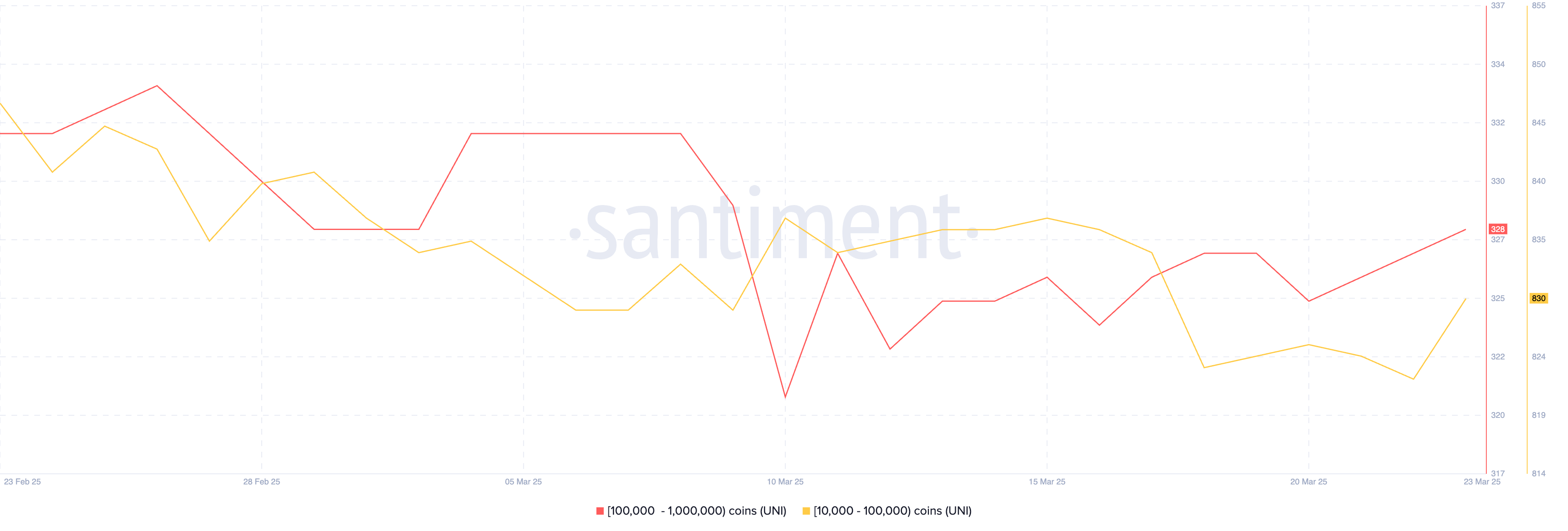

3 Altcoins Crypto Whales Are Buying For The Last Week Of March

CryptoNewsNet·2025/03/24 20:44

Donald Trump Endorses His Own Coin – Is Another Run Incoming?

One whale lost money by buying and the selling TRUMP soon after the President endorsed his own meme token.

CryptoNews·2025/03/24 19:44

XRP Price in Focus as Ripple Face New Future: Are Traders Betting Big on XRP?

99bitcoins·2025/03/24 19:22

Flash

- 01:44Survey: Demand for Crypto ETFs Surges Among US Financial Advisors, 57% Plan to Increase Investment Allocation This YearAccording to CoinDesk, at the Exchange conference held in Las Vegas, Todd Rosenbluth, head of research at TMX VettaFi, and senior investment strategist Cinthia Murphy shared a survey targeting U.S. financial advisors. The results showed that cryptocurrency exchange-traded funds (ETFs) are receiving widespread attention; 57% of advisors plan to increase their investment allocation in crypto ETFs this year while only 1% said they would reduce it. Murphy pointed out: "Last year, investing in cryptocurrencies might have been seen as a reputational risk but now no advisor can avoid having basic conversations about cryptocurrencies." The survey revealed that advisors particularly favor crypto stock ETFs which invest in publicly listed companies directly related to the crypto industry such as Strategy (formerly MicroStrategy) or Tesla. Murphy stated: "Crypto stock ETFs are easier to understand and get started with which may explain their popularity." In addition, spot crypto ETFs and multi-token funds are also attracting increasing interest. 22% of respondents plan to allocate funds to spot crypto ETFs like Bitcoin (BTC) or Ethereum (ETH) ETF; another 19% expressed interest in holding cryptocurrency asset funds with multiple tokens.

- 01:18Data: A certain whale released a collateral of 4,721 ETH about 5 hours ago and transferred it to Bitget, which is approximately equivalent to 9.91 million USDChainCatcher reports that, according to third-party monitoring, a certain whale unstaked 4,721 ETH (approximately $9.91 million) five hours ago and transferred it to the Bitget exchange. In the past three months, this whale has withdrawn 6,849 ETH (about $17.95 million) from other CEXes at an average price of $2,621 and staked them. However, due to market fluctuations, the value of its ETH decreased by $3.57 million during this period.

- 01:15OP Labs: Will upgrade the response to fault proof events with approved management on April 1stChainCatcher has announced that OP Labs will be upgrading its response to fault proof events on April 1st. This will trigger a one-time invalidation of all pending withdrawal proofs created on L1. Please complete all pending withdrawals before April 1st to avoid creating new withdrawal proofs that cannot be executed in time. Failure to complete any pending withdrawals will not put any ETH or ERC-20 tokens at risk, but users will need to submit a second withdrawal proof transaction on L1.