News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Bitcoin traders tend to cut risk leading into FOMC meetings, but key price metrics are showing a divergence. Will BTC rally when the Fed minutes are released?

Ethereum's struggle to recover amid significant ETF outflows and weak market interest puts its price at risk of a 17-month low. If the bearish trend persists, further declines are possible, with $1,745 as the next critical level.

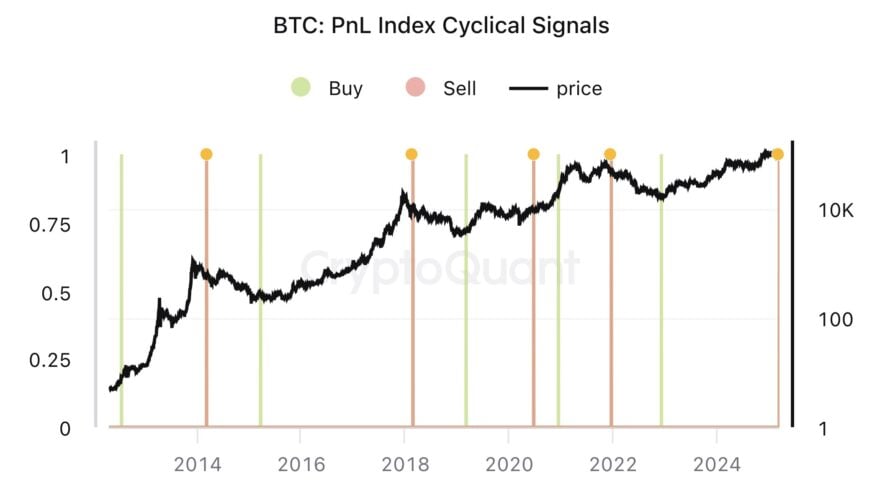

Bitcoin may be in a classic bear trap, a phase seen in past cycles. Experts debate whether it will hit new highs or if the bull run has ended.

The surge in crypto token buybacks aims to boost scarcity and investor confidence, but regulatory risks and liquidity concerns remain.

- 13:51Analysis: The Federal Reserve's FOMC interest rate decision may trigger a 3-5% price fluctuation in BTC, ETH, and SOLOdaily Planet Daily reports that the Federal Open Market Committee (FOMC), the monetary policy-making body of the U.S. Federal Reserve, is expected to soon release its interest rate assessment, growth and inflation forecasts, and other related data. This highly anticipated event could trigger volatility in the cryptocurrency market, stimulating a 3% to 5% price fluctuation in BTC, ETH and SOL. However, this does not mean that there is a significant deviation from normal conditions in the cryptocurrency market. In other words, while events at the Fed are crucially important they are unlikely to cause large-scale fluctuations.

- 13:48A whale deposited 5 million USDC into Hyperliquid and purchased 315,070 HYPEPANews reported on March 19th, according to Lookonchain, a whale deposited $5 million USDC into the Hyperliquid platform three hours ago and purchased 315,070 HYPE (approximately $4.69 million).

- 13:46906 BTC was transferred from Cumberland to CEX, valued at approximately 76.056 million USDPANews reported on March 19th, according to Whale Alert monitoring, 906 Bitcoins (approximately 76.056 million USD) have been transferred from Cumberland to CEX.