Bitget: #4 mondial en volume de trading quotidien!

Part de marché du BTC62.62%

Nouveaux listings sur Bitget : Pi Network

BTC/USDT$80286.62 (+1.97%)Indice Fear and Greed24(Peur extrême)

Altcoin Season Index:0(Saison du Bitcoin)

Tokens listés dans Pré-MarchéBABY,PAWS,WCTTotal des flux nets des ETF Spot Bitcoin -$97.7M (1j) ; -$355.9M (7j).Pack de bienvenue pour les nouveaux utilisateurs d'une valeur de 6200 USDT.Récupérer

Tradez à tout moment et en tout lieu grâce à l'application Bitget ! Télécharger maintenant

Bitget: #4 mondial en volume de trading quotidien!

Part de marché du BTC62.62%

Nouveaux listings sur Bitget : Pi Network

BTC/USDT$80286.62 (+1.97%)Indice Fear and Greed24(Peur extrême)

Altcoin Season Index:0(Saison du Bitcoin)

Tokens listés dans Pré-MarchéBABY,PAWS,WCTTotal des flux nets des ETF Spot Bitcoin -$97.7M (1j) ; -$355.9M (7j).Pack de bienvenue pour les nouveaux utilisateurs d'une valeur de 6200 USDT.Récupérer

Tradez à tout moment et en tout lieu grâce à l'application Bitget ! Télécharger maintenant

Bitget: #4 mondial en volume de trading quotidien!

Part de marché du BTC62.62%

Nouveaux listings sur Bitget : Pi Network

BTC/USDT$80286.62 (+1.97%)Indice Fear and Greed24(Peur extrême)

Altcoin Season Index:0(Saison du Bitcoin)

Tokens listés dans Pré-MarchéBABY,PAWS,WCTTotal des flux nets des ETF Spot Bitcoin -$97.7M (1j) ; -$355.9M (7j).Pack de bienvenue pour les nouveaux utilisateurs d'une valeur de 6200 USDT.Récupérer

Tradez à tout moment et en tout lieu grâce à l'application Bitget ! Télécharger maintenant

En lien avec la crypto

Calculateur de prix

Historique des prix

Prédiction de prix

Analyse technique

Guide d'achat crypto

Catégorie de crypto

Calculateur de profit

Prix de SMARTSMART

Non listé

Devise de cotation:

EUR

Les données proviennent de fournisseurs tiers. Cette page et les informations qu'elle contient ne recommandent aucune cryptomonnaie en particulier. Vous souhaitez trader des cryptos listées ? Cliquez ici

€0.001019-18.93%1D

Graphique de prix

Dernière mise à jour : 2025-04-08 02:36:42(UTC+0)

Capitalisation boursière:--

Capitalisation entièrement diluée:--

Volume (24h):€412,454.16

Vol. (24h) / Cap. boursière:0.00%

Haut (24h):€0.001255

Bas (24h):€0.0009474

Record historique (ATH):€0.009136

Plus bas niveau historique:€0.0009474

Offre en circulation:-- SMART

Offre totale:

9,000,010,200,000SMART

Taux de circulation:0.00%

Offre maximale:

--SMART

Prix en BTC:0.{7}1389 BTC

Prix en ETH:0.{6}6978 ETH

Prix avec la capitalisation du BTC:

--

Prix avec la capitalisation de l'ETH:

--

Contrats:--

Que pensez-vous de SMART aujourd'hui ?

Remarque : ces informations sont données à titre indicatif.

Prix de SMART aujourd'hui

Le prix en temps réel de SMART est de €0.001019 (SMART/EUR) aujourd'hui, avec une capitalisation boursière de €0.00 EUR. Le volume de trading sur 24 heures est de €412,454.16 EUR. Le prix de SMART à EUR est mis à jour en temps réel. La variation de SMART est de -18.93% durant les dernières 24 heures. Son offre en circulation est de 0 .

Quel est le prix le plus élevé de SMART ?

SMART a atteint un record historique (ATH) de €0.009136, enregistré le 2023-11-03.

Quel est le prix le plus bas de SMART ?

SMART a un plus bas niveau historique (ATL) de €0.0009474, enregistré le 2025-04-07.

Prédiction de prix de SMART

Quel est le bon moment pour acheter SMART ? Dois-je acheter ou vendre SMART maintenant ?

Lorsque vous décidez d'acheter ou de vendre SMART, vous devez d'abord tenir compte de votre stratégie de trading. L'activité de trading des traders à long terme sera également différente de celle des traders à court terme. L'analyse technique Bitget de SMART peut vous fournir une référence pour le trading.

Selon l'analyse technique de SMART (4h), le signal de trading est Vente.

Selon l'analyse technique de SMART (1j), le signal de trading est Vente forte.

Selon l'analyse technique de SMART (1w), le signal de trading est Vente forte.

Quel sera le prix de SMART en 2026 ?

En se basant sur le modèle de prédiction des performances historiques de SMART, le prix de SMART devrait atteindre €0.001476 en 2026.

Quel sera le prix de SMART en 2031 ?

En 2031, SMART devrait voir son prix augmenter de -4.00%. D'ici la fin de l'année 2031, SMART devrait voir son prix atteindre €0.002011, avec un ROI cumulé de +95.98%.

Historique des prix de SMART (EUR)

Le prix de SMART enregistre -65.65% sur un an. Le prix le plus élevé de en EUR au cours de l'année écoulée est de €0.003507 et le prix le plus bas de en EUR au cours de l'année écoulée est de €0.0009474.

HeureVariation de prix (%) Prix le plus bas

Prix le plus bas Prix le plus élevé

Prix le plus élevé

Prix le plus bas

Prix le plus bas Prix le plus élevé

Prix le plus élevé

24h-18.93%€0.0009474€0.001255

7d-21.78%€0.001012€0.001365

30d-32.88%€0.0009474€0.001527

90d-51.80%€0.0009474€0.002524

1y-65.65%€0.0009474€0.003507

Tous les temps-88.15%€0.0009474(2025-04-07, Aujourd'hui )€0.009136(2023-11-03, il y a 1an(s) )

Données de marché de SMART

Historique de capitalisation SMART

Capitalisation boursière

--

Capitalisation entièrement diluée

€9,173,752,996.33

Classement du marché

Avoirs SMART par concentration

Baleines

Investisseurs

Particuliers

Adresses SMART par durée de détention

Holders

Cruisers

Traders

Graphique en temps réel du prix de coinInfo.name (12)

Notes SMART

Note moyenne de la communauté

4.4

Ce contenu est uniquement destiné à des fins d'information.

SMART en devise locale

1 SMART en MXN$0.021 SMART en GTQQ0.011 SMART en CLP$1.111 SMART en UGXSh4.161 SMART en HNLL0.031 SMART en ZARR0.021 SMART en TNDد.ت01 SMART en IQDع.د1.471 SMART en TWDNT$0.041 SMART en RSDдин.0.121 SMART en DOP$0.071 SMART en MYRRM0.011 SMART en GEL₾01 SMART en UYU$0.051 SMART en MADد.م.0.011 SMART en OMRر.ع.01 SMART en AZN₼01 SMART en KESSh0.141 SMART en SEKkr0.011 SMART en UAH₴0.05

- 1

- 2

- 3

- 4

- 5

Dernière mise à jour : 2025-04-08 02:36:42(UTC+0)

Actualités SMART

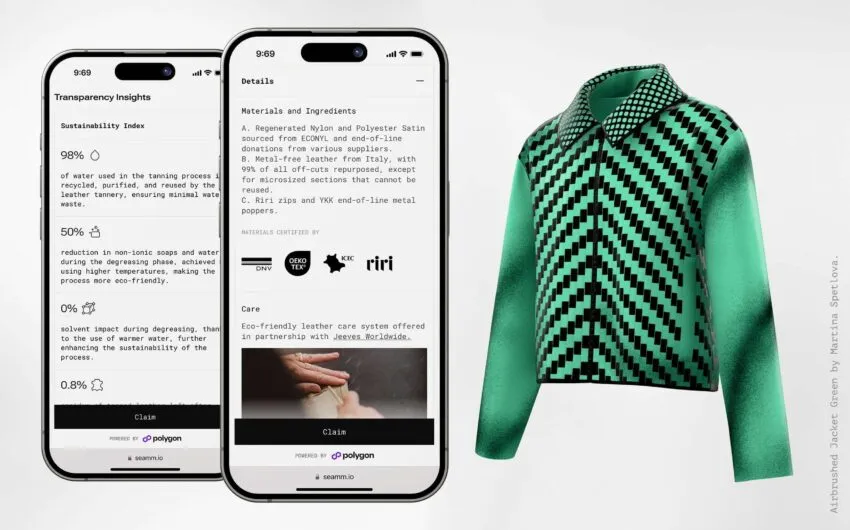

SMART DPP lance son passeport numérique pour produits sur Polygon

Beincrypto•2024-09-26 09:33

Nouveaux listings sur Bitget

Nouveaux listings

Acheter plus

FAQ

Quel est le prix actuel de SMART ?

Le prix en temps réel de SMART est €0 (SMART/EUR) avec une capitalisation actuelle de €0 EUR. La valeur de SMART connaît des fluctuations fréquentes en raison de l'activité continue, 24 heures sur 24 et 7 jours sur 7, du marché des cryptomonnaies. Le prix en temps réel de SMART et ses données historiques sont disponibles sur Bitget.

Quel est le volume de trading sur 24 heures de SMART ?

Au cours des dernières 24 heures, le volume de trading de SMART est de €412,454.16.

Quel est le record historique de SMART ?

Le record historique de SMART est de €0.009136. Il s'agit du prix le plus élevé de SMART depuis son lancement.

Puis-je acheter SMART sur Bitget ?

Oui, l'achat de SMART est actuellement disponible sur la plateforme d'échange centralisée Bitget. Pour des instructions plus détaillées, pensez à consulter notre guide pratique Comment acheter .

Puis-je gagner des revenus réguliers en investissant dans SMART ?

Bien entendu, Bitget fournit une plateforme de trading de stratégie, avec des bots de trading intelligents permettant d'automatiser vos trades et d'engranger des bénéfices.

Où puis-je acheter des SMART au meilleur prix ?

Nous avons le plaisir d'annoncer que plateforme de trading de stratégie est désormais disponible sur la plateforme d'échange Bitget. Bitget offre les frais de trading les plus bas du secteur ainsi qu'une profondeur importante afin d'assurer des investissements rentables aux traders.

Où puis-je acheter des cryptos ?

Section vidéo – vérifier son identité rapidement

Comment vérifier son identité sur Bitget et se protéger contre les fraudes

1. Connectez-vous à votre compte Bitget.

2. Si vous êtes nouveau sur Bitget, consultez notre guide sur comment créer un compte.

3. Survolez l'icône de votre profil, cliquez sur "Non vérifié" puis sur "Vérifier".

4. Choisissez le pays ou région d'émission de votre pièce d'identité et votre type de document, puis suivez les instructions.

5. Sélectionnez "Vérification mobile" ou "PC" selon votre préférence.

6. Saisissez vos informations personnelles, présentez une copie de votre pièce d'identité et prenez un selfie.

7. Enfin, soumettez votre demande pour terminer la vérification de l'identité.

Les investissements en cryptomonnaies, y compris l'achat de SMART en ligne sur Bitget, sont soumis au risque du marché. Bitget fournit des moyens faciles et pratiques pour vous d'acheter des SMART, et nous faisons de notre mieux pour informer pleinement nos utilisateurs sur chaque cryptomonnaie que nous offrons sur la plateforme d'échange. Toutefois, nous ne sommes pas responsables des résultats qui pourraient découler de votre achat de SMART. Cette page et toute information qui s'y trouve ne constituent pas une recommandation d'une quelconque cryptomonnaie.

Bitget Insights

DefiLlamadotcom_

1h

Now tracking @GoldenOtterWld on @worldcoin Chain

Golden Otter Hub is a smart contract-powered staking mini app within the World App wallet on World Chain, users stake GOTR tokens to earn dynamically tiered Baby Otter rewards

Cryptonews Official

2h

Hedera’s The Hashgraph Group invests in AgNext Technologies

The Hashgraph Group, a Switzerland-based venture capital and technology firm supporting the Hedera blockchain network, has announced a strategic investment in agritech company AgNext Technologies.

According to details in a press release on April 7, the collaboration will see the Hedera ( HBAR ) blockchain network support AgNext’s growing artificial intelligence-driven agricultural solutions.

The investment sees The Hashgraph Group join AgNext’s recent fundraising initiative led by Denmark-based Novo Holdings, but more than that, is a key integration milestone for the Hedera blockchain ecosystem.

In particular, AgNext is looking to leverage Hedera’s distributed ledger technology to digitize trust in the supply chain ecosystem, including around insurance and traceability across the food supply chains.

“With this strategic co-investment alongside Novo Holdings, we look forward to embarking on the tech-enablement journey with AgNext to drive the convergence of AI and Blockchain/DLT, while jointly bringing to market Hedera-powered AgriTech solutions that will enhance AgNext’s competitive edge in the web3 era,” said Stefan Deiss, co-founder & chief executive officer of The Hashgraph Group.

AgNext will also tap into Hedera’s blockchain technology and smart contracts for immutability, and efficiency.

THG and AgNext’s goals also align around an initiative for Hedera-powered embedded devices, with these set to be available to customers globally via a new web3 venture. The partners will establish this venture in Switzerland.

AgNext raised $21 million in a Series A funding in 2021, with Alpha Wave Incubation leading the capital injection initiative.

The company has operations in India, the Middle East and the United States, with its first international office having opened in Abu Dhabi, the United Arab Emirates.

Meanwhile, Hedera is seeing notable traction in the tokenization of real-world assets. This includes via integrations such as with Chainlink and Alchemy Pay – the latter for onboarding via fiat-crypto on and off ramping.

ALPHA+2.89%

S+0.60%

Cointribune EN

3h

Pump.fun Relaunches Live Streaming After 5-Month Suspension

After five months of suspension, the meme creation platform Pump.fun is gradually reintroducing its live streaming feature. This relaunch is accompanied by new moderation measures and occurs in a challenging context for the memecoin ecosystem.

Alon Cohen, co-founder of Pump.fun, recently announced the reactivation of live streaming on the meme creation platform based on Solana .

This feature had been abruptly suspended in November 2024 due to a proliferation of extreme and harmful content that had overwhelmed the platform. Five months later, Pump.fun is attempting a more measured approach.

In his announcement posted on X, Cohen specifies that this reintroduction comes with “moderation systems compliant with industry standards” and transparent community rules.

For now, only 5% of users can access this feature, while the team tests the effectiveness of its new safety measures and adjusts its policies.

The new moderation policy aims to find a delicate balance between creativity, freedom of expression, and user safety. It explicitly prohibits violent content, animal abuse, pornography, and anything that could endanger minors.

However, the language used in this policy remains relatively vague regarding the precise definition of “inappropriate content,” leaving significant room for interpretation.

The platform acknowledges that some content deemed NSFW (Not Safe For Work) may still appear and reserves the right to moderate content according to its own criteria.

This relaunch of live streaming occurs in a particularly unfavorable environment for the memecoin ecosystem.

Investor interest in this sector has seen a significant decline, exacerbated by several scandals and highly publicized token withdrawals like LIBRA and MELANIA. The Trump token (TRUMP) has also seen its value drop by over 90% from its peak in January.

Recent data from Dune Analytics reveals a concerning situation for Pump.fun. The graduation rate of tokens on the platform, that is, the percentage of tokens that manage to pass the incubation phase to become fully tradable on a Solana DEX, has fallen below 1%, down from 1.67% at the beginning of the year.

This situation reflects the broader difficulties of Solana . The VanEck report shows that revenues and trading volumes on smart contract platforms have dropped by 36% and 40% respectively. Solana is particularly suffering, with a 66% collapse in revenue related to daily fees.

To address this situation, Pump.fun recently left Raydium to launch PumpSwap, its own DEX. This strategic decision aims to stem the decline in its revenues and limit the carnage of memecoins on its platform.

Thus, the relaunch of live streaming is an attempt at revitalization during a critical period for Pump.fun . Its success will depend on the effectiveness of the new moderation measures and the ecosystem’s ability to win back investors after several months of decline.

WIN+1.19%

X-2.31%

Crypto-Ticker

1j

Bitcoin Price Crash to $60,000? Here's What the Charts Say Now

Bitcoin (BTC) is currently dancing on a razor’s edge near $82,500, and traders are watching nervously. After a period of sideways consolidation, the crypto giant is showing early signs of weakness—raising the question: Is Bitcoin price preparing for a deep drop to $60,000 , or is this a bear trap before the next rally? Let’s dive into the daily and hourly charts to decode the truth behind BTC’s next major move.

On the daily chart, Bitcoin continues to struggle below major resistance levels. The Heikin Ashi candles are small-bodied and red, signaling a lack of momentum and indecision in the market. Price action is firmly below all major moving averages—with the 20 SMA at $84,477, 50 SMA at $86,921, and 100 SMA at $92,808. This alignment indicates a clear bearish structure where each rally is being sold into.

What’s more concerning is that Bitcoin has failed multiple times to reclaim the 100-day SMA, indicating sustained selling pressure from institutions and swing traders. The presence of the 200 SMA below current price around $86,675 had acted as a temporary support in March, but it has now turned neutral as price hovers well below it.

The ADL (Accumulation/Distribution Line) has sharply dropped, confirming distribution over accumulation. This means that even during slight upward moves, smart money has been offloading, not adding to positions. Without a turn in the ADL, any bounce is suspect.

Zooming into the 1-hour chart, the picture becomes even more clear: Bitcoin is grinding downward in a slow, controlled bleed. After peaking briefly around $87K on April 2nd, BTC experienced sharp rejection and has since been forming lower highs. The recent attempt to climb was stopped cleanly at the 200 SMA near $83,300, confirming it as short-term resistance.

The moving averages on the hourly (20, 50, and 100 SMA) are compressing and curving downward, which typically leads to momentum breakdowns, especially when paired with flat volume and fading bullish candles. The most recent Heikin Ashi candles are small-bodied and leaning bearish, showing that the bulls are losing steam and failing to defend even intraday bounces.

The hourly ADL is declining, further confirming the lack of demand at current price levels. Retail interest appears low, and there’s no sign of whale-driven accumulation on this timeframe either.

Immediate support lies at $82,000, which has been tested several times over the past few sessions. A decisive break below this level could trigger a sharp selloff down to $78,500, with a psychological and structural support zone around $75,000. If that fails, then the long-feared move toward $69,000–$60,000 could come into play quickly.

On the upside, resistance sits heavy around $84,500, followed by $86,900, both marked by the daily 20 and 50 SMA zones. Only a break above $87,500–$88,000, backed by volume, would confirm a bullish reversal and negate the current bearish setup.

Short-Term Outlook (Next 48–72 hours): If $82,000 fails, expect a fast drop to $78,000 or lower. If bulls hold the line and reclaim $84,500 with volume, we might see a short-term bounce to $87K.

Mid-Term Outlook (Next 1–2 weeks): Without a break above the 100-day SMA, Bitcoin price is at risk of cascading down to $75,000. Market sentiment is fragile, and macroeconomic news or ETF flows could tip the balance.

Long-Term Outlook (Rest of April 2025): If $75,000 breaks in April, then a full correction down to $60,000 is on the table. However, if bulls manage to regain $90K territory, it could open the door back to $100K.

The charts are clear—Bitcoin price is at a critical level. The current structure favors bears, with no strong signs of reversal just yet. Accumulation is weak, momentum is fading, and major resistances are pushing BTC price lower. Unless bulls step in with force soon, a deep correction could be just around the corner.

So, is Bitcoin price heading for $60,000 or ready to bounce? For now, the trend says: Proceed with caution.

Bitcoin (BTC) is currently dancing on a razor’s edge near $82,500, and traders are watching nervously. After a period of sideways consolidation, the crypto giant is showing early signs of weakness—raising the question: Is Bitcoin price preparing for a deep drop to $60,000 , or is this a bear trap before the next rally? Let’s dive into the daily and hourly charts to decode the truth behind BTC’s next major move.

On the daily chart, Bitcoin continues to struggle below major resistance levels. The Heikin Ashi candles are small-bodied and red, signaling a lack of momentum and indecision in the market. Price action is firmly below all major moving averages—with the 20 SMA at $84,477, 50 SMA at $86,921, and 100 SMA at $92,808. This alignment indicates a clear bearish structure where each rally is being sold into.

What’s more concerning is that Bitcoin has failed multiple times to reclaim the 100-day SMA, indicating sustained selling pressure from institutions and swing traders. The presence of the 200 SMA below current price around $86,675 had acted as a temporary support in March, but it has now turned neutral as price hovers well below it.

The ADL (Accumulation/Distribution Line) has sharply dropped, confirming distribution over accumulation. This means that even during slight upward moves, smart money has been offloading, not adding to positions. Without a turn in the ADL, any bounce is suspect.

Zooming into the 1-hour chart, the picture becomes even more clear: Bitcoin is grinding downward in a slow, controlled bleed. After peaking briefly around $87K on April 2nd, BTC experienced sharp rejection and has since been forming lower highs. The recent attempt to climb was stopped cleanly at the 200 SMA near $83,300, confirming it as short-term resistance.

The moving averages on the hourly (20, 50, and 100 SMA) are compressing and curving downward, which typically leads to momentum breakdowns, especially when paired with flat volume and fading bullish candles. The most recent Heikin Ashi candles are small-bodied and leaning bearish, showing that the bulls are losing steam and failing to defend even intraday bounces.

The hourly ADL is declining, further confirming the lack of demand at current price levels. Retail interest appears low, and there’s no sign of whale-driven accumulation on this timeframe either.

Immediate support lies at $82,000, which has been tested several times over the past few sessions. A decisive break below this level could trigger a sharp selloff down to $78,500, with a psychological and structural support zone around $75,000. If that fails, then the long-feared move toward $69,000–$60,000 could come into play quickly.

On the upside, resistance sits heavy around $84,500, followed by $86,900, both marked by the daily 20 and 50 SMA zones. Only a break above $87,500–$88,000, backed by volume, would confirm a bullish reversal and negate the current bearish setup.

Short-Term Outlook (Next 48–72 hours): If $82,000 fails, expect a fast drop to $78,000 or lower. If bulls hold the line and reclaim $84,500 with volume, we might see a short-term bounce to $87K.

Mid-Term Outlook (Next 1–2 weeks): Without a break above the 100-day SMA, Bitcoin price is at risk of cascading down to $75,000. Market sentiment is fragile, and macroeconomic news or ETF flows could tip the balance.

Long-Term Outlook (Rest of April 2025): If $75,000 breaks in April, then a full correction down to $60,000 is on the table. However, if bulls manage to regain $90K territory, it could open the door back to $100K.

The charts are clear—Bitcoin price is at a critical level. The current structure favors bears, with no strong signs of reversal just yet. Accumulation is weak, momentum is fading, and major resistances are pushing BTC price lower. Unless bulls step in with force soon, a deep correction could be just around the corner.

So, is Bitcoin price heading for $60,000 or ready to bounce? For now, the trend says: Proceed with caution.

BTC+1.35%

NEAR+1.69%

Aicoin-EN-Bitcoincom

1j

Ripple Deploys RLUSD in Kenya as Blockchain Aid Faces Real-World Drought Test

Ripple unveiled a new blockchain-based drought relief initiative on April 4, targeting arid communities in Kenya’s Laikipia County. Collaborating with Mercy Corps Ventures and DIVA Donate, the firm introduced a pilot that will automatically distribute financial assistance to 533 pastoralists if vegetation health indicators confirm drought conditions.

This project utilizes Ripple USD (RLUSD), the company’s stablecoin pegged to the U.S. dollar and issued on both the XRP Ledger and Ethereum networks. As Ripple stated:

In partnership with Mercy Corps Ventures and DIVA Donate, Ripple is supporting a pilot project that will use blockchain technology to deliver financial support in the form of Ripple USD (RLUSD)—the stablecoin backed by stability, trust, and compliance—to pastoral communities in Kenya affected by drought.

Mercy Corps Ventures is the impact investing arm of the global development agency Mercy Corps. DIVA Donate is a parametric conditional donation platform that leverages decentralized finance (DeFi) and remote-sensed data to deliver effective and efficient disaster relief. The system integrates smart contracts and satellite imaging to monitor grazing conditions.

The Normalized Difference Vegetation Index (NDVI), a satellite-based metric, is used to evaluate vegetation health. If conditions fall below the drought threshold by May 31, funds are automatically disbursed via RLUSD, with each pastoralist eligible to receive about $75—sufficient to feed one livestock animal for half a year.

Contributors can participate by depositing RLUSD through connected wallets, with funds held in escrow and distributed only when satellite data activates the smart contract. If drought conditions are not met, funders may reclaim their contributions or allocate them to future campaigns.

Ripple underscored how stablecoins and blockchain technology can streamline global aid distribution. Traditional challenges like delayed settlement, lack of transparency, and difficulty reaching unbanked populations often hinder cross-border support. RLUSD aims to counter these issues with programmable, traceable disbursements. This effort builds on Ripple’s previous work funding organizations such as CARE and Mercy Corps Ventures to explore blockchain’s role in financial inclusion. At Swell 2024, Ripple expanded its efforts by partnering with the International Rescue Committee to pilot blockchain-powered payments in relief programs, reflecting the growing interest in merging digital finance and social impact.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

SWELL+2.55%

XRP+0.99%

Actifs liés

Cryptos populaires

Sélection des 8 principales cryptomonnaies par capitalisation boursière.

Récemment ajoutées

Les cryptomonnaies les plus récemment ajoutées.

Capitalisation boursière comparable

Parmi tous les actifs Bitget, ces 8 actifs sont les plus proches de SMART en termes de capitalisation boursière.