Mt. Gox Executes $905 Million Bitcoin Transfer Amid Market Correction

- Mt. Gox transferred 11,501 BTC ($905M) to an unmasked wallet after Bitcoin fell below $77,000, per Arkham Intelligence data.

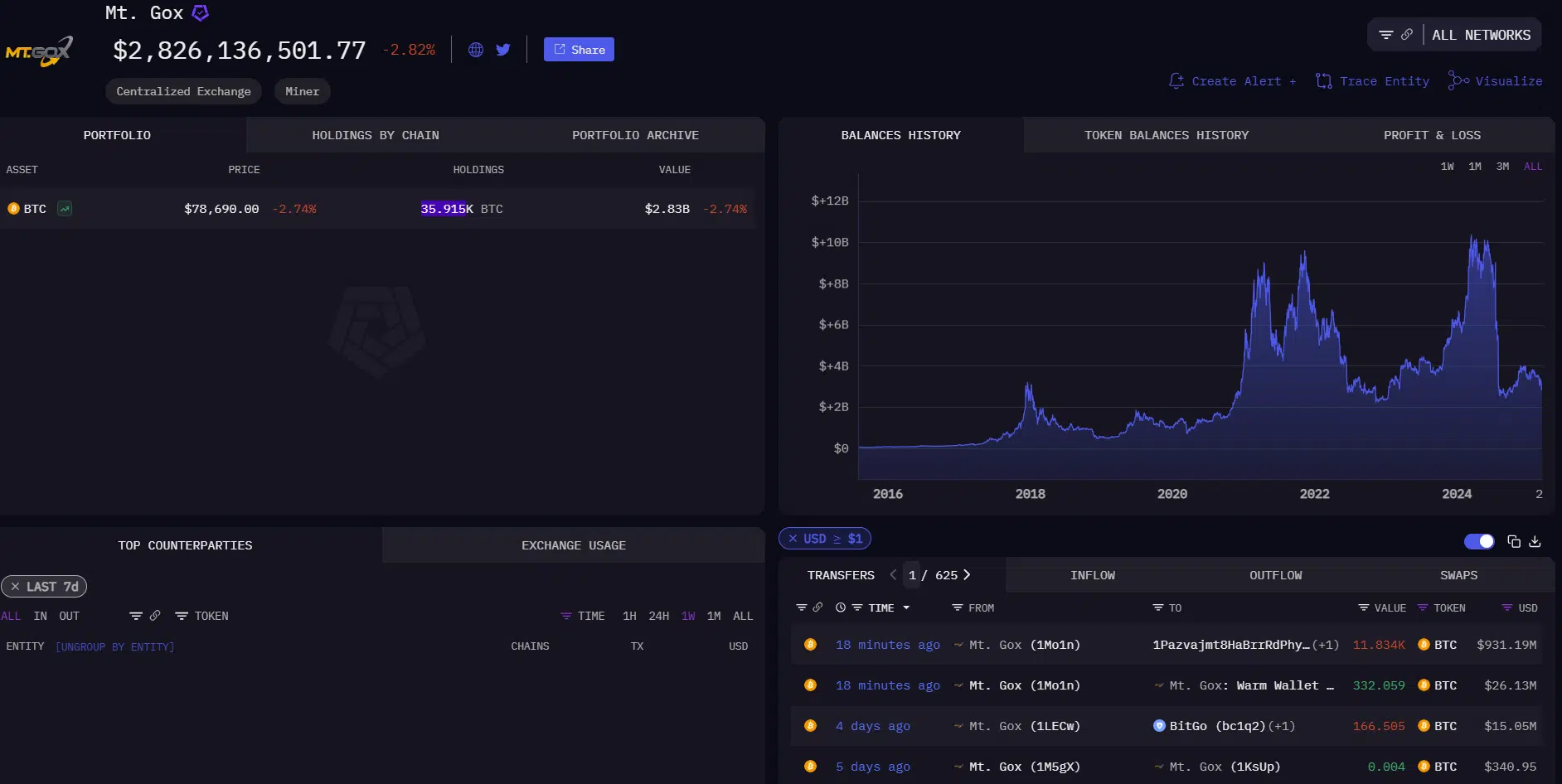

- The entity still holds 35,915 BTC ($2.8B), having moved $1B to a “1Mo1n” wallet last week before obscuring it.

The defunct cryptocurrency exchange Mt. Gox transferred 11,501 Bitcoin (BTC), valued at approximately $905 million, to an unmasked digital asset address on March 18, per Arkham Intelligence data.

This transaction followed a test transfer of 20 BTC to custodial platform BitGo on March 15. The movement occurred as Bitcoin’s spot price dipped below $77,000, extending a downward trend observed since early March.

Source: Arkham

Source: Arkham

Mt. Gox retains ownership of 35,915 BTC, currently valued at $2.8 billion based on CoinGecko’s market data. Last week, the entity relocated over $1 billion in BTC to a wallet prefixed “1Mo1n,” later obscured through privacy protocols. On March 18, this wallet redistributed $931 million in BTC, allocating $905 million to an unknown address and the remainder to its operational hot wallet.

Bitcoin’s price decline has prompted mixed technical analyses. Arthur Hayes, co-founder of derivatives exchange BitMEX, projected a potential rebound to $78,000 but warned of heightened volatility if this resistance level fails. Hayes noted elevated open interest in BTC options contracts clustered between $70,000 and $75,000, suggesting downside risk if bearish momentum intensifies.

Ryan Lee, head of research at Bitget, outlined a dual scenario: a breakdown below $77,000 could test support at $70,000–$72,000, while a recovery might push prices toward $80,000–$85,000. Lee emphasized macroeconomic variables, including Federal Reserve policy decisions and regulatory developments, as pivotal to Bitcoin’s near-term price action.

“The most likely scenario for this week suggests a mid-week test of $72,000-$75,000, with Bitcoin stabilizing near $83,000 by March 18-19, depending on general market sentiment, external factors such as regulatory news and the upcoming FOMC meeting,” Lee said in a statement on Monday.

Traders continue to track Mt. Gox’s wallet activity due to its historical influence on Bitcoin liquidity. The exchange’s remaining holdings represent roughly 1.8% of BTC’s circulating supply, amplifying scrutiny over potential future distributions.

ETHNews analysts caution that external factors, such as institutional demand and macroeconomic trends, will likely dictate market direction ahead of key events like the Federal Open Market Committee meeting in mid-March.

Descargo de responsabilidad: El contenido de este artículo refleja únicamente la opinión del autor y no representa en modo alguno a la plataforma. Este artículo no se pretende servir de referencia para tomar decisiones de inversión.

También te puede gustar

Chaos Labs presenta Chaos AI para brindar información avanzada a los traders

En Resumen Chaos Labs ha lanzado Chaos AI, la primera herramienta de investigación de criptomonedas impulsada por IA, entrenada en una combinación de cuatro años de datos de criptomonedas públicos y propietarios y la base de conocimiento de Chaos Labs.

Transacciones USDT-TRC-20 sin gas ya disponibles en Tonkeeper Pro

En Resumen Tonkeeper anunció que Tonkeeper Pro ahora admite tokens USDT TRC-20 sin necesidad de adquirir TRX.

Venta de Tokens de World Liberty Financial Respalda por Trump Recaída $550 Millones

Justin Sun, Uno de los Mayores Inversionistas en WLFI

Candidato a gobernador de Florida, Byron Donalds, impulsa legislación para proteger la orden ejecutiva sobre Bitcoin de Trump

Legislación de amplio alcance busca asegurar políticas cripto de Trump y reforzar apoyo bipartidista.