Solana Eyes Major Price Surge as Grayscale Proposes SOL ETF

- Grayscale has filed to launch a Solana ETF in the US, aiming to convert its existing Solana Trust into a spot ETF.

- The filing aligns with a favorable regulatory environment and could boost institutional interest in Solana.

Grayscale, a leading digital asset manager, has made waves with its recent filing to launch a Solana (SOL) ETF in the United States. The decision has raised interest, particularly amid increased interest in crypto ETFs in the country with friendly regulations.

Grayscale’s Push for a Solana ETF

Grayscale’s application to NYSE to list a Solana ETF is an indication of the company’s efforts to ensure that investors have access to more cryptocurrencies. The ETF would simply reorganize Grayscale’s present Solana Trust, with an asset value of approximately $134.2 million, into a spot ETF. This transition is to allow trading on a regulated securities exchange to give investors an efficient and safe method of investing in Solana without having to purchase the asset directly.

Solana Trust currently holds 0.1% of all Solana tokens in circulation, underlining its importance in the market. This proposed ETF structure by Grayscale aims to provide an efficient means of investing in SOL by tracking the value of SOL held by the Trust and reducing expenses.

Coinbase Custody Trust Company will handle the key custodial functions, while BNY Mellon will handle the administrative functions. These measures are expected to increase the product’s credibility among investors and make it more readily acceptable for use by a larger number of investors.

The filing occurs at a time when the regulatory climate for cryptocurrencies appears to be on the upswing. Other major asset managers, such as CoinShares and Canary Capital, have also explored similar strategies under the present administration. For instance, CoinShares has submitted an application for an XRP ETF with the U.S. Securities and Exchange Commission (SEC). Grayscale has also filed for the listing of an ETF in Litecoin. Analysts argue that such advancements point to further regulatory guidance.

Solana Price Forecast

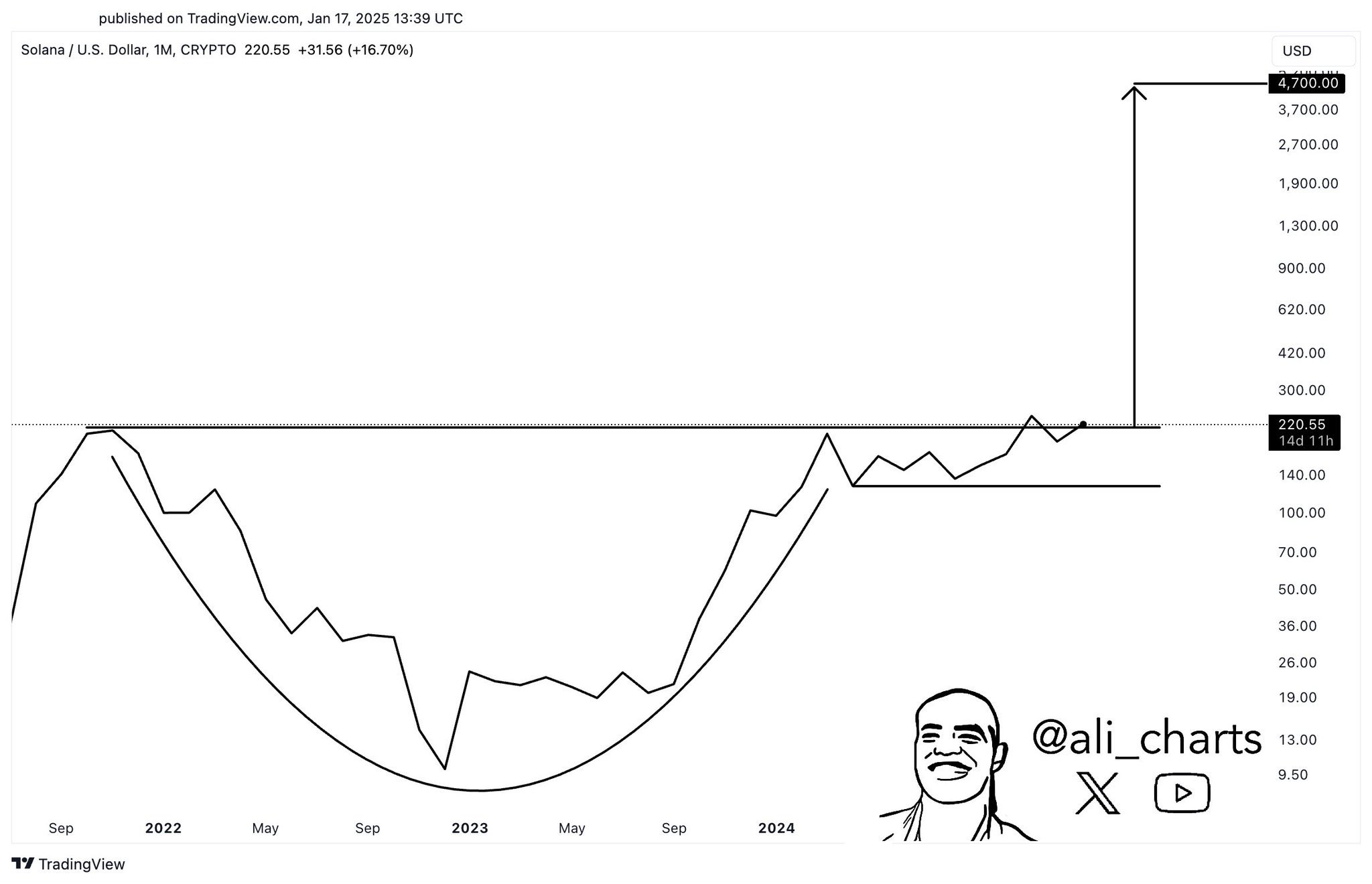

According to market analysts, the Solana ETF filing by Grayscale may lead to a price increase. Popular market analyst Ali Martinez also recently set a price target of $4,700 for Solana, with the ETF as one of the factors.

At the time of writing, Solana is trading at $248.39 and has shown a 5% drop within the last 24 hours, with a 34% reduction in trading volume to $6.4 billion. Even though it had a fall, the crypto rose to $269 within 24 hours after Grayscale’s announcement.

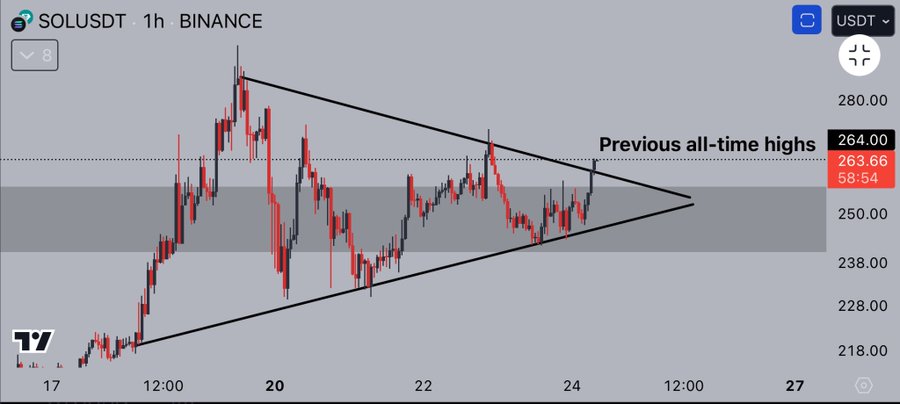

According to crypto analyst Jelle, SOL is close to a key barrier of $270. The price movement of the asset shows that a breakout may be on the verge of happening. Jelle further states that SOL is trading in a pennant pattern, which is typical for the coins that are about to break out. If SOL climbs above $270, it will create a path for new record highs.

Solana’s expansion is not only in the native token of SOL. Recently, the market has hit a new milestone in the industry of stablecoins, where the total supply of blockchain has crossed $10 billion for the first time. This is up from $5.1 billion at the start of the year and has more than doubled in just weeks, meaning it has grown by over 110%. According to DeFiLlama , Solana’s stablecoin supply has now surpassed BNB Chain and other networks.

Haftungsausschluss: Der Inhalt dieses Artikels gibt ausschließlich die Meinung des Autors wieder und repräsentiert nicht die Plattform in irgendeiner Form. Dieser Artikel ist nicht dazu gedacht, als Referenz für Investitionsentscheidungen zu dienen.

Das könnte Ihnen auch gefallen

Solana Mitgründer kritisiert Trumps Pläne für Krypto-Strategiereserve

ROAMUSDT jetzt für Futures-Trading und Trading-Bots eingeführt

Präsident Trump unterzeichnet Anordnung zur Einrichtung einer strategischen Bitcoin-Reserve, die als Wertaufbewahrung ähnlich wie Fort Knox dienen soll

Kurze Zusammenfassung Die Exekutivanordnung fordert eine vollständige Aufstellung der digitalen Vermögenswerte der Bundesregierung. Die USA werden keine in die Reserve eingezahlten Bitcoins verkaufen, und sie werden als Wertaufbewahrungsmittel ähnlich einem digitalen Fort Knox gehalten.

Coinbase-Manager sagt, dass Trumps Strategische Bitcoin-Reserve etwa 18 Milliarden Dollar Verkaufsdruck beseitigen könnte

Kurzfassung Coinbase-Direktor Conor Grogan sagte, dass die Einrichtung einer Bitcoin-Reserve durch die USA den Verkaufsdruck verringern könnte. Die US-Regierung hält derzeit schätzungsweise etwa 198.109 BTC, so Schätzungen von Arkham Intelligence.